The order-to-cash (O2C) process can make or break your business. From the time your customer places an order to the moment you receive their payment, every step in between must be carefully orchestrated to ensure efficiency, accuracy, and customer satisfaction.

In this blog post, find out more about the most important components of a successful O2C process and explore strategies for optimization.

Key Components of the Order-to-Cash Process

A smooth O2C process covers all the steps involved in capturing, processing, and fulfilling customer orders, as well as invoicing and collecting payments. The main goal of the O2C process is to fulfill orders as timely and accurately as possible. Of course, equally important is collecting prompt payment to maintain a steady cash flow and high customer satisfaction.

Order Management

Order management is about capturing and processing customer orders efficiently. You can use an integrated system to handle orders of all sizes, including bulk and recurring orders typical in B2B transactions.

If you automate your order entry, you’ll cut down on errors and speed up processing. And if your system has a real-time tracking feature, you can monitor order status and quickly respond to any issues. This keeps customers happy and accelerates revenue recognition.

Credit Management

Credit management protects your cash flow by assessing your customer’s creditworthiness before you extend them any credit. It’s wise to use credit reports and financial data to evaluate new and existing customers alike. Plus, setting clear credit limits and regularly reviewing them helps your team manage risks.

Thankfully, automated tools can streamline this process, providing alerts for at-risk accounts and enabling quick, informed decisions. This proactive approach minimizes bad debt and strengthens your financial stability.

Order Fulfillment and Shipping

Efficient order fulfillment and shipping are key to customer satisfaction. It involves picking, packing, and delivering orders accurately and on time. Integrate your order management system with warehouse and logistics operations for seamless coordination.

Automation can update your inventory in real time to prevent stockouts and overstocks. Plus, you can plan for potential supply chain disruptions and maintain good supplier relationships for even smoother operations. When done correctly, this increased transparency builds trust among your customers and keeps them informed every step of the way, should they need it.

Invoicing

If you want your customers to submit timely payments, deliver prompt and accurate invoicing. After all, clear, compliant invoices prevent payment delays. Plan to create invoices immediately after order fulfillment and tailor them to meet specific B2B contract requirements, including purchase orders and billing cycles.

Of course, you can automate this process to minimize errors and lessen your manual workload. Implementing digital invoicing can speed up delivery and processing, improving your cash flow. Don’t forget to regularly review your invoicing practices to identify and fix any inefficiencies along the way.

Accounts Receivable

Managing accounts receivable effectively ensures steady cash flow. For best results:

- Use automated systems to track outstanding invoices and send timely reminders for payments.

- Establish clear payment terms and immediately follow up on overdue accounts.

- Regularly review aging reports to identify issues and take corrective actions.

- Segment customers by payment behavior to tailor collection strategies, and offer flexible plans for reliable payers and stricter terms for others.

If you do this, you’ll optimize your cash collection and lower the risk of accumulating bad debt. It’s a win-win.

Payment Collection

Effective payment collection strategies are essential for maintaining liquidity. Offer multiple payment options to make it easy for customers to pay. Automated reminders for upcoming and overdue payments can reduce delays. Consider incentives like early payment discounts to encourage prompt payments.

A well-structured collection process minimizes late payments and bad debt. Regularly evaluate your collection methods, adjusting strategies based on customer feedback and payment trends to ensure continuous improvement.

Data Management and Reporting

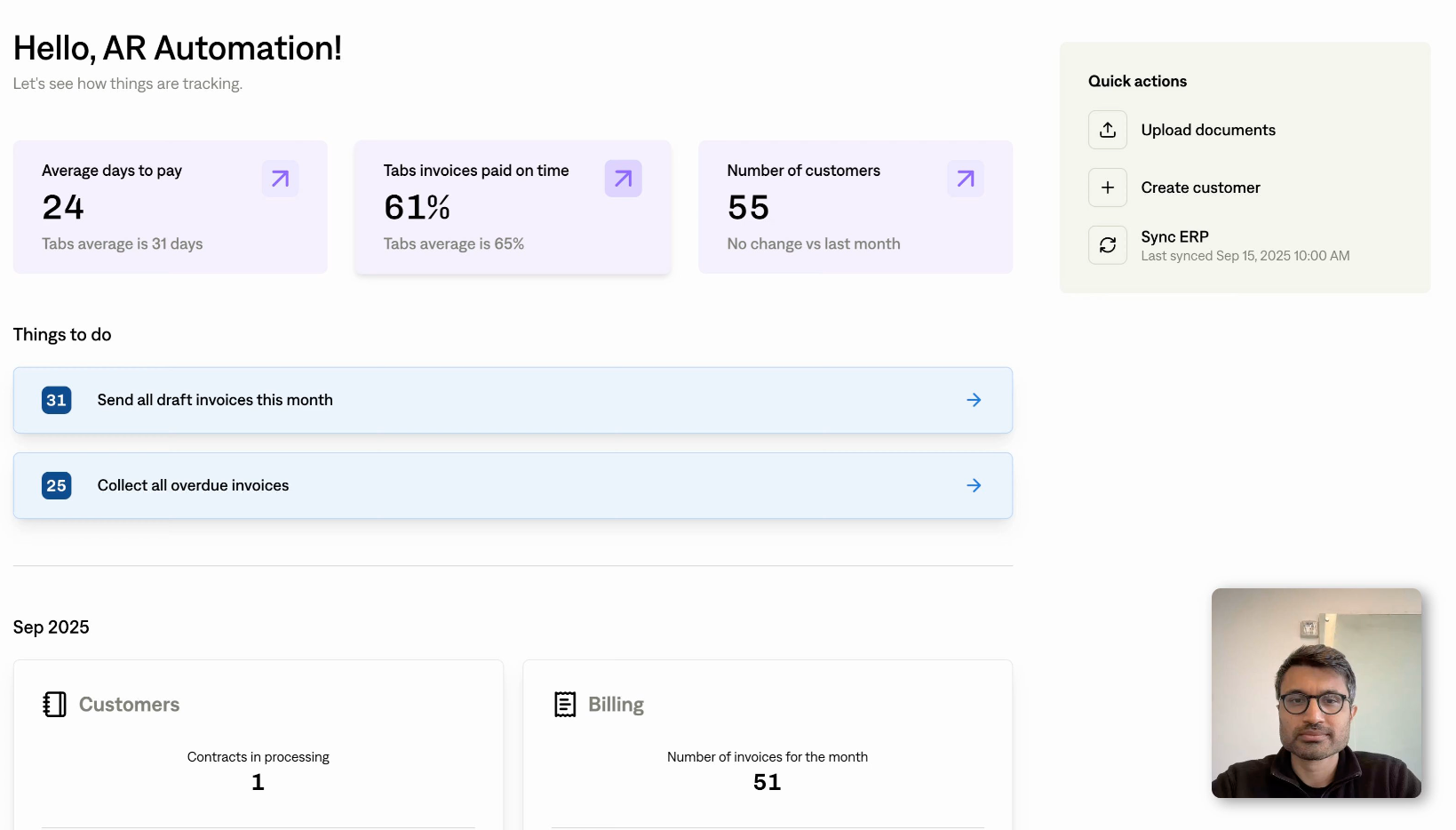

When it comes to managing your data, take advantage of analytics to spot your bottlenecks and potential inefficiencies. Be sure to regularly review metrics like order accuracy, fulfillment times, and payment collection rates.

Data-driven insights help you make informed decisions and continuously refine your processes. Implement comprehensive data management practices to stay proactive and maintain operational smoothness.

Don’t overestimate the power of a good report, either! Dashboards and real-time reporting tools keep your team agile, enabling quick adaptation to changing market conditions and customer needs.

The Role of Technology in Optimizing O2C

When it comes to fine-tuning your O2C process, technology is your friend. By integrating systems like ERP, CRM, and AR, you can automate functions, experience fewer errors, and speed up your business processes.

ERP Systems

Enterprise Resource Planning (ERP) systems are the backbone of O2C optimization. They integrate various business functions into a single, unified platform. With an ERP system, you can seamlessly manage everything from order entry to product delivery and payment processing.

For example, when you record a sale, the ERP system automatically updates inventory levels. This real-time visibility prevents stock discrepancies, so you can enjoy more efficient order management.

Additionally, ERP systems facilitate accurate invoicing by pulling data directly from order records, reducing manual errors and speeding up the billing cycle. They also provide comprehensive reports on sales, inventory, and financials. As a result, your team can make informed, data-backed decisions.

CRM Systems

Customer Relationship Management (CRM) systems enhance the O2C process by helping you maintain detailed records of customer interactions, purchases, and preferences. You need this information if you plan to tailor your sales approach to individual customer needs.

For instance, a CRM system can alert your sales team to customer-specific pricing or special terms, reducing the time needed to finalize that order. CRM systems also track communication histories, ensuring that you address any issues promptly, leading to higher customer satisfaction. Plus, they can automate follow-ups and reminders to keep your sales cycle moving efficiently and improve the chances of repeat business.

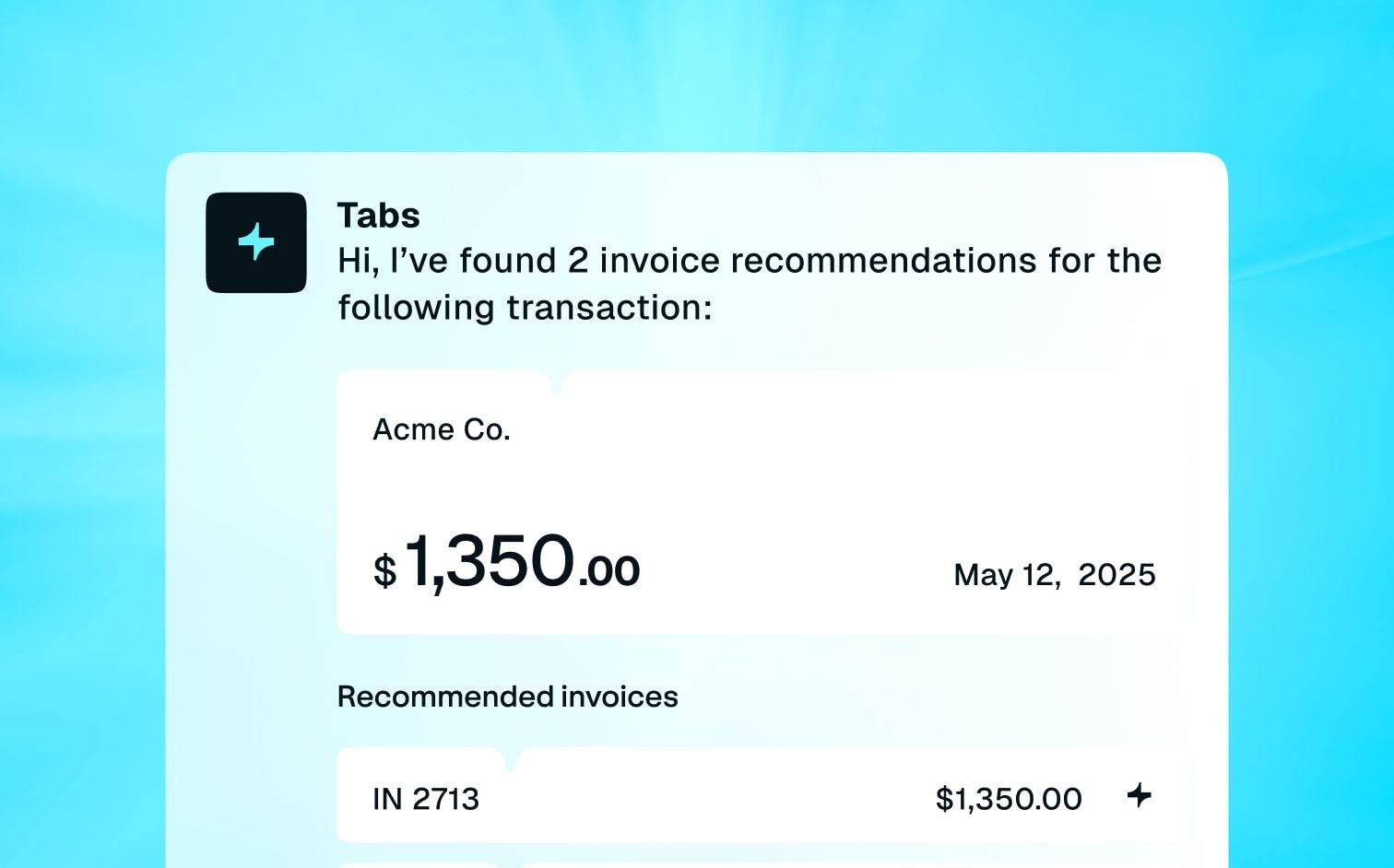

AR Systems

Accounts Receivable (AR) systems make the invoicing and payment collection phases of the O2C cycle easier, reducing the administrative burden on your finance team. These systems can quickly automate invoice generation based on data from ERP systems, so you know the numbers are accurate. AR systems send automated reminders to your customers about upcoming or overdue payments, and in doing so, significantly reduce the risk of getting late payments.

These systems also give you detailed reports on payment history and aging accounts receivable. You can use this feedback to identify and address potential issues proactively.

Integrating Technologies for a Seamless O2C Process

Of course, the real power of these technologies lies in their integration.

An ERP system integrated with CRM and AR systems creates a cohesive, end-to-end O2C process. For example, when an order is placed through CRM, the ERP system updates the inventory and initiates order fulfillment. Once the order is fulfilled, the AR system generates and sends the invoice and tracks the payment status. This seamless flow of information reduces manual interventions and accelerates the entire O2C cycle.

Common Challenges in the Order-to-Cash Process

The O2C process is critical for your business success, but it comes with a few challenges. If you’re able to identify and address these issues, it’ll speed things up and significantly improve your cash flow.

Delayed Payments

Late payments can disrupt cash flow and impact financial stability. To combat this, implement automated invoicing and payment reminders. These systems can send timely alerts to customers about upcoming and overdue payments, reducing the risk of delays.

Offering multiple payment options and incentives for early payments can also encourage timely settlements. Regularly review your accounts receivable aging reports to identify slow-paying customers and take proactive measures to address these accounts.

Order Errors and Inaccuracies

Order errors and inaccuracies can lead to customer dissatisfaction and increased operational costs. To reduce these issues, use an integrated order management system that automates order entry and processing. This minimizes manual input errors and ensures accurate order details.

Regularly update your product and pricing information in the system to avoid discrepancies. Implementing a robust quality control process to verify order accuracy before shipping can further reduce errors and enhance customer satisfaction.

Inventory Management Issues

Effective inventory management is crucial for fulfilling orders on time. Stockouts and overstocks can disrupt the O2C process. Integrate your order management system with inventory management software to maintain real-time inventory levels. Use demand forecasting tools to predict stock needs accurately and plan inventory accordingly. Establish strong relationships with suppliers to manage lead times and mitigate supply chain disruptions. Regular audits and cycle counts can help maintain inventory accuracy and prevent shortages or excesses.

Complex Billing and Invoicing

Billing and invoicing in B2B transactions can be complex, especially with varying contract terms and billing cycles. Automate your invoicing process to handle different billing requirements and reduce manual work. Ensure that your invoicing system can generate customized invoices that comply with specific contract terms, including purchase orders and special billing cycles.

Clear and accurate invoices prevent payment delays and disputes. Regularly review and update your invoicing practices to streamline the process and improve efficiency.

Inefficient Data Management

Poor data management can lead to inefficiencies and missed opportunities in the O2C process. Use integrated systems to consolidate data from various sources, ensuring accurate and up-to-date information. Implement data analytics tools to monitor and analyze key performance indicators (KPIs) such as order accuracy, fulfillment times, and payment collection rates.

Regularly review these metrics to identify bottlenecks and areas for improvement. A centralized data management approach enables better decision-making and enhances overall process efficiency.

Communication Breakdowns

Breakdowns in communication between departments can lead to delays and errors. Implement collaboration tools that facilitate real-time communication and information sharing across teams. Regular meetings and updates can ensure everyone is aligned and aware of their responsibilities. Establishing clear protocols for handling issues and escalations can also improve response times and prevent problems from escalating.

Benefits of an Efficient Order-to-Cash Process

An efficient O2C process is essential for the health and growth of any organization. Here are the key benefits your business can experience from streamlining this process.

Enhanced Cash Flow

A streamlined O2C process directly impacts your cash flow. So, reducing the time between order placement and payment collection accelerates the inflow of cash. Automated invoicing and payment reminders mean more timely payments. Improved cash flow means you have more working capital to reinvest in your business, fund operations, and support growth initiatives.

Improved Customer Satisfaction

Efficiency in the O2C process leads to higher customer satisfaction. Accurate order processing, timely deliveries, and clear invoicing all contribute to a better customer experience. Customers appreciate consistency and reliability, which strengthens your relationships and encourages repeat business. Satisfied customers are more likely to become loyal advocates for your brand, further enhancing your market reputation.

Operational Efficiency

Optimizing the O2C process reduces manual work and errors. Automation of tasks such as order entry, invoicing, and payment tracking frees up your staff to focus on more strategic activities. This boosts productivity and lowers operational costs. Efficient processes ensure that all departments work in harmony, reducing delays and improving overall workflow.

Reduced Days Sales Outstanding

An efficient O2C process helps reduce Days Sales Outstanding (DSO), the average number of days it takes to collect payment after a sale. Lower DSO indicates that your business is collecting payments more quickly, improving liquidity. This metric is crucial for maintaining a healthy financial position and demonstrating financial stability to investors and stakeholders.

Better Decision Making

A well-optimized O2C process provides valuable data insights. By leveraging analytics, you can track KPIs such as order accuracy, fulfillment times, and payment collection rates. This data helps you identify trends, pinpoint inefficiencies, and make informed decisions. Better decision-making leads to continuous improvement and long-term success.

Strengthened Supplier Relationships

Efficient order management and timely payments also benefit your relationships with suppliers. When you manage your inventory well and settle invoices promptly, you become a preferred partner for your suppliers. This can lead to better terms, discounts, and priority service, further enhancing your operational efficiency and cost savings.

Increased Scalability

A robust O2C process supports business scalability. As your business grows, handling a higher volume of orders, invoices, and payments becomes more complex. An efficient O2C system ensures that you can manage this increased volume without compromising on accuracy or speed. This scalability is crucial for sustaining growth and adapting to market demands.

Concluding Thoughts

Effective accounts receivable management is crucial for a smooth B2B order-to-cash cycle, ensuring healthy cash flow and operational efficiency. Continuously assess and adapt your AR strategies to meet evolving business needs. Tabs offers powerful tools to streamline your AR processes, helping you stay ahead. Book a demo to see how Tabs can help you optimize your O2C cycle and drive business growth.