Running a business, whether a bustling brick-and-mortar shop or a thriving online store, requires a reliable way to accept payments. For businesses that want to accept credit and debit cards, a merchant account is essential. It's the behind-the-scenes machinery that makes card transactions possible, securely moving money from your customer's account to yours.

This guide breaks down everything you need to know about merchant accounts, from how they work to choosing the right provider for your business. We'll cover the different types of merchant accounts, the fees involved, and the key features to look for.

Plus, we'll debunk some common misconceptions and explore the future of payment processing. By the end of this post, you'll have a clear understanding of how a merchant account can help your business thrive.

Key Takeaways

- Merchant accounts are essential for modern businesses. They're the backbone of card processing, enabling businesses of all sizes to accept credit and debit card payments smoothly and securely. Understanding the different types of merchant accounts helps you choose the best fit for your specific needs.

- Finding the right provider is a strategic decision. Look beyond the price tag and consider factors like security features, customer support responsiveness, and seamless integration with your existing business tools. A provider that understands your industry and offers scalable solutions is crucial for long-term growth.

- The payments landscape is dynamic; stay informed. Keep up with emerging trends like mobile wallets and biometric authentication to meet evolving customer expectations. Choose a provider that adapts to these changes and offers data-driven insights to help you make informed decisions about your payment processing strategy.

What Is a Merchant Account?

A merchant account is a specialized bank account that lets businesses accept credit and debit card payments. Think of it as the bridge between your customer's card and your business's checking account. When a customer buys something from you with their card, the money travels through this merchant account before landing in your business bank account.

This process ensures secure transactions and facilitates the movement of funds between different financial institutions. It's a fundamental piece of the puzzle for any business accepting card payments, especially those operating online. Learn more about merchant accounts.

How Merchant Accounts Process Payments

The payment process with a merchant account involves several steps. After a customer swipes, dips, or taps their card, the transaction information goes to your payment processor. The processor communicates with the card network (like Visa or Mastercard) to verify the funds. The card network then requests authorization from the customer's issuing bank.

Once approved, the funds are moved from the customer's account to your merchant account. From there, the funds are settled into your regular business bank account, typically within a few business days. This entire process happens quickly, often within seconds, allowing for seamless transactions.

Merchant Accounts vs. Regular Bank Accounts

While both hold money, merchant accounts differ significantly from regular business bank accounts. A key difference is control. With a standard checking account, you have full access to your funds—you can deposit, withdraw, and transfer money as needed.

However, with a merchant account, the funds are held temporarily while transactions are processed and verified. You don't have direct access to this money; it's managed by your payment processor. This setup ensures secure handling of card payments and protects both businesses and customers from fraud.

Another important distinction is the purpose. A regular bank account is for managing your day-to-day business finances, while a merchant account is specifically for processing card payments. They work together to keep your business running smoothly. This article provides a comprehensive guide to understanding merchant accounts.

How Merchant Accounts Work

This section breaks down the inner workings of merchant accounts, from processing transactions to understanding the key players involved. Think of it as a behind-the-scenes look at how your business gets paid.

The Transaction Process

Imagine a customer buying a new gadget from your online store. They enter their credit card details, hit “purchase,” and seconds later, receive a confirmation. But what happens in between? Here’s a simplified breakdown:

- Authorization: The customer's card information is sent to the payment processor, who then contacts the card network (like Visa or Mastercard). The network checks with the customer's issuing bank to ensure they have sufficient funds and approves or declines the transaction.

- Capture: Once authorized, the transaction details are sent back to the payment processor, who then requests the funds from the customer's bank. This is the “capture” phase.

- Settlement: The acquiring bank (your bank, where your merchant account is held) receives the funds from the issuing bank.

- Funding: Finally, the funds are transferred from your merchant account to your regular business bank account.

This entire process, from authorization to funding, can take anywhere from a few seconds to a couple of business days.

Key Players in the Ecosystem

Several parties work together to make these transactions happen seamlessly. Understanding their roles is crucial for navigating the world of merchant accounts.

- Merchant: That's you! The business accepting card payments.

- Cardholder: Your customer, the person making the purchase.

- Issuing Bank: The bank that issued the customer's credit or debit card.

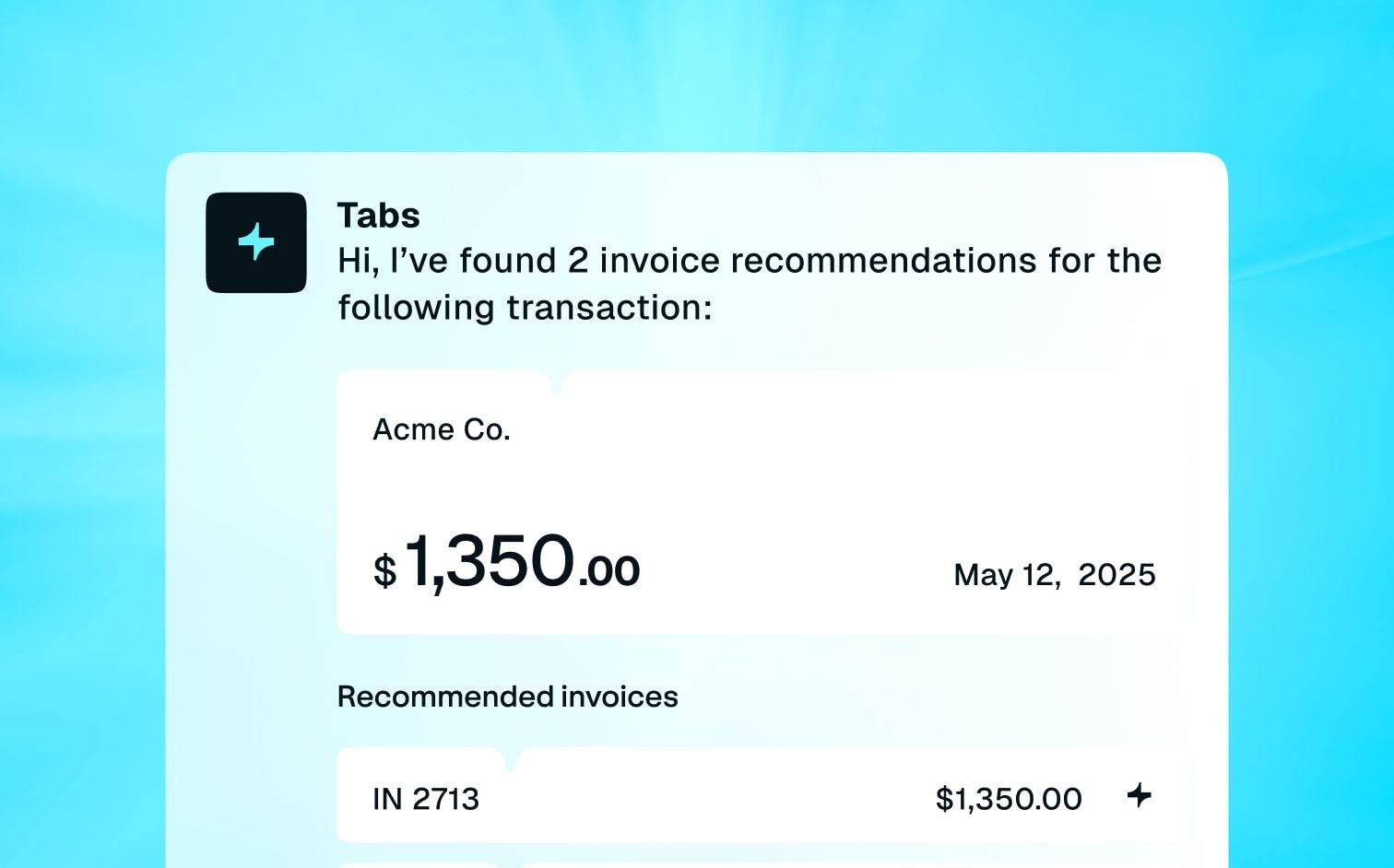

- Acquiring Bank (Merchant Bank): The bank that provides you with the merchant account and processes the transactions on your behalf. They essentially “acquire” the funds for you. Companies like Tabs can help you streamline this process.

- Payment Processor: The intermediary between your business and the card networks. They handle the authorization, capture, and settlement of transactions. Often, they also provide additional services like fraud prevention and reporting. Stripe is a well-known example of a payment processor.

- Card Network (e.g., Visa, Mastercard, American Express, Discover): These networks set the rules and regulations for card transactions and facilitate communication between issuing and acquiring banks.

By understanding these key players and the flow of a transaction, you can better manage your finances and choose the right merchant account provider for your business. For more information on automating complex invoicing and supporting various payment types, check out Tabs' platform features.

Tabs also offers solutions for simplifying revenue recognition, a critical aspect of financial management for subscription businesses. The platform event uses AI to extract key contract terms, further streamlining your financial operations.

Types of Merchant Accounts

Not all merchant accounts are created equal. Different business models require different account types. Let's break down the most common ones:

Retail Accounts

If you run a brick-and-mortar store where you swipe cards in person, you'll need a retail merchant account. These accounts are designed for businesses that process transactions on-site, typically using a point-of-sale (POS) system. Think of your local coffee shop, clothing boutique, or bookstore—they all likely use retail merchant accounts.

This type of account facilitates face-to-face transactions, making it essential for businesses with a physical presence. For a smoother, more efficient in-person payment process, explore Tabs' payment features.

E-commerce Accounts

For online businesses, e-commerce merchant accounts are essential. These accounts let you securely accept payments through your website, handling everything from credit card processing to other electronic payment methods. Whether you're selling handmade jewelry, digital courses, or subscription boxes, an e-commerce merchant account is crucial for managing online transactions.

If you're looking to simplify revenue tracking from your online sales, check out Tabs' revenue recognition tools.

Mobile Accounts

Mobile merchant accounts are designed for businesses that take payments on the go. Using a mobile card reader attached to a smartphone or tablet, these accounts allow you to process transactions anywhere. This flexibility is perfect for food trucks, market vendors, and service providers who visit clients. Mobile accounts offer the convenience of accepting payments wherever your business takes you.

High-Risk and Offshore Accounts

Some businesses operate in industries considered "high-risk" by payment processors. These can include businesses like online gambling, adult entertainment, or travel agencies. These businesses often require specialized high-risk merchant accounts due to the increased potential for fraud or chargebacks.

Similarly, businesses operating internationally may need offshore merchant accounts to process transactions in different currencies and regions. These accounts offer tailored solutions for businesses with unique needs and global operations. For businesses dealing with complex financial transactions across borders, explore how Tabs can simplify managing your finances with robust reporting features.

Merchant Account Fees

Running a business means understanding your payment processing costs. With a merchant account, several fees come into play. Knowing what they are and how they're calculated helps you manage your finances more effectively. This section breaks down common merchant account fees.

Transaction Fees and Interchange Rates

Every time a customer pays with a credit or debit card, you'll incur transaction fees. These typically range from 0.5% to 5% of the transaction amount plus a small per-transaction fee (around $0.20 to $0.30). Factors like the card type (e.g., Visa, Mastercard, American Express) and your business's industry affect the exact percentage.

For example, a retail store processing a standard Visa credit card transaction might pay a lower fee than an online gaming company processing an international American Express transaction. Understanding these interchange rates is crucial for accurate financial forecasting.

Monthly and Annual Fees

Beyond per-transaction costs, expect regular fees for maintaining your merchant account. These can include flat monthly or annual fees. Some providers also impose minimum monthly fees, so you'll pay a set amount even with low processing volume.

Factor these costs into your budget. Also, watch out for other charges like batch fees (for processing groups of transactions) and statement fees. Knowing the fee schedule upfront helps you avoid surprises.

Setup and Early Termination Fees

Getting started with a merchant account often involves a one-time setup fee. This covers the initial costs of establishing your account and integrating it with your payment systems. While not all providers charge this, it's something to consider.

If you close your account before the contract term ends, you might encounter an early termination fee. Read your merchant account agreement carefully to understand any potential penalties.

Chargeback and Other Hidden Fees

Chargebacks happen when a customer disputes a charge, and the funds are returned to them. While sometimes legitimate, chargebacks can be costly. You lose the sale amount and likely incur a chargeback fee from your provider. These fees can vary, so understand your provider's policy.

Other less obvious fees might exist, such as fees for specific card types or international transactions. A transparent conversation with your provider clarifies all potential costs associated with your merchant account. Knowing what to expect helps you make informed decisions and manage your finances effectively.

Opening a Merchant Account: Requirements

Getting a merchant account isn't as simple as opening a checking account. Providers need to assess your business and the potential risk involved. This means you'll need to gather some paperwork and information before you apply. Think of it as assembling your best business profile.

Required Business Documents

First things first, you'll need to prove your business is legitimate. This usually involves providing a valid business license. Think of this as your business's official ID. You might also need to provide your Employer Identification Number (EIN) or Social Security number (SSN) if you're a sole proprietor.

Some providers may also ask for articles of incorporation or partnership agreements. These documents help verify your business structure and ownership.

Financial Statements and Credit

Next, providers will want to understand your financial health. This helps them assess the risk of working with your business. Expect to provide financial statements, such as profit and loss statements and balance sheets. These statements give providers a snapshot of your revenue, expenses, and overall financial stability.

Your personal credit history might also be a factor, especially for newer businesses. Providers use this information to gauge your ability to manage finances responsibly. The type of transactions you process—card-present versus online—also plays a role in the risk assessment.

Industry Requirements

While the basic requirements are generally the same, certain industries face additional scrutiny. For example, businesses considered "high risk," such as those selling age-restricted products or operating in industries with high chargeback rates, may face stricter requirements.

Understanding the specific requirements for your industry is crucial for a smooth application process. Even if you're a small business, understanding these nuances can save you time and headaches.

Choosing a Merchant Account Provider

Picking the right merchant account provider is a big decision. It impacts your finances, security, and growth potential. Here's what to consider:

Evaluate Pricing Structures

Pricing for merchant accounts can be complex. Providers use various models, from low transaction fees with high monthly charges to tiered pricing based on sales volume. Don't get distracted by the headline rates.

Carefully compare quotes and understand the complete fee structure. The variety in pricing structures can significantly affect your costs.

Assess Customer Support

When payment processing issues arise, you need quick solutions. A provider with reliable customer support is essential. Look for multiple support channels (phone, email, chat) and a reputation for responsiveness.

Consider your business hours and choose a provider available when you need them. Customer service is a priority for some providers but not others, so finding the right fit is important.

Integrations and Scalability

Your merchant account should integrate smoothly with your existing business tools, such as your e-commerce platform, POS system, and accounting software. Think long-term. As your business expands, your payment processing needs will evolve.

Choose a provider that can scale and adapt to your future requirements. While local banks may be better for integration and scalability, research various options to find the best fit for your specific setup.

Security and PCI Compliance

Security is paramount for payment processing. Choose a provider that prioritizes data protection and adheres to PCI compliance standards. Look for features like fraud prevention tools, chargeback management, and data encryption. Protecting customer data builds trust and safeguards your reputation.

Avoided.io emphasizes proactive measures like dispute resolution and fraud prevention in their post on merchant accounts and chargebacks, highlighting the critical role of security. Ensure your chosen provider prioritizes these aspects.

Key Merchant Account Features

When you’re comparing merchant account providers, remember that the cheapest option isn't always the best. Look beyond the surface and consider these key features to find the right fit for your business.

Competitive Transaction Fees

Transaction fees are a significant part of your operating costs. They can range from 0.5% to 5% of the transaction amount plus $0.20 to $0.30 per transaction. In addition to per-transaction fees, be aware of monthly fees and other charges that can add up.

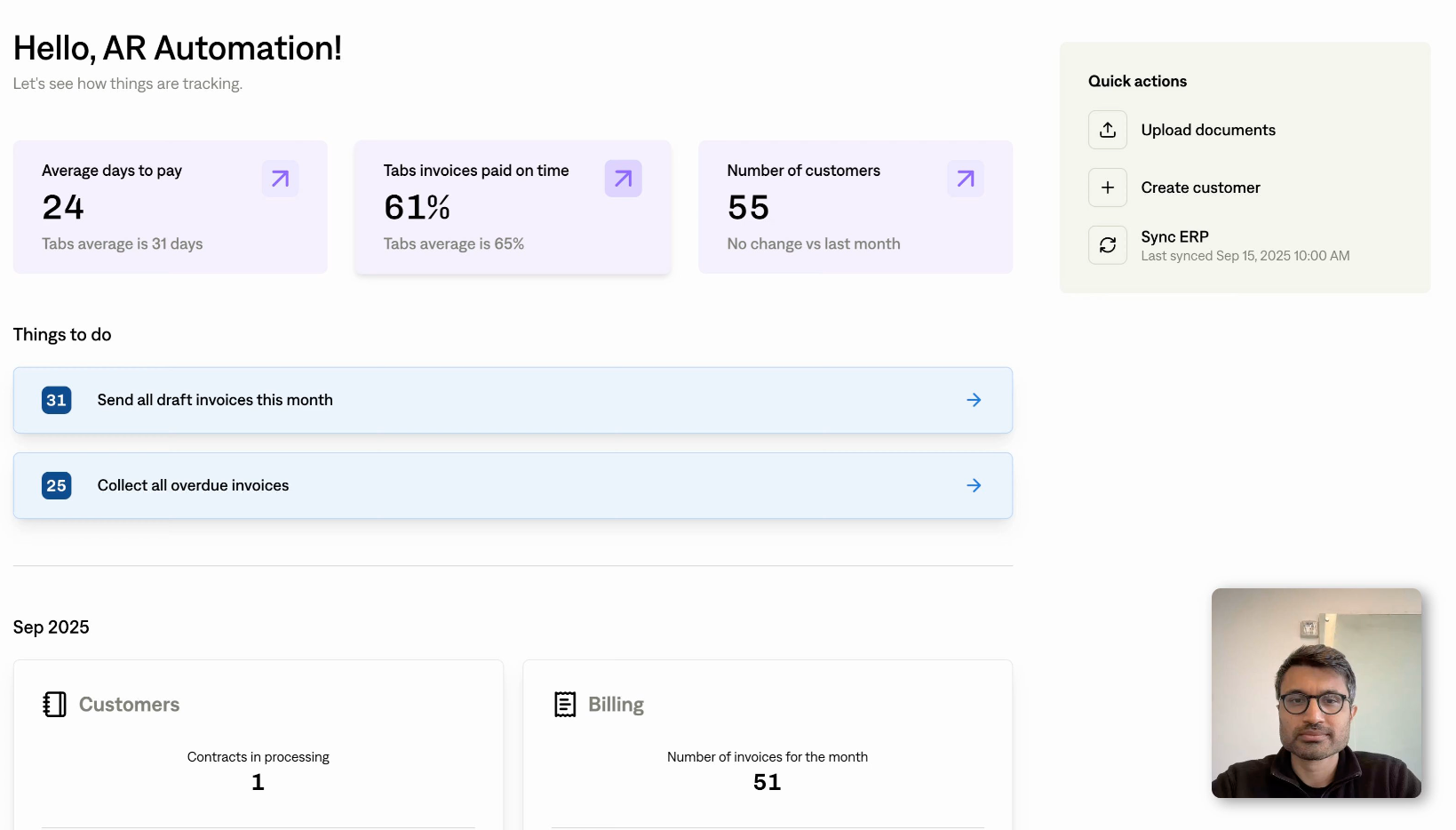

Look for transparent pricing and compare the total cost across different providers. A slightly higher per-transaction fee might be worthwhile if it comes with better features or lower overall costs. Consider providers like Tabs that offer clear and competitive pricing structures for recurring billing.

Fraud Protection and Chargeback Management

Chargebacks happen when a customer disputes a charge on their credit card. They're a hassle for any business, costing you time and money. A good merchant account provider should offer robust fraud protection and chargeback management tools.

Look for features like address verification, CVV matching, and fraud scoring to help minimize fraudulent transactions. A solid chargeback management system can help you resolve disputes efficiently and potentially recover revenue.

Reporting and Analytics

Data is power. Your merchant account should provide detailed reporting and analytics so you can track key metrics like sales volume, transaction fees, and chargeback rates. This data can help you identify trends, optimize your pricing, and make informed business decisions.

Look for providers that offer customizable reports, real-time data access, and integrations with your other business tools. Tabs offers robust reporting on key metrics, empowering finance teams to make data-driven decisions.

Contract Terms and Flexibility

Before signing a contract, carefully review the terms. Pay attention to contract length, early termination fees, and any hidden costs. Choosing the right provider means finding one that aligns with your business needs and growth plans. Consider factors like transaction volume, future expansion, and the specific features you require.

A flexible contract can give you the freedom to adapt as your business evolves. For recurring billing, explore platforms like Tabs that offer flexible contract terms tailored to the subscription economy.

Integrate Merchant Accounts with Business Systems

Connecting your merchant account with your existing business tools streamlines operations and gives you a clearer picture of your finances. Here’s how integrating your merchant account with different systems benefits your business:

E-commerce Platform Compatibility

A merchant account is essential for accepting credit card payments online. Most e-commerce platforms like Shopify and WooCommerce offer integrations with various payment processors, simplifying setup and management. This lets you focus on selling, not technical details.

These integrations often sync sales data, simplifying reconciliation and reporting. For businesses using platforms like Shopify, choosing a compatible payment gateway is a crucial step in setting up your online store.

POS System Integration

For businesses with a physical presence, integrating your merchant account with your point-of-sale (POS) system is crucial. Many POS systems offer bundled merchant services, creating a unified system. This centralizes sales data, simplifies payment processing, and enhances the customer experience with various payment options and faster transactions.

Real-time sales data within your POS system provides valuable insights for inventory management and understanding customer behavior. This streamlined approach is particularly beneficial for retail businesses and restaurants that handle a high volume of daily transactions.

Accounting Software Sync

Manually entering transaction data is tedious and error-prone. Syncing your merchant account with your accounting software, like QuickBooks, automates this. This integration eliminates manual data entry, reduces errors, and provides a real-time view of your financial health.

Accurate, up-to-the-minute financial data empowers you to make informed business decisions and simplifies tasks like tax preparation and financial reporting. This level of automation is a significant advantage for businesses looking to scale efficiently.

Merchant Account Misconceptions

Let's clear up some common misunderstandings about merchant accounts. These misconceptions can prevent businesses from accessing the payment processing solutions they need.

Debunking "Only Large Businesses Need Merchant Accounts"

There's a persistent myth that only large corporations require merchant accounts. The truth is, businesses of all sizes can benefit from having a dedicated merchant account. While enterprise-level companies use these accounts to manage high transaction volumes, small and medium-sized businesses (SMBs) also gain a competitive edge by offering diverse payment options.

A merchant account allows you to accept credit and debit cards directly, expanding your customer base and streamlining transactions. This improves cash flow and provides a more professional image than relying solely on third-party payment processors.

Debunking "All Providers Are the Same"

Another misconception is that all merchant account providers are created equal. This isn't the case. Fees, services, and support vary significantly between providers. Some specialize in specific industries, like recurring billing for subscription services, while others focus on e-commerce or retail.

It's crucial to research and compare providers to find the best fit for your business needs. Don't assume a one-size-fits-all approach; look for a provider that understands your specific business model and offers competitive rates and relevant features.

Debunking "Chargebacks Are Always the Merchant's Fault"

Finally, let's address the misconception that merchants are always to blame for chargebacks. While merchants can certainly implement strategies to minimize chargebacks, such as clear return policies and robust fraud prevention, sometimes they are initiated due to circumstances outside the merchant's control. For example, a customer might legitimately forget a purchase or become a victim of identity theft.

Merchants have the right to dispute chargebacks by providing compelling evidence to support the validity of the transaction. Understanding your rights and having a clear process for managing disputes is essential for protecting your revenue.

The Future of Merchant Accounts and Payment Processing

The payments landscape is constantly changing. To stay competitive, businesses need to understand emerging trends and adapt to shifting consumer preferences. This forward-thinking approach is crucial for choosing the right merchant account and payment processing solutions.

Emerging Payment Technologies

New technologies are transforming how we pay, from how we authenticate transactions to the devices we use. Biometric payments, like fingerprint or facial recognition, are gaining traction. A recent study by Global Payments found that one-third of businesses believe biometric authentication will be a leading trend in commerce and payments.

This shift toward increased security and convenience is something merchants need to consider when evaluating payment processors. Beyond biometrics, the rise of mobile wallets is undeniable. Discover Global Network projects a substantial increase in mobile wallet use over the next few years, making seamless integration of these options essential for businesses.

And let's not forget wearable payment devices. The same Discover report predicts significant growth in this area, highlighting the need for merchants to adapt their systems for compatibility with these devices.

Adapting to Consumer Preferences

Meeting customer expectations is paramount in today's market. Consumers crave real-time payments and instant gratification. Discover Global Network's research shows a strong consumer preference for real-time payouts from businesses. Offering this capability can significantly improve customer satisfaction and loyalty.

Furthermore, giving customers control over their payment methods is key. Discover also emphasizes that greater payment flexibility leads to higher buyer satisfaction. As consumer preferences continue to evolve, businesses must stay informed and adaptable.

McKinsey & Company notes that businesses that fail to adapt risk falling behind. This means staying current with payment trends and choosing a merchant account provider that can support your evolving needs, including robust reporting features to track these trends.

Related Articles

- The Ultimate Guide to B2B Payment Solutions

- Tabs - Accounts Receivables Payments

- Is Accounts Receivable Debit or Credit?

- How to Understand & Prevent Chargebacks

Frequently Asked Questions about Merchant Accounts

Why do I need a merchant account instead of just using a regular bank account?

A regular bank account manages your everyday business finances. A merchant account is specifically designed to handle the complexities of credit and debit card transactions, ensuring secure processing and managing the flow of funds between different financial institutions. It acts as a holding area for card payments before they settle into your regular business bank account.

What fees can I expect with a merchant account?

You'll encounter various fees, including transaction fees (a percentage of each sale plus a small per-transaction fee), monthly or annual fees, potential setup and early termination fees, and chargeback fees. Understanding these fees upfront is crucial for managing your budget.

How do I choose the right merchant account provider for my business?

Look beyond the headline rates. Consider the complete fee structure, the quality of customer support, available integrations with your existing business systems, security measures, and the provider's ability to scale with your business. If you're in a specific industry like subscription services, look for a provider specializing in that area.

What are some common misconceptions about merchant accounts?

Many believe only large businesses need merchant accounts, but they benefit businesses of all sizes. Another misconception is that all providers are the same; they're not. Fees, services, and support vary widely. Finally, it's a myth that merchants are always at fault for chargebacks; sometimes, they occur due to circumstances beyond the merchant's control.

How can I prepare for the future of payment processing with my merchant account?

Stay informed about emerging payment technologies like biometric authentication, mobile wallets, and wearable payment devices. Choose a provider that can adapt to these changes and offers features like real-time payments and flexible payment options to meet evolving consumer preferences. Robust reporting and analytics tools can also help you track trends and adapt your strategies.