Bad debt refers to receivables you’re unlikely to collect because of customer bankruptcy, disputes, or other financial difficulties. In B2B accounts receivable, this can significantly affect your company’s financial health.

You need to understand the dynamics of bad debt to reduce its impact. Recognizing the signs early and taking proactive measures can protect your business from financial setbacks. Focus on identifying potential issues in your balance sheet and implementing strategies to minimize them. By doing so, you protect your revenue and make your company more resilient to economic changes.

Understanding Bad Debt

Understanding how to prevent or minimize these doubtful accounts is crucial when you want to extend credit to customers. They occur in B2B transactions for one or more reasons, including:

- Customer bankruptcy: When a customer’s financial health leads to bankruptcy, they often cannot fulfill their payment obligations. This leaves you with receivables you can't collect that directly impact your cash flow.

- Disputes: Disagreements over the quality of goods or services, invoicing errors, or unmet contract terms can cause missed payments. These disputes strain business relationships and make debt recovery more challenging.

- Economic downturns: Recessions or economic slowdowns increase the likelihood of customers delaying payments or defaulting altogether. Staying aware of economic trends and how they might affect your clients' ability to pay is crucial. It helps with managing risk, accurate financial planning, and maintaining strong customer relationships.

Identifying common scenarios that lead to bad debt allows you to develop targeted strategies to mitigate risks. For example, if customer bankruptcy is a frequent issue, consider requiring upfront deposits or setting stricter credit limits. If disputes over invoicing are common, implement more detailed and transparent invoicing processes. This proactive approach is key to maintaining financial health and keeping your business thriving despite potential setbacks.

Importance of Good Management

Managing bad debt is crucial for your business’s financial health. Unchecked bad debt can severely impact your cash flow and financial stability. When customers fail to pay, your revenue decreases while expenses remain the same, leading to potential cash shortages. This strain affects your ability to meet financial obligations, such as paying suppliers and employees.

Legal and tax implications are also significant. Writing off bad debt can lead to tax deductions, but only if handled correctly. Improper documentation and mismanagement of bad debt can result in legal issues and missed opportunities for tax relief. Seek advice from legal and tax professionals to stay compliant and maximize potential benefits.

By tracking payment behaviors and identifying risky customers, you can refine your credit policies. This proactive stance helps you extend credit more carefully, reducing the chances of future bad debt. Ultimately, managing bad debt is about protecting your business’s financial health and fostering a sustainable, growth-oriented environment.

Methods for Calculating Bad Debt

Calculating bad debt is essential for maintaining accurate financial statements and planning for potential losses. There are two primary methods for calculating bad debt: the direct write-off method and the allowance method.

Direct Write-Off Method

The direct write-off method involves recognizing bad debt only when a specific account is deemed uncollectible. This method is easy to implement, as it deals with actual uncollectible amounts rather than estimates.

Direct write-off is ideal for small businesses with minimal bad debt or situations where bad debts are infrequent and insignificant.

The advantages include:

- Simplicity: This is an easy process involving writing off bad debts only when they are deemed uncollectible.

- Immediate Recognition: You can recognize bad debts as expenses in the period they become uncollectible, providing clarity and immediacy in financial reporting.

- No Estimations Required: This method allows you to avoid estimating bad debts and deal only with actual uncollectible accounts.

The disadvantages include:

- Timing Issues: The direct write-off method can create timing mismatches between revenue and expenses. Bad debts might be recognized in a different period than the related revenue, distorting financial results.

- Non-compliance with GAAP: This method does not follow the Generally Accepted Accounting Principles (GAAP), which prefer the allowance method for its compliance with the accrual basis of accounting and the matching principle.

- Misleading Financial Health: Initial overstatement of receivables and net income can lead to misleading financial statements until you write off the bad debt.

Allowance Method

The allowance method involves estimating bad debts in advance and creating an allowance for doubtful accounts. This method aligns with GAAP and matches bad debt expenses with related revenues in the same accounting period.

One approach to the allowance method estimates a fixed percentage of total sales as bad debt. Another approach bases estimates on the age of outstanding receivables, considering older accounts more likely to become uncollectible.

To estimate and record using the allowance method, analyze historical data and industry trends to determine an appropriate percentage for bad debt. Also, regularly update the allowance account with new data and insights.

Allowance method advantages include:

- Adherence to GAAP: The allowance method complies with GAAP, matching bad debt expenses with related revenues in the same period.

- Accurate Financial Statements: By estimating bad debts in advance, this method keeps accounts receivable reported at their net realizable value, improving reliability and accuracy.

- Proactive Management: Establishing an allowance for doubtful accounts encourages proactive receivables management, allowing you to better prepare for potential losses and make informed credit decisions.

Allowance method disadvantages include:

- Complexity: The allowance method requires estimates and judgments about future uncollectible accounts, introducing complexity and subjectivity.

- Potential Inaccuracy: Estimating bad debts can be challenging, especially for new businesses without historical data. Inaccurate estimates can lead to over- or under-estimation of bad debts, affecting financial statements.

- Resource Intensive: Using the allowance method requires more time and resources for monitoring and adjusting the allowance account, which can be burdensome if you have limited accounting capabilities.

Recording Bad Debt in Financial Statements

Accurately recording bad debt is important for reflecting your company’s financial health. The approach you choose impacts how you present your financial statements.

Direct Write-Off Method

When you identify an account as uncollectible, you record the following journal entry:

Debit: Bad Debt ExpenseCredit: Accounts Receivable

For example, if you write off a $1,000 uncollectible account, you would record:

Debit: Bad Debt Expense $1,000Credit: Accounts Receivable $1,000

This entry directly reduces your accounts receivable and increases your expenses, impacting the income statement and balance sheet in the period the bad debt is identified.

Writing off bad debt also affects key financial ratios. For example, it can lower profitability ratios, such as net profit margin, as expenses increase. Similarly, it impacts liquidity ratios, such as the current ratio, as assets are reduced.

Allowance Method

The allowance method requires you to estimate bad debts and record an allowance. This method requires two journal entries. Here’s how you do it:

First Journal Entry: Establish the Allowance

This entry is made at the end of an accounting period to estimate uncollectible accounts.

Debit: Bad Debt ExpenseCredit: Allowance for Doubtful Accounts

For instance, if you estimate $2,000 in bad debts, you will record the following:

Debit: Bad Debt Expense $2,000Credit: Allowance for Doubtful Accounts $2,000

Second Journal Entry: Write Off the Debt

When you identify a specific account as uncollectible, make this entry:

Debit: Allowance for Doubtful AccountsCredit: Accounts Receivable

If you write off a $1,500 debt, you would:

Debit: Allowance for Doubtful Accounts $1,500Credit: Accounts Receivable $1,500

This method separates the estimation of bad debts from the actual write-off, providing a more accurate financial picture. The initial entry impacts the income statement, while the write-off affects the balance sheet without altering the income statement again.

Strategies for Minimizing Bad Debt

Proactively managing your receivables reduces the risk of bad debt. Implement these strategies to minimize bad debt and strengthen your cash flow.

Conduct Thorough Credit Assessments

Before extending credit, perform detailed credit checks on potential customers. Analyze their credit history, financial statements, and payment behaviors. Use credit reporting agencies to obtain comprehensive credit reports.

Additionally, request and verify references from other businesses that have extended credit to the prospective customer. This insight helps assess their reliability and payment patterns.

Establish Clear Credit Policies

Set credit limits based on the customer’s creditworthiness and regularly review these limits to manage risk effectively. Define clear payment terms, including due dates, late payment penalties, and early payment discounts. Make sure customers understand and agree to these terms before any transaction.

Educating your sales teams about credit policies will help them clearly communicate those policies to customers. The sales team is often the first point of contact with customers and can help stop potential issues. Regular training sessions and clear communication channels between sales and finance teams can also lead to better credit decisions and lower bad debt.

Monitor Accounts Receivable Regularly

Use aging reports to track the status of accounts receivable. These reports categorize outstanding invoices by their age, helping identify overdue accounts requiring immediate attention. Conduct regular reviews of accounts receivable to spot and address potential issues early. This proactive approach helps manage and reduce overdue accounts.

Implement Effective Collections Processes

Automated systems can send regular reminders to customers about upcoming and overdue payments, significantly reducing late payments and improving cash flow. For significantly overdue accounts, personal follow-ups through phone calls or meetings can be more effective in securing payments. Establish a dedicated collections team to handle these cases efficiently.

Offer Early Payment Discounts and Impose Late Payment Fees

Encourage timely payments by offering discounts to customers who pay their invoices early. This improves cash flow and reduces the risk of bad debt. Discourage late payments by imposing penalties on overdue accounts. Clearly communicate these penalties to customers as part of your credit policy so they are aware of the consequences.

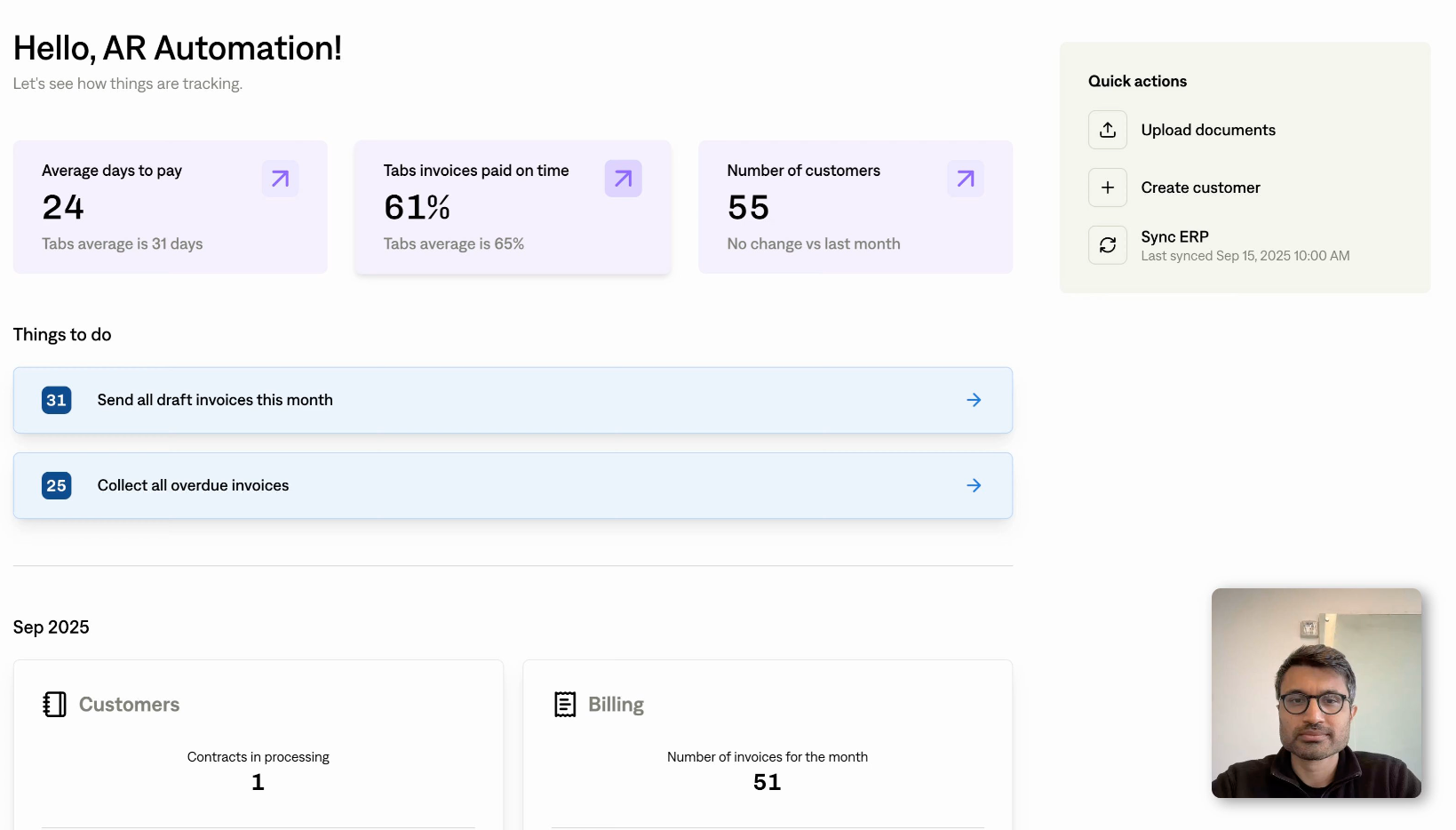

Use Automated Tools for Accounts Receivable Management

Invest in advanced accounts receivable management software that can automate invoicing, payment tracking, and collections. These tools streamline processes and reduce the likelihood of bad debt. Use the analytics and reporting features of AR management software to gain insights into payment trends and customer behavior. This information can inform credit policies and collection strategies.

Monitoring and Analyzing Bad Debt

Effective bad debt management requires continuous monitoring and analysis. Key metrics like the bad debt ratio and days sales outstanding help you track and evaluate the impact of bad debt on your business. The bad debt ratio, calculated by dividing bad debt by total sales, provides insight into the proportion of sales that turn into bad debt. A rising bad debt ratio signals a need for immediate action.

Regularly review and adjust your credit policies. Analyzing trends in payment behaviors and economic conditions allows you to make informed adjustments to credit limits and payment terms. Continuous improvement in credit management practices reduces bad debt and enhances overall financial stability.

By staying vigilant and adapting your strategies based on data insights, you can effectively manage bad debt and maintain a healthy cash flow. Monitoring and analysis are ongoing processes that keep your business resilient against financial risks.

Concluding Thoughts

Proactive bad debt management is essential for safeguarding your business’s financial health. Understanding the causes, implementing effective strategies to minimize it, and regularly monitoring key metrics help protect your cash flow and financial stability.

By implementing thorough credit assessments, clear credit policies, and effective collections processes, you reduce the risk of uncollected receivables. Using automated tools for accounts receivable management further streamlines these efforts, making your processes more efficient and reliable.

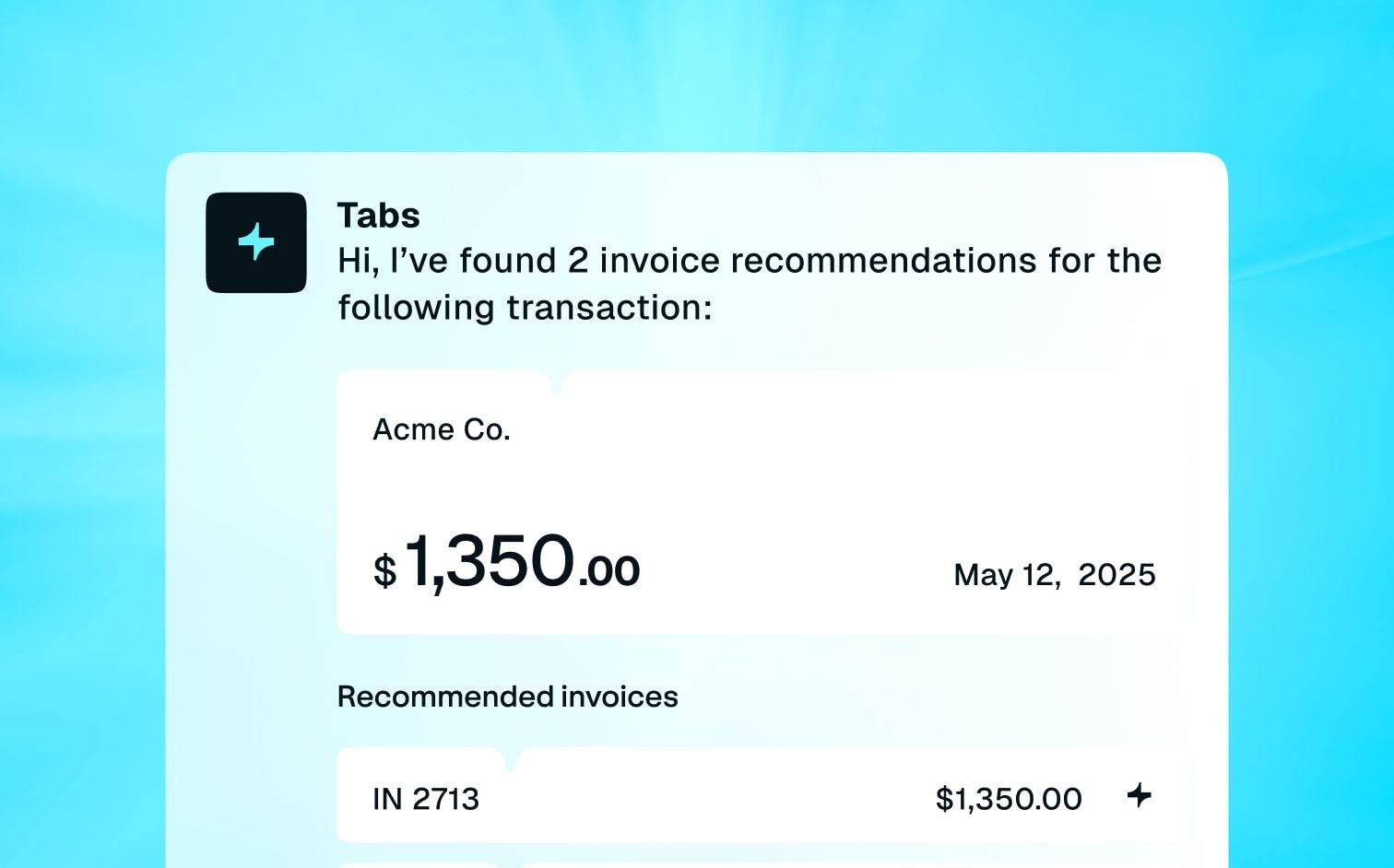

Ultimately, the key to minimizing bad debt lies in proactive and informed management. These strategies protect your business from financial setbacks and position it for sustainable growth. Leveraging tools like Tabs can enhance your AR processes, providing the automation and insights needed to stay ahead of bad debt challenges. Schedule a demo today to learn more.