Finance & Accounting

Less chaos, more cashflow clarity.

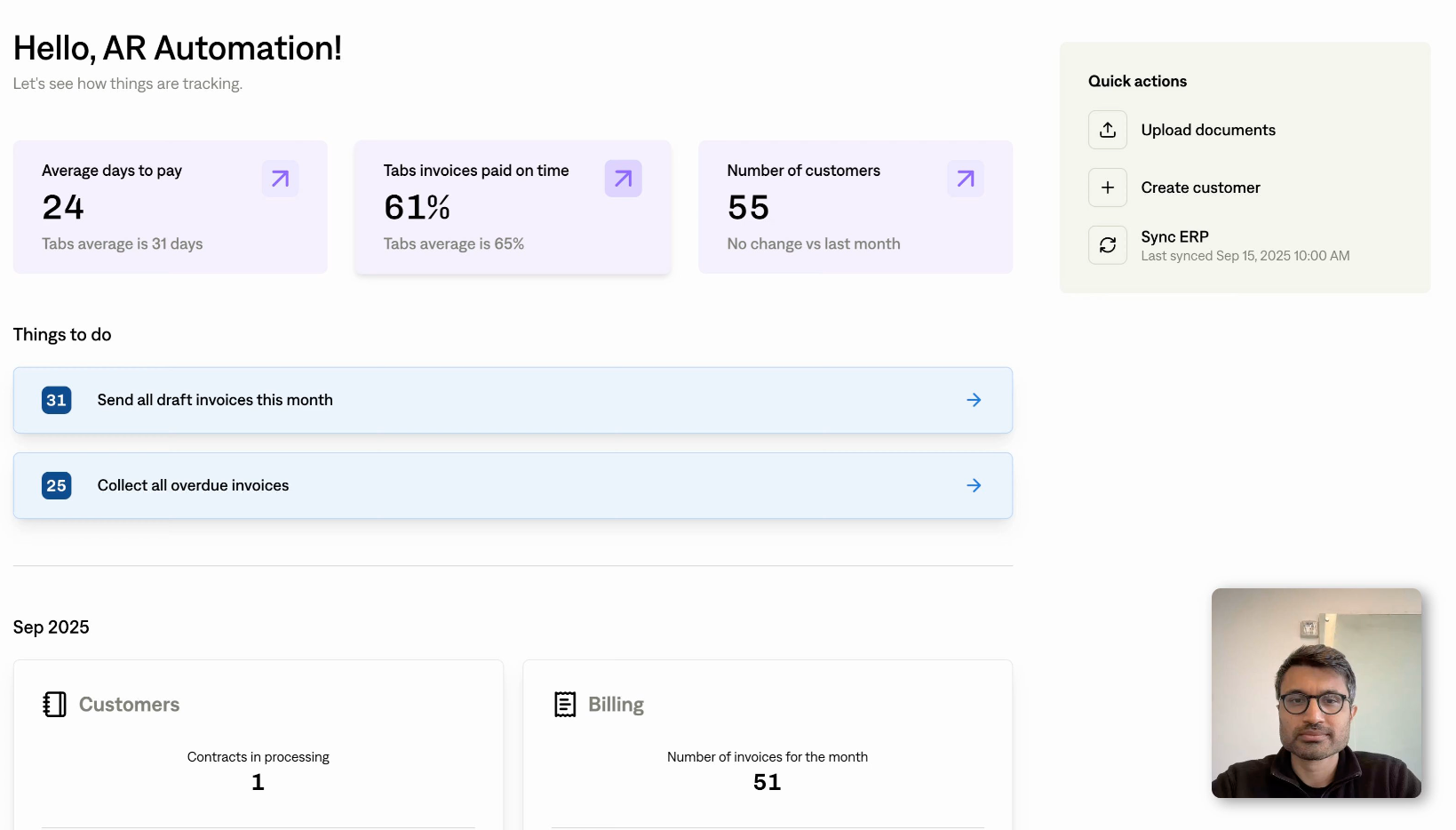

Helping finance and accounting teams accelerate revenue recognition, reduce DSO, and close the books faster - with full visibility from invoice to revenue.

Tabs is the unified partner for finance and accounting — giving CFOs cash flow clarity and controllers the speed and accuracy to close the books with confidence.

Automate workflows

Automate contract-to-cash workflows across disparate workflows

Centralized Workflows

One platform, all your systems in sync

Your systems stay connected — CRMs, ERPs, BI tools, and more — with Tabs as the single source of truth.

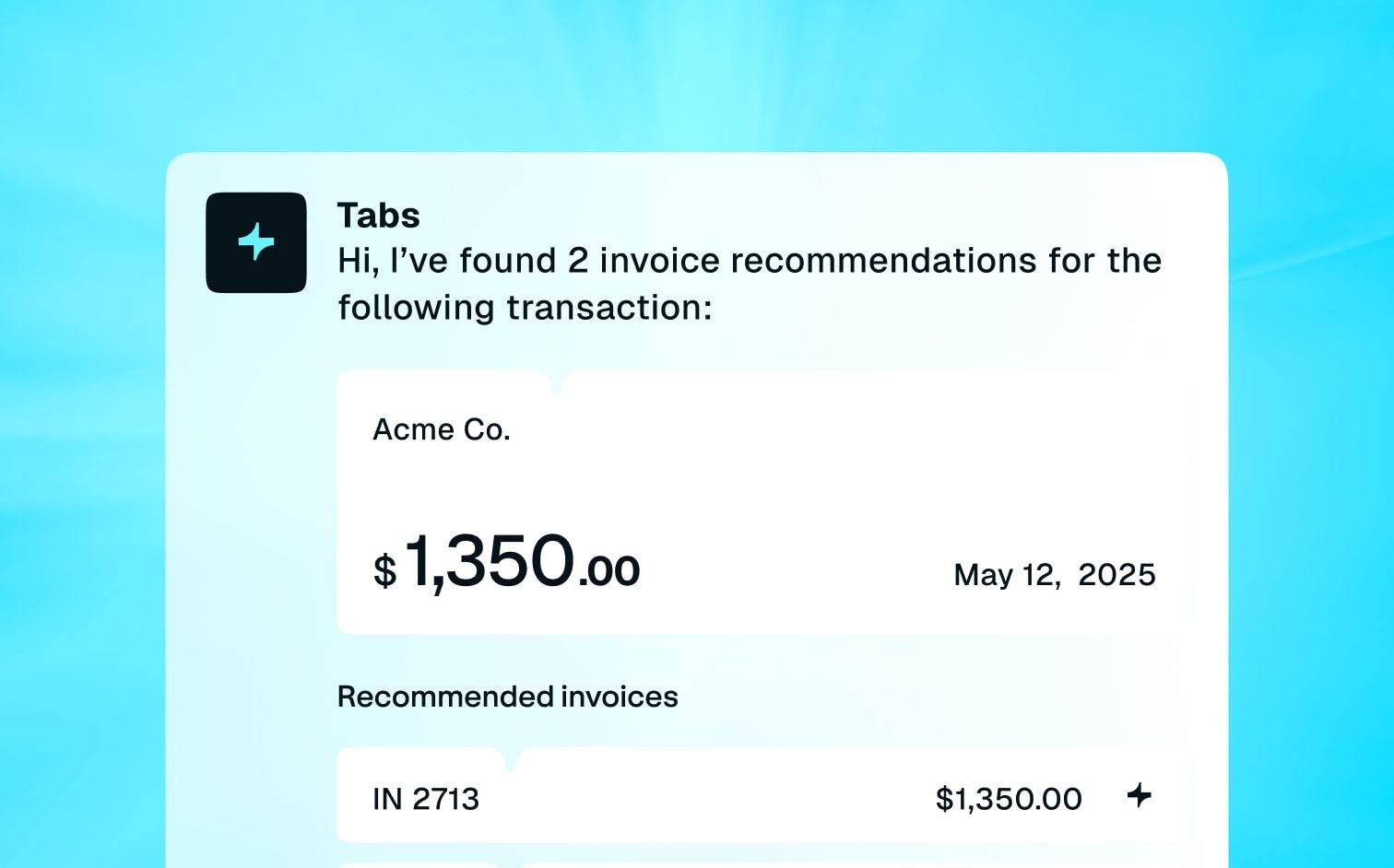

Tabs Agent

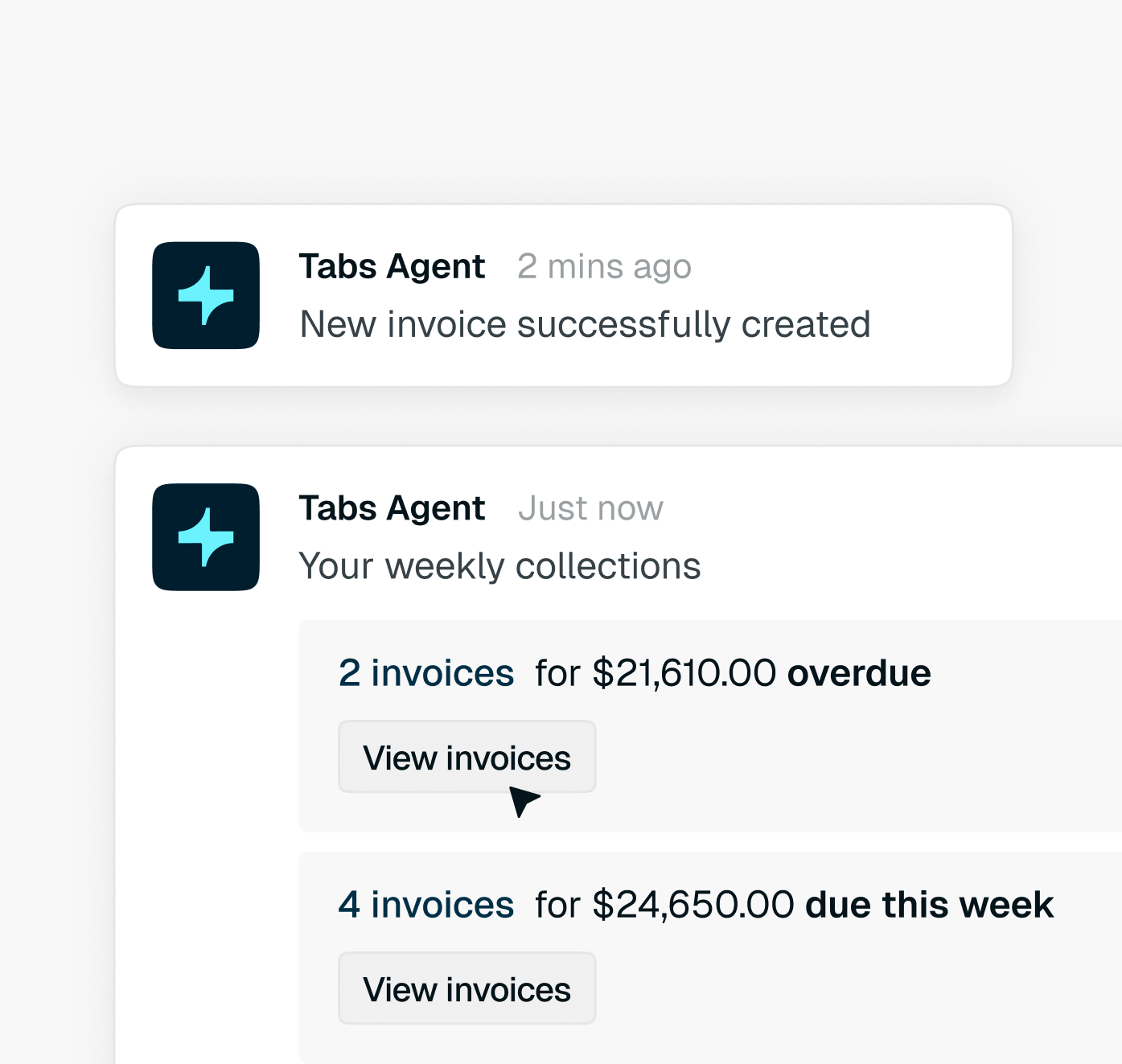

Tabs Agent that actually does the work

Your co-pilot for billing and reconciliation in Slack, your inbox, or wherever you work.

Get paid faster

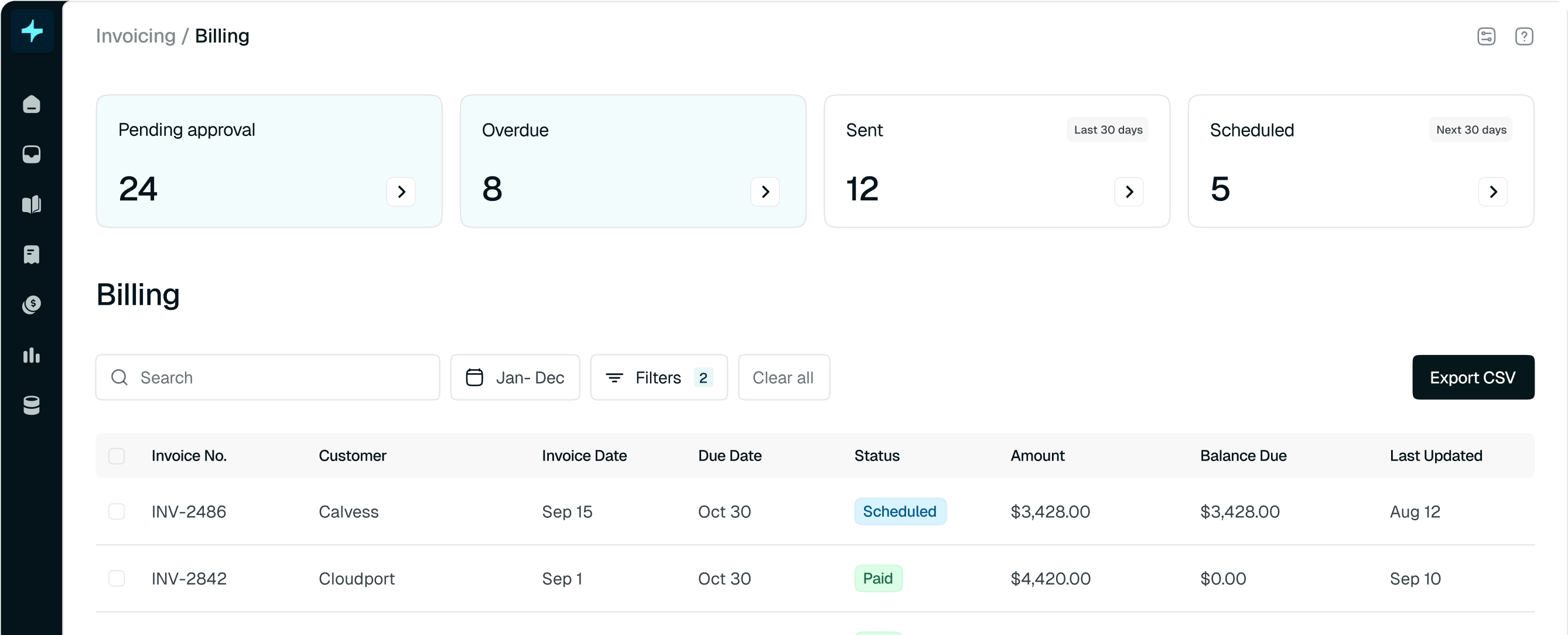

Get paid faster with intelligent collections and integrated payments

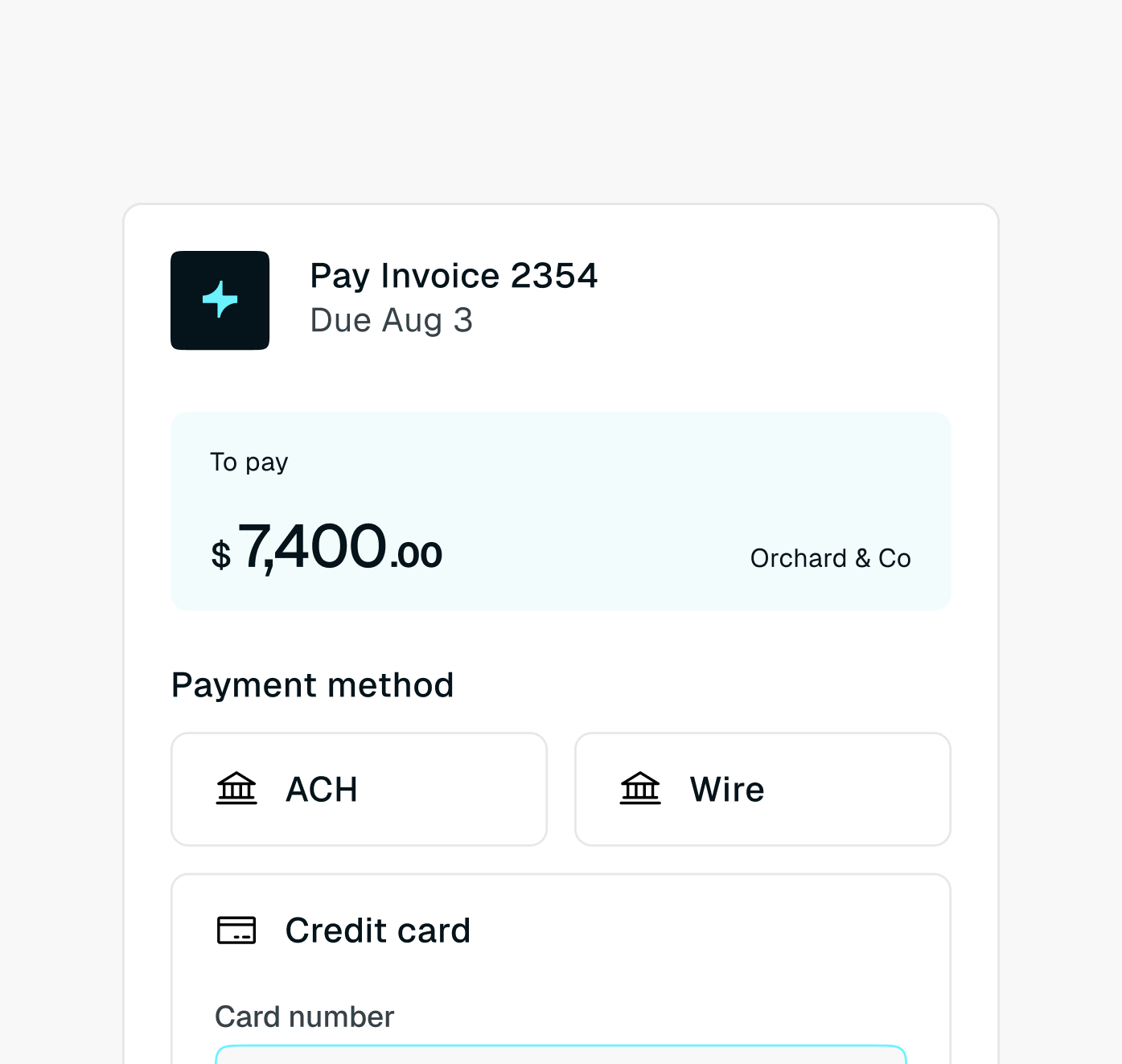

Collections

Embedded payments that just work

Customers can pay however they want — and you stay in control with auto-charge and full reconciliation.

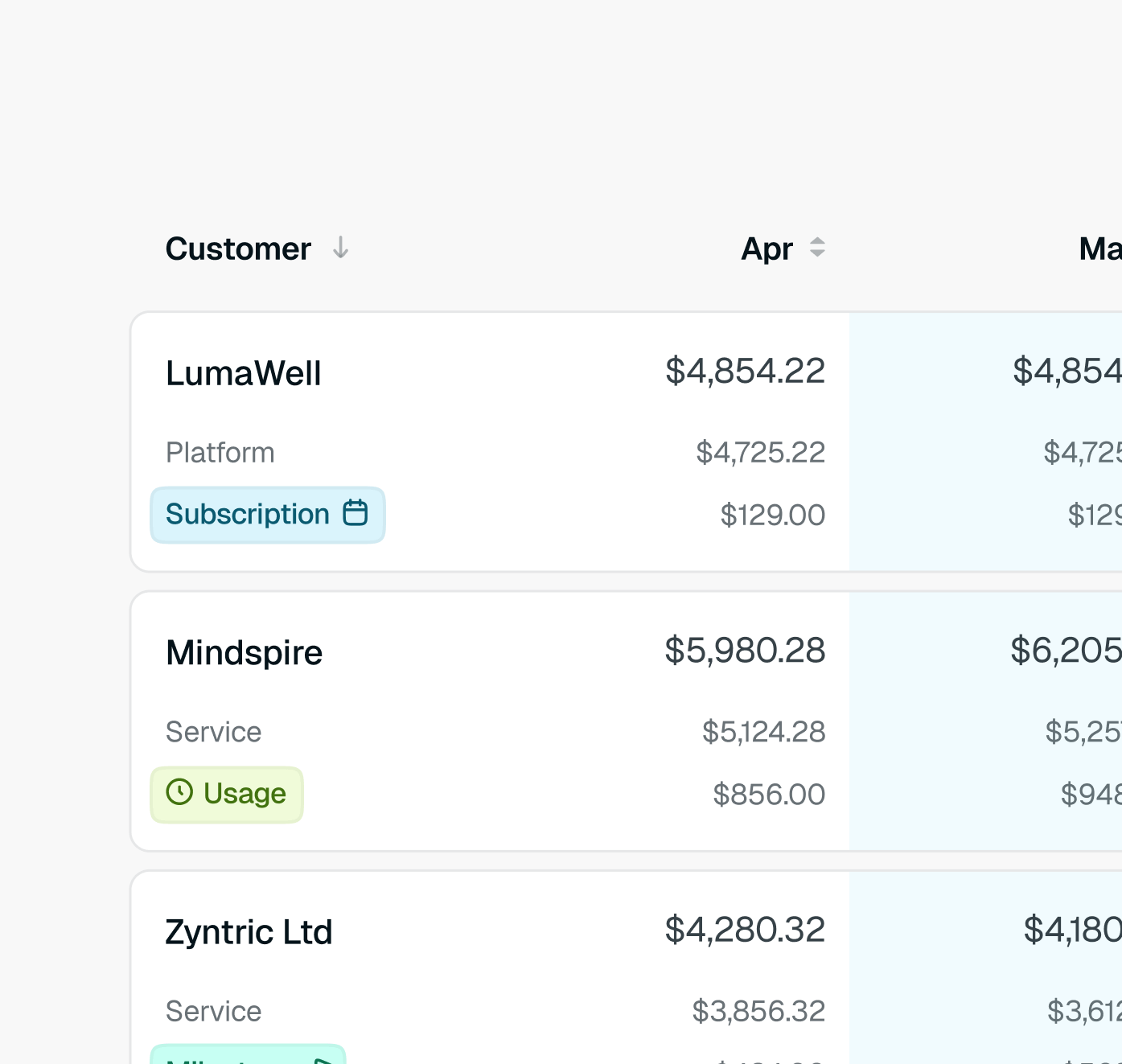

BIlling models

Any model, any customer, any scale

As your pricing evolves, Tabs supports every model — fixed, usage, milestone, or hybrid — no matter how complex the use case.

Close faster

Close faster, stay compliant

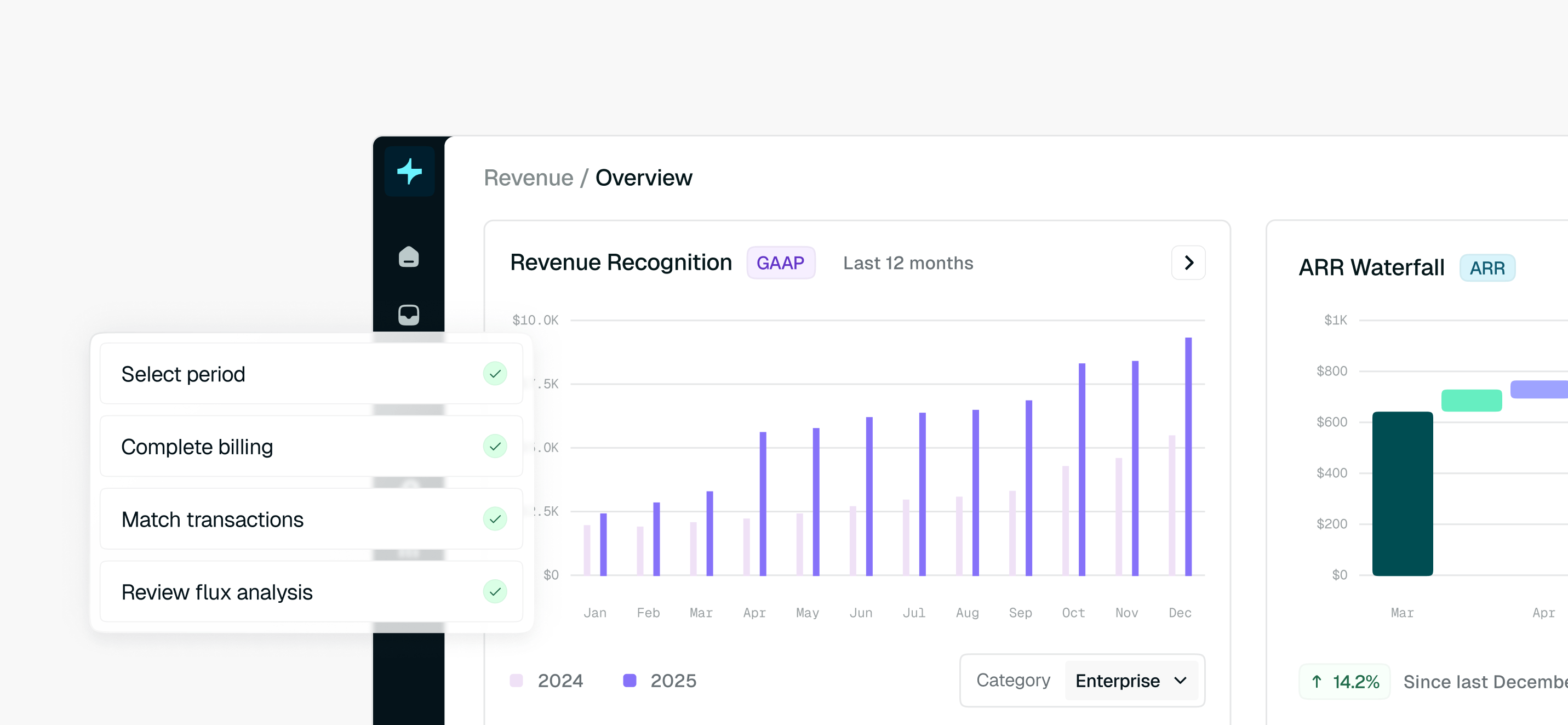

Tabs automates GAAP revenue recognition and supports non-GAAP views — so you can close the books with accuracy and deliver insights on time.

Revenue Close Management

Revenue done right, end to end

- Automated GAAP compliance

- Flexible non-GAAP views

- Revenue close management

See everything

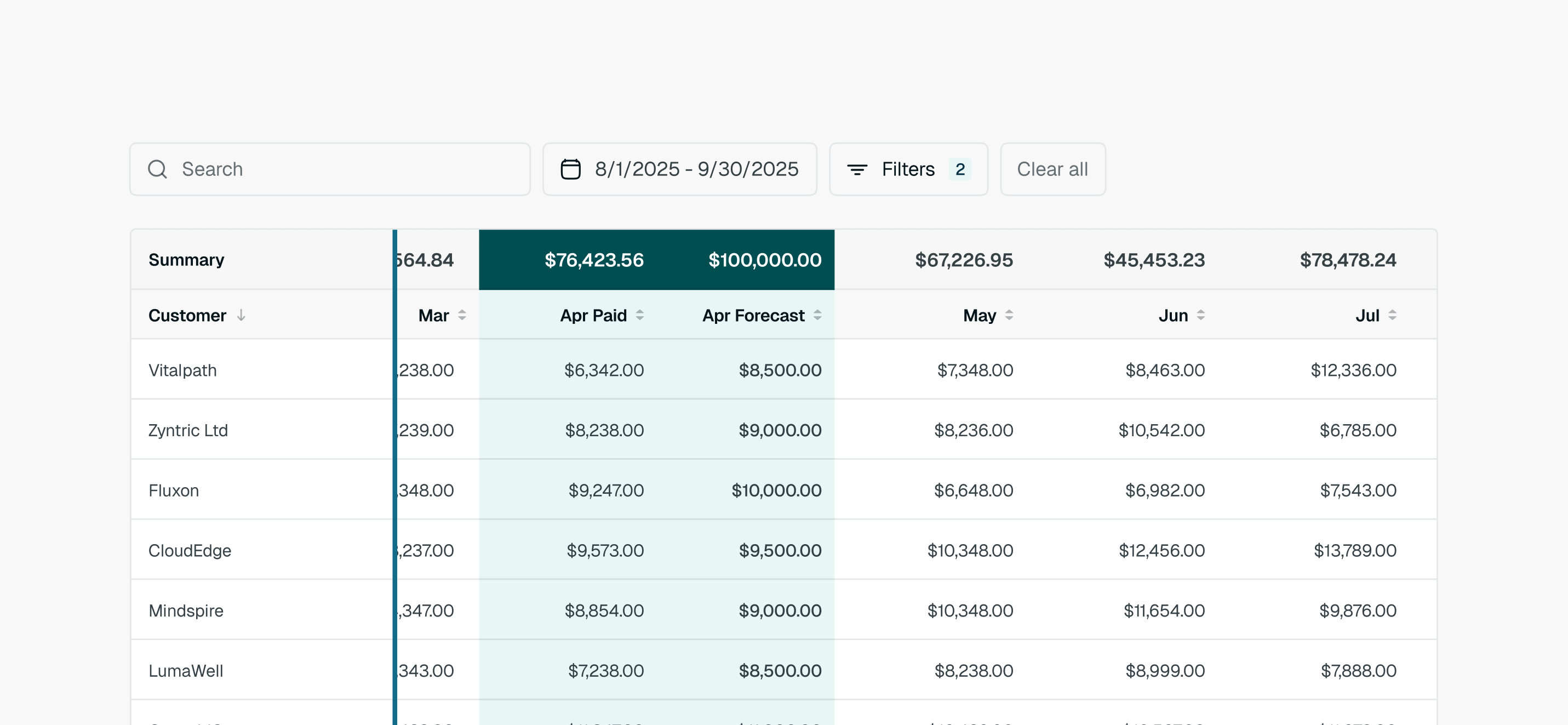

Reporting across the entire revenue cycle

Track AR aging, DSO, billing, collections, and revenue in one place — with real-time accuracy and drill-downs that replace manual spreadsheets.

Reporting