Software-as-a-Service (SaaS) has revolutionized how businesses operate, offering scalable, cloud-based solutions that have transformed industries across the globe. However, with this new business model comes a unique set of financial challenges requiring specialized knowledge and strategic planning. SaaS accounting, in particular, demands a deep understanding of the complexities inherent in recurring revenue, subscription management, and evolving regulatory standards.

From recognizing revenue in accordance with ASC 606 and IFRS 15 to managing deferred revenue and tracking critical SaaS metrics, the role of finance professionals has never been more crucial—or more challenging.

Essentials of SaaS Financial Management

At the core of SaaS financial management lies fundamental principles and practices that differ significantly from traditional accounting methods.

ASC 606 and IFRS 15

These regulatory standards, issued by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), respectively, provide a comprehensive framework for recognizing revenue from contracts with customers. SaaS companies must adhere to these guidelines to ensure accurate and consistent financial reporting.

Subscription Business Model

SaaS companies operate on a subscription-based model, where customers pay a recurring fee for access to cloud-based software. This model offers predictable revenue streams and scalability but also introduces complexities in revenue recognition, deferred revenue management, and expense allocation.

Revenue Recognition

Under ASC 606 and IFRS 15, SaaS companies must recognize revenue as performance obligations are satisfied over time. This requires careful analysis of customer contracts, identification of distinct performance obligations, and allocation of transaction prices based on standalone selling prices.

Deferred Revenue

In the SaaS model, customers often pay upfront for services to be delivered over a period of time. This creates a deferred revenue liability on the balance sheet, which must be carefully tracked and amortized as you provide services.

By understanding these essential concepts, SaaS finance teams can build a strong foundation for effective financial management and decision-making.

Key SaaS Accounting Methods

To accurately reflect the financial health of a SaaS business, finance teams must choose the appropriate accounting methods. The two primary methods used in SaaS accounting are cash-basis and accrual accounting.

Cash-Basis Accounting

This method recognizes revenue when cash is received and records expenses when paid. While cash-basis accounting provides a simple approach, it fails to capture the true economic reality of a SaaS business, where revenue is often recognized over time as you deliver services.

Accrual Accounting

In contrast, accrual accounting recognizes revenue when earned and expenses when incurred, regardless of when cash is exchanged. This method aligns revenue recognition with the delivery of services, providing a more accurate picture of a company's financial performance. Accrual accounting is the preferred method for SaaS businesses, as it complies with ASC 606 and IFRS 15 and offers greater visibility into the company's true profitability.

The choice between cash-basis and accrual accounting will depend on various factors, including the stage of the company's growth, the complexity of its financial operations, and the requirements of investors and stakeholders. As SaaS businesses mature and seek funding or prepare for an IPO, they typically transition to accrual accounting to provide more robust and reliable financial reporting.

Challenges in SaaS Accounting

Revenue Recognition

One of the most significant challenges in SaaS accounting is accurately recognizing revenue in accordance with ASC 606 and IFRS 15. These standards require companies to follow a five-step process for revenue recognition:

- Identify the contract with the customer.

- Identify the performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price to the performance obligations.

- Recognize revenue when or as the entity satisfies a performance obligation.

This process can be particularly complex for SaaS companies due to the nature of their contracts and the variety of services they offer. Some common challenges include:

- Complexity in Contracts: SaaS agreements often include multiple elements, such as software access, implementation services, customer support, and professional services. Finance teams must carefully analyze these contracts to identify distinct performance obligations and determine the appropriate revenue allocation.

- Subscription Cycles: The recurring nature of SaaS revenue means that companies must recognize revenue over the subscription term rather than upfront. This requires meticulous tracking of contract start and end dates and any changes to the subscription, such as upgrades, downgrades, or cancellations.

- Variable Considerations: SaaS contracts may include usage-based fees, discounts, or performance bonuses, which introduce variability into the revenue recognition process. Finance teams must estimate these variable amounts and include them in the transaction price, subject to certain constraints.

To overcome these challenges, SaaS finance teams must develop processes and controls around contract management, revenue recognition, and financial reporting. This may involve investing in specialized accounting software, training staff on the intricacies of ASC 606 and IFRS 15, and collaborating closely with legal and sales teams to ensure accurate and timely revenue recognition.

Deferred Revenue Management

Another significant challenge in SaaS accounting is managing deferred revenue. When a customer pays upfront for a subscription, the company must record the payment as a liability on the balance sheet until the services are delivered. Carefully track and amortize this deferred revenue over the subscription term in line with the company's revenue recognition policies.

The key challenge here is ensuring deferred revenue balances are accurate and up-to-date, reflecting any changes to the underlying subscriptions. This requires close coordination between finance, sales, and customer success teams and robust systems for tracking and managing deferred revenue.

To effectively manage deferred revenue, SaaS finance teams should:

- Establish clear policies and procedures for recording and amortizing deferred revenue.

- Automate billing and revenue recognition software to minimize manual errors and ensure compliance with accounting standards.

- Regularly review and reconcile deferred revenue balances to identify any discrepancies or anomalies.

- Provide transparent reporting on deferred revenue to stakeholders, including investors and auditors.

Expense Allocation

SaaS companies often face challenges allocating expenses across different departments, products, and customer segments. This is particularly true for costs not directly attributable to a specific revenue stream, such as research and development, marketing, and general and administrative expenses.

The key challenge here is determining the appropriate basis for allocating these costs, which can significantly impact the company's reported profitability and key metrics.

When allocating expenses, SaaS finance teams must also consider the timing of recognition. Some costs, such as software development, may need to be capitalized and amortized over the asset's useful life, while you should expense others as incurred.

To overcome these challenges, SaaS finance teams must:

- Develop clear policies and methodologies for expense allocation based on the company's specific business model and cost structure.

- Regularly review and update allocation models to ensure they remain relevant and accurate.

- Use data analytics and cost accounting tools to gain deeper insights into the drivers of expenses and identify opportunities for optimization.

- Collaborate with other departments to ensure that expense allocations are fair, transparent, and aligned with the company's overall strategy.

By effectively managing expense allocation, SaaS companies can make more informed decisions about pricing, investments, and resource allocation, driving long-term growth and profitability.

Sales Tax Compliance

SaaS companies face unique challenges when it comes to sales tax compliance, as the taxability of their services can vary widely by jurisdiction. In the United States, for example, some states consider SaaS to be a taxable service, while others treat it as a non-taxable intangible.

To further complicate matters, the rules around sales tax nexus—the level of business activity that triggers a tax collection obligation—have rapidly evolved in recent years. With the Supreme Court's 2018 decision in South Dakota v. Wayfair, states can now require out-of-state sellers to collect and remit sales tax based on their economic activity rather than just their physical presence.

For SaaS companies, this means they may have sales tax obligations in multiple states, even if they don't have any employees or physical infrastructure there. This can create significant compliance burdens, as companies must register for tax permits, calculate and collect the appropriate tax amounts, and file returns in each applicable jurisdiction.

To navigate these challenges, SaaS finance teams should consider investing in automated sales tax compliance software, which can help streamline nexus determination, tax calculation, and filing processes. They should also stay up-to-date on changes in state and local tax laws and work closely with legal and compliance teams to ensure that the company is meeting its obligations.

International Operations

As SaaS companies expand globally, they face additional accounting challenges related to international operations. Some key issues to consider include:

- Currency fluctuations: SaaS companies that transact in multiple currencies must manage the risks and complexities of foreign exchange. This includes properly translating foreign currency transactions and balances into the company's functional currency, as well as hedging against currency fluctuations to minimize financial statement volatility.

- Local tax and regulatory compliance: Each country has its own unique tax and regulatory requirements, which can vary widely from those in the company's home jurisdiction. SaaS finance teams must work closely with local advisors and authorities to ensure that they are meeting all applicable compliance obligations, including income tax, VAT, and payroll tax.

To effectively manage these challenges, SaaS finance teams should:

- Develop a clear international expansion strategy in collaboration with legal, tax, and business teams

- Invest in robust financial systems and processes supporting multi-currency transactions and reporting

- Work with experienced international tax and legal advisors to ensure compliance with local regulations

- Regularly review and assess the company's international operations to identify optimization and risk mitigation opportunities

Customer Churn and Lifetime Value Calculations

Customer churn and lifetime value (CLTV) are two critical metrics for SaaS businesses. They provide insight into the health and sustainability of the company's customer base. However, accurately calculating and forecasting these metrics can be challenging due to the inherent volatility and uncertainty of customer behavior.

To overcome these challenges, SaaS finance teams should:

- Invest in robust data management and analytics tools supporting churn and CLTV calculations.

- Develop clear and consistent definitions and methodologies for calculating churn and CLTV, aligned with industry best practices.

- Regularly review and update assumptions and models based on customer behavior and market trends.

- Collaborate with customer success and product teams to identify non-financial drivers of churn and CLTV and incorporate them into forecasting models.

- Use churn and CLTV insights to inform strategic customer acquisition, retention, and growth decisions.

SaaS Revenue Recognition Under ASC 606 and IFRS 15

The adoption of ASC 606 and IFRS 15 has had a significant impact on revenue recognition for SaaS companies. These standards provide a comprehensive framework for recognizing revenue from contracts with customers based on the transfer of control of promised goods or services.

ASC 606: Key Steps for SaaS

Under ASC 606, SaaS companies must follow a five-step process for revenue recognition:

- Identify the contract with the customer: This includes all written, oral, and implied contracts that create enforceable rights and obligations.

- Identify the performance obligations in the contract: SaaS companies must identify the distinct promises to transfer goods or services to the customer, such as software access, implementation services, or customer support.

- Determine the transaction price: This is the amount of consideration the company expects to be entitled to in exchange for transferring the promised goods or services, including any variable consideration, such as usage-based fees or performance bonuses.

- Allocate the transaction price to the performance obligations: Allocate each price to each performance obligation based on its relative standalone selling price, which may need to be estimated if not directly observable.

- Recognize revenue when (or as) the entity satisfies a performance obligation: SaaS companies typically recognize revenue over time, as the customer simultaneously receives and consumes the benefits of the software. This requires measuring progress toward complete satisfaction of the performance obligation using methods such as time elapsed or usage.

IFRS 15: Specific Considerations

While IFRS 15 follows a similar five-step model to ASC 606, there are some specific considerations that SaaS companies should be aware of.

- Contract modifications: Under IFRS 15, contract modifications are accounted for as separate contracts if they add distinct goods or services at their standalone selling prices. If the modification does not add distinct goods or services, it is a continuation of the existing contract.

- Variable consideration: IFRS 15 requires companies to estimate variable consideration and include it in the transaction price, subject to a constraint. The constraint limits the amount of variable consideration you can include to the amount for which it is highly probable that a significant reversal will not occur.

- Licenses of intellectual property: IFRS 15 provides specific guidance on accounting for licenses of intellectual property based on whether the license represents a right to access or a right to use the underlying IP. SaaS companies must carefully evaluate the nature of their software licenses to determine the appropriate revenue recognition pattern.

- Principal versus agent considerations: IFRS 15 guides whether a company acts as a principal or an agent in a transaction. SaaS companies that resell third-party software or services must evaluate whether they control the specified good or service before it is transferred to the customer to determine whether to recognize revenue on a gross or net basis.

Challenges and Implementation

Implementing ASC 606 and IFRS 15 can be a significant challenge for SaaS companies, particularly those with complex customer contracts or multiple revenue streams. Some common challenges include:

- Data management: Capturing and managing the data required to support revenue recognition under the new standards, such as contract terms, performance obligations, and standalone selling prices.

- Process and control changes: Updating accounting processes and internal controls to ensure compliance with the new standards, including changes to financial close and reporting processes.

- Disclosure requirements: Providing the expanded disclosures required under ASC 606 and IFRS 15, including disaggregated revenue, contract balances, and performance obligations.

- Transition methods: Choosing between the full and modified retrospective transition methods while managing the complexity and cost of restating prior period financial statements.

To successfully implement ASC 606 and IFRS 15, SaaS finance teams should:

- Establish a cross-functional implementation team, including accounting, finance, legal, sales, and IT representatives.

- Develop a detailed project plan and timeline with clear milestones and responsibilities.

- Assess the impact of the new standards on the company's revenue streams, contracts, and processes.

- Design and implement new processes and controls to support compliance with the standards.

- Communicate the impact of the new standards to internal and external stakeholders, including investors, analysts, and auditors.

By proactively addressing these challenges and implementing a robust revenue recognition framework, SaaS companies can ensure compliance with ASC 606 and IFRS 15 and provide stakeholders with transparent and reliable financial information.

Strategic Tax Planning for SaaS Companies

Effective tax planning is critical for SaaS companies, as it can help optimize cash flow, reduce tax liabilities, and support long-term growth and profitability.

SaaS companies with global operations must navigate a complex web of international tax laws and regulations, including transfer pricing, withholding taxes, and permanent establishment risk. Developing a comprehensive international tax strategy, in collaboration with experienced tax advisors, can help minimize global tax liabilities and support efficient cross-border operations.

In addition to sales taxes, SaaS companies may be subject to various state and local taxes, such as income taxes, franchise taxes, and gross receipts taxes. Analyzing nexus and apportionment factors and developing a state and local tax planning strategy can help minimize tax liabilities and ensure compliance with local regulations.

Accounting Software and Tools for SaaS

To effectively manage the complex financial and accounting challenges faced by SaaS companies, finance teams must have access to robust and flexible accounting software and tools. Some popular accounting software options for SaaS businesses include:

- Sage Intacct: A cloud-based accounting and financial management platform designed for high-growth SaaS businesses with strong revenue recognition and contract management capabilities.

- Zuora: A subscription management platform that offers billing, revenue recognition, and analytics functionality specifically designed for SaaS and other subscription-based businesses.

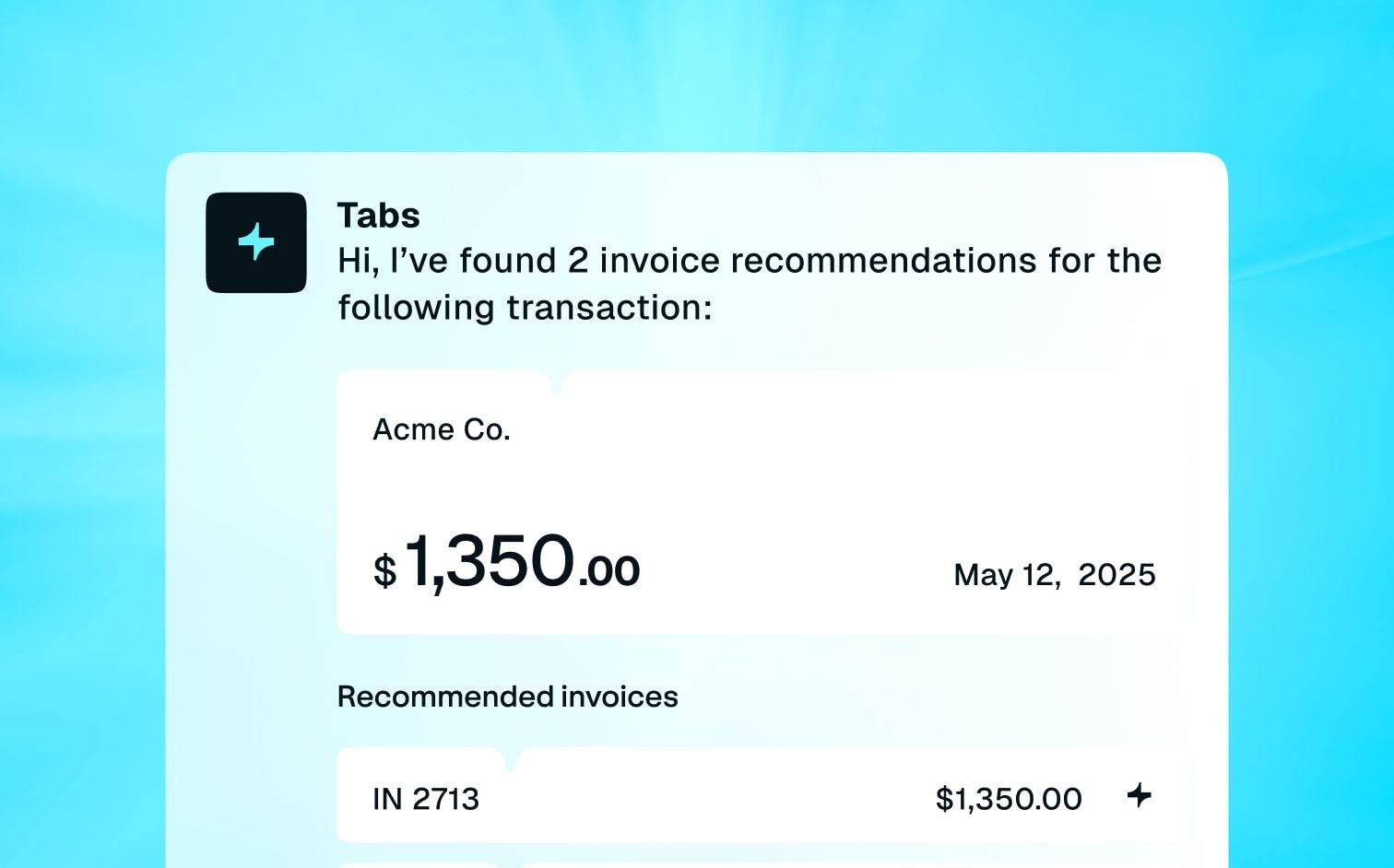

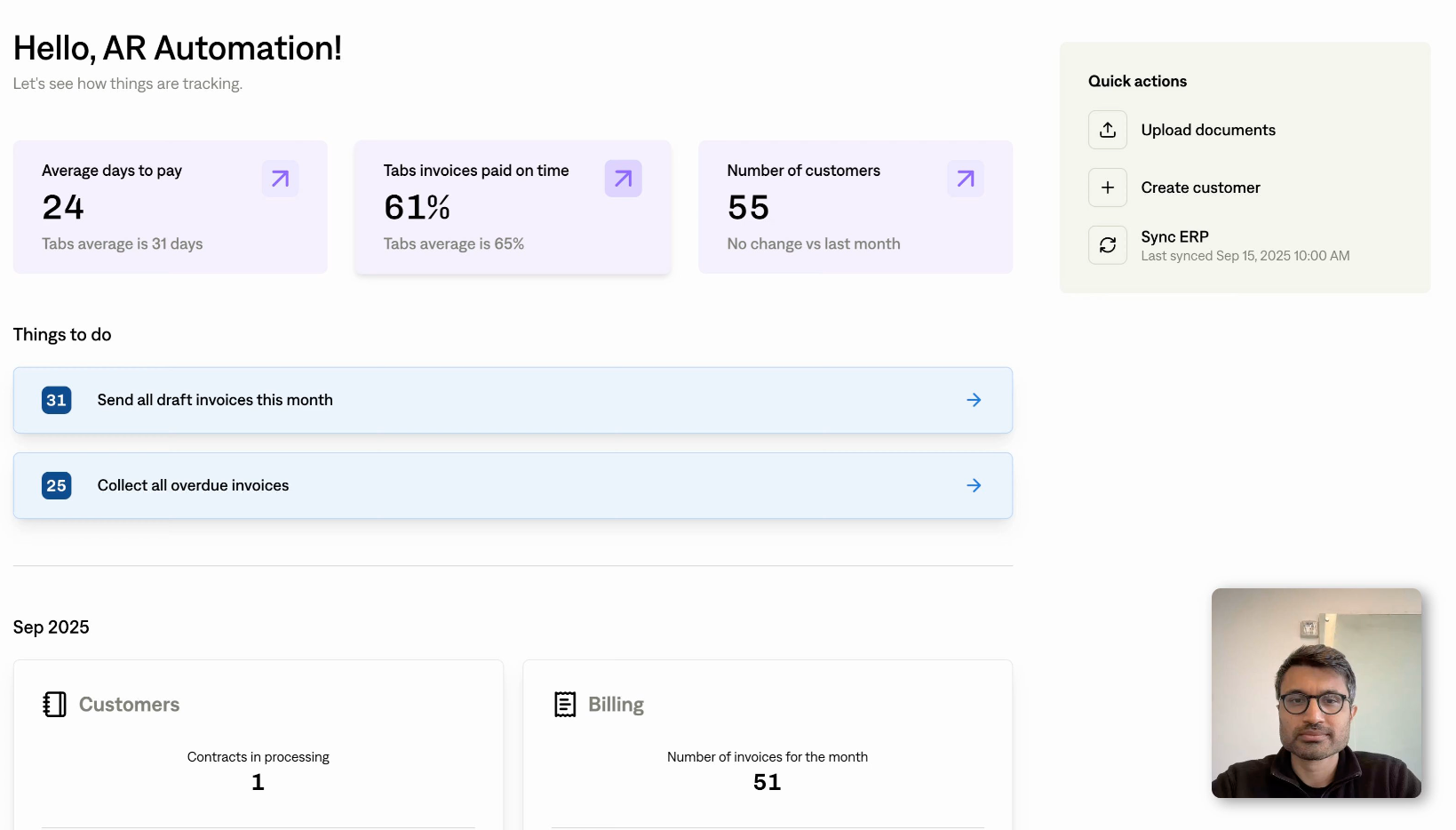

- Tabs: An AI-powered accounts receivable platform tailored for B2B SaaS companies, automating the AR process and handling complex contracts to improve cash flow and streamline operations.

By investing in the right accounting software and tools, SaaS finance teams can streamline financial processes, improve data accuracy and visibility, and gain valuable insights to support strategic decision-making and growth.

Financial KPIs and Metrics Crucial for SaaS Businesses

In addition to traditional financial metrics such as revenue, profitability, and cash flow, SaaS businesses must track and manage a unique set of key performance indicators (KPIs) that reflect the dynamics of the subscription-based business model. Some crucial SaaS financial metrics include:

- Monthly Recurring Revenue (MRR): The total amount of predictable revenue that a SaaS company expects to receive every month from its current customers. MRR is a key indicator of the company's growth and stability and is often used to forecast future revenue and cash flow.

- Annual Recurring Revenue (ARR): The annualized equivalent of MRR, representing the total amount of predictable revenue that a SaaS company expects to receive over a 12-month period. ARR is a key metric for measuring the overall size and growth of a SaaS business.

- Churn Rate: The percentage of customers or revenue that a SaaS company loses over a given period, typically measured on a monthly or annual basis. Churn is a critical metric for SaaS businesses, as high churn rates can significantly impact growth and profitability.

Concluding Thoughts

Robust accounting practices are vital for the growth and sustainability of SaaS businesses. Staying ahead of the curve requires continuously adapting financial management strategies, staying current with accounting standards, and understanding the unique financial dynamics of the SaaS model.

Future trends and evolving standards in SaaS accounting include:

- Increasing automation and artificial intelligence: With the surge in financial data, manual processes and spreadsheets will no longer suffice. Finance teams must adopt AI and automation to streamline processes, enhance accuracy, and gain real-time business insights.

- Expanding global compliance requirements: As SaaS businesses enter new markets, they'll face complex global compliance challenges, including tax, accounting, and data privacy regulations. Robust compliance strategies and collaboration with legal and business functions are crucial.

- Growing focus on sustainability and ESG: Investors and stakeholders are prioritizing ESG factors. SaaS businesses must develop comprehensive ESG strategies and reporting frameworks. Finance teams will play a key role in measuring and communicating ESG initiatives' financial impacts.

- Evolving role of the CFO: CFOs must evolve beyond traditional financial management to become strategic business partners. This requires new skills in data analytics, strategic planning, and cross-functional collaboration.

By embracing these trends and continuously innovating their financial practices, SaaS finance teams can drive growth and long-term success. Tabs, an AI-powered accounts receivable platform, supports this journey by automating AR processes and managing complex contracts, ultimately improving cash flow and operational efficiency.