The AI REVENUE platform

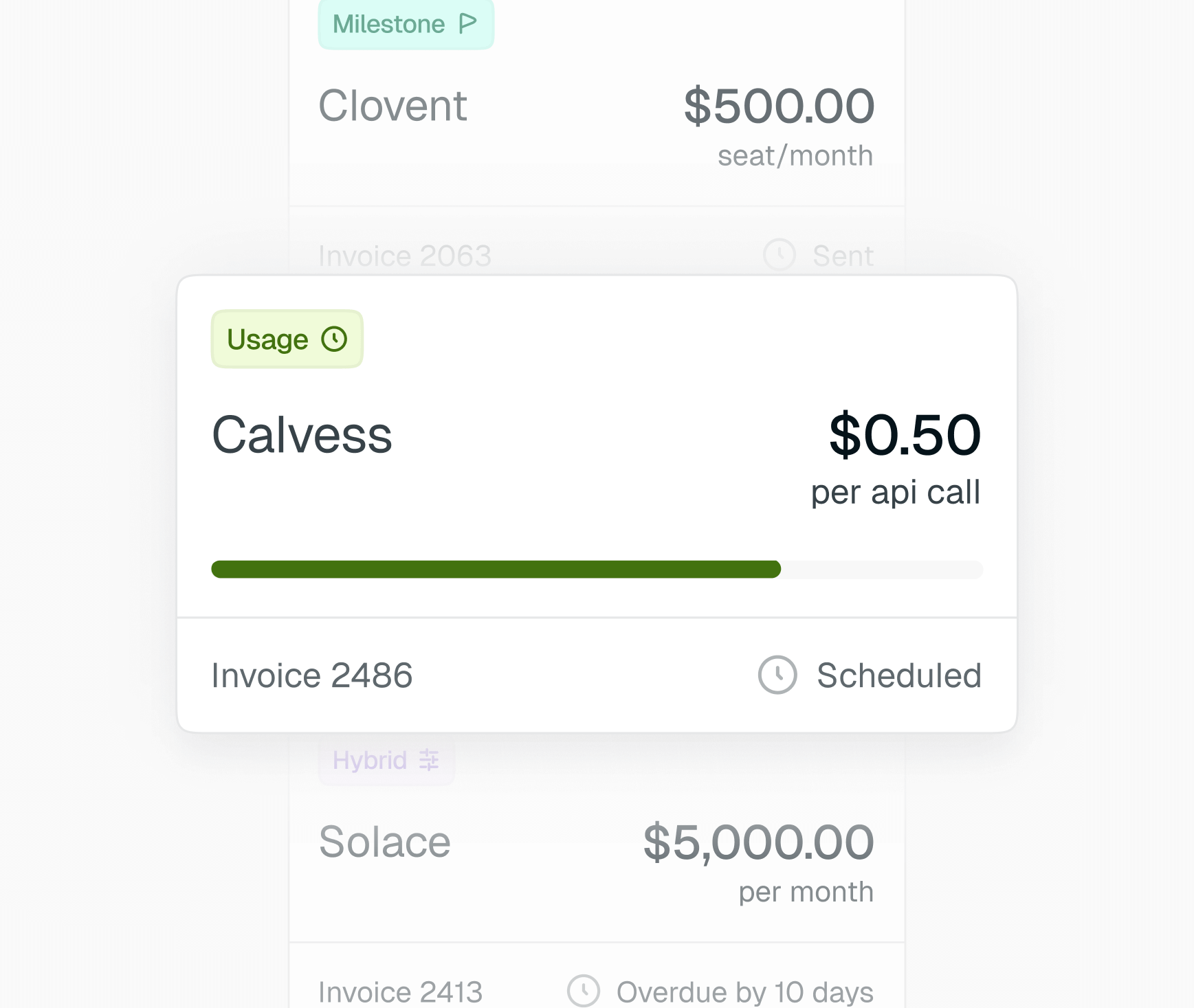

Automation and agents for modern finance teams

From billing to revenue recognition, streamline your entire contract-to-cash process and eliminate manual work.

Too many tools, manual work, and systems that don't talk to each other? Finance leaders today face a choice.

Keep stitching together workflows and chasing down invoices.

Switch to Tabs

The Tabs Platform

Revenue automation, from contract to close

Designed to handle growth and extend across your stack.

API

Robust API built for revenue complexity

Developer-friendly APIs that let you extend Tabs, connect systems, and embed billing into your product.

Explore the API

Security and compliance

Security and compliance you can trust

Enterprise-grade security with SOC 2 compliance, encryption, and audit-ready controls.

Security