When managing overdue payments, the dunning letter is necessary to bridge the gap between your business and your clients. Understanding and using dunning letters helps enhance your accounts receivable processes and keep healthier cash flows.

The Importance of Dunning Letters

Dunning letters are more than just reminders. They are a critical element in maintaining a healthy cash flow.

Dun & Bradstreet’s Q3 2023 U.S. Accounts Receivable and Days Sales Outstanding Industry Report highlights alarming figures in several industries. For instance, the social services sector reported a staggering 72.4% of accounts receivable dollars being 91+ days overdue. Similarly, miscellaneous and regular repair services industries reported over 22% of their receivables falling into the same severely delinquent category.

By clearly communicating the status of accounts and the urgency of settling overdue payments, dunning letters serve as a proactive step toward reducing the Days Sales Outstanding (DSO). Reducing DSO boosts your cash flow and stabilizes your financial operations, allowing for smoother business transactions and planning.

Legal Considerations and When To Send Dunning Letters

Understanding and obeying legal requirements protects your business and ensures that your communications are effective and professional.

Legal Prerequisites

Before dispatching a dunning letter, make sure you are compliant with local and national debt collection laws. These regulations often outline specific information you must include in any communication regarding debt, such as clear identification of the creditor, the amount of debt, and a statement informing the debtor of their right to dispute the debt.

In the U.S., the Fair Debt Collection Practices Act governs the actions of third-party debt collectors, stipulating that communications must be honest, fair, and free of misleading information.

Timeline for Sending Dunning Letters

- Initial Payment Reminder: This is sent shortly after the invoice due date has passed, typically within five to 10 days. It’s often informal and friendly, a nudge to remind the customer of the oversight.

- First Dunning Letter: If there’s no response to the initial reminder, then you send the first formal dunning letter. This usually occurs 15 to 30 days after the due date and includes a firmer tone, restating the debt owed and the agreed-upon terms.

- Second Dunning Letter: Send this second letter 30 to 60 days past the due date with an increased urgency tone. This letter may also outline potential consequences of continued nonpayment, such as reporting the debt to credit agencies or preparing for legal action.

- Final Notice: You would typically send this around 90 days past due as a last resort before taking more severe actions. It should clearly state that you may begin legal proceedings if you don’t receive the payment within a specified period.

By setting a clear timeline for escalating communications, your business can keep its professionalism and preserve important business relationships in the long run.

Components of a Dunning Letter

Clarity and accuracy are central elements in a dunning letter. Carefully structure each component to ensure the recipient understands the seriousness of the situation and to facilitate any potential legal actions.

Header and Company Information

Begin with a clear label at the top of the document stating “Dunning Letter.” This immediate identification makes the document’s purpose unmistakable and highlights its importance.

Include your company’s name, address, contact details, and other relevant information. This authenticates the letter and provides easy contact points for the recipient, ensuring they know exactly who is reaching out and how to respond.

Recipient Information

Address the letter personally to the individual or the business responsible for the debt. Use correct titles and company names to prevent any confusion or misdelivery. This personalization is crucial, showing respect and consideration for a more receptive response.

Reference Details

Clearly indicate the original invoice number along with the date it was issued. This is critical as it helps the recipient easily identify the specific transaction in question, ensuring no confusion about the payment. If applicable, include the customer’s account number.

Statement of Account Status

Provide a brief description of the debt, outlining the charges. List the total overdue amount, including any late fees or interest accrued. It is crucial to itemize these details, so the recipient knows exactly how much is owed and why.

Previous Communications

Detail the history of your attempts to collect the debt, including the dates of past communications. This shows your ongoing effort to resolve the matter and establishes a timeline that can be important in legal contexts or further debt recovery efforts.

Payment Instructions

Clearly outline how the recipient can settle the outstanding balance. Provide concise instructions and include all available payment methods — such as online payment portals, bank transfer details, or addresses for mailing checks.

Consequences of Nonpayment

Articulate the potential consequences of further delayed payment. These may include legal actions, additional fees, discontinuation of services, or negative impacts on the recipient’s credit score. This information stresses the seriousness of the situation and the importance of settling the debt promptly.

Deadline for Payment

Set a firm deadline for the payment. Specify a precise date on which you should receive payment. This creates a sense of urgency and gives the recipient a specific timeframe to resolve the issue, helping expedite the payment process.

Offer of Assistance

Demonstrate your commitment to resolving the matter amicably by providing the contact details of a person or department within your company. This contact should be available to assist with any queries or issues regarding the payment. Offering help in this way can ease the payment process and maintain a positive relationship with the recipient.

Closing Statement

Conclude the letter on a respectful note. Thank the recipient for their attention to the matter and express hope for a fast resolution. This creates goodwill and reinforces the seriousness of the communication in a professional manner.

Legal Advisories

If necessary, include any legal disclaimers or advisories required by law in your jurisdiction. These might pertain to debt collection practices and the recipient’s rights. Ensuring that your dunning letter complies with legal standards protects your business and informs the recipient of their rights, adding a layer of transparency and trust to the process.

Writing the Dunning Letter: A Step-by-Step Guide

Crafting effective dunning letters involves a balance of firmness and tact. Each stage of communication escalates the urgency while maintaining professionalism.

First Dunning Letter: Crafting a Polite Reminder

- Purpose: To gently remind the customer of the overdue payment without creating hostility.

- Tone: Friendly and helpful, as if assuming the delay was an oversight or error.

- Content: Include the invoice number, the total amount due, and a brief reference to your payment terms. Offer your contact details for any questions and provide easy payment options.

- Example: “We noticed that invoice #1234 has not been settled according to our 30-day payment terms. We’re sure this is just an oversight, but please let us know if you have any questions.”

Second Dunning Letter: Introducing Urgency and Potential Consequences

- Purpose: To escalate the matter by highlighting the urgency and potential consequences of nonpayment.

- Tone: Firm but respectful, making it clear that the matter requires immediate attention.

- Content: Reiterate the debt details, mention previous communications, and clearly outline potential consequences of further delays, such as late fees or credit implications.

- Example: “As noted in our previous reminder, invoice #1234 remains unpaid. It is crucial that this amount is settled within the next 10 days to avoid late fees and potential disruptions to our service.”

Third Dunning Letter: Final Notice Before Legal Actions

- Purpose: To serve as a final warning before taking more severe recovery actions.

- Tone: Serious and direct, stating that this is the final opportunity to resolve the debt amicably.

- Content: Stress the seriousness of the situation, list all previous attempts to collect the debt, and specify the actions you will take if you don’t receive payment by the deadline.

- Example: “This is the final notice regarding invoice #1234. If we do not receive payment by [specific date], we will initiate legal proceedings to recover the debt.”

Writing Tips

- Use a consistent format for all your dunning letters, including branding elements like your company logo and a professional layout.

- Be clear and concise in your language. Avoid jargon that might confuse the recipient.

- Show understanding of potential reasons for delayed payment and offer solutions like payment plans if appropriate.

- End each letter with a clear call to action, specifying what the recipient needs to do next and by when.

Medium and Delivery of Dunning Letters

Choosing between email and physical letters can significantly impact your dunning communications’ effectiveness and response rates. Here’s a concise comparison to help you decide the best method for your needs:

Medium Advantages Disadvantages Best for Email Fast, cost-effective, and easy to track. Easily overlooked, it can be perceived as less serious. Quick reminders and initial notices. Physical Letters Perceived as more formal, less likely to be ignored, and meets certain legal requirements. More costly, slower delivery, higher environmental impact. Serious notices and final warnings.

Emails might prompt quicker responses due to their immediacy but risk being ignored if not opened. Physical letters command more attention, and the recipient generally takes it more seriously, leading to higher engagement.

Using both methods strategically can maximize your results. Start with emails for initial reminders and escalate to physical letters for more severe or final notices. This approach leverages the strengths of both mediums while minimizing their weaknesses.

Avoiding Common Pitfalls in Dunning Letters

Dunning letters are crucial tools in debt collection, but common mistakes can hinder their effectiveness. Here’s how to avoid these pitfalls and ensure your dunning process is both efficient and respectful.

Lack of Clarity and Detail

- Pitfall: Vague details about the debt and unclear payment instructions can confuse the recipient.

- Solution: Always include specific details such as invoice numbers, descriptions of services, total amounts due, and clear payment instructions. This clarity helps the recipient understand the debt and how to resolve it.

Incorrect or Outdated Information

- Pitfall: Incorrect recipient details or outdated information might lead to disputes and erode trust.

- Solution: Verify all information before sending a dunning letter, including the debtor’s contact details and the account status.

Aggressive or Inappropriate Tone

- Pitfall: An overly aggressive tone can alienate customers and potentially lead to legal issues.

- Solution: Use a professional and courteous tone, starting with polite reminders and gradually increasing seriousness if necessary.

Ignoring Legal Requirements

- Pitfall: Failing to comply with legal standards in debt collection can lead to penalties.

- Solution: Ensure compliance with both local and international debt collection laws, including any required disclaimers and adherence to timing regulations.

Inadequate Follow-Up Procedures

- Pitfall: Poor follow-up on dunning letters can suggest disorganization and result in missed opportunities.

- Solution: Implement a systematic follow-up process using scheduling tools to track communications and escalate actions as needed.

One-Size-Fits-All Approach

- Pitfall: Using a uniform dunning letter for all debts can reduce effectiveness.

- Solution: Tailor letters to the customer profile and debt nature. Personalize approaches, especially for long-standing customers.

Failure To Offer Payment Solutions

- Pitfall: Lack of payment options might hinder the resolution of debts.

- Solution: Provide multiple payment methods and, where possible, negotiate payment plans to facilitate easier settlement of debts.

Advanced Strategies and Technologies

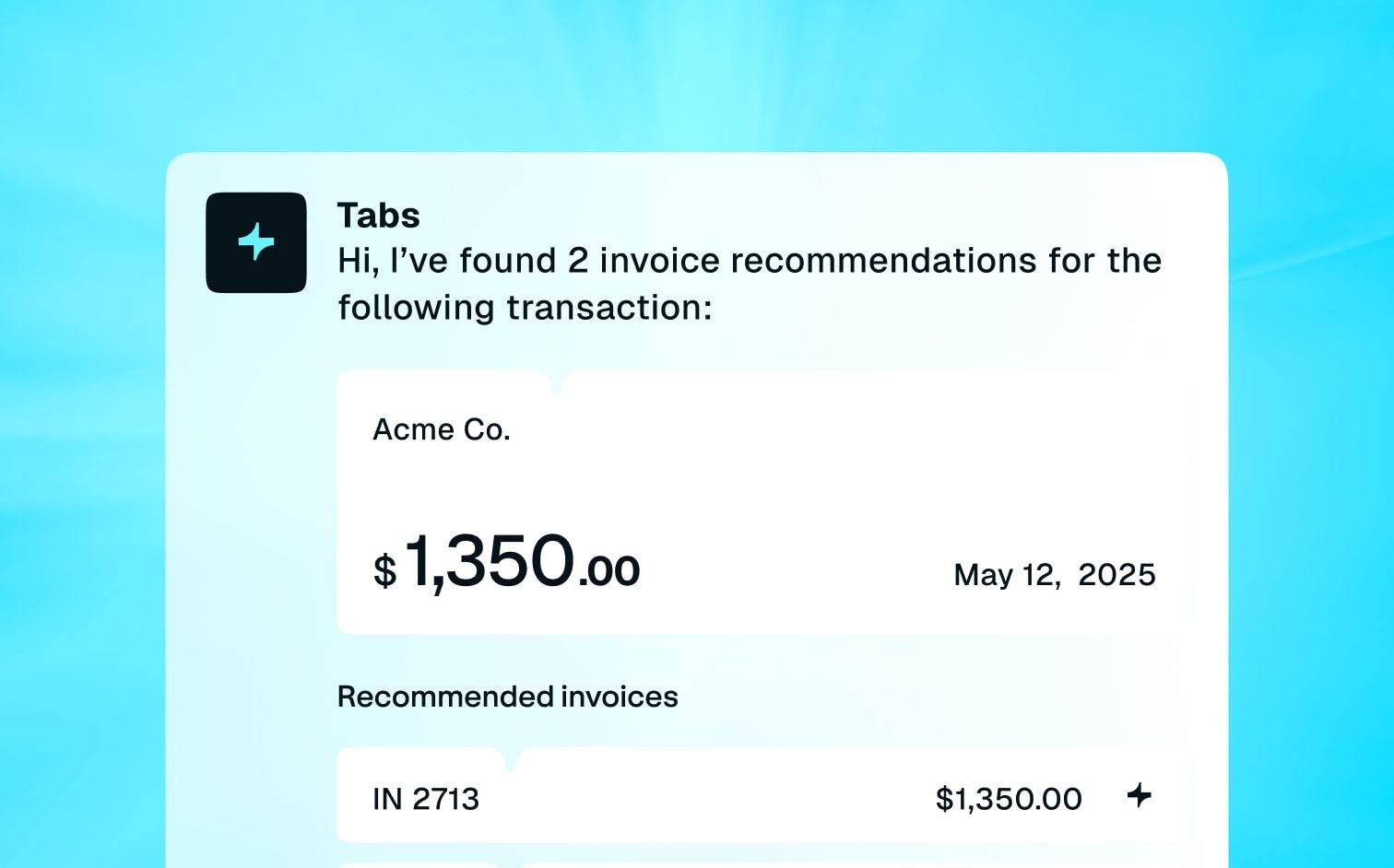

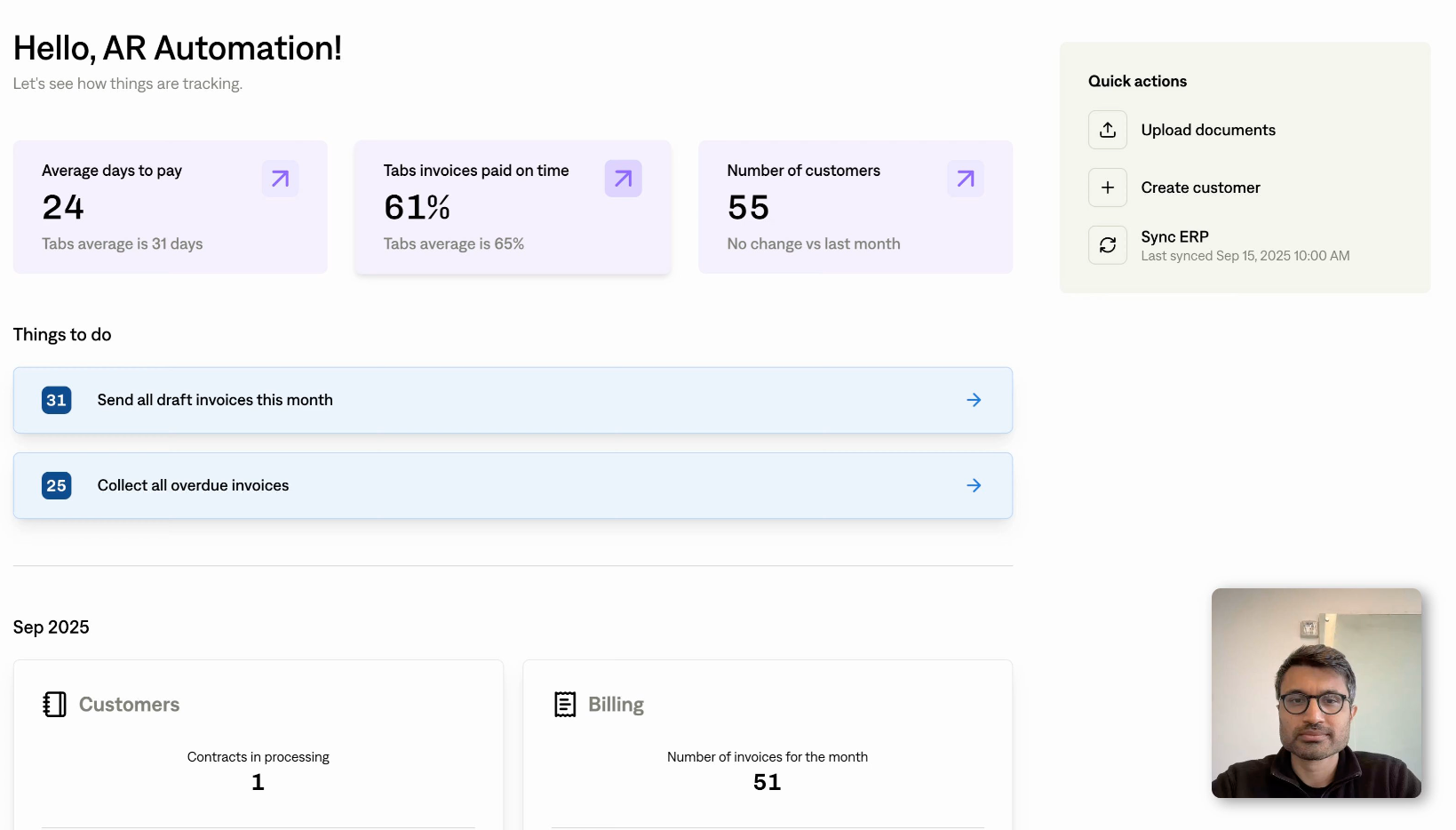

Automated systems are invaluable for streamlining the delivery of dunning letters, as they aid in timely and consistent communication while minimizing human error. Additionally, integrating AI and analytics can deeply impact your management of delinquencies.

These tools analyze payment behaviors, forecast potential defaults, and tailor dunning strategies to specific customer profiles, significantly improving your recovery rates. Together, these technologies optimize your dunning efforts and contribute to a more efficient overall accounts receivable management.

Concluding Thoughts

Dunning letters are essential tools that help manage your accounts receivable for healthy cash flows. All it takes to improve your dunning processes is to adopt clear communication strategies, comply with applicable laws, and use advanced technologies. Remember, a strategic approach to dunning is vital for overall financial health.

Streamline your dunning process with Tabs. Our platform leverages cutting-edge AI to automate your accounts receivable management for timely collections and robust financial health. See what Tabs can do for you today and transform your dunning strategy.