SOLUTIONS

Tabs for Founders and CEOs

Tabs gives Founders and CEOs a comprehensive, bird's-eye view of their business, automating invoicing, payments, and revenue recognition so you can take control of your growth.

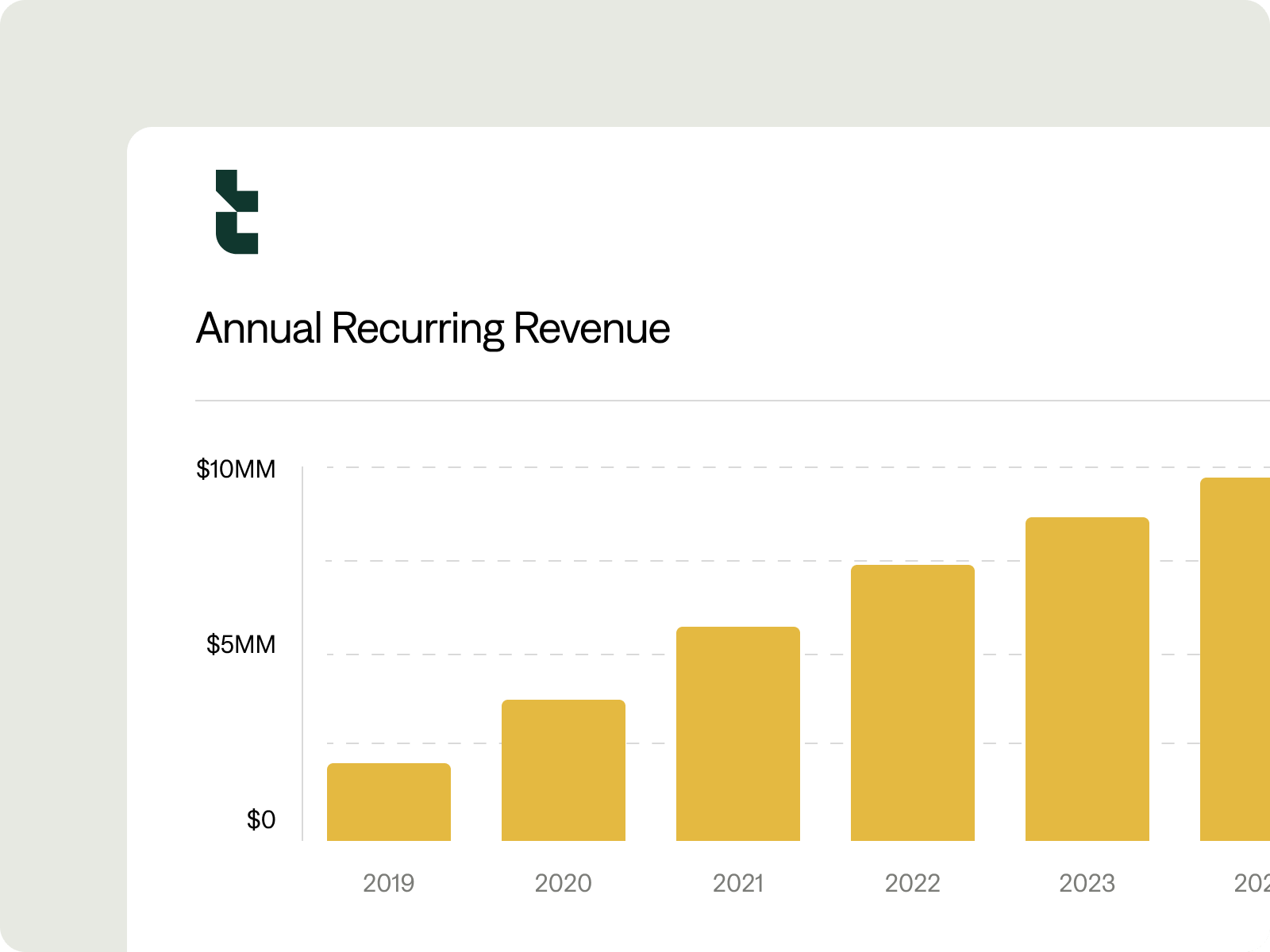

Founders and CEOs often face the challenge of managing accounts receivable and billing while staying focused on business growth. Manual processes not only slow down cash flow but also introduce errors and inefficiencies, making it hard to scale effectively. Tabs solves these challenges by automating invoicing, payments, and revenue recognition—giving leaders a comprehensive, real-time view of their business’s financial health to scale efficiently, stay compliant, and make smarter decisions.

Automate invoicing and scale without headcount

Tabs automates the entire invoicing process, from generating invoices to tracking payments. This means you can handle an increasing volume of transactions without needing to hire additional finance staff. As your business grows, Tabs scales with you, allowing for seamless, efficient operations without increasing complexity.

Ensure compliance and avoid errors

Staying compliant with revenue recognition standards like ASC 606 is critical, and Tabs ensures your processes align with regulatory requirements. By automating revenue recognition and reducing manual input, Tabs minimizes the risk of costly errors and audit issues, keeping your business compliant as you grow.

TEXT EYEBROW

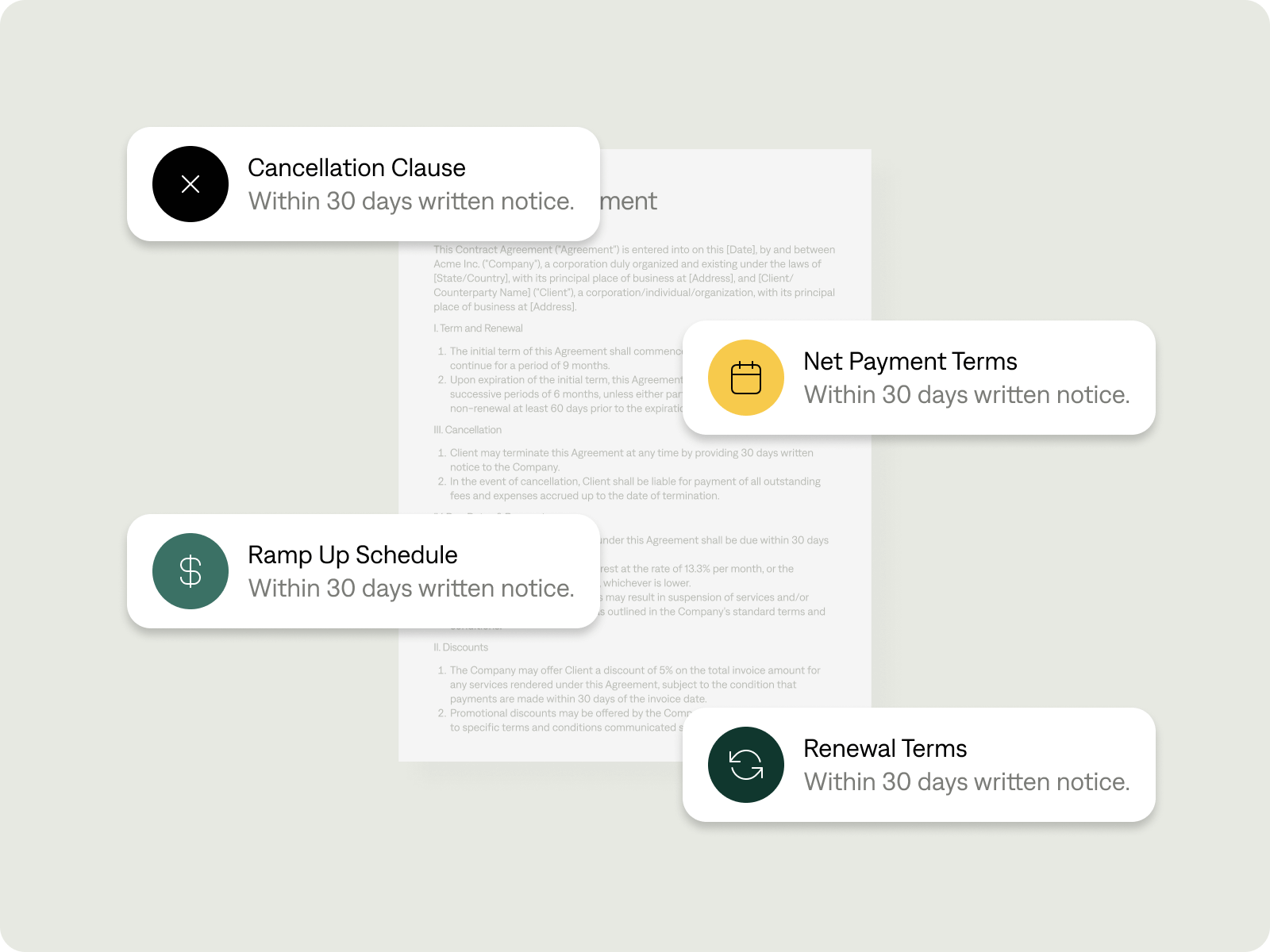

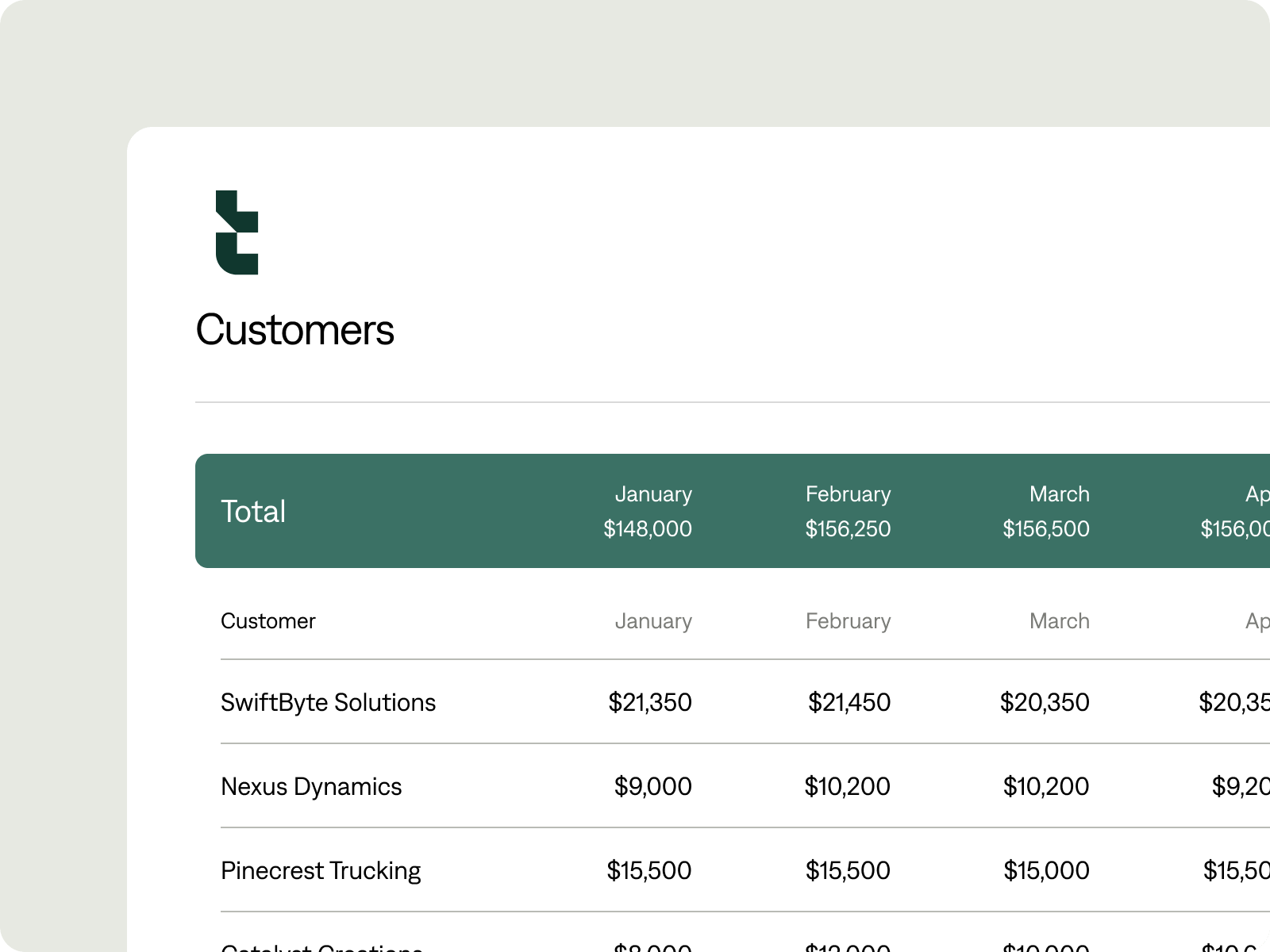

Seamless reporting and control of your business

Tabs provides a real-time, comprehensive view of your revenue and billing data, giving you full control over your financial operations. With customizable reporting and intuitive dashboards, you can easily track performance, identify trends, and make informed strategic decisions without needing to dig into spreadsheets or wait for monthly reports.

"Tabs is the only software we saw that could fully automate our complex billing and remittances process. Tabs provides all the features we need to manage our receivables in one, easy-to-use platform. Not only are we now saving time on manual tasks, we’re also able to get cash in the door faster."

Sebastian Hart

Director of Finance & Business Development

Related articles

Dunning Explained: Best Communication Practices

When your cash flow is healthy, your business thrives. Effective communication is key in this process, especially when collecting payments.

5 Ways to Improve Your AR Management

The best way to continue a strong cash flow within your business is to manage your accounts receivable correctly.

Order-to-Cash (O2C) Explained in Five Minutes

The order-to-cash (O2C) process can make or break your business. From the time your customer places an order to the moment...

GET A PERSONALIZED DEMO

Ready to see Tabs for yourself?

“There are a million platforms that help you manage spend, but Tabs is unique in that it actually helps me get the company’s money faster. ”

Alan Federman, VP of Finance, Canvas