Running a business is like juggling flaming torches while riding a unicycle—challenging, to say the least. And managing your finances? That's like adding another flaming torch to the mix. But what if you could streamline one of the most critical aspects of your financial operations: your payments? Understanding payment tech is no longer a luxury; it's a necessity. This guide will demystify the world of payment technology, providing you with the knowledge to choose the right tools and strategies for your business. We'll explore the evolution of payment tech, the key components of modern systems, and the essential features to look for when selecting a provider. Get ready to take control of your payments and simplify your financial juggling act.

Key Takeaways

- The right payment tech fuels business growth: From accepting diverse payment methods to automating complex invoicing and simplifying revenue recognition, choosing the right tools empowers smoother financial operations and enhances the customer experience. Look for solutions that integrate seamlessly with your existing systems and offer robust reporting features.

- Prioritize payment security: Protecting customer data is paramount. Seek out payment solutions that emphasize security measures like encryption, tokenization, and fraud detection to build trust and safeguard sensitive information. Stay informed about evolving security threats and industry best practices.

- The payments landscape is constantly changing: Stay ahead of the curve by understanding emerging trends like AI-driven fraud prevention, the increasing use of digital wallets, and the rise of BNPL options. Adapting to these changes will help you create a frictionless and secure payment experience for your customers.

What is Payment Tech?

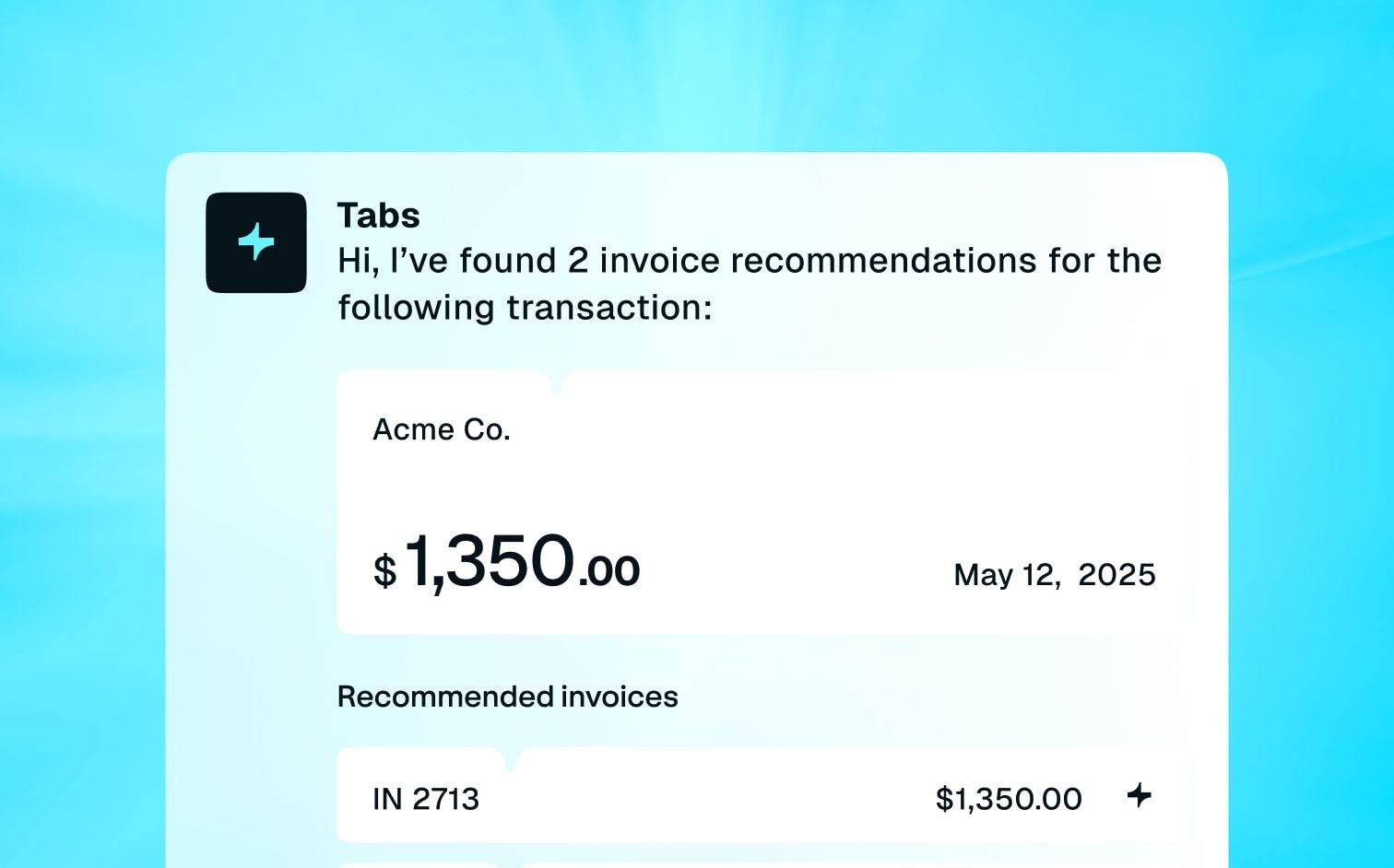

Payment technology includes the tools and systems that let businesses accept payments. It's the connection between your sales and your bank account. Payment tech is more than just credit card readers; it includes the software, hardware, and networks that authorize, process, and settle transactions. This can range from simple online payment gateways to sophisticated recurring billing platforms like Tabs, which offer features like automated invoicing and revenue recognition. For businesses with subscription models, managing recurring billing efficiently is key, and platforms like Tabs provide specialized solutions to automate complex invoicing and simplify revenue recognition. Choosing the right payment technology is crucial for smooth financial operations and a positive customer experience. Understanding payment tech basics helps you make informed decisions that support your business growth.

How Payment Technology Has Evolved

Remember cash? While it's still around, the way we pay for things has drastically changed, even in the last decade. From bartering to coins, checks to credit cards, and now digital wallets and beyond, payment technology is constantly innovating. This evolution is driven by consumer demand for faster, more convenient, and secure transactions. Let's take a quick walk through the major milestones:

The Rise of Plastic

The introduction of credit cards in the mid-20th century was a game-changer. Suddenly, consumers could make purchases without carrying large amounts of cash. This paved the way for increased spending and the growth of e-commerce. Later, debit cards offered a direct link to bank accounts, providing another layer of convenience. Managing recurring billing for card payments became a key focus for businesses as subscription services gained popularity.

The Dawn of the Digital Age

The internet revolutionized how we shop and, consequently, how we pay. E-commerce platforms emerged, requiring secure online payment gateways. This led to the development of technologies like electronic funds transfers (EFTs) and online payment processors. Businesses needed solutions to automate complex invoicing and manage the increasing volume of online transactions. Simplifying revenue recognition also became critical for businesses with recurring revenue streams.

The Mobile Revolution

Smartphones put the power of payment in our pockets. Mobile payment systems and digital wallets like Apple Pay and Google Pay enabled contactless transactions, making paying faster and more secure. This shift also fueled the growth of in-app purchases and mobile point-of-sale (mPOS) systems, empowering businesses to accept payments anywhere. Understanding key metrics for finance teams through robust reporting became crucial for tracking mobile transactions and overall revenue performance.

Beyond the Transaction

Today, payment technology is about more than just processing payments. It's about creating seamless, integrated experiences. We're seeing the rise of artificial intelligence (AI) in fraud detection, personalized payment options, and even predictive analytics to help businesses optimize their pricing strategies. The focus is shifting towards enhancing the entire customer journey, from initial purchase to ongoing subscription management. Tools that help businesses extract key contract terms with AI are becoming increasingly valuable for streamlining financial processes. As the subscription economy continues to grow, so too will the need for sophisticated payment technology that can support complex billing models and provide valuable insights into financial performance. The future of payments is about creating a frictionless and personalized experience for every customer.

Key Components of Payment Tech Systems

Modern payment tech systems are intricate, relying on several interconnected components to securely and efficiently process transactions. Understanding these core elements helps businesses appreciate the complexities behind a seemingly simple purchase.

A typical payment technology system includes:

- Payment Gateway: Think of this as the digital equivalent of a physical point-of-sale terminal. The payment gateway securely captures customer payment information—card numbers, expiration dates, etc.—and transmits it to the payment processor. It's the first step in authorizing a transaction. A reliable payment gateway is crucial for ensuring secure and smooth transactions, especially when dealing with various payment types.

- Payment Processor: This component acts as the intermediary between the payment gateway, the merchant's bank, and the customer's bank. The payment processor verifies the transaction details, checks for sufficient funds, and ultimately facilitates the transfer of money. They play a vital role in ensuring the funds reach the merchant's account. Efficient payment processors can significantly simplify complex invoicing processes and streamline financial operations.

- Merchant Account: This is a specialized bank account that allows businesses to accept and process electronic payments. Funds from successful transactions are deposited into this account. Having a dedicated merchant account is essential for managing cash flow and tracking sales revenue. Robust financial reporting tools provide key metrics for finance teams and enhance financial management, giving businesses valuable insights into their revenue streams.

- Payment Methods: This refers to the various ways customers can pay, including credit and debit cards, digital wallets, and other emerging payment options. Offering a variety of payment methods caters to customer preferences and can increase sales. Using AI-powered contract analysis can streamline payment agreements and support various payment types, ensuring a smooth and efficient process for both businesses and customers.

- Security Measures: These are crucial for protecting sensitive financial data and preventing fraud. Security measures include encryption, tokenization, and fraud detection tools. Prioritizing security builds trust with customers and safeguards businesses from potential losses. Secure payment technology can also simplify revenue recognition and ensure accurate financial reporting, contributing to a more transparent and trustworthy financial process.

These components work together seamlessly to create a robust and reliable payment system. By understanding how each element functions, businesses can make informed decisions about their payment infrastructure and optimize their financial processes.

Types of Payment Technologies

Businesses today encounter a wide range of payment situations, each requiring specific technology. Understanding the different types available helps you choose the right solutions for your needs. Let's break down the most common types:

Card-Present Solutions

Card-present transactions occur when a physical card is used at the point of sale. Think of swiping, dipping, or tapping a credit or debit card at a checkout terminal. These transactions rely on hardware like point-of-sale (POS) systems, card readers, and terminals equipped to process chip cards and contactless payments. Modern POS systems often integrate with other business tools, like inventory management and accounting software, to streamline operations. For a seamless experience, ensure your chosen system supports various payment methods and integrates with your existing business tools.

Card-Not-Present Solutions

Card-not-present (CNP) transactions take place when the physical card isn't present during the purchase. This covers online shopping, phone orders, and recurring billing. Securing these transactions is crucial, relying heavily on verification methods like CVV codes, address verification, and sometimes even two-factor authentication. Robust invoicing software can automate and secure these transactions, especially for businesses with recurring revenue models. Successfully managing CNP transactions opens doors to broader markets and more flexible sales strategies.

Mobile Payment Systems

Mobile payment systems allow customers to pay using their smartphones or other mobile devices. Popular examples include digital wallets like Apple Pay and Google Pay. These systems often use near-field communication (NFC) technology for contactless payments. Mobile payments offer convenience for customers and can integrate with loyalty programs and other marketing initiatives. For businesses, adopting mobile payments can simplify the checkout process and improve the customer experience. Consider exploring payment platforms that seamlessly integrate mobile payment options for a more streamlined checkout.

Contactless Payment Methods

Contactless payments enable transactions without physical contact between the payment device and the POS terminal. This includes contactless cards, mobile wallets, and even wearable devices. Contactless payments offer speed and convenience, making them increasingly popular for quick purchases. As contactless technology becomes more prevalent, businesses that adopt these methods can reduce checkout times and cater to evolving customer preferences. For businesses managing complex recurring billing, ensuring your payment technology supports these methods is key for a frictionless customer experience.

Essential Features of Advanced Payment Tech

Modern businesses need payment technology that does more than just process transactions. Look for these key features when choosing a system to support your growth and create a seamless customer experience.

Multi-Currency Support

Going global? Multi-currency support is a must-have. This feature allows you to accept payments in various currencies, making it easier for international customers to buy your products or services. It also simplifies accounting by automatically handling currency conversions and reducing the need for manual calculations. This is especially important for businesses with international ambitions or those operating within a global marketplace. For businesses looking to expand their reach, accepting multiple currencies is a key component of a successful strategy.

Fraud Detection and Prevention

Protecting your business and your customers from fraud is paramount. Robust payment technology should include features like address verification, CVV matching, and 3D Secure authentication to help minimize fraudulent transactions. Look for systems that offer real-time fraud monitoring and alerts, so you can quickly identify and address any suspicious activity. Proactive fraud prevention measures protect your bottom line and maintain customer trust.

Real-Time Transaction Processing

Waiting for payments to clear can slow down your business operations. Real-time transaction processing ensures that funds are available quickly, improving your cash flow and allowing you to fulfill orders faster. This speed and efficiency are crucial for businesses that rely on quick turnaround times. Automating your billing processes can further streamline these operations and free up valuable time.

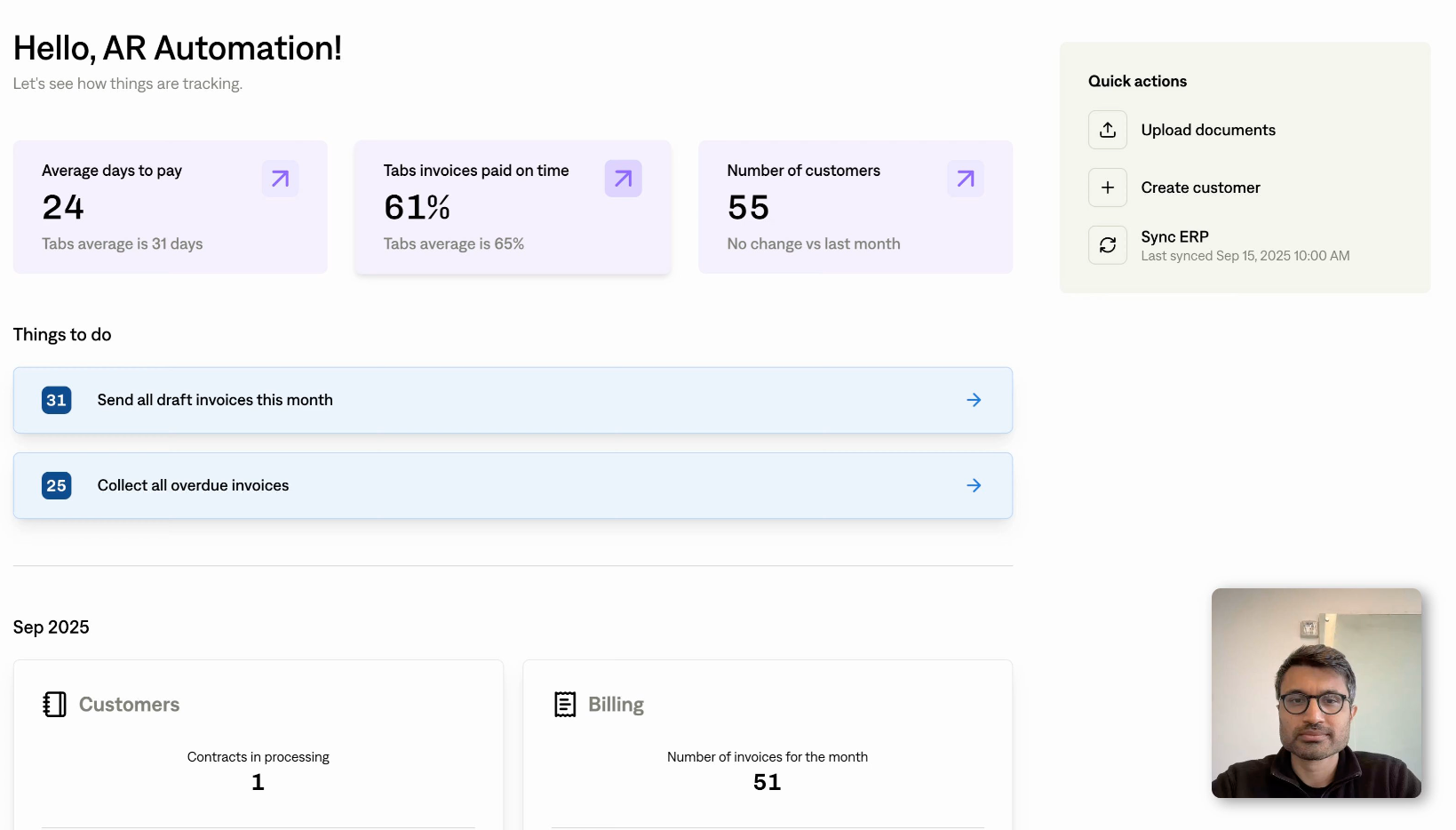

Integration Capabilities

Your payment technology shouldn't exist in a silo. Seamless integration with your existing business tools, such as your CRM, accounting software, and reporting dashboards, is essential for efficient operations. Look for systems that offer APIs and webhooks to connect with other platforms and automate data transfer. This streamlines workflows and provides a holistic view of your financial data, giving you valuable insights into your business performance. Consider platforms like Tabs, which offer robust reporting features designed for finance teams.

User-Friendly Checkout Experiences

A complicated checkout process can lead to abandoned carts and lost sales. Prioritize payment technology that offers a smooth, intuitive checkout experience for your customers. This includes features like mobile optimization, guest checkout options, and support for various payment methods. A positive checkout experience encourages repeat business and builds customer loyalty. Streamlining your payment processes is a smart investment in long-term growth.

Secure Your Payment Technology

Protecting your customers' financial information is paramount. Robust payment technology prioritizes security, employing several methods to safeguard sensitive data. Understanding these methods helps you choose a provider that makes security a priority.

Encryption Methods

Encryption scrambles sensitive data, making it unreadable to unauthorized individuals. Think of it as a lock and key system for your data. Strong encryption algorithms are essential for protecting customer information during transactions. Look for providers that use industry-standard encryption protocols like Advanced Encryption Standard (AES) and Transport Layer Security (TLS). These protocols ensure data transmitted between the customer's browser and your payment gateway remains confidential. Learn more about encryption.

Tokenization

Tokenization replaces sensitive card details with unique, non-sensitive tokens. This means that even if a breach occurs, the actual card data isn't compromised. Instead of storing sensitive card information on your servers, you store a token representing the card. This token can process transactions without exposing the actual card details. Tokenization reduces the risk of data breaches and simplifies PCI compliance.

Biometric Authentication

Biometric authentication adds an extra layer of security by verifying a customer's identity using unique biological traits. Fingerprint scanning and facial recognition are common examples. This technology makes it significantly harder for unauthorized users to access accounts or make fraudulent purchases. While not yet universally adopted, biometric authentication is becoming increasingly popular in payment technology, offering a more secure and convenient way for customers to verify their identity. Explore the future of biometrics.

PCI Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect cardholder data. Any business that processes, stores, or transmits card information must comply with these standards. PCI compliance involves implementing various security measures, including regular security assessments, network security, and data encryption. Choosing a PCI-compliant payment processor helps ensure your business meets these requirements and protects your customers' sensitive information.

Payment Tech Pricing Structures

Understanding payment processing fees is crucial for any business. Picking the right pricing structure can significantly impact your bottom line. Let's break down the most common pricing models so you can make an informed decision.

Transaction-Based Pricing

Transaction-based pricing is straightforward: you pay a fee for every transaction processed. This fee typically includes a percentage of the transaction amount plus a fixed per-transaction fee. For example, you might pay 2.9% + $0.30 per transaction. This model is easy to understand and predict in the short term, especially for businesses with consistent sales volume. However, as your business grows and your transaction volume increases, these fees can add up quickly. This model can be a good starting point for small businesses with lower transaction volumes, but it's essential to monitor costs as you scale. For more information on pricing strategies, explore our resources.

Flat-Rate Models

Flat-rate pricing offers a fixed percentage fee per transaction, regardless of the card type or transaction amount. This simplifies budgeting since you know exactly what percentage you'll pay. However, this simplicity can also be a drawback. If you process a lot of smaller transactions, a flat rate might be more expensive than other models. Conversely, for businesses with larger average transaction sizes, a flat rate could be more cost-effective. Consider your average transaction value and sales volume when evaluating if a flat-rate model aligns with your business needs. Our invoicing tools can help you manage and track these figures.

Interchange-Plus Pricing

Interchange-plus pricing is known for its transparency. With this model, you pay the interchange rate (set by card networks) plus a fixed markup from the payment processor. This structure offers greater visibility into the true cost of processing, allowing you to understand where your money is going. It can also be more cost-effective, especially for businesses with high transaction volumes or a mix of different card types. While slightly more complex to understand initially, the potential savings and transparency make interchange-plus pricing worth considering. For businesses looking to simplify complex financial processes, our platform offers robust reporting to help you analyze your payment processing costs.

Choose the Right Payment Tech for Your Business

Selecting the right payment technology is crucial for any business. It directly impacts your customer experience, operational efficiency, and bottom line. This isn't a one-size-fits-all decision; you need to consider your specific needs and goals. Let's break down the key factors to consider when making this important choice.

Industry-Specific Considerations

Different industries have unique payment processing requirements. A restaurant, for example, needs a system that can handle tableside payments and tips, while an e-commerce business requires secure online transaction processing. If you run a subscription-based business, you'll need a platform that can manage recurring billing and automate complex invoicing. Researching solutions tailored to your industry will ensure you have the right features from the start. Think about what your customers expect and how your payment system can deliver.

Scalability and Flexibility

As your business grows, your payment technology needs to keep pace. Choose a system that can handle increasing transaction volumes and adapt to changing business needs. This might involve adding new payment methods, expanding into new markets, or integrating with other software. Supporting various payment types gives your customers more options and can improve conversion rates. A flexible system will save you time and money in the long run, allowing you to scale smoothly. Consider where you see your business in the next few years and choose a payment partner that can support your growth.

Customer Support and Reporting Features

Reliable customer support is essential, especially when dealing with sensitive financial data. Look for a provider that offers responsive support channels, such as phone, email, and chat. Comprehensive reporting features are also crucial for understanding your financial performance. You need access to data on transaction volumes, fees, and other key metrics. Robust reporting on key metrics can help you identify trends, optimize pricing, and make informed business decisions. Don't underestimate the value of a provider who can offer guidance and support as your business evolves.

Overcome Payment Processing Challenges

Successfully navigating the complexities of payment processing requires a proactive approach to common challenges. By addressing these hurdles head-on, businesses can optimize their financial operations and improve customer experiences.

Address Security Concerns

Security is paramount in payment processing. Protecting customer data and defending against fraud are critical concerns for any business. With data breaches becoming increasingly common, merchants must prioritize robust security measures. This includes adhering to industry best practices like PCI DSS compliance, implementing strong encryption protocols, and using multi-factor authentication. Choosing a payment processor that prioritizes security features like tokenization and fraud detection tools can significantly reduce your risk. For a deeper dive into security best practices, explore resources like the PCI Security Standards Council website.

Manage Transaction Costs

High transaction fees can significantly impact a business's bottom line. Carefully evaluating different payment processors and understanding their fee structures is crucial. Look for transparent pricing models and consider negotiating fees, especially if you process a high volume of transactions. Some processors offer tiered pricing based on volume, while others offer interchange-plus pricing, which can be more cost-effective for certain businesses. Understanding the different pricing structures and choosing the right one for your business model is essential for managing transaction costs. Investopedia's guide on transaction fees offers a helpful overview of common fee structures. For businesses using Tabs, our platform helps manage these costs by streamlining billing and automating key financial processes. Learn more about how Tabs can help optimize your invoicing and reporting.

Ensure Seamless Integration

Integration issues can disrupt payment processing and create a frustrating experience for both businesses and customers. When selecting a payment gateway, ensure it seamlessly integrates with your existing accounting software, CRM, and other business systems. This streamlines operations, reduces manual data entry, and minimizes the risk of errors. A smooth integration also allows for automated reconciliation and reporting, providing valuable insights into your financial performance. Look for payment processors that offer APIs and developer documentation to facilitate integration. For businesses using platforms like Shopify, explore payment gateways that offer dedicated integrations for a streamlined setup. Tabs offers robust integration capabilities, allowing you to connect your payment processing with other key financial tools. Explore our platform features to learn more.

The Future of Payment Tech

The world of payments is constantly evolving. Keeping up with the latest trends is crucial for any business that wants to stay competitive and offer a seamless customer experience. Let's explore some of the key trends shaping the future of payment technology.

AI and Machine Learning Applications

Artificial intelligence (AI) and machine learning are poised to revolutionize payment processing. These technologies can analyze massive amounts of data to detect fraudulent activities, personalize customer experiences, and automate tasks like reconciling payments. Imagine a system that automatically flags suspicious transactions or tailors payment options based on a customer's purchase history. AI can also help businesses optimize pricing strategies and predict future revenue trends, giving you a clearer picture of your financial health. For more on how Tabs uses AI, check out how we extract key contract terms with AI.

Digital Wallets and Mobile Payments

The rise of digital wallets like Apple Pay and Google Pay has transformed how we make purchases. Customers now expect the convenience of tapping their phones or smartwatches to pay, bypassing the need for physical cards. This trend is only expected to accelerate, with mobile payments becoming increasingly integrated into our daily lives. For businesses, embracing mobile payment options is essential for providing a frictionless checkout experience and catering to the evolving preferences of consumers. This includes ensuring your payment technology supports any payment type and integrates seamlessly with popular digital wallets.

Buy Now, Pay Later (BNPL) Options

BNPL services have gained significant traction, particularly among younger demographics. These services allow customers to split their purchases into smaller, interest-free installments, making larger purchases more accessible. While BNPL can be a valuable tool for increasing sales and attracting new customers, businesses need to carefully consider the implications for their cash flow and accounting processes. Choosing a billing platform that can handle the complexities of BNPL transactions is essential for smooth financial management. Learn more about how Tabs streamlines complex invoicing to support various payment structures.

Enhanced Security Innovations

As payment technology advances, so do the methods used by fraudsters. Staying ahead of these threats requires a proactive approach to security. Biometric authentication, such as fingerprint or facial recognition, is becoming increasingly common, adding an extra layer of protection against unauthorized access. Tokenization, which replaces sensitive data with unique tokens, is another key security measure that minimizes the risk of data breaches. Investing in robust security features is not just a best practice—it's a necessity for protecting your business and your customers’ financial information. For a deeper dive into how Tabs prioritizes security, explore our resources on payment processing and financial reporting.

Related Articles

- B2B Payments: A Field Guide

- Merchant Account 101: The Ultimate Business Guide

- The Ultimate Guide to B2B Payment Solutions

Frequently Asked Questions

What’s the difference between a payment gateway and a payment processor?

A payment gateway is the initial point of contact for capturing customer payment information online. Think of it as the digital equivalent of a card reader. The payment processor then takes that information, verifies it with the relevant banks, and facilitates the actual transfer of funds. They work together, but have distinct roles.

How can I reduce payment processing fees for my business?

Carefully analyze your transaction volume and average transaction size. Different pricing models, like flat-rate, interchange-plus, and tiered pricing, work better for different business types. Negotiating with processors and understanding the various fee components can also help you minimize costs. Look for a platform that offers transparent pricing and tools to help you analyze your spending.

What security measures should I look for in a payment technology provider?

Essential security features include encryption (like AES and TLS), tokenization, and fraud detection tools. PCI DSS compliance is a must. For added security, consider providers offering biometric authentication options and real-time fraud monitoring. Prioritizing security protects both your business and your customers.

What’s the best way to choose payment technology for a subscription business?

Focus on features that support recurring billing, automated invoicing, and revenue recognition. Look for a system that can handle various subscription models, manage recurring payments efficiently, and provide detailed reporting on key subscription metrics. Seamless integration with your other business tools is also crucial for a streamlined workflow.

How can I stay up-to-date on the latest trends in payment technology?

Follow industry blogs, attend webinars, and engage with payment technology providers to stay informed about emerging trends. Keep an eye on developments in areas like AI, mobile payments, and enhanced security measures. Understanding these trends will help you adapt your payment strategies and offer the best possible customer experience.