Fighting chargebacks drains your time and resources. Wouldn't it be great to stop them before they happen? Chargeback alerts give you a heads-up, a critical chance to fix customer issues early. This article is your guide to chargeback alerts, showing you how they work and why they're essential for protecting your revenue. We'll cover choosing the right provider and using data to prevent future disputes. Get ready to take control of your chargeback management.

Key Takeaways

- Proactive dispute management saves money: Addressing customer concerns before they become chargebacks minimizes fees and protects your merchant account.

- Early intervention strengthens customer relationships: Resolving disputes quickly through chargeback alerts builds trust and encourages customer loyalty.

- Automation maximizes ROI: Streamline your chargeback alert process with automated tools and data analysis to improve efficiency and prevent future disputes.

What Is a Chargeback Alert?

Chargeback alerts act as an early warning system, notifying you of potential disputes before they become costly chargebacks. Think of it like a friendly heads-up, giving you a chance to address a customer's concern before it snowballs. This proactive approach empowers you to resolve issues directly with the customer, often preventing the chargeback altogether. This saves you time, money, and the hassle of dealing with complicated retrieval requests and chargeback representment.

Traditional chargeback management is reactive—you only learn about the dispute after the chargeback hits. This often means lost revenue, operational headaches, and potential damage to your merchant account. Chargeback alerts shift you from reactive firefighting to proactive problem-solving. You gain valuable time to investigate the issue, contact the customer, and potentially offer a refund or other resolution. This can not only save the sale but also foster positive customer relationships. By addressing the root cause of the dispute, you can also identify areas for improvement in your customer service or order fulfillment processes. This proactive approach helps build a more sustainable and profitable business.

Chargeback Alerts vs. Notifications

Understanding the difference between chargeback alerts and notifications is crucial for effective dispute management. A chargeback alert is your early warning system. It notifies you of a customer complaint before it escalates into a formal chargeback. Think of it as a heads-up, giving you the chance to step in and resolve the issue proactively. This proactive intervention can often prevent a chargeback entirely, saving you time and money.

A chargeback notification, on the other hand, arrives after the chargeback has already been filed. At this point, you’re in reactive mode, dealing with the fallout. The chargeback process is already in motion, and recovering revenue becomes significantly more challenging. While you can still fight the chargeback through representment, it's a more complex and time-consuming process. The key takeaway? Alerts empower you to prevent chargebacks, while notifications inform you they've already happened.

This distinction highlights the power of early intervention. By addressing customer concerns at the alert stage, you can often resolve the issue quickly and efficiently. Preventing chargebacks not only protects your revenue but also strengthens customer relationships. A swift resolution demonstrates your commitment to customer satisfaction, building trust and encouraging loyalty. So, while notifications are important for managing existing chargebacks, alerts are your first line of defense in preventing them altogether.

How Do Chargeback Alerts Work?

Chargeback alerts act as an early warning system, giving you a heads-up before a chargeback becomes official. Think of it as a chance to intercept a potential problem and turn it into a customer service win. Here’s how the process typically unfolds:

- A customer disputes a charge: When a customer questions a transaction on their credit card statement, they contact their issuing bank (the bank that issued their card). They might not recognize the charge, think it’s fraudulent, or believe they didn’t receive the goods or services they paid for.

- The issuing bank investigates: The bank reviews the customer's claim. If they find it potentially valid, they’ll issue a “chargeback alert” through a network like Verifi or Ethoca. These networks specialize in connecting issuers and merchants for pre-chargeback communication.

- You receive the alert: Your chargeback alert service immediately notifies you of the dispute. This alert typically includes key details like the transaction amount, date, customer name, and the reason for the dispute. The speed of this notification is crucial—it’s your window of opportunity to address the issue.

- You take action: Armed with this information, you can investigate the transaction. Do you have proof the customer received their order? Was there a billing error? This is your chance to gather evidence and potentially resolve the issue directly with the customer.

- Resolution or chargeback: If you can resolve the issue to the customer’s satisfaction (maybe by issuing a refund or providing tracking information), the dispute stops there. No chargeback is filed. If you can’t resolve it, or if you don’t respond to the alert within a specific timeframe, the dispute escalates into a formal chargeback. At that point, you’ll need to follow the standard chargeback representment process, which is more time-consuming and complex.

Why Use Chargeback Alerts?

Chargeback alerts empower businesses to proactively address disputes, saving time, money, and valuable customer relationships. They offer several advantages, from reducing chargeback rates and preventing lost revenue to improving the overall customer experience.

Lower Your Chargeback Rates

One of the most significant benefits of chargeback alerts is the ability to address disputes before they become costly chargebacks. Real-time notifications allow you to quickly identify the reason for a dispute and take action. Perhaps the customer doesn't recognize the charge on their statement. A quick email with a copy of the invoice, showing the billing descriptor, can often clear up the confusion. This proactive approach can significantly reduce the number of chargebacks you incur, saving you money on fees and protecting your merchant account standing. Early intervention also allows you to offer refunds or alternative solutions, satisfying the customer and preventing the dispute from escalating. For recurring billing businesses, integrating chargeback alerts with your billing platform can further streamline this process, allowing you to automatically pause subscriptions or issue credits in response to specific alerts. This automation not only saves time but also ensures a consistent and timely response to customer disputes.

Understanding Chargeback Costs and Statistics

Chargebacks put a serious dent in your bottom line. Merchants lose nearly $118 billion annually because of chargebacks, with each one costing around $128 on average. And that's not even counting the time your team spends dealing with them. Considering that friendly fraud makes up about 60% of chargebacks in North America, it's clear that preventative measures like chargeback alerts can make a real difference. With 615 million chargebacks globally last year, the problem is widespread, making effective management crucial. Stepping in early with alerts can significantly cut these costs by resolving disputes before they turn into chargebacks.

The Impact of Chargeback Ratios and Penalties

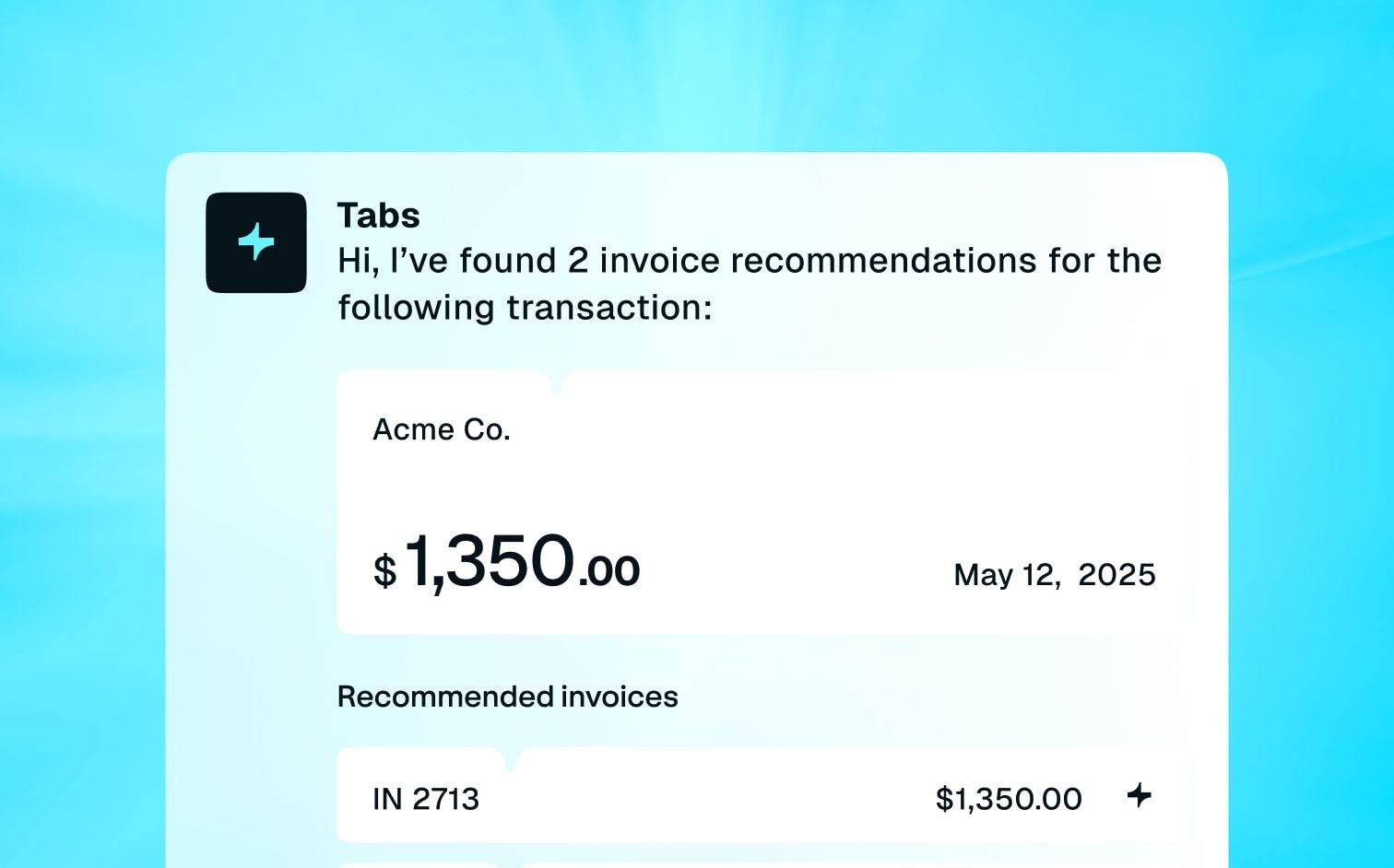

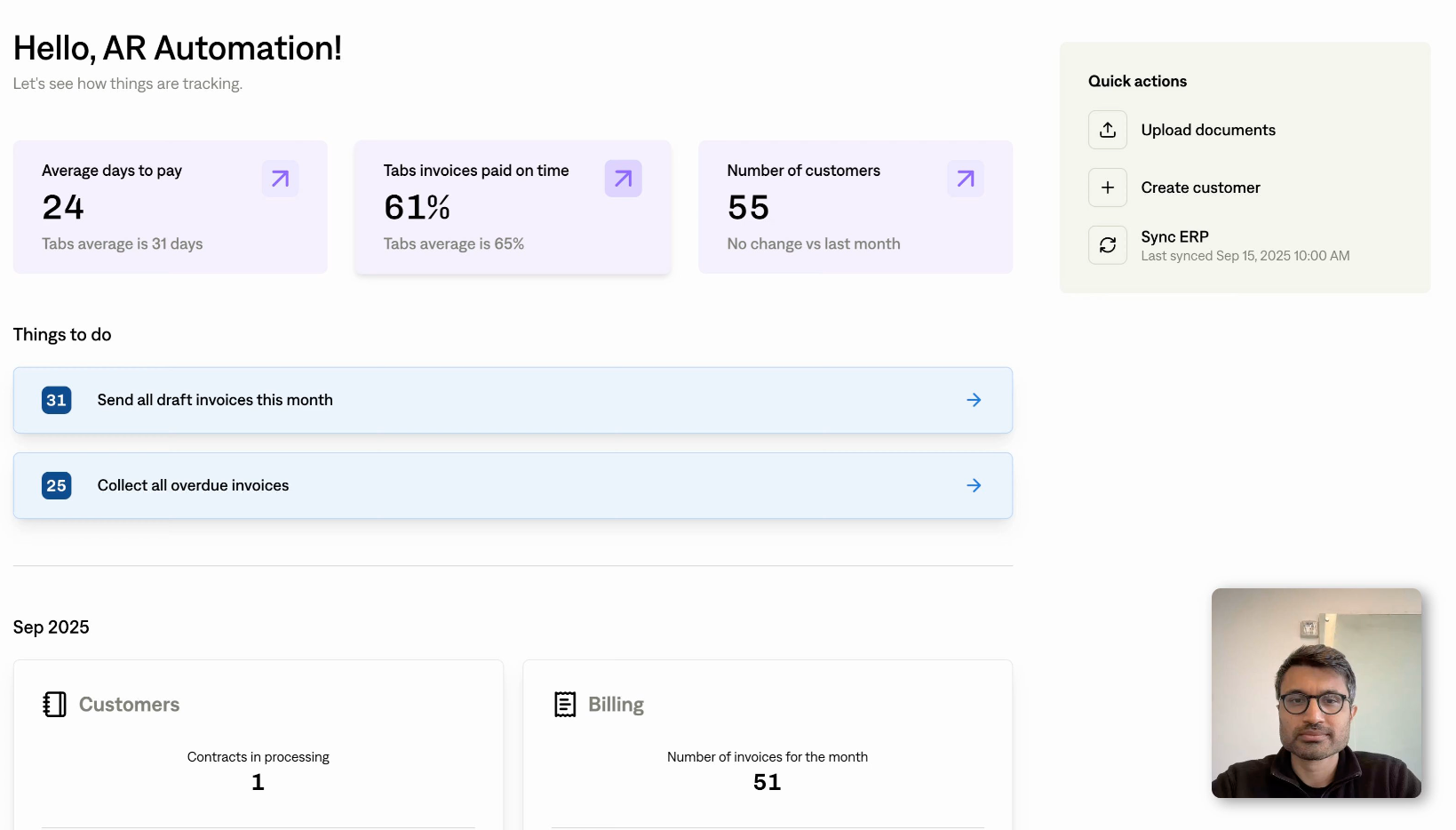

Your chargeback ratio—the percentage of your transactions that end up as chargebacks—is a key metric that payment processors and banks watch carefully. A high ratio can mean penalties, higher processing fees, or even losing your merchant account. If you're seeing more than 50 chargebacks a month, alerts are worth considering—that volume signals a potential issue. Over 100 a month puts you in the high-risk zone, making penalties much more likely. Chargeback alerts can help you keep that ratio healthy by giving you a chance to resolve disputes quickly. They save you money not just on that $128 average chargeback fee, but also on the time spent managing disputes. This proactive approach also shows your customers you're serious about fixing problems quickly and fairly. For SaaS companies with recurring subscriptions, a low chargeback ratio is especially important for long-term financial health and good relationships with payment processors. A solid billing platform like Tabs can help streamline your billing and reduce errors that lead to disputes. Features like automated invoicing, clear payment options, and detailed reporting all contribute to a smoother billing experience for your customers, making chargebacks less likely.

Prevent Inventory Loss With Chargeback Alerts

Chargebacks often result in the loss of both revenue and the goods or services sold. Chargeback alerts give you the opportunity to intercept the dispute before it reaches that point. Immediate alerts enable you to contact the customer directly, understand their concerns, and potentially resolve the issue without a chargeback being filed. For example, if a customer claims they never received their order, you can quickly verify the shipping information and, if necessary, resend the product or offer a refund. This proactive approach can help you prevent the loss of goods and maintain positive customer relationships. By leveraging robust reporting tools, you can gain deeper insights into the reasons behind disputes and identify trends that may indicate vulnerabilities in your fulfillment process.

Create a Better Customer Experience

While the financial benefits of chargeback alerts are clear, they also play a crucial role in improving the customer experience. By addressing disputes quickly and efficiently, you demonstrate a commitment to customer satisfaction. Clear communication and a willingness to resolve issues can turn a potentially negative experience into a positive one. This proactive approach can build trust and loyalty, encouraging repeat business and positive word-of-mouth referrals. A comprehensive strategy that includes chargeback alerts shows your customers that you value their business and are committed to providing a seamless and positive purchasing experience. Using a platform like Tabs, you can automate complex invoicing and ensure accurate billing, which in turn reduces the likelihood of customer confusion and disputes. Furthermore, by extracting key contract terms with AI, you can ensure clarity and transparency in your agreements, minimizing the potential for misunderstandings that could lead to chargebacks.

Proactive Communication and Customer Satisfaction

Think about it: getting a chargeback alert isn’t just about saving money on fees; it’s a chance to show your customers you care. When you reach out proactively to address a potential dispute, you’re demonstrating a commitment to their satisfaction. This direct communication lets you understand their concerns firsthand and offer personalized solutions. Maybe there was a simple misunderstanding about the charge, or perhaps the product didn’t meet their expectations. Whatever the reason, by engaging in open communication, you can turn a potentially negative experience into a positive one. This proactive approach can transform a frustrated customer into a loyal advocate. Learn more about the benefits of chargeback alerts.

Resolving issues quickly and efficiently through chargeback alerts builds trust and fosters stronger customer relationships. It shows you value their business and are willing to go the extra mile to ensure a smooth experience. This personalized attention can lead to increased customer lifetime value, repeat purchases, and positive word-of-mouth referrals. Plus, a satisfied customer is less likely to file future disputes, further reducing your chargeback rates and operational overhead. Using a platform like Tabs to streamline your invoicing process can also contribute to a more positive customer experience by ensuring accurate and transparent billing. For recurring billing businesses, this is especially valuable, as clear and predictable invoices can significantly reduce customer confusion and disputes.

Top Chargeback Alert Providers

Several companies offer chargeback alert services, each with its own strengths and focus. Understanding these differences will help you choose the best fit for your business. Two key players in the space are Verifi and Ethoca. Researching other providers is also important to find the ideal solution for your specific needs. Remember, the right fit will depend on your business model and transaction volume.

Verifi: Resolve Customer Disputes

Verifi, a Visa company, offers a comprehensive suite of services, including its CDRN (Cardholder Dispute Resolution Network) alert system. This system focuses on resolving “friendly fraud,” which occurs when a legitimate customer initiates a chargeback instead of contacting the merchant directly. Maybe they don’t recognize the charge on their statement or simply forgot about the purchase. Verifi’s CDRN allows card issuers to send alerts to merchants about pending disputes, giving them a chance to refund the transaction before it escalates into a chargeback. This proactive approach helps preserve customer relationships and improve communication around billing. By resolving issues quickly, you can improve customer satisfaction and reduce the time spent managing disputes.

CDRN and Order Insight

Verifi’s Cardholder Dispute Resolution Network (CDRN) plays a crucial role in preventing chargebacks. CDRN provides merchants with early notifications of potential disputes, acting as a direct line of communication between you and the card issuer. When a cardholder questions a transaction, the issuer uses CDRN to alert you, giving you the opportunity to address the issue proactively. This often allows you to issue a refund or provide clarifying information, preventing the dispute from escalating into a chargeback. Combined with Verifi’s Order Insight, which provides detailed transaction data, you gain a comprehensive view of the purchase, empowering you to resolve disputes efficiently. This not only saves you money on chargeback fees but also helps maintain positive customer relationships. For businesses using recurring billing models, this early intervention is especially valuable, allowing you to address billing concerns and potentially retain subscribers.

Rapid Dispute Resolution (RDR)

Rapid Dispute Resolution (RDR) streamlines the dispute process by enabling faster communication and resolution between merchants and issuers. RDR functions similarly to a chargeback alert, providing you with an early warning of a potential dispute. This allows you to quickly investigate the transaction and take appropriate action, such as issuing a refund or providing additional information to the cardholder through their bank. By resolving the issue promptly, you can avoid the costly fees and time-consuming processes associated with traditional chargebacks. This proactive approach protects your bottom line and demonstrates a commitment to customer service, which can strengthen customer loyalty. Integrating RDR with your existing payment processing system can further automate this process, allowing for seamless and efficient dispute management.

Ethoca: Fight Fraud

Ethoca, a Mastercard company, specializes in real-time collaboration between merchants and card issuers to eliminate fraud. Their alert system focuses on confirmed fraud, such as stolen card details or account takeover. Ethoca’s platform enables card issuers to share evidence of fraud with merchants, allowing them to immediately stop fulfilling fraudulent orders. This prevents shipping goods to fraudsters, saving merchants the cost of lost merchandise and protecting revenue. Ethoca’s focus on real-time data exchange helps businesses maintain smooth operations. By addressing fraudulent transactions promptly, you can minimize financial losses and gain clearer insights into your business's financial health.

Ethoca Alerts and Consumer Clarity

Ethoca Alerts contribute to a more transparent transaction environment. By focusing on confirmed fraud—like stolen card details or account takeover—Ethoca provides clarity for both merchants and consumers. Merchants receive actionable information, enabling them to immediately stop fraudulent orders. This prevents shipping goods to fraudsters, which in turn protects revenue. This proactive approach minimizes financial losses and provides clearer insights into a business's financial health. For consumers, Ethoca Alerts offer peace of mind, knowing their card issuer and the merchant are collaborating in real time to prevent fraudulent card use. This collaboration creates a more secure and trustworthy online shopping experience. Ethoca, a Mastercard company, covers 95% of Mastercard orders and 50% of other networks, offering widespread protection against fraudulent activities. By addressing fraudulent transactions promptly, businesses can minimize financial losses and gain clearer insights into their financial health.Research suggests Ethoca Alerts can prevent up to 40% of chargebacks, significantly reducing the costs and complexities associated with dispute resolution.

Kount: Automated Chargeback Prevention

Kount, an Equifax company, offers a robust chargeback prevention solution with a multi-layered approach. A key feature is their automated chargeback prevention alerts, notifying businesses of disputed transactions before they escalate into chargebacks. This early warning system gives you valuable time to proactively resolve issues, potentially avoiding fees and preserving customer relationships. Kount also provides detailed reports and analytics to help businesses understand chargeback trends and refine prevention strategies. This data-driven approach can lead to significant improvements in your chargeback management process and contribute to a healthier bottom line. For recurring billing businesses, integrating Kount with a platform like Tabs can further enhance automation, allowing for seamless payment processing and streamlined dispute resolution.

Kount's Automation Levels

Kount offers various automation levels to suit different business needs. Their system can provide early dispute notifications, sometimes weeks ahead of a potential chargeback, giving you ample time to investigate and respond. This proactive approach can significantly reduce the time and resources spent on manual chargeback management. By automating key processes, you can focus on other critical aspects of your business, such as customer service and product development. Kount's detailed reporting also provides valuable insights into chargeback trends, enabling you to identify areas for improvement and optimize your prevention strategies. This data-driven approach helps you make informed decisions and continuously improve your chargeback management process.

Chargeflow Alerts

Chargeflow is another provider in the chargeback alert space, emphasizing automation and a high success rate in preventing chargebacks. Their system uses machine learning to analyze transactions and identify potential disputes, claiming to prevent up to 90% of incoming chargebacks. This automated approach can significantly reduce the manual effort required to manage chargebacks, freeing up your team to focus on other priorities. Integrating Chargeflow with your existing invoicing system can further streamline your operations and improve efficiency.

Choosing the Right Provider: Verifi vs. Ethoca vs. Kount vs. Chargeflow

Selecting the right chargeback alert provider depends on your specific business needs and priorities. Verifi and Ethoca, affiliated with Visa and Mastercard respectively, offer extensive network coverage and specialize in different types of disputes. Verifi focuses on resolving friendly fraud, while Ethoca prioritizes confirmed fraud. Kount offers a more comprehensive approach, combining automated alerts with robust analytics and reporting. Chargeflow emphasizes automation and a high chargeback prevention rate. Consider your transaction volume, industry, and the types of disputes you commonly encounter when making your decision. Evaluating each provider’s integration capabilities with your existing systems, such as your billing platform and CRM, is also important. A seamless integration can significantly improve efficiency and streamline your chargeback management workflow.

Network Coverage and Geographic Locations

Network coverage and geographic reach are important factors when choosing a chargeback alert provider. The effectiveness of an alert system depends on its ability to connect with a wide range of issuing banks. Ethoca, for instance, boasts extensive coverage, particularly with Mastercard transactions. Verifi also has a broad reach, leveraging its connection with Visa. When evaluating providers, consider your customer base and their geographic locations. Ensure the chosen provider offers adequate coverage in the regions where your customers reside to maximize the effectiveness of your chargeback prevention efforts. This will help you capture the majority of potential disputes and proactively address them before they escalate into chargebacks.

4 Steps to Handle Chargeback Alerts

Effectively managing chargeback alerts involves a straightforward, four-step process. Understanding each step empowers you to respond quickly and minimize losses.

Step 1: Issuer Sends an Alert

The process begins when a customer disputes a charge with their bank (the issuer). The issuer then sends a chargeback alert, notifying you of the dispute. These alerts act as an early warning system, giving you a head start in addressing the issue. Think of it like a friendly heads-up before things escalate. This initial alert typically includes key details like the transaction amount, date, and the reason for the dispute. The speed of this alert is crucial, allowing you to address the situation promptly.

Step 2: The Alert is Processed

Your chargeback alert provider receives the notification from the issuer. The provider then processes this information, often enriching it with additional data points from their network. This might include details about the customer's purchase history or previous disputes. This added context can help you better understand the situation and determine the best course of action. The provider then relays this comprehensive alert to you in real-time, usually through email or a dedicated dashboard.

Step 3: Review the Alert

Once you receive the alert, it's time to review the information. Carefully examine the details provided, including the reason for the dispute. This is where having robust reporting tools within your billing software can be invaluable. By analyzing transaction data and customer history, you can often identify the root cause of the chargeback. For example, was there a billing error, a problem with product delivery, or perhaps a case of friendly fraud? Understanding the "why" behind the dispute is key to resolving it effectively. Accurate revenue recognition practices can also help prevent disputes down the line.

Step 4: Resolve and Follow Up

Armed with the details from the alert and your own internal data, you can now take action. If the chargeback appears valid, you might choose to issue a refund immediately, preventing further fees and complications. Consider how your payment processing system can facilitate quick refunds. If you believe the chargeback is unwarranted, you can gather compelling evidence to dispute it. This might include shipping confirmations, communication logs with the customer, or proof of service delivery. Regardless of the outcome, following up with the customer is crucial. A simple email explaining the steps you've taken can go a long way in maintaining a positive customer relationship, even in the midst of a dispute. Clear communication can often turn a negative experience into an opportunity to demonstrate your commitment to customer satisfaction. This also provides a chance to clarify any confusion around invoicing or contract terms, which you can easily extract using AI-powered tools.

Get the Most From Your Chargeback Alerts

Getting the most from your chargeback alerts requires a strategic approach. Think about how you'll manage the process and what tools you'll use to streamline your efforts. By optimizing your approach, you can significantly improve your bottom line.

In-House or Reseller: Which Is Right for You?

One of your first decisions will be whether to manage chargeback alerts in-house or use a reseller. Managing alerts internally gives you direct control, allowing you to tailor responses to each situation. This approach works well for companies with dedicated resources and a deep understanding of chargeback processes. However, it can also be time-consuming and require specialized expertise. If your team is already stretched thin, managing chargebacks internally might not be the best use of your resources. A recurring billing platform can free up some of those resources by automating key financial processes.

Alternatively, partnering with a reseller can simplify the process. Resellers often offer comprehensive solutions, including alert monitoring, case management, and representment services. They handle the complexities of chargeback disputes, freeing up your team to focus on other critical tasks. This can be a cost-effective solution, especially for businesses lacking the internal resources to manage chargebacks effectively. When evaluating resellers, look for those with a proven track record and expertise in your industry. Consider factors like their pricing model, the support they offer, and their integration capabilities with your existing systems. Choosing the right reseller can significantly impact your ROI.

Benefits of Using a Reseller

Partnering with a reseller simplifies the complex world of chargeback management. Resellers offer a wealth of experience and specialized knowledge, handling the intricacies of disputes so you can focus on core business functions, from product development to customer service. Think of it as having a dedicated team of experts protecting your revenue. Resellers typically offer comprehensive solutions, including alert monitoring, case management, and representment services, streamlining the entire process. This is a cost-effective solution for businesses lacking the internal resources to manage chargebacks effectively. When evaluating resellers, look for a proven track record and expertise in your industry. Consider their pricing model, the support offered, and integration capabilities with your existing systems. Choosing the right reseller significantly impacts your ROI, helping reduce chargeback rates and improve the efficiency of your dispute management process. Plus, by ensuring disputes are handled efficiently, you preserve customer relationships and improve overall satisfaction.

Chargeback Management Companies

Several companies specialize in chargeback management services through reseller partnerships. These companies offer various solutions to help businesses of all sizes manage disputes and protect revenue. Many resellers provide a full suite of services, from alert monitoring and case management to representment services. This comprehensive approach benefits businesses lacking the internal resources to handle chargebacks effectively. Outsourcing these tasks streamlines operations and frees up your team to focus on other critical areas. When choosing a chargeback management company, consider their expertise in your specific industry, pricing structure, and support level. Look for companies offering transparent reporting and analytics, allowing you to track progress and identify areas for improvement. A reliable chargeback management partner minimizes losses, improves efficiency, and maintains positive customer relationships. For businesses using a recurring billing platform like Tabs, seamless integration between your billing system and the chargeback management solution is crucial for a smooth, efficient workflow. This integration automates key processes, such as updating customer accounts and processing refunds, further reducing the burden on your team.

Automate Your Chargeback Alerts

Automation is key to maximizing the return on your chargeback alert investment. Manually reviewing and responding to each alert can be tedious and error-prone. Automated solutions can streamline your workflow by automatically retrieving transaction data, matching it with the alert details, and even generating responses based on predefined rules. This not only saves time but also ensures consistency and accuracy in your responses. Look for chargeback alert solutions that offer robust automation features, such as automated data retrieval, response generation, and case management. Automating these tasks frees up your team to focus on more strategic initiatives, like identifying the root causes of chargebacks and implementing preventative measures. This proactive approach can significantly reduce chargeback rates and increase revenue. For example, integrating your recurring billing system with automated chargeback alert tools can streamline everything from invoice to dispute resolution. This integration can help ensure accurate revenue recognition and minimize disruptions to your recurring revenue streams.

Effective Chargeback Alert Management

Effectively managing chargeback alerts is crucial for maintaining healthy revenue streams and positive customer relationships. By implementing the right strategies, you can minimize losses, improve operational efficiency, and foster customer loyalty. Here's how:

Choosing the Right Alert Provider

Selecting a reliable chargeback alert provider is the first step. Look for a service that offers real-time notifications, ideally integrated with your existing billing platform. Swift alerts empower you to address customer concerns proactively, potentially resolving issues before they escalate into chargebacks. Key features to consider include customizable alert parameters, comprehensive reporting, and seamless integration with your payment gateways. This allows you to centralize information and streamline your response process. A provider that offers insights into chargeback reason codes can also help you identify trends and implement preventative measures. For a streamlined approach to billing and payments, explore platforms like Tabs that offer robust integrations and comprehensive features.

Costs and Pricing Models

Chargeback alert pricing models vary by provider and typically depend on the volume of alerts you receive. The cost of alerts can range from $15 to $40 per alert, but volume discounts may be available. Chargeback prevention alerts often cost between $35 and $40 per alert. While this might seem like an added expense, the cost of these alerts is often offset by the savings from preventing chargebacks. Some providers, like Chargeflow, even offer ROI guarantees, claiming a 4x return on investment for their chargeback recovery automation. When evaluating providers, consider your projected alert volume and factor in potential cost savings to determine the true value.

Timeframe for Response (Verifi vs. Ethoca)

The timeframe for responding to chargeback alerts depends on the provider. Verifi generally gives merchants up to 72 hours to respond, while Ethoca provides a tighter window of up to 24 hours. This speed of notification is crucial. It’s your opportunity to address the issue before it escalates. If you resolve the issue to the customer’s satisfaction within that timeframe—perhaps by issuing a refund or providing tracking information—the dispute often stops there, preventing a formal chargeback. Consider these different response times when choosing a provider and ensure your team can investigate and respond effectively within the given timeframe. A platform like Tabs can streamline this process by providing quick access to transaction data and facilitating efficient communication with customers.

Use Data to Prevent Chargebacks

Data analysis plays a critical role in reducing chargeback rates. By analyzing historical chargeback data, you can pinpoint patterns and identify vulnerabilities in your processes. For example, are a disproportionate number of chargebacks stemming from a specific product line or geographic region? This information allows you to address the root causes, whether it's unclear product descriptions, shipping delays, or billing discrepancies. Robust reporting tools can provide the insights you need to make informed decisions and optimize your operations for chargeback prevention. Analyzing data also helps you refine your pricing models and ensure clarity around subscription terms, minimizing confusion and potential disputes. Tabs Platform offers robust reporting features to help you gain a deeper understanding of your financial data.

Improve Customer Communication

Proactive communication is key to mitigating chargebacks. Clear and concise billing descriptors are a good starting point. Ensure your customers easily recognize the charges on their statements, minimizing the chance of confusion-driven disputes. Providing multiple channels for customer support—email, phone, and chat—empowers customers to reach out with questions or concerns quickly. Addressing these inquiries promptly and efficiently can often resolve issues before they escalate. Consider implementing self-service options, such as a detailed FAQ page or a robust knowledge base, to empower customers to find answers independently. This not only improves customer satisfaction but also frees up your support team to handle more complex issues. Remember, a positive customer experience is the best defense against chargebacks. Learn more about how Tabs can help you streamline your billing and communication processes.

Overcome Chargeback Alert Challenges

Implementing chargeback alerts can feel like adding another layer of complexity to your already busy schedule. But with the right approach, you can smoothly integrate these powerful tools into your existing workflows. Here's how to tackle some common implementation challenges:

Simplify Your Integration

One of the biggest hurdles is often the initial setup and integration with your current systems. Look for chargeback alert providers that offer seamless integration with your payment gateway and other financial software. APIs and webhooks can automate data transfer, reducing manual entry and ensuring real-time updates. This streamlined approach minimizes disruptions to your existing processes and allows your team to quickly adapt to the new system. Think of it like adding a new app to your phone—the best ones are the ones you barely notice because they work so well in the background. For businesses using recurring billing software like Tabs, integrating chargeback alerts can be even simpler, as many platforms offer direct integrations or compatibility with leading alert providers. This simplifies the process and allows you to centralize your financial management. Check with your billing software provider to see what integrations they offer for chargeback alerts. This can save you valuable time and resources during implementation.

Effective Resource Allocation

Successfully managing chargeback alerts requires dedicating the right resources. Consider who on your team will be responsible for monitoring alerts, responding to customers, and gathering evidence. Proper training is essential to ensure your team understands the process and can handle disputes efficiently. Clear roles and responsibilities will prevent confusion and ensure a timely response to each alert. Think of it like assembling a pit crew—everyone has a specific job to do, and when they work together seamlessly, the results are impressive. Prioritize tasks and focus on the alerts that pose the greatest risk to your revenue. By allocating resources strategically, you can maximize the impact of your chargeback management efforts. Tools like Tabs' reporting features can help you identify trends and patterns in your chargebacks, allowing you to allocate resources more effectively.

Managing Multiple Systems

Many businesses use a variety of tools to manage their finances, from payment gateways to accounting software. Integrating chargeback alerts into this ecosystem can be a challenge. Look for a centralized platform or dashboard that can consolidate information from multiple sources. This single view of your chargeback data will simplify monitoring and reporting, saving you time and reducing the risk of errors. Imagine trying to conduct an orchestra with musicians scattered across different rooms—it's much easier when everyone is on the same stage. Centralizing your chargeback information allows you to see the big picture and make informed decisions. This streamlined approach also makes it easier to track the effectiveness of your chargeback prevention strategies and identify areas for improvement.

Fight Fraud with Chargeback Alerts

Chargeback alerts aren't just about reacting to disputes—they're a powerful tool for proactively stopping fraud. By integrating real-time data sharing and fostering collaboration between merchants, issuers, and payment processors, you can significantly reduce the risk of fraudulent chargebacks.

Types of Fraud Addressed by Alerts

Chargeback alerts help you combat various types of fraud, saving you money and protecting your business reputation. Two common scenarios where alerts are particularly effective are confirmed fraud and friendly fraud.

Confirmed Fraud (like stolen card details): Services like Ethoca, a Mastercard company, excel in this area. They facilitate real-time collaboration between merchants and card issuers. When a card issuer confirms fraudulent activity, such as a stolen card or account takeover, they immediately notify the merchant through Ethoca’s alert system. This rapid communication allows you to decline the transaction before it’s processed, preventing the shipment of goods to fraudsters and avoiding the hassle of dealing with a chargeback later. This proactive approach protects your revenue and inventory. By stopping fraudulent transactions before they impact your business, you're saving time, money, and resources that can be better used elsewhere.

Friendly Fraud:Verifi, a Visa company, offers a strong defense against friendly fraud through its CDRN (Cardholder Dispute Resolution Network). Friendly fraud occurs when a legitimate customer initiates a chargeback instead of contacting the merchant directly to resolve an issue. Perhaps they don’t recognize the charge on their statement, or they’ve simply forgotten about the purchase. Verifi’s CDRN alerts give you the opportunity to contact the customer, clarify the transaction, and potentially issue a refund if necessary, all before a chargeback is filed. This not only saves you chargeback fees but also helps preserve valuable customer relationships. Addressing these situations proactively can turn a potentially negative customer experience into a positive one, fostering loyalty and repeat business.

Real-Time Data Sharing

The key to stopping fraud is speed. Real-time data sharing allows merchants to instantly provide transaction details and supporting evidence to issuers when a chargeback alert is triggered. This rapid response can make all the difference. Imagine a customer claims they didn't authorize a purchase. With real-time data sharing, you can quickly provide proof of purchase, shipping confirmations, and even customer communication logs, demonstrating the legitimacy of the transaction. This often resolves the issue before it escalates into a costly chargeback. Services like Visa’s Rapid Dispute Resolution offer real-time collaboration tools to streamline this process. This immediate access to information empowers issuers to make informed decisions and prevents unnecessary chargebacks.

Collaboration and Dispute Resolution

Effective fraud prevention requires a collaborative approach. Chargeback alerts facilitate communication between all parties involved, creating an environment where disputes can be resolved quickly and efficiently. When a chargeback alert is received, it opens a direct line of communication between the merchant and the issuer. This allows for a more thorough investigation of the transaction and encourages a collaborative effort to find a resolution that satisfies everyone. By working together, merchants and issuers can identify and address fraudulent activity more effectively, protecting both businesses and consumers. This collaborative approach can also help identify patterns of fraudulent behavior, allowing for preventative measures to be implemented. For example, if multiple chargebacks originate from the same IP address, it could indicate a larger fraud operation. Sharing this information across the industry strengthens the overall fight against fraud.

The Future of Chargeback Prevention

The landscape of chargeback prevention is constantly evolving. New technologies and strategies regularly emerge, promising businesses a stronger defense against revenue loss and an improved customer experience. So, what can we expect to see in the future of chargeback prevention?

One key trend is the growing use of artificial intelligence (AI) and machine learning (ML). These technologies can analyze massive amounts of data to identify patterns and anomalies that indicate fraudulent activity or predict potential chargebacks. Imagine software that learns your typical customer behavior and flags transactions that deviate from the norm—that's the power of AI and ML in chargeback prevention. This data-driven approach allows businesses to proactively identify and prevent disputes before they escalate into chargebacks.

Another developing area is real-time collaboration between merchants, payment processors, and issuing banks. Improved communication and data sharing can help resolve disputes quickly and efficiently. Think of systems that allow merchants to instantly provide compelling evidence to support a transaction, preventing a chargeback from ever being filed. Connecting merchants directly to card networks is becoming increasingly sophisticated, facilitating this seamless exchange of information.

We can also anticipate more advanced chargeback alert systems. These systems will not only notify merchants of potential chargebacks but also provide actionable insights and recommendations for resolving them. They might even automate parts of the dispute process, freeing up valuable time and resources. Services like Chargeflow, with their focus on dispute alerts, offer a glimpse into this future.

Finally, the future of chargeback prevention will likely emphasize the customer experience. By providing clear and transparent communication throughout the transaction process, businesses can build trust with their customers and reduce the likelihood of disputes. This includes providing easy access to order information, shipping updates, and customer support. Effective chargeback prevention isn't just about stopping fraud; it's also about creating a positive customer journey.

Related Articles

- Is Accounts Receivable Debit or Credit?

- Bad Debt: A Comprehensive Overview

- Recurring Payment Processing: The Ultimate Guide

- Best Recurring Billing Software

Frequently Asked Questions

What’s the main difference between chargeback alerts and traditional chargeback management?

Traditional chargeback management is reactive; you only find out about a dispute after the chargeback hits, meaning you've already lost revenue and are now dealing with a complicated retrieval process. Chargeback alerts, however, give you a heads-up before the chargeback becomes official, allowing you to address the customer's concern proactively and potentially avoid the chargeback entirely. It's like getting a chance to fix a small problem before it becomes a major headache.

How quickly do I need to respond to a chargeback alert?

The timeframe for responding to chargeback alerts varies depending on the alert provider and the specific circumstances. Generally, you have a short window, often just a few days, to respond. It's crucial to act quickly because if you don't respond within the specified timeframe, the dispute automatically escalates into a formal chargeback, making it much more difficult and expensive to resolve. Setting up real-time notifications and having a clear internal process for handling alerts can help ensure a timely response.

If I refund a transaction after receiving a chargeback alert, is the issue completely resolved?

Yes, in most cases, issuing a refund after receiving a chargeback alert resolves the issue and prevents the chargeback from being filed. The customer gets their money back, and you avoid the fees and hassle associated with processing a formal chargeback. It's a win-win situation that helps maintain a positive customer relationship. However, it's always a good idea to follow up with the customer to confirm they're satisfied and to address any underlying issues that may have led to the dispute.

What kind of information is typically included in a chargeback alert?

Chargeback alerts usually include key details about the disputed transaction, such as the transaction amount, date, customer name, and the reason for the dispute. Some alerts also provide additional information, like the customer's purchase history or previous disputes, which can be helpful in understanding the context of the current issue. The more information you have, the better equipped you are to resolve the dispute quickly and effectively.

Besides Verifi and Ethoca, are there other chargeback alert providers I should consider?

While Verifi and Ethoca are major players in the chargeback alert space, they aren't the only options. Several other companies offer similar services, each with its own strengths and areas of focus. It's worth researching different providers to find the best fit for your specific business needs and transaction volume. Consider factors like pricing, integration capabilities with your existing systems, and the types of alerts they offer. The right provider can make a significant difference in your chargeback management success.