SOLUTION

Tabs for Fintech

Simplify complex billing cycles, automate revenue recognition, and stay compliant with evolving regulations. Tabs helps Fintech companies streamline invoicing, payments, and reporting, so you can focus on scaling innovation and financial services—not managing operational overhead.

Fintech businesses face unique challenges with managing complex, multi-layered pricing models, handling cross-border transactions, and ensuring compliance with strict financial regulations. These complexities often lead to delayed payments, inaccurate invoicing, and time-consuming reporting. Tabs automates invoicing, payments, and revenue recognition, simplifying compliance with regulations like ASC 606 while providing Fintech companies with real-time insights to improve cash flow and financial accuracy.

Adapt pricing models for a dynamic financial landscape

As the Fintech market evolves, so do your pricing needs. Tabs allows you to easily configure, test, and implement flexible pricing models, whether it’s tiered, transactional, or subscription-based. With the ability to adapt pricing strategies on the go, your company can stay competitive while delivering transparent billing experiences that meet client expectations.

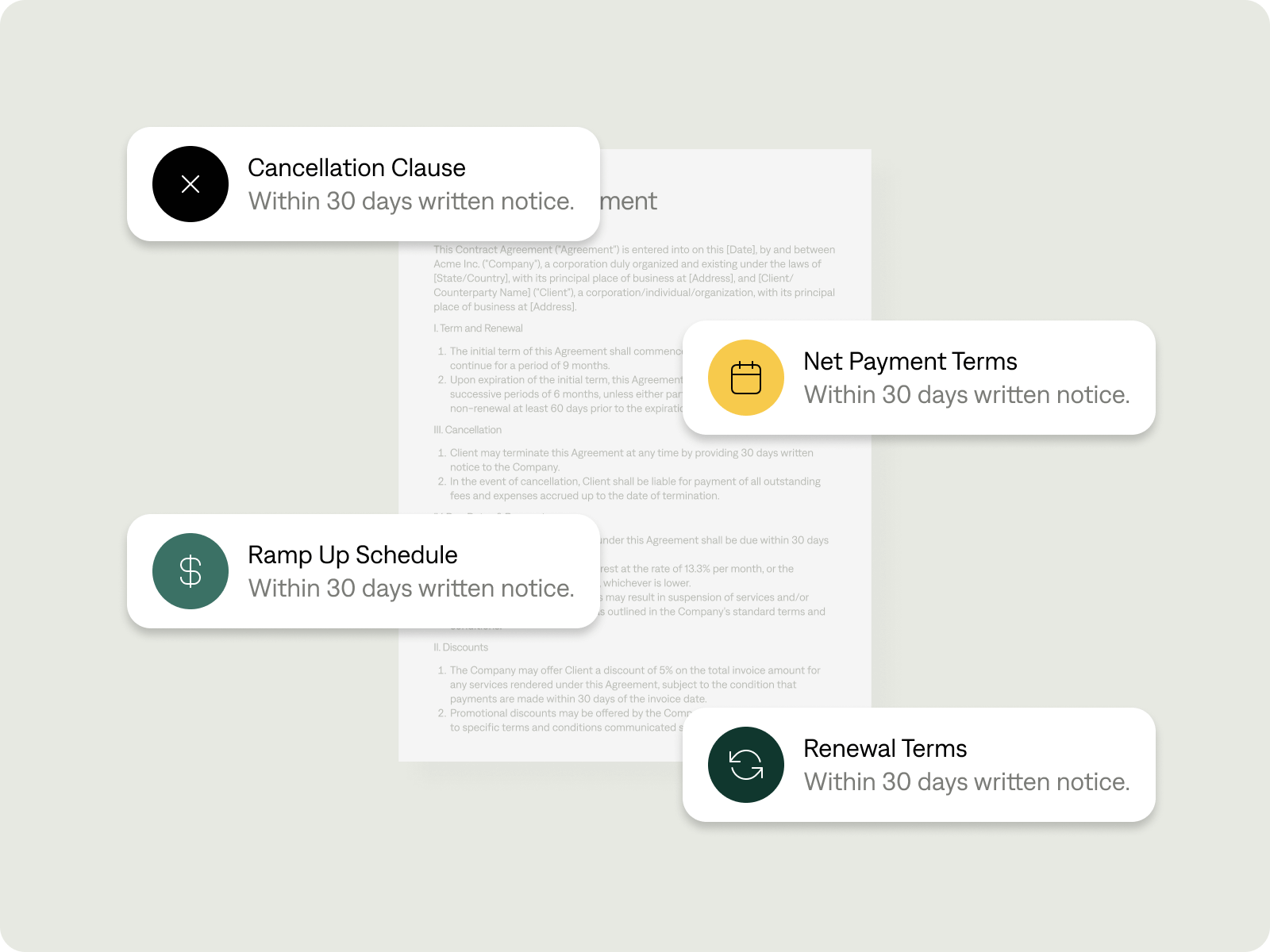

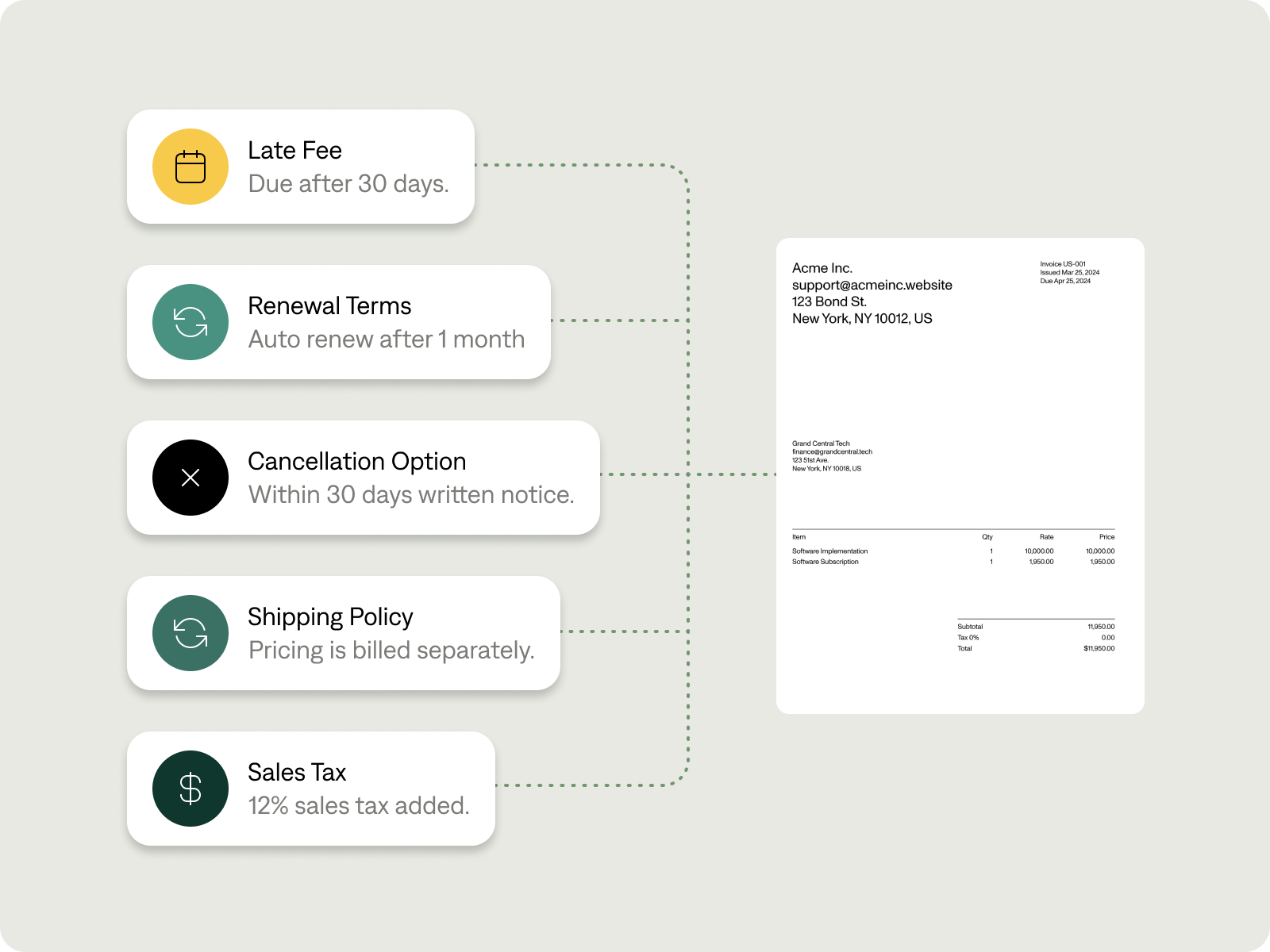

Automate even the most complex invoicing scenarios

Managing diverse financial services means handling intricate billing cycles. Tabs automates even the most complex invoices, calculating fees, interest, usage, and more—without the need for manual intervention. This eliminates errors, ensures billing accuracy, and frees your finance team to focus on high-level strategies instead of chasing down discrepancies.

Accelerate payments and optimize receivables management

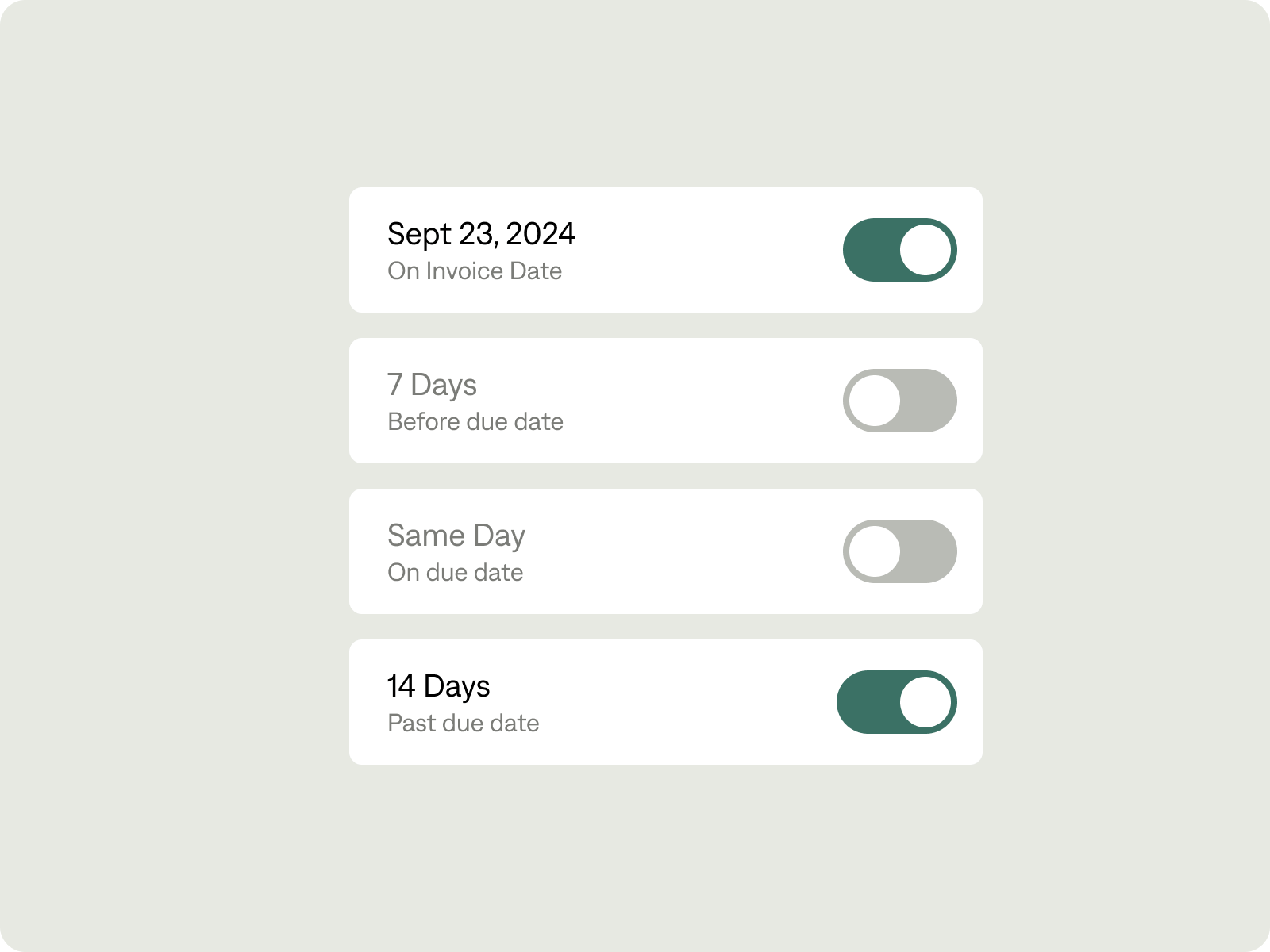

Keep your cash flow strong with automated payments and streamlined receivables. Tabs integrates directly with your payment systems to ensure that invoices are paid on time, while tracking and reconciling payments without manual oversight. With Tabs, your Fintech business reduces payment delays and gains faster access to cash, improving liquidity and client satisfaction.

"Tabs is the only software we saw that could fully automate our complex billing and remittances process. Tabs provides all the features we need to manage our receivables in one, easy-to-use platform. Not only are we now saving time on manual tasks, we’re also able to get cash in the door faster."

Sebastian Hart

Director of Finance & Business Development

Related articles

Dunning Explained: Best Communication Practices

When your cash flow is healthy, your business thrives. Effective communication is key in this process, especially when collecting payments.

5 Ways to Improve Your AR Management

The best way to continue a strong cash flow within your business is to manage your accounts receivable correctly.

Order-to-Cash (O2C) Explained in Five Minutes

The order-to-cash (O2C) process can make or break your business. From the time your customer places an order to the moment...

GET A PERSONALIZED DEMO

Ready to see Tabs for yourself?

“There are a million platforms that help you manage spend, but Tabs is unique in that it actually helps me get the company’s money faster. ”

Alan Federman, VP of Finance, Canvas