Recurring revenue is the lifeblood of your SaaS business. But what happens when payments are late? A clunky accounts receivable process can stall growth and create stress. This guide offers practical strategies to improve your AR workflow, boost cash flow, and strengthen customer relationships. Let's get your SaaS financials healthy and thriving.

This guide is your roadmap to a healthier AR workflow. We'll dissect each step of the accounts receivable process, offering actionable tips and best practices to streamline operations and improve cash flow predictability. From credit approval to data-driven reporting, you'll learn how to optimize every stage of the AR process, turning it into a powerful engine for financial stability and growth.

Key Takeaways

- Efficient AR management fuels SaaS growth: Streamlining your AR process ensures timely payments, which directly impacts cash flow and allows for strategic reinvestment and scaling. Automating key steps like invoicing and payment processing minimizes errors and frees up your team for more strategic work.

- The right tools optimize your AR process: Leverage automation software, payment processing solutions, and comprehensive AR management platforms to improve efficiency and gain valuable insights into your financial health. Look for tools that integrate with your existing systems and offer robust reporting.

- Strong customer relationships are key to healthy AR: Clear communication, flexible payment options, and proactive account management create a positive customer payment experience. This approach fosters loyalty and reduces friction in the billing process, ultimately benefiting your bottom line.

Your Accounts Receivable Process: How Does It Work?

The accounts receivable (AR) process refers to the steps your business takes to collect payments owed by customers. It's a fundamental aspect of managing cash flow and ensuring the financial health of your SaaS business. Think of it as the engine that drives your revenue cycle, converting sales into actual cash. A smooth, efficient AR process is critical for SaaS companies, especially those relying on recurring revenue.

Key Parts of the AR Process

A typical accounts receivable process involves several key components. It starts with a customer placing an order and receiving credit approval. Then, you generate and send invoices. Managing collections, processing payments, and applying cash are the next steps.

Finally, reporting and analysis help track performance and identify areas for improvement. Each step is essential for maintaining accurate financial records and ensuring timely payments. Effective AR management relies on accurate record-keeping, timely invoicing, and efficient collections. Tools like Tabs can automate and streamline these processes for SaaS businesses.

Traditional vs. Modern AR Processes

Traditional AR processes often rely heavily on manual tasks. Think spreadsheets, paper invoices, and lots of back-and-forth communication. This approach is not only time-consuming but also prone to errors. Manual processes like these can lead to delayed payments, inaccurate reporting, and ultimately, a hit to your cash flow. Chasing down late payments can feel like a full-time job, pulling your team away from more strategic activities. This can be especially challenging for SaaS businesses that rely on predictable recurring revenue.

Modern AR processes leverage automation to streamline operations. Automated invoicing and payment reminders reduce manual work and minimize the risk of errors. Real-time reporting and analytics provide a clear view of your financial health, enabling data-driven decision-making. This shift toward automation improves efficiency and frees up your team to focus on building customer relationships and driving growth. A smoother, more efficient process makes for happier customers, which is crucial for SaaS companies dependent on renewals and upgrades.

Modern AR solutions also prioritize a better customer experience. Offering flexible payment options and proactive communication builds trust and encourages timely payments. When customers have a positive payment experience, it strengthens their relationship with your business. This approach improves cash flow and increases customer satisfaction. For SaaS businesses, this can be particularly valuable, as recurring revenue depends on maintaining strong customer relationships. Using tools designed for subscription billing, like Tabs, can further enhance these benefits by automating complex recurring billing scenarios and providing accurate, timely invoices.

6 Steps to a Smooth Accounts Receivable Process

A well-defined accounts receivable process is crucial for maintaining healthy cash flow in any SaaS business. These six steps outline a typical AR workflow:

1. Order Placement and Credit Approval

The AR process begins when a customer places an order for your software or service. Before moving forward, it's essential to conduct a credit check. This helps ensure the customer can meet their payment obligations.

For established businesses, this might involve reviewing their payment history. For newer companies, you might require upfront payment or a deposit. This initial step sets the stage for a smooth billing process.

2. Customer Onboarding: A Deeper Dive

Customer onboarding is more than just a welcome email; it’s the foundation of a successful customer relationship and, consequently, a healthy accounts receivable process. A well-structured onboarding process clarifies payment terms, sets expectations, and fosters trust, making future collections smoother. This is where you solidify the agreement and ensure the customer understands the value they’re receiving, which encourages timely payments.

Think of onboarding as setting the stage for a positive payment experience. By providing clear instructions on how to access your software, offering helpful resources, and establishing clear communication channels, you’re proactively addressing potential billing questions before they even arise. This minimizes misunderstandings and disputes later, contributing to a more predictable and efficient AR process. Strong customer relationships are key to healthy AR. Clear communication, flexible payment options, and proactive account management create a positive customer payment experience. This reduces friction in the billing process, ultimately benefiting your bottom line.

For SaaS businesses, using tools that automate communication and provide self-service options can significantly enhance the onboarding experience. Consider incorporating automated welcome emails, in-app tutorials, and readily available FAQs. This streamlines the process and empowers customers to find answers quickly, reducing the need for extensive communication and freeing up your team to focus on other essential tasks. This increased efficiency translates directly to a more streamlined AR process, as clear communication and readily available information minimize payment delays and disputes. For SaaS businesses looking to optimize their onboarding and, by extension, their AR processes, Tabs offers tools to automate and streamline these crucial steps.

2. Invoice Generation and Delivery

Once the order is confirmed and credit is approved, generate and send invoices promptly. Clearly outline the services provided, the amount due, payment terms, and accepted payment methods. Automating this process with software like Tabs ensures accuracy and timely delivery, which are crucial for efficient AR management. A streamlined invoicing system contributes significantly to healthy financial operations.

3. Managing Your Collections

Effective collections management involves consistent follow-up on outstanding invoices. Establish a clear follow-up schedule, including email reminders and phone calls. Address any payment disputes promptly and professionally.

This proactive approach minimizes late payments and keeps your cash flow steady. Remember, clear communication is key to maintaining positive customer relationships while ensuring timely payments.

Dunning Management: Best Practices

Dunning is the systematic process of communicating with customers to collect overdue payments. A well-executed dunning strategy is essential for maintaining healthy cash flow while preserving customer relationships. It’s a delicate balance, but crucial for long-term success. Start by establishing a clear dunning policy with a predefined schedule of communication. This might include automated email reminders, followed by phone calls for larger outstanding amounts. Consistent follow-up on outstanding invoices is key to minimizing late payments and keeping your cash flow steady.

Your dunning communication should be polite yet firm, clearly stating the outstanding amount, due date, and available payment options. Offering flexible payment plans can be helpful for customers facing temporary financial difficulties. Remember, the goal is to recover the payment while maintaining a positive customer experience. Automating your payment processes can ensure timely and consistent communication.

Dispute Resolution: Maintaining Customer Relationships

Occasionally, customers may dispute an invoice due to discrepancies, billing errors, or other issues. Addressing payment disputes promptly and professionally is crucial for preserving customer trust and minimizing potential churn. Establish a clear process for handling disputes, ensuring they are investigated thoroughly and resolved fairly.

Open communication is essential throughout the dispute resolution process. Keep the customer informed of the investigation's progress and explain the resolution clearly. Offering flexible payment options and proactive account management can help smooth over any friction and reinforce a positive customer payment experience. By prioritizing customer relationships during dispute resolution, you can build loyalty and protect your recurring revenue streams.

4. Payment Processing: What to Expect

Offer various payment options to make it easy for customers to pay. This might include credit cards, bank transfers, or online payment platforms. Ensure your system accurately records each payment and applies it to the correct invoice.

Tabs supports various payment types, simplifying this step and reducing manual data entry. Efficient payment processing is essential for maintaining accurate financial records.

5. Applying Cash Effectively

Once payments arrive, accurately applying them to the correct invoices is crucial. This seemingly small step ensures your financial records accurately reflect the state of your accounts receivable and helps you track outstanding balances. Think of it like balancing your checkbook—you need to know where every dollar goes to have a clear picture of your finances. Proper cash application prevents discrepancies and keeps your AR reporting clean and insightful. For SaaS businesses with complex recurring billing models, this process can be tricky. Using automated billing software like Tabs can simplify cash application and provide robust reporting to give you a clear view of your revenue streams.

6. Writing Off Bad Debt

Sometimes, despite your best efforts, a customer's account becomes uncollectible. It's a tough reality for any business, but knowing how to handle bad debt is essential. Writing off bad debt means accepting that the outstanding amount is unlikely to be recovered and adjusting your financial records accordingly. This is a necessary process for maintaining accurate financial statements and understanding the true financial health of your business. Think of it as a form of financial hygiene—clearing out the clutter to get a clearer picture of your actual revenue. While writing off bad debt is sometimes unavoidable, focusing on proactive measures like clear communication and flexible payment options can minimize its occurrence. A robust AR management system can help you identify potential bad debt situations early on, allowing you to take appropriate action.

5. Applying Cash Effectively

Cash application involves matching payments received with outstanding invoices and updating customer accounts. This ensures your records accurately reflect your current financial status. Automating this process reduces errors and frees up your team for more strategic tasks. Accurate cash application is fundamental for reliable financial reporting.

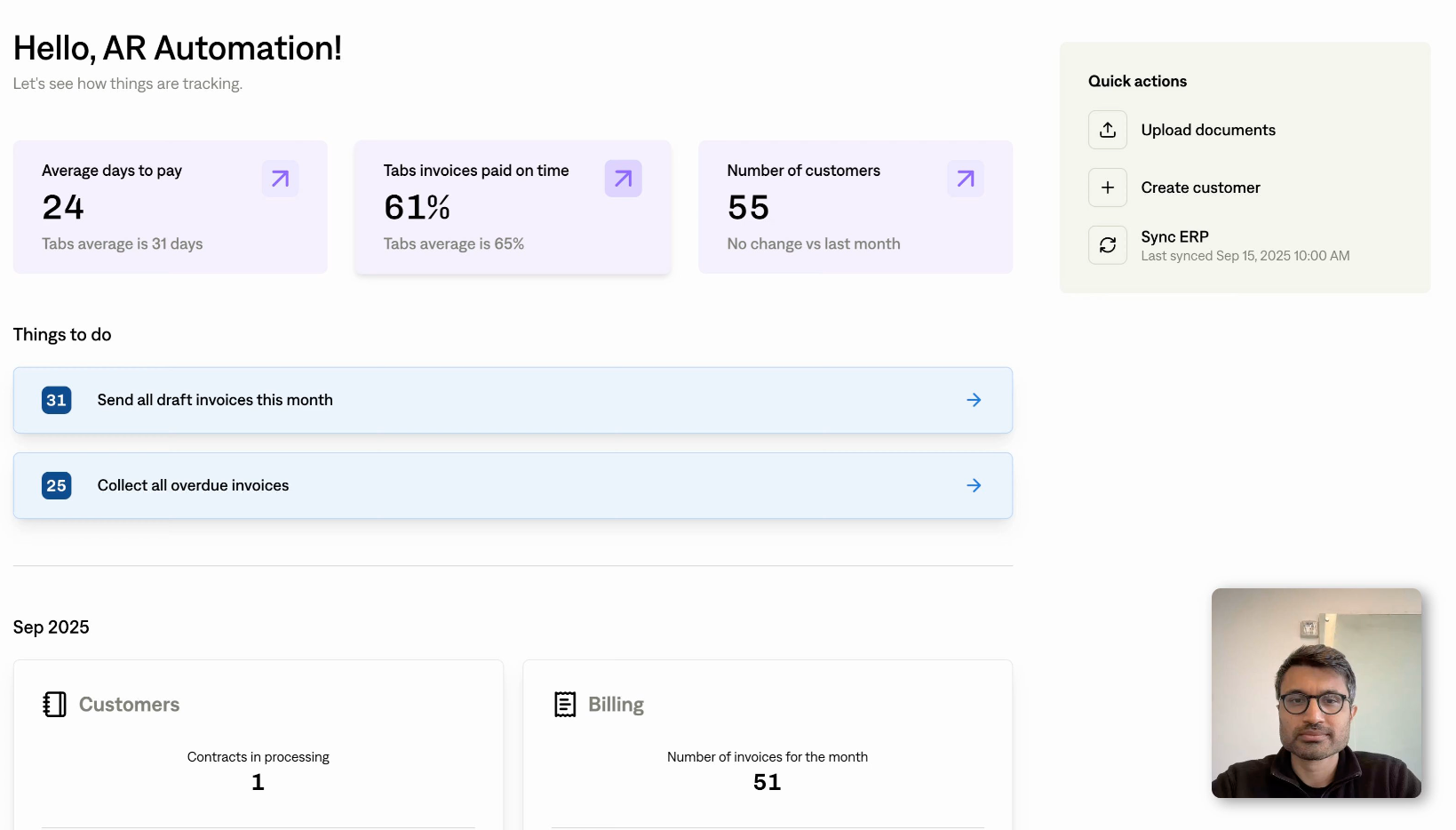

6. Reporting and Analysis: What You Need to Know

Regularly review key metrics to assess the effectiveness of your AR process. Track metrics like Days Sales Outstanding (DSO) and Collections Effectiveness Index (CEI) to identify areas for improvement. Robust reporting tools, like those offered by Tabs, help you monitor these metrics and gain valuable insights into your financial performance. Data-driven analysis is essential for optimizing your AR process and driving continuous improvement.

Best Practices for Managing Accounts Receivable

Solid accounts receivable processes are crucial for healthy SaaS financials. Here's how to optimize yours:

Clear Communication: A Must for AR Success

Open communication is key for a smooth AR process. Make sure your payment terms are crystal clear from the start. This includes outlining payment methods, due dates, and any penalties for late payments.

Proactive communication minimizes misunderstandings and sets clear expectations, reducing the likelihood of late payments and fostering positive customer relationships. Consider automated email notifications to keep customers informed about upcoming invoices and payment confirmations.

Accurate and Timely Invoicing

Accurate, timely invoices are the bedrock of efficient AR management. Errors and delays create confusion and disputes, leading to payment delays and frustration. Establish a standardized invoicing process and double-check every invoice for accuracy before sending. Automated invoicing software can help eliminate manual errors and ensure timely delivery.

Credit Policies That Protect Your Business

A well-defined credit policy is essential for managing risk and maintaining healthy cash flow. This involves setting clear credit limits, establishing payment terms, and outlining procedures for handling late payments. Offering various payment options can also encourage timely payments. A strong credit policy protects your business from potential losses and provides a framework for consistent AR management.

Regular Review of Aging Reports

Aging reports provide a snapshot of outstanding invoices categorized by their due dates. Regularly reviewing these reports helps you identify overdue accounts and take appropriate action. This allows you to prioritize follow-up efforts, understand payment patterns, and identify potential problem areas before they escalate. Robust reporting tools can automate this process and provide valuable insights into your AR performance.

Automated Payment Reminders: A Simple Solution

Automated payment reminders are a simple yet effective way to reduce late payments. Set up automatic email or SMS reminders to gently nudge customers about upcoming due dates and outstanding invoices. This saves your team time and ensures consistent follow-up, freeing them to focus on other critical tasks. Automating this process also reduces the risk of overlooking overdue accounts.

How Automation Improves Your Accounts Receivable Process

Automating your accounts receivable process dramatically improves efficiency and accuracy, freeing up your team for strategic work. No more manual data entry, chasing late payments, or wrestling with spreadsheets. Let's explore how automation transforms AR and why it's essential for SaaS businesses.

Benefits of Automating Your AR

Modern AR processes use automation to streamline key tasks, leading to faster processing, fewer errors, and a better customer experience. Automated systems handle everything from generating and sending invoices to tracking payments and creating reports. This saves time and reduces the risk of human error, ensuring accurate invoicing and payment processing.

Automated reminders and online payment options create a smoother, more convenient payment experience for customers, strengthening client relationships. This increased efficiency allows your finance team to shift from tedious manual tasks to strategic activities like financial planning and analysis.

Improved Accuracy and Reduced Errors

Manual data entry is prone to errors. Typos, transposed numbers, and incorrect calculations can lead to billing disputes, payment delays, and frustrated customers. Automating your accounts receivable process minimizes these risks, ensuring accuracy and consistency, and improving the overall quality of your financial data. This leads to fewer disputes and faster payment processing.

Faster Processing and Enhanced Scalability

Time is money in a SaaS business. Manual AR processes are time-consuming. Automation streamlines tasks like generating invoices, tracking payments, and reconciling accounts, allowing for faster processing and quicker turnaround times. Automated systems can handle large volumes of transactions efficiently, enabling your SaaS business to scale without adding significant overhead.

Improved Customer Experience and Increased Security

Customer experience is paramount in SaaS. A clunky billing process can damage customer relationships and lead to churn. Automation improves the customer experience by providing convenient payment options, timely reminders, and easy access to billing information. Automated systems also enhance security by reducing the risk of fraud and ensuring compliance with industry regulations. Secure online payment portals and automated fraud detection protect both your business and your customers’ financial information, building trust and fostering stronger customer relationships.

Simplified Risk Management

A well-defined credit policy, coupled with automated tools, simplifies risk management. Automating credit checks and approvals ensures consistent application of your credit policies, reducing the risk of extending credit to high-risk customers. Automated systems can flag potential issues, such as late payments or exceeding credit limits, allowing you to proactively mitigate risk. This helps maintain healthy cash flow and protects your business from potential losses. For more insights, review our accounts receivable best practices.

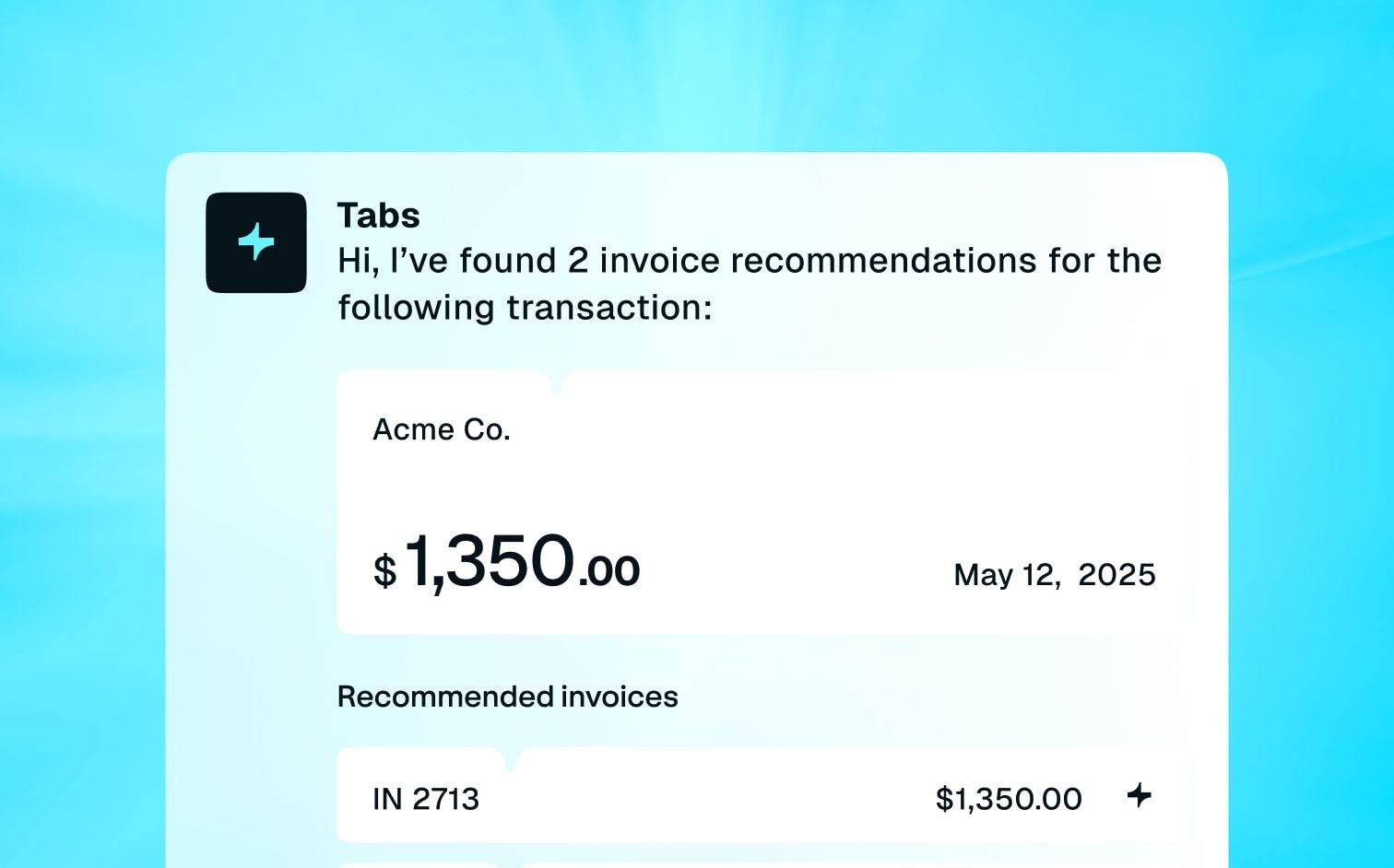

Key Features of Accounts Receivable Software

Robust AR software offers features designed to optimize the entire receivables process. Tabs, for instance, automates complex invoicing by gathering data from across your company and sending invoices directly to customers. This eliminates manual data entry and ensures invoices are accurate and on time.

Look for software with automated payment reminders, online payment portals, and seamless integration with your existing accounting systems. A comprehensive platform like Tabs combines contract review, billing, receivables, payments, revenue recognition, and reporting—all powered by AI. This streamlines your workflow and provides a complete view of your financial data, simplifying financial management and empowering data-driven decisions.

Tabs: Streamlining Your Recurring Billing

Modern AR processes use automation to streamline key tasks, leading to faster processing, fewer errors, and a better customer experience. Automated systems handle everything from generating and sending invoices to tracking payments and creating reports. This eliminates manual data entry, a notorious source of errors, and frees up your team for more strategic work. Think of all the time you'll save!

Accounts receivable software like Tabs integrates seamlessly with existing accounting systems. This integration streamlines your workflow, consolidating financial data into a single source of truth. This not only saves time but also reduces the risk of discrepancies between different systems. For SaaS businesses, this means a more accurate and efficient way to manage recurring billing, giving you more time to focus on what matters most: growing your business.

Automated Billing and Revenue Recognition

Robust AR software offers features designed to optimize the entire receivables process. Tabs, for instance, automates complex invoicing by gathering data from across your company and sending invoices directly to customers. This eliminates manual data entry and ensures invoices are accurate and on time, improving customer satisfaction and reducing the risk of payment disputes. Happy customers and accurate books? Win-win.

Beyond billing, automated revenue recognition is a game-changer for SaaS businesses. Accurately recognizing revenue is crucial for compliance and financial reporting. Automation ensures this process is handled correctly and efficiently, minimizing the risk of errors and providing a clear picture of your financial performance. This allows you to focus on growth and strategic decision-making, rather than getting bogged down in complex accounting procedures. Who needs that headache?

Flexible Payment Options and Robust Reporting

Look for software with automated payment reminders, online payment portals, and seamless integration with your existing accounting systems. Offering a variety of payment options, such as credit cards, ACH transfers, and online payment platforms, caters to customer preferences and encourages timely payments. This flexibility simplifies the payment process for your customers, leading to a better overall experience. Because making things easy for your customers is always a good idea.

A comprehensive platform like Tabs combines contract review, billing, receivables, payments, revenue recognition, and reporting—all powered by AI. This streamlines your workflow and provides a complete view of your financial data, simplifying financial management and empowering data-driven decisions. With access to real-time data and key performance indicators, you can identify trends, optimize your pricing strategies, and make informed decisions to drive business growth. Knowledge is power, right?

Implementing AR Automation in Your Workflow

Implementing AR automation is a game-changer for SaaS businesses. Start by identifying the most time-consuming and error-prone tasks in your current AR workflow. These are the best candidates for automation.

Automated invoicing is a great place to begin. Software can generate and send invoices automatically, eliminating manual effort and reducing errors.

Next, automate payment reminders. Timely reminders can significantly reduce late payments and improve cash flow.

Finally, explore automated payment processing and cash application. These features streamline payment handling and reconciliation, further enhancing efficiency. By automating these key steps, you'll significantly improve your AR process, freeing up your team for more strategic work.

Measuring AR Success: Key Metrics to Track

Solid metrics are your compass in the world of accounts receivable, guiding you toward efficient cash flow and a healthy financial outlook. For SaaS businesses, where recurring revenue is king, understanding these metrics is especially crucial. Let's explore some of the most important ones.

Understanding Days Sales Outstanding (DSO)

DSO tells you the average time it takes to collect payments after a sale. Think of it as a pulse check on your invoicing and collections process. A lower DSO is generally better, showing that you're converting sales into cash quickly.

For SaaS companies, a high DSO can signal problems with subscription management or payment processing. Regularly monitoring DSO helps you spot these issues early and adjust your strategies accordingly. You can calculate DSO by dividing your ending accounts receivable balance by your total credit sales, and then multiplying that number by the number of days in the period you're measuring.

Why DSO Matters

DSO isn’t just a number; it directly impacts your company’s financial health. A high DSO means your money is tied up in receivables, limiting your ability to invest in growth, cover operational expenses, or handle unexpected financial challenges. It can also indicate underlying issues, like inefficient billing processes, unclear payment terms, or even strained customer relationships. Keeping a close eye on DSO empowers you to address these challenges proactively.

For SaaS businesses, a healthy DSO is especially critical. Recurring revenue models thrive on predictable cash flow. A high DSO disrupts this predictability, making it harder to forecast revenue and plan for the future. By reducing your DSO, you free up cash, improve your financial stability, and create a more solid foundation for growth. This, in turn, allows you to reinvest in product development, customer acquisition, and other strategic initiatives.

Using the Collections Effectiveness Index (CEI)

CEI measures how well you're bringing in the money you're owed. It's a simple calculation: divide the total payments collected during a specific period by the total amount due during that same period.

A higher CEI (closer to 100%) means your collections process is humming along nicely. A lower CEI suggests you might need to revisit your collection strategies, perhaps by automating reminders or offering different payment options. For SaaS companies, a strong CEI is essential for maintaining predictable recurring revenue.

Aging Reports and Their Importance

Aging reports are like an X-ray of your outstanding invoices, categorizing them by how long they've been unpaid. They provide a clear picture of which customers are consistently late with payments and which invoices are slipping through the cracks. This information is gold for SaaS businesses, allowing you to identify potential churn risks and prioritize follow-up efforts.

Regularly reviewing aging reports helps you stay on top of collections, improve forecasting, and maintain healthy cash flow. Aging reports can also inform your credit policies, helping you make informed decisions about extending credit to new customers.

Timely Invoicing

Accurate, timely invoices are the bedrock of efficient AR management. Errors and delays create confusion and disputes, leading to payment delays and frustration. Establish a standardized invoicing process and double-check every invoice for accuracy before sending. Automated invoicing software can help eliminate manual errors and ensure timely delivery.

Reduction in Bad Debt

A well-defined credit policy is essential for managing risk and maintaining healthy cash flow. This involves setting clear credit limits, establishing payment terms, and outlining procedures for handling late payments. Offering various payment options can also encourage timely payments. A strong credit policy protects your business from potential losses and provides a framework for consistent AR management.

Reduction in % AR Open

Regularly reviewing your aging reports gives you a clear view of outstanding invoices, categorized by their due dates. This helps you identify overdue accounts and take appropriate action, allowing you to prioritize follow-up and understand payment patterns. This proactive approach helps reduce the percentage of your AR that remains open, improving cash flow and providing a more accurate picture of your financial health. For more insights on managing and reducing DSO, check out this helpful resource.

Accurate Record-Keeping (Cash Reconciliation)

Cash application, the process of matching payments received with outstanding invoices, is crucial for accurate record-keeping. This ensures your records reflect your current financial status. Automating this process through tools like Tabs reduces errors and frees up your team for more strategic tasks. Accurate cash application is fundamental for reliable financial reporting.

Automation and Scalability

Automating your accounts receivable process dramatically improves efficiency and accuracy. Modern AR processes use automation to streamline key tasks, leading to faster processing, fewer errors, and a better customer experience. Automating your AR process allows your team to focus on strategic work and scale your business more effectively.

Customer Satisfaction

Open communication is key to a smooth AR process and happy customers. Clearly communicate payment terms from the start, including payment methods, due dates, and any penalties for late payments. Proactive communication minimizes misunderstandings and fosters positive customer relationships.

Days Deductions Outstanding (DDO)

Days Deductions Outstanding (DDO) tracks the time it takes to resolve deductions, such as discounts or disputed amounts, on your invoices. A high DDO can indicate inefficiencies in your deduction management process. Regularly monitoring DDO, often alongside aging reports, helps identify bottlenecks and improve your overall AR performance.

Average Days Delinquent (ADD)

Average Days Delinquent (ADD) measures the average number of days invoices remain overdue. Tracking ADD helps you understand how long it takes customers to pay after the due date. Regularly monitoring ADD, often in conjunction with aging reports, can reveal trends in late payments and inform your collections strategies.

Number of Revised Invoices

Tracking the number of revised invoices helps identify recurring errors in your invoicing process. A high number of revisions can indicate problems with data entry, product or service descriptions, or pricing. Minimizing invoice revisions through automation and quality control improves efficiency and customer satisfaction. Consider implementing automated payment reminders to reduce the need for revised invoices related to late payments.

Common AR Challenges and How to Solve Them

Even with a solid process, managing the accounts receivable process has its hurdles. Understanding these challenges and their solutions is key to maintaining healthy financial operations for your SaaS business.

Late Payments and Cash Flow Problems

Late payments are a recurring problem for many businesses. Customers might delay payments for various reasons, from simple oversight to invoice disputes. These late payments disrupt cash flow, making it tough to predict revenue and plan expenses.

This uncertainty can hinder growth and make it difficult to invest in new opportunities. For SaaS companies, consistent cash flow is especially crucial for scaling operations and investing in product development. Late payments can throw a wrench in those plans.

Invoice Errors and Manual Mistakes

Another common challenge is inaccurate invoicing. Manual data entry is prone to errors, leading to billing disputes and payment delays. Incorrect invoices damage your customer relationships and create extra work for your team.

No one wants to spend time chasing down payments because of a typo, especially when your team could be focusing on customer acquisition or retention. In the fast-paced SaaS world, time is money.

Challenges of Manual AR Processes

Manual AR processes are often riddled with inefficiencies. High error rates in invoice creation, collections, and payment processing are common. Keeping accurate records and reconciling cash becomes a tedious, time-consuming chore. It’s difficult to scale your business without significantly increasing staff to handle the workload. This can strain resources and limit your growth potential, especially for SaaS companies with subscription-based models.

Manual processes also negatively impact customer experience. Slow response times and limited self-service options can frustrate customers and damage your brand reputation. A positive customer experience is essential for retention and growth. Providing a seamless and efficient payment experience is key.

Improving Communication with Customers

Clear communication is essential for healthy customer relationships. When communication breaks down, it can lead to misunderstandings about invoices, payment terms, and other important details. Proactive account management builds trust and ensures customers feel heard.

This can lead to more timely payments and stronger customer retention. For SaaS businesses, retaining customers is paramount, and clear communication in the billing process plays a significant role.

Overcoming AR Challenges: Proven Strategies

There are ways to address these common accounts receivable challenges. Implementing a structured approach with robust software can automate many AR processes, reducing manual errors and freeing up your team for more strategic work.

Automated payment reminders can gently encourage customers to pay on time, improving cash flow predictability. Regularly checking in with customers about their billing experience and adapting based on their feedback strengthens relationships and reduces the likelihood of disputes. Investing in these strategies improves your AR process and contributes to a healthier bottom line.

Consider exploring tools like Tabs to streamline your billing and revenue operations. Tabs offers solutions for automated billing, revenue recognition, and insightful reporting, helping SaaS businesses optimize their financial processes.

Optimizing Your Accounts Receivable for Success

Optimizing your AR process is crucial for healthy cash flow and strong customer relationships. For SaaS companies, a smooth AR process is even more critical, given the recurring nature of revenue. Here’s how to fine-tune your AR process for optimal performance:

Streamlining Invoice Creation and Delivery

A streamlined invoicing process is the foundation of efficient AR. Think of it as the first impression you make on your customers regarding billing. The entire AR process, from customer onboarding and invoicing to payment posting, needs a clear structure.

Start by automating invoice generation. Software can automatically create and send invoices based on subscriptions, ensuring accuracy and timely delivery. This eliminates manual data entry, reducing errors and freeing up your team for more strategic tasks. Offer multiple delivery options, such as email and even postal mail if needed, to cater to different customer preferences.

Better Collection Techniques

Effective collections are key to minimizing late payments and maximizing cash flow. A balanced approach is essential: you want to recover outstanding payments while preserving customer relationships. Establish clear payment terms upfront and communicate them clearly to customers.

Automated payment reminders can gently nudge customers before payments become overdue. When following up on late payments, maintain a polite but firm tone. Offer flexible payment options when possible, such as installment plans or alternative payment methods. This shows a willingness to work with customers and can improve your chances of getting paid.

Using Technology to Improve AR Efficiency

Modern AR processes rely on automation to improve speed, accuracy, and the overall customer experience. Manual AR processes are time-consuming and prone to errors. Automated solutions can handle repetitive tasks like invoice generation, payment reminders, and reporting. This not only reduces manual work but also improves efficiency and allows your team to focus on higher-value activities like customer relationship management and financial analysis.

Tabs, for example, offers tools to extract key contract terms with AI and automate complex invoicing, which can significantly streamline your AR workflow and simplify revenue recognition.

Building Stronger Customer Relationships

A positive customer experience extends to the billing process. Proactive account management demonstrates your commitment to customer satisfaction. Make it easy for customers to access their invoices, payment history, and support resources. Regularly solicit feedback on their billing experience and be responsive to their concerns.

Addressing issues promptly and efficiently can strengthen customer relationships and improve payment behavior. Clear communication and a customer-centric approach to AR can contribute significantly to customer retention and long-term loyalty. Consider using robust reports on key metrics to gain insights into customer behavior and identify areas for improvement in your AR process.

The Importance of Accounts Receivable for Financial Health

For SaaS companies, a healthy accounts receivable process is more than just a back-office function—it's the engine that drives financial stability and growth. Let's explore how AR directly impacts key areas of your financial well-being.

AR's Impact on Cash Flow Management

Effective AR management is the cornerstone of healthy cash flow. Your SaaS business relies on recurring revenue, but that revenue isn't truly yours until it's in your bank account. A smooth AR process ensures timely invoice delivery and payment collection, providing the steady stream of cash you need to cover operational expenses, invest in product development, and confidently plan for the future.

Without prompt payments, you could face difficulties meeting payroll, paying vendors, or investing in crucial growth initiatives. A well-managed AR process keeps the cash flowing, allowing you to reinvest and scale strategically.

Accurate Financial Reporting and AR

Accurate financial reporting is non-negotiable for any successful SaaS business. Your AR process plays a vital role here. Meticulous record-keeping of invoices, payments, and outstanding balances provides the foundation for accurate financial statements. This data is essential for making informed business decisions, securing funding, and maintaining compliance.

Clean AR data ensures your financial reports reflect the true state of your business, giving you and your stakeholders a clear picture of your financial performance. This transparency is crucial for building trust and making sound strategic decisions.

How AR Influences Business Growth

As your SaaS business grows, so too does the complexity of your AR process. Manual processes that worked in the early stages can quickly become bottlenecks, hindering your ability to scale efficiently. Automating your AR workflow with tools like Tabs streamlines everything from invoice generation to payment processing and revenue recognition. This frees up valuable time and resources and minimizes errors, improving reporting accuracy.

By automating AR, you create a scalable foundation for sustainable growth, allowing you to handle increasing transaction volumes without sacrificing efficiency or accuracy. This scalability is essential for taking your SaaS business to the next level.

Essential Tools for Managing Accounts Receivable

Getting a handle on your accounts receivable process can feel like a huge task, but the right tools can make all the difference. Let's explore some solutions that can streamline your AR workflow and free up your team to focus on growth.

Automated Invoicing Software Options

Automated invoicing software transforms the often tedious billing process. Instead of manually gathering information from different teams and creating invoices one by one, these tools pull the necessary data and generate invoices automatically. This not only minimizes errors (bye-bye, typos!) but also speeds up the entire invoicing cycle. Faster invoicing means faster payments, which is a win for everyone.

Payment Processing Solutions for Your Business

Think about how much easier it is for you to pay a bill when you have multiple options and a smooth checkout experience. The same goes for your customers. Robust payment processing solutions simplify payments, making it more convenient for customers to settle their invoices.

This reduces the administrative headaches associated with chasing down payments and frees up your team's time. Plus, offering a variety of payment methods can significantly improve your revenue collection.

Comprehensive AR Management Platforms

Imagine having all your key financial processes—contract review, billing, receivables, payments, revenue recognition, and reporting—in one streamlined system. That's the power of a comprehensive AR management platform.

These platforms, often powered by AI, offer a centralized hub for managing all things AR, boosting efficiency and giving you a clearer picture of your financial health. For SaaS businesses looking to scale efficiently, a platform like Tabs offers a robust solution.

Analytics and Reporting Tools for AR

Data is king, especially when it comes to optimizing your AR process. Analytics and reporting tools provide valuable insights into your AR workflow, highlighting areas for improvement.

By tracking key metrics, you can identify bottlenecks, refine your collections strategies, and ultimately boost your bottom line. Whether you're implementing a new payment collection model or simply want to understand your current process better, these tools are essential for data-driven decision-making.

Future Trends in Accounts Receivable

The way we manage accounts receivable is constantly evolving. Staying ahead of the curve means understanding and adapting to these key trends:

AI and Machine Learning in AR

AI is transforming accounts receivable, offering powerful tools to automate tasks, analyze data, and improve decision-making. Think automated invoice processing, intelligent payment reminders, and predictive analytics for identifying potential late payments. Tabs AI offers a solution for managing invoices, receivables, and revenue recognition.

By automating complex AR processes, including gathering information from across your company and sending invoices directly to customers, companies can free up valuable time and resources. This shift toward automation streamlines operations and reduces errors, improving overall efficiency.

Data-Driven Decisions in Accounts Receivable

Analyzing accounts receivable data provides valuable insights into customer payment behavior, identifies bottlenecks in your processes, and informs strategic decisions. This data-driven approach allows you to optimize payment terms, refine collection strategies, and ultimately improve your bottom line. For example, implementing a new payment collection model or invoicing system with integrated payment options can automate steps in the receivables process, reducing costs and increasing efficiencies.

Regularly asking your customers about their billing experience and making adjustments based on their feedback can lead to significant improvements. Robust reporting on key metrics empowers finance teams to make informed decisions.

Customer-Centric Approaches to AR

Accounts receivable management isn't just about collecting payments; it's about building strong customer relationships. A customer-centric approach focuses on providing a positive payment experience, from clear and accurate invoices to flexible payment options and proactive communication. This approach fosters customer loyalty and reduces friction in the payment process.

Proactive account management shows customers that you value their satisfaction. To improve customer experience, focus on enhancing communication, making payments convenient, and fostering a client-friendly invoicing process. This can be as simple as offering multiple payment methods or sending personalized payment reminders. Simplify revenue recognition to provide a seamless experience for your customers.

Related Articles

- Receivables Management: A Practical Guide for SaaS

- A/R in Accounting: A Practical Guide

- A Field Guide to SaaS Accounting

Frequently Asked Questions

What's the biggest mistake businesses make in their accounts receivable process?

Often, it's neglecting the customer relationship aspect. While efficient processes and automation are crucial, remember that AR involves real people. Clear communication, flexible payment options, and a willingness to work with customers can significantly impact your success in collecting payments.

A positive customer experience can lead to faster payments and stronger client relationships.

How can I improve my DSO?

Improving your Days Sales Outstanding involves a multi-pronged approach. Start with clear, accurate, and timely invoicing. Then, implement a robust collections process that includes automated reminders and consistent follow-up.

Offering a variety of payment options can also encourage faster payments. Finally, analyze your aging reports regularly to identify and address any bottlenecks in your process.

What's the best way to automate my AR process if I'm on a tight budget?

Start by identifying the most time-consuming manual tasks in your current workflow. Often, automating invoicing and payment reminders offers the biggest initial return on investment. Many affordable software solutions specialize in these areas. As your budget allows, you can explore more comprehensive AR management platforms.

Is AR automation only beneficial for large enterprises?

Absolutely not! Businesses of all sizes can benefit from AR automation. Even small businesses can streamline their processes, reduce errors, and improve customer relationships with the right tools. The key is to choose solutions that fit your specific needs and budget.

Beyond software, what's one actionable step I can take today to improve my AR process?

Review your current communication strategy with customers. Ensure your payment terms are crystal clear from the outset, and that you're providing ample opportunities for customers to ask questions or raise concerns. Open communication can prevent misunderstandings and foster a more positive payment experience.