Today we’re excited to share that Tabs has closed a $55M Series B led by Lightspeed, with continued support from General Catalyst and Primary. In the last year, Tabs has grown to serve 200+ customers such as Cursor and Statsig, and on track to automating over $1 billion in annual invoice volume, achieving 5X ARR growth, and helping customers automate over 80% of manual tasks spent on billing and invoicing.

Funding is always a huge milestone, but for us, the real news is what comes next - the launch of our first set of AI agents, built to automate the most manual, painful parts of billing and revenue, and bring automation into the CFO’s office.

Why Revenue Work Has Stayed Manual

Finance has been transformed in procurement, spend management, and payroll, but revenue —billing, collections, revenue recognition, and reporting—remains stuck in the manual era.

A contract gets signed. Someone in finance reads the PDF, keys a billing schedule into an ERP, manually checks if the invoice was paid, chases payments weeks later, and then rebooks everything at month-end. None of it is strategic. It’s just hours of repetitive work, scattered across spreadsheets, email threads, and legacy systems. Multiply this by hundreds of contracts, and entire finance teams are consumed by monthly billing cycles, collections emails, and late-night closes.

What Tabs Agents Do Differently

Tabs’ AI-Native Platform flips that equation and solves these problems by automating the entire contract-to-cash cycle.

Today, we’re excited to introduce the first set of Tabs Agents to turn that manual work into an automated flow.

- Billing Agent ingests contracts once signed, automatically extracts billing terms and generates invoices, and syncs with your ERP.

- Collections Agent tracks due dates, matches payments, handles follow-ups, and reconciles automatically.

Instead of spending 70% of their time on billing and collections, finance teams now get invoices out instantly, payments reconciled in real time, and cash collected faster. Early customers like Cursor are saving hundreds of hours per quarter on invoicing, while Statsig has cut its close time nearly in half. Across our base, companies are automating over 80% of manual work across billing, collections, and rev rec.

Why It Matters Now

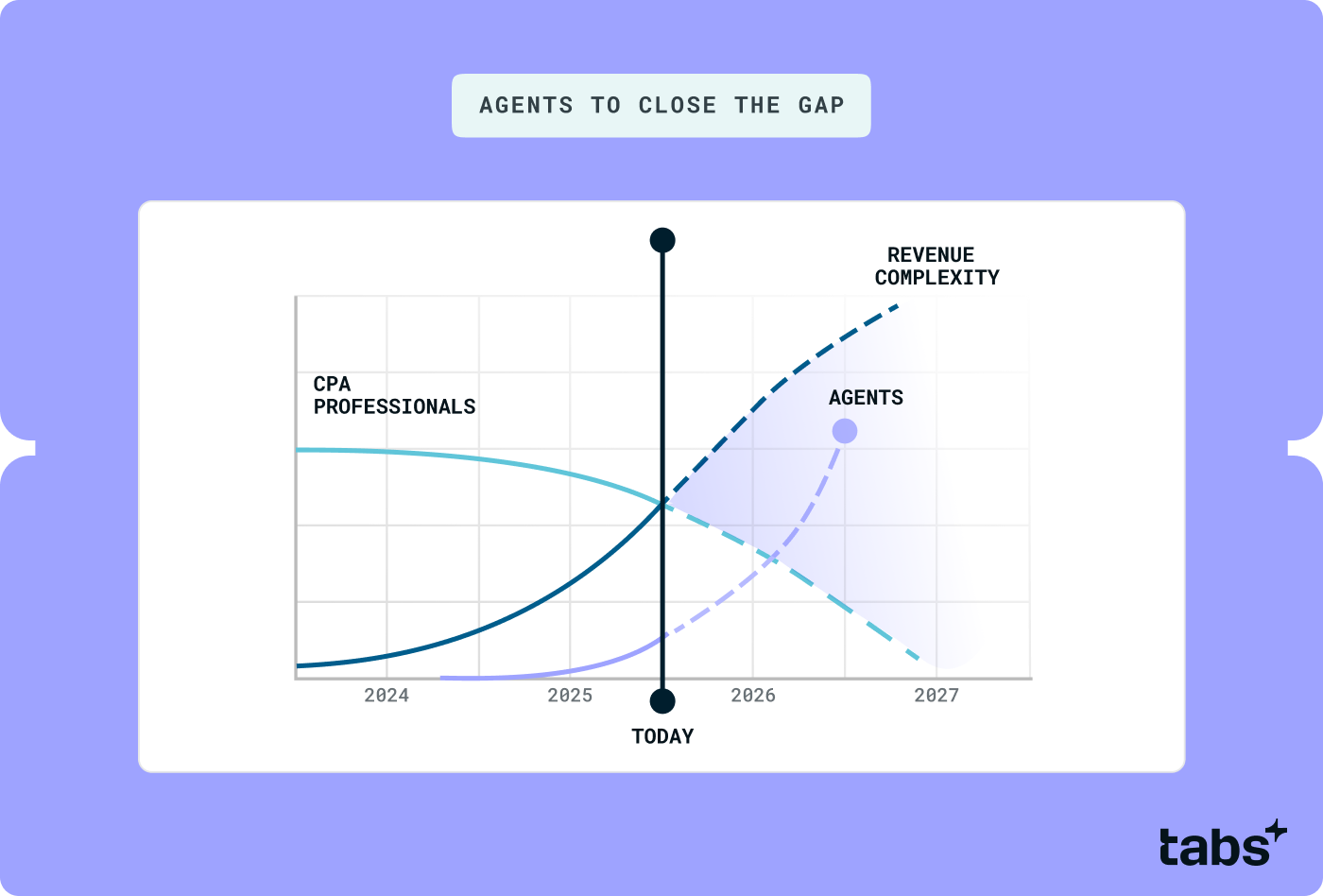

This shift comes at a critical time. 75% of accountants are nearing retirement, while the number of new CPAs has dropped 30% in the past decade. Meanwhile, pricing is getting more complex, with usage-based and hybrid models becoming the norm. CFOs can’t solve this by adding headcount. Agents allow modern finance teams to scale output and increase revenue without scaling headcount.

Built for Finance, With Finance

Tabs’ Agents are built to understand your contracts and has complete visibility into invoices, payments, and revenue schedules. That makes them faster, more accurate, and more scalable than manual ERP workflows. We designed them around three principles:

- Contracts as source of truth. Agents ingest signed agreements and instantly build billing schedules, renewals, and collection workflows.

- Continuous learning. Every invoice, payment, and revenue entry is reconciled automatically, with learning baked in from each transaction and billing cycle.

- Full auditability. Every action comes with a rationale. If the agent sent the invoice or booked the revenue, you know why and can trace it back.

The result: a system that feels less like another SaaS add-on and more like a trusted teammate that never sleeps.

A Note of Thanks

This raise gives us the fuel to move faster on our agent roadmap, expand our engineering and AI research in New York, and help more companies cut out manual finance work for good.

To our investors Lightspeed, General Catalyst, and Primary, thank you for believing in the vision. To our customers and partners, thank you for pushing us to build better and faster. And to our team, you’ve proven that finance and AI expertise together can tackle one of the biggest problems in enterprise software.

The manual era ends here.

- Ali Hussain

CEO & Co-Founder of tabs