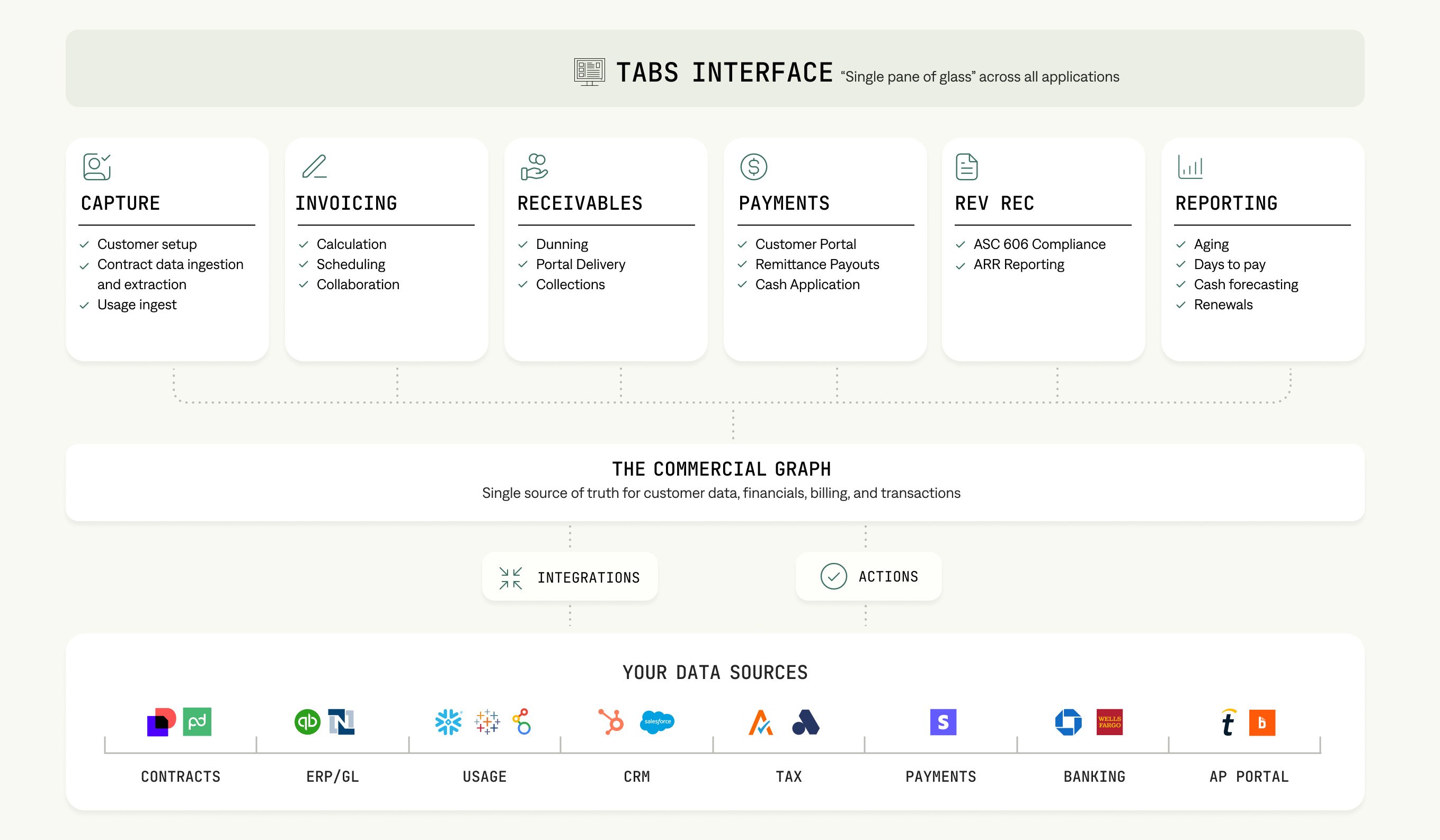

TABS REVENUE AUTOMATION PLATFORM

Put your contract-to-cash on autopilot

From contract review through to reporting, Tabs helps you save hours of manual effort, maximize flexibility, and reduce days to pay, all on a single modern platform.

PLATFORM

A single platform purpose built to power your entire revenue lifecycle

At its core, Tabs is a software platform that brings all of your financial data sources and applications together onto a single consolidated platform. From contracts to your ERP/GL to usage and tax data, Tabs brings these previously fragmented data sources and applications together to unlock your revenue lifecycle.

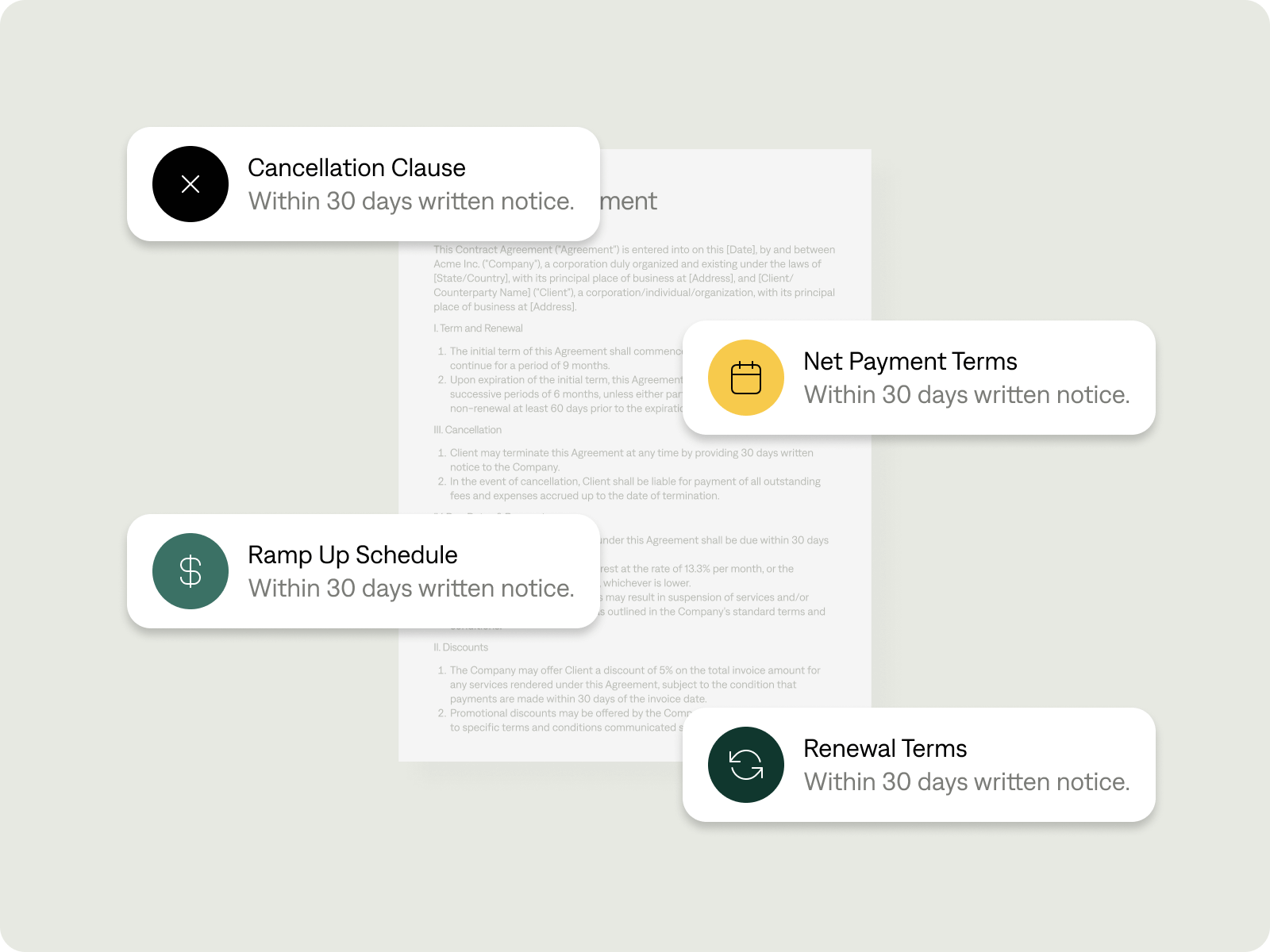

CAPTURE

Ingest complex contracts with sophisticated AI

Say goodbye to massive invoicing spreadsheets or "swivel chair" updates between your CRM, contracts, and billing system. Tabs uses AI to automatically extract, structure, and organize pricing and terms directly from your contracts. This means Tabs can handle any pricing change or new contract term on-the-fly without having to update your price book. If it's in a contract, we can bill for it.

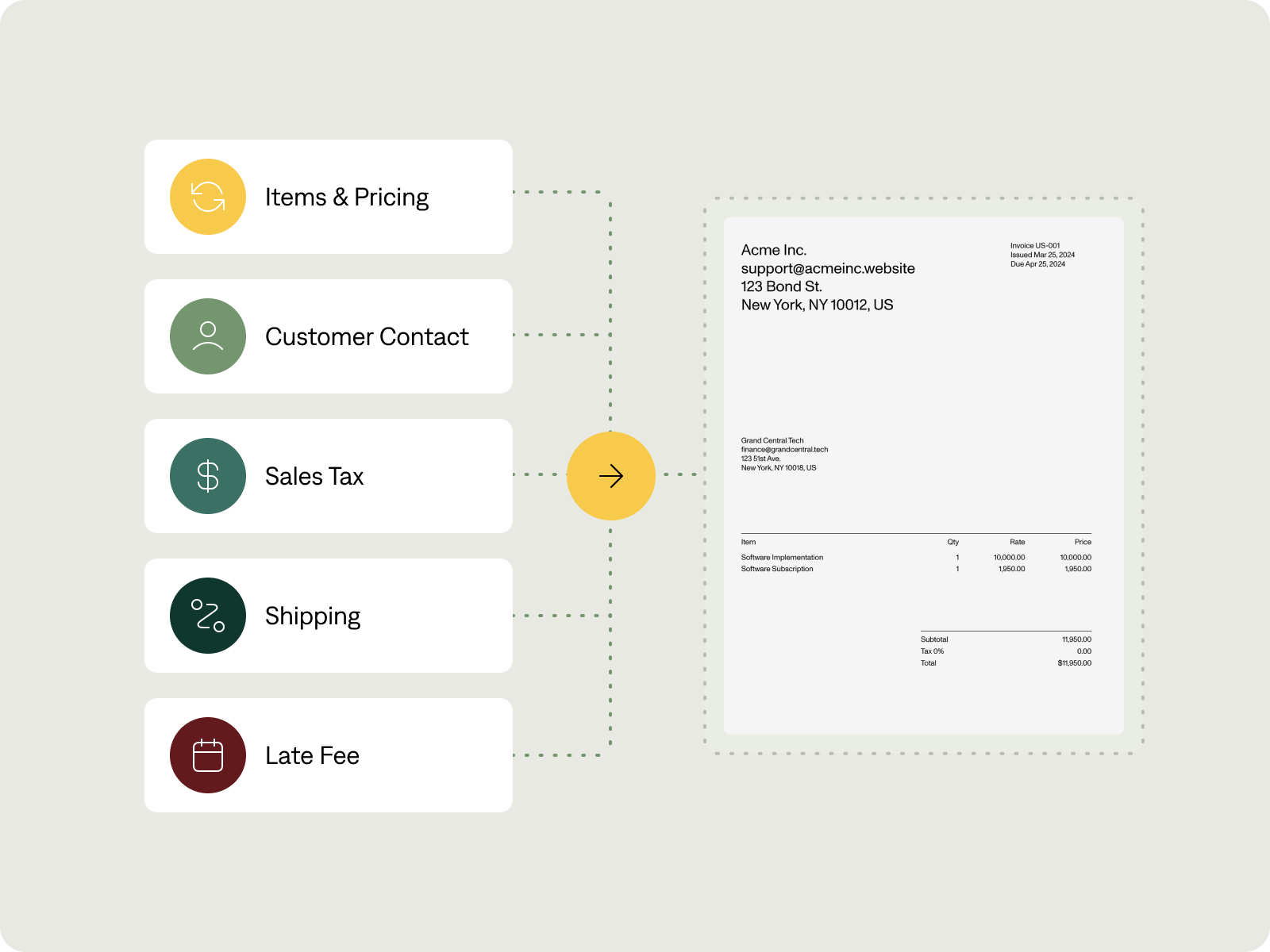

INVOICING

Streamline calculations and build complex bills in seconds

Tabs integrates with source systems and calculates even the most complex invoices. Create detailed schedules and collaborate on more qualitative topics. Automatically create an invoice schedule based on the contract terms. Determine usage or handle overage with direct feeds into source systems. Define an approval process and get buy-in before you send. Control your follow-up schedule to make sure nothing falls through the cracks.

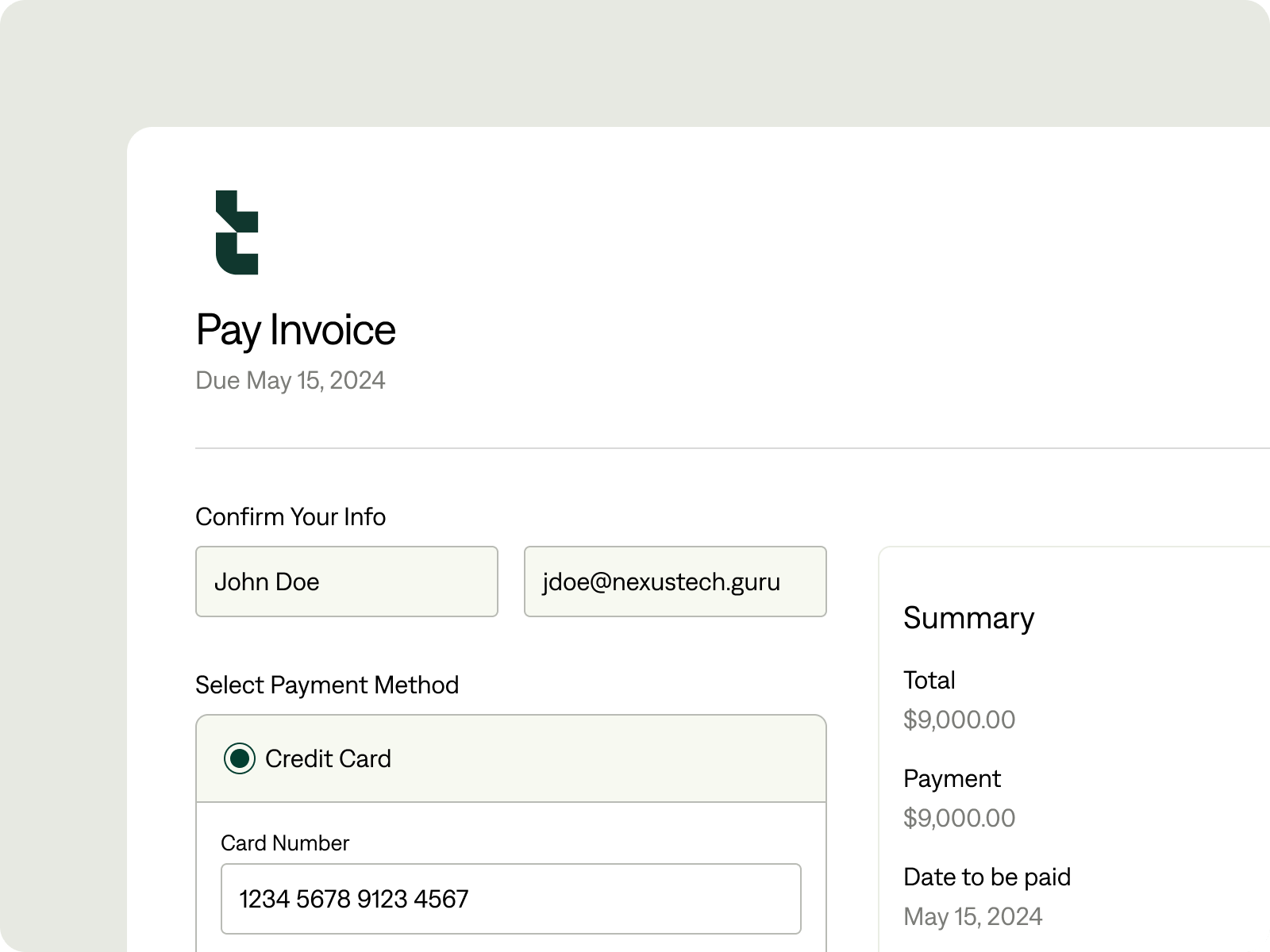

PAYMENTS

Collect payments seamlessly with automated cash application

Support your customers with a variety of payment options common in B2B ranging from physical checks, ACH Credit/Debit, and Credit Cards. Extend your brand with a customer-facing portal. Automatically distribute funds to third-parties. Automatically reconcile both analog and digital payments as they come in to close out your books faster.

REVENUE RECOGNITION

Automate revenue recognition and drive compliance

Automate your revenue recognition schedules to ensure GAAP compliance, reduce time spent and risk inherent in manual processes, and pass your audit with flying colors.Easily adjust schedules for individual customers, contracts, or transactions as needed. Populate your revenue schedule based on the contract terms and service obligations. Ensure financial precision and validation in your reports.

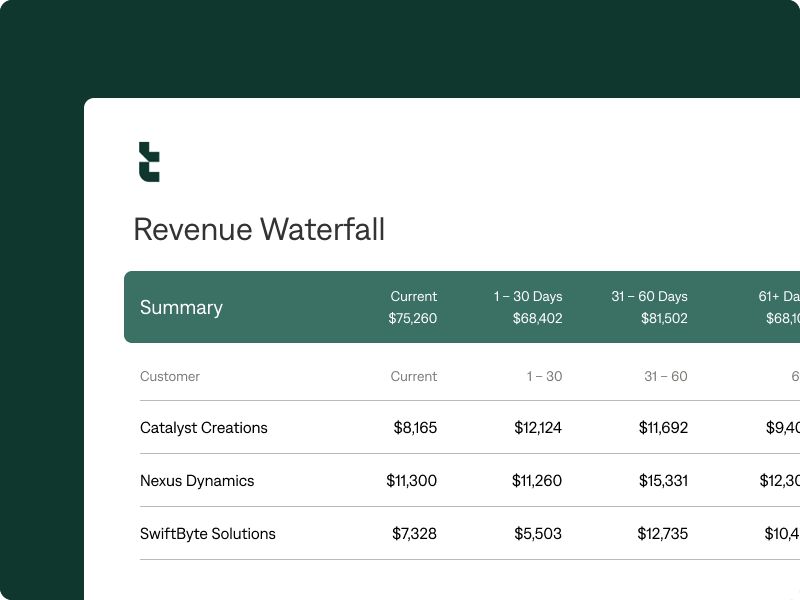

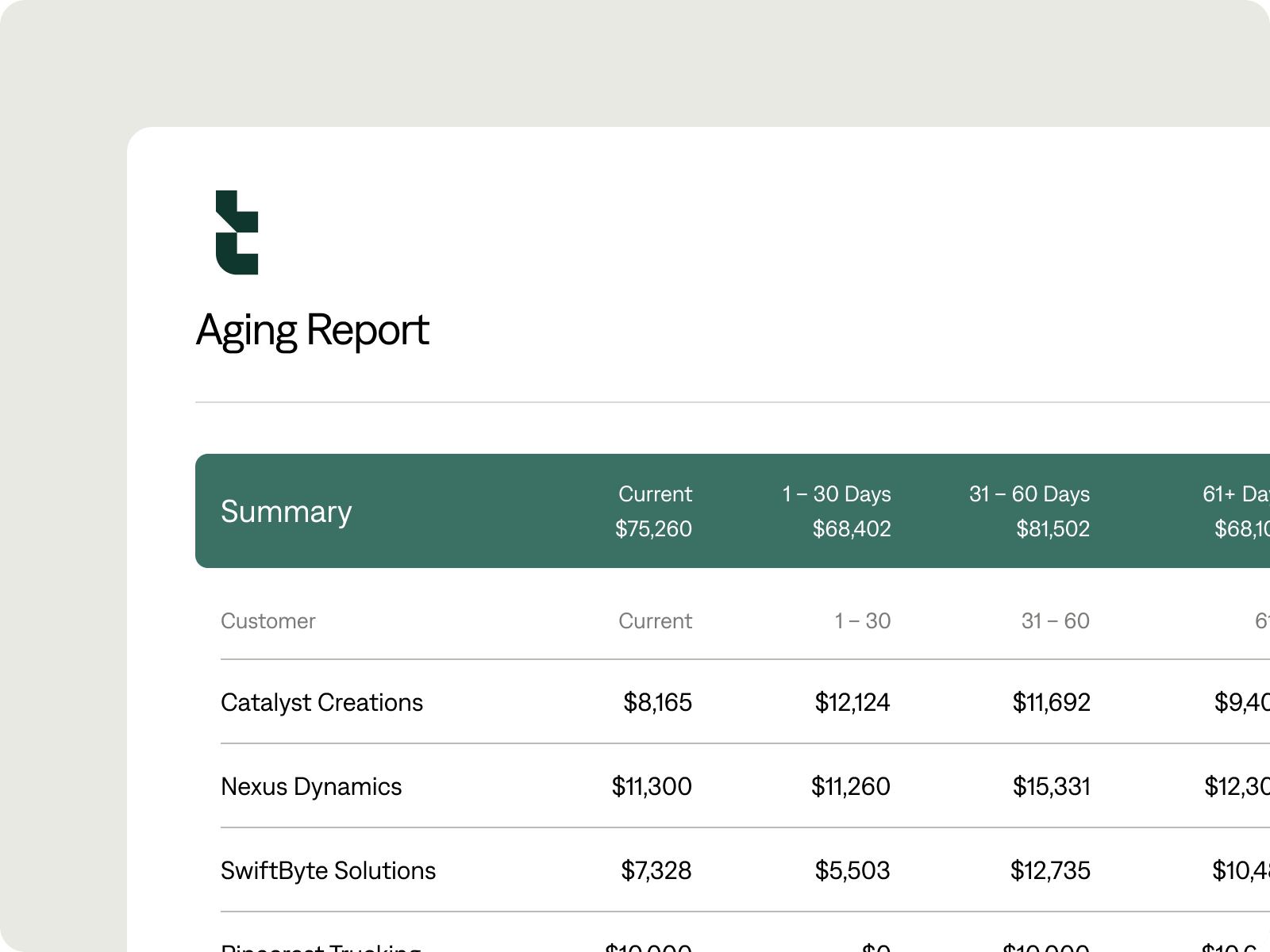

REPORTING

Create universal visibility across your entire customer financial relationship

Manage and store all of your key customer records in one platform to enable advanced reporting, easy configuration and actionable insights. Stay on top of core aging and collections. Get a birds-eye view of key performance metrics including ARR/MRR< Cash Forecasting, and Deferred revenue. Understand your customer behavior and determine churn risk.

INTEGRATIONS

Seamless integrations to all your financial data

"Tabs' ability to read and utilize unstructured data in addition to automating invoice creation and dunning in NetSuite has completely streamlined our AR processes."

Nick DeCesare

VP, Finance

Related Articles

Dunning Explained: Best Communication Practices

When your cash flow is healthy, your business thrives. Effective communication is key in this process, especially when collecting payments.

5 Ways to Improve Your AR Management

The best way to continue a strong cash flow within your business is to manage your accounts receivable correctly.

Order-to-Cash (O2C) Explained in Five Minutes

The order-to-cash (O2C) process can make or break your business. From the time your customer places an order to the moment...

GET A PERSONALIZED DEMO

Ready to see Tabs for yourself?

“There are a million platforms that help you manage spend, but Tabs is unique in that it actually helps me get the company’s money faster. ”

Alan Federman, VP of Finance, Canvas