Running a business feels like a constant balancing act, and one of the trickiest things to juggle is client churn. You work hard to attract new customers, but what happens when they start slipping away? High client churn can sink your business faster than you can say "profit margin." This post is your guide to understanding, measuring, and minimizing client churn. We'll explore the real cost of losing clients, delve into the common reasons they leave, and provide actionable strategies to improve retention. Get ready to transform your business from a leaky bucket into a thriving ecosystem of loyal, long-term clients.

Key Takeaways

- Churn impacts your bottom line: Acquiring new customers is expensive. Prioritizing customer retention through proactive engagement and targeted strategies strengthens your financial health.

- Improve retention with proactive strategies: Enhance customer experience, optimize onboarding, and leverage technology like CRM and automated billing to build customer loyalty and reduce churn.

- Customer feedback fuels improvement: Gather feedback, analyze it for actionable insights, and adapt your approach. A customer-centric culture, supported by aligned teams and trained employees, is essential for reducing churn.

What is Client Churn?

What is Client Churn and Why Does it Matter?

Client churn, also known as customer churn or attrition, is the rate at which customers stop doing business with an entity. It’s a critical metric because it directly impacts your bottom line. Think of it as a leaky bucket: you’re constantly adding new customers (pouring water in), but if you have a high churn rate (lots of holes), you’ll struggle to fill it up. Understanding your churn rate helps you identify problems with customer retention and make informed decisions about your business strategy. A high churn rate might indicate issues with your product, customer service, pricing, or even your marketing message. Learn more about calculating and addressing churn. Focusing on retention is key for a healthy business.

How Client Churn Impacts Your Bottom Line

High churn significantly impacts your bottom line in several ways. First, acquiring new customers is typically more expensive than retaining existing ones. You’re investing in marketing, sales, and onboarding—costs that could be minimized by focusing on customer retention. See how Tabs streamlines financial operations. Second, loyal customers tend to spend more over time. They’re familiar with your product or service and are more likely to upgrade or purchase additional offerings. Losing these customers means losing out on potential future revenue. Finally, high churn can damage your brand reputation. Unhappy customers often share their negative experiences, which can deter potential new clients. By reducing churn, you not only improve your financial performance but also build a stronger, more sustainable business.

Identify and Analyze Client Churn

Understanding how and why customers leave is the first step toward reducing churn. Pinpointing the root causes requires careful analysis of customer behavior and feedback. This section covers common reasons for churn, calculating your churn rate, and identifying early warning signs.

Common Churn Causes

Several factors contribute to client churn. Identifying these in your business is crucial for developing effective retention strategies. Some of the most common causes include:

- Poor customer service: Unresponsive, unhelpful, or rude customer service can quickly drive customers away. Customers expect timely and efficient support. If they don't receive it, they'll likely seek alternatives.

- Lack of perceived value: Customers may churn if they don't believe your product or service offers adequate value for its price. This could be due to a mismatch between their needs and your offering, or simply a perception that the price is too high. Regularly demonstrating your product's value through clear communication and excellent service is essential.

- Difficult or confusing user experience: A complicated or frustrating user experience can lead to frustration and ultimately, churn. Ensure your product is intuitive and easy to use. Provide ample resources like tutorials and FAQs to help customers understand its functionality, including how to extract key contract terms with AI.

- Lack of ongoing engagement: Failing to engage with customers after the initial sale can make them feel undervalued. Regular communication, exclusive content, and personalized offers can help maintain customer interest and loyalty.

- Pricing and billing issues: Unexpected price increases, hidden fees, or complicated billing processes can create friction and lead to churn. Transparent pricing and streamlined billing are key to customer satisfaction. Consider features like automating complex invoicing and supporting various payment types.

Calculate and Interpret Your Churn Rate

Calculating your churn rate is a simple but crucial step in understanding customer retention. The basic formula is:

- (Number of customers lost during a specific period) / (Number of customers at the beginning of that period) x 100%

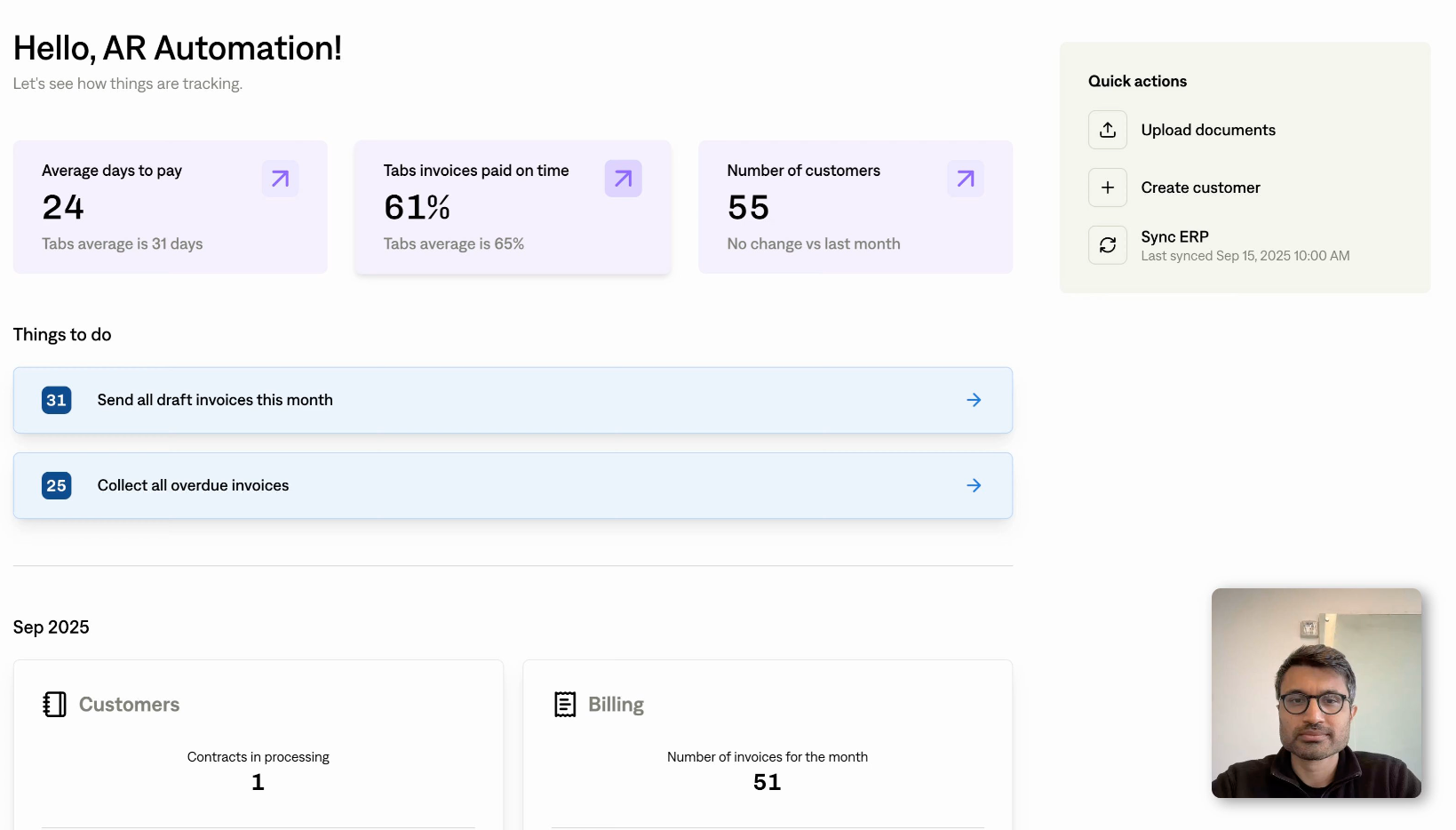

For example, if you began the month with 100 customers and lost 10, your churn rate is 10%. While a low churn rate is desirable, the ideal rate varies across industries. Regularly monitoring and analyzing your churn rate helps you track progress and identify potential problems. Accessing robust reports on key metrics can provide valuable insights for your finance team.

Spot Early Churn Signs

Identifying early churn signs allows you to proactively address customer concerns before they escalate. These signs can include:

- Decreased product usage: If a customer uses your product less frequently, it could indicate declining satisfaction or a shift in their needs.

- Reduced customer engagement: Lower email open rates, less interaction with your content, and fewer support requests can all be red flags.

- Negative feedback: Pay close attention to customer reviews, surveys, and support interactions. Negative feedback, even if isolated, can highlight areas for improvement.

- Increased customer support inquiries: A sudden increase in support tickets from a specific customer could signal underlying issues with your product or service.

By understanding common churn causes, calculating your churn rate, and recognizing early warning signs, you can take proactive steps to improve customer retention and build a more sustainable business. Retaining existing customers is often more cost-effective than acquiring new ones.

The Real Cost of Churn

Losing clients stings, but understanding the real cost of churn often reveals a far deeper wound than a simple dip in revenue. It impacts everything from your marketing budget to your company's overall growth trajectory. Let's break down why churn is so expensive.

Acquisition vs. Retention: The Cost Difference

Think about how much time, effort, and money you pour into attracting new clients. From targeted ad campaigns to sales team salaries, client acquisition is a significant investment. Now consider this: retaining existing clients is almost always cheaper. Studies show that acquiring a new customer can be five to 25 times more expensive than keeping an existing one. That's because you've already built a relationship, established trust, and understand their needs. Focusing on retention frees up resources that you can then reinvest in product development or other growth initiatives. For SaaS businesses, this is particularly crucial, as recurring revenue streams are the lifeblood of their business model. By prioritizing retention, you're not just saving money; you're investing in the long-term health of your business.

Churn's Long-Term Revenue Impact

Churn doesn't just impact your current revenue; it significantly hinders your future earning potential. Each lost client represents a stream of recurring revenue that disappears, impacting your monthly recurring revenue (MRR) and hindering predictable growth. Over time, even a small churn rate can compound, leading to substantial revenue loss and making it harder to forecast and plan for the future. This instability can make it difficult to secure funding or attract investors. For companies using a subscription model, understanding customer lifetime value (CLV) is essential. A high churn rate directly diminishes CLV, reducing the overall profitability of each customer.

How Churn Affects Brand and Growth

Beyond the immediate financial hit, churn can quietly erode your brand reputation and stifle growth. Dissatisfied clients often share their negative experiences, impacting your brand image and making it harder to attract new customers. Negative reviews and word-of-mouth can be incredibly damaging. High churn also creates a volatile customer base, making it challenging to implement effective long-term growth strategies. A stable, loyal customer base is essential for sustainable business growth and provides valuable feedback for product development and improvement. Consider the impact churn has on your team's morale. Constantly losing clients can be demoralizing, especially for sales and customer service teams. A focus on retention fosters a more positive and productive work environment.

Reduce Client Churn

Losing customers is a costly problem. Thankfully, proven strategies exist to improve customer retention and build a loyal customer base. Here are four key areas to focus on:

Enhance Customer Experience (CX)

Happy customers rarely leave. Prioritizing a positive customer experience is paramount. This means providing excellent customer service, responding promptly to inquiries, and offering convenient self-service options. Think about making every interaction enjoyable and efficient. A seamless experience, from purchase to support, builds trust and encourages customers to stay. For SaaS businesses, consider personalized onboarding and ongoing support to ensure customers understand and use your product's features. This proactive approach can significantly reduce churn by addressing potential pain points.

Improve Onboarding and Education

First impressions are crucial. A smooth, effective onboarding process sets the stage for a successful customer relationship. Guide new customers through your product or service, highlighting key features and benefits. Provide clear documentation, tutorials, and readily available support. When customers feel confident using your product from the start, they're more likely to see its value. Consider a knowledge base or FAQ section on your website to empower customers to find answers independently. This improves their experience and frees up your support team for complex issues. For onboarding inspiration, explore these effective strategies.

Implement Loyalty Programs

Rewarding loyal customers impacts your churn rate. Loyalty programs offer exclusive perks, discounts, or early access to new features, making customers feel valued. These programs encourage repeat business and foster a sense of community. Consider tiered programs with increasing benefits based on engagement or spending. This incentivizes customers to stay engaged and invest more. Learn more about building successful loyalty programs with these practical tips.

Recognize High-Value Clients

Not all customers are equal. Identify your high-value clients—those generating the most revenue or having the highest lifetime value—and tailor retention efforts accordingly. Offer personalized support, exclusive content, or dedicated account managers. By nurturing these key relationships, you protect your most valuable revenue streams and reduce churn's impact. Understanding your customer segments is crucial. Explore these customer segmentation strategies to identify and target your most valuable clients.

Use Technology and Data to Fight Churn

Technology and data offer powerful tools to combat customer churn. By using these resources strategically, businesses gain valuable insights into customer behavior, automate key processes, and implement proactive retention strategies.

Automate Billing and Invoicing

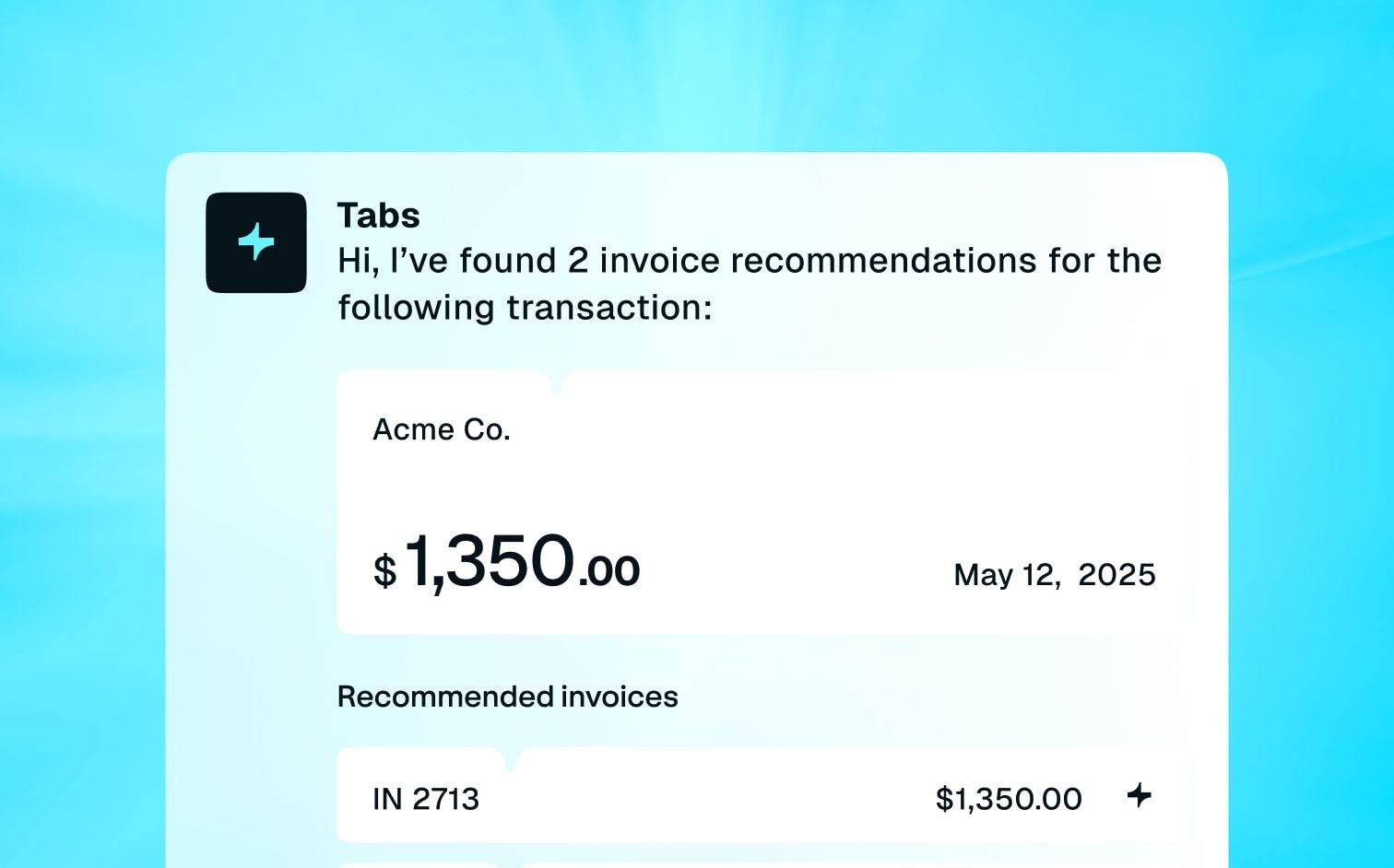

One of the most effective ways to reduce involuntary churn is automating your billing and invoicing. Many customers churn because of failed payments—a problem easily solved with the right systems. Automating these essential financial operations ensures timely and accurate billing, reducing friction that can lead to involuntary churn. Automated systems also send payment reminders, retry failed transactions, and offer flexible payment options, further minimizing the risk of losing customers due to billing issues. This automation frees up your team to focus on strategic initiatives instead of chasing late payments.

Use CRM Tools

Customer Relationship Management (CRM) tools are invaluable for understanding your customers and identifying those at risk of churning. A good CRM system tracks all customer interactions, from purchase history and support tickets to website activity and email engagement. This comprehensive view lets you segment your customer base, identify patterns, and pinpoint potential churn risks. For example, you might notice that customers who haven't used your product recently are more likely to churn. With this knowledge, you can proactively contact these customers with targeted offers or support to re-engage them and prevent churn. Using CRM data creates personalized experiences that foster customer loyalty and reduce churn.

Predict and Prevent Churn with Data

Beyond simply tracking customer interactions, you can use data to predict and prevent churn. Analyzing historical data reveals key indicators that correlate with churn. This might include factors like product usage, customer demographics, or support interactions. Once you've identified these indicators, use predictive modeling to identify customers showing signs of churning. This proactive approach allows early intervention, offering personalized support, incentives, or other actions to address their concerns and improve their experience. Robust reporting tools can provide the insights you need to understand your churn drivers and develop effective retention strategies. Combining data analysis with proactive outreach significantly reduces churn and improves your bottom line.

Get Feedback, Reduce Churn

Customer feedback is invaluable. It's a direct line to understanding what's working and what's not, giving you the insights you need to improve your offerings and keep clients happy. This section focuses on how gathering and using feedback effectively can significantly reduce churn.

Implement Effective Feedback Channels

Opening up multiple channels for feedback makes it easier for customers to share their thoughts. Consider these options:

- In-app surveys: Short, targeted surveys within your software can capture immediate feedback on specific features or workflows. Keep them concise and focused on a single question or topic.

- Email surveys: Reach out periodically for more comprehensive feedback. Email marketing remains a reliable way to gather information, but keep emails brief and incentivize participation.

- Customer interviews: One-on-one conversations provide rich qualitative data. Talking directly with customers can uncover deeper insights into their experiences and needs. Schedule these strategically with key customer segments.

- Feedback forms on your website: A readily available form on your website offers a simple way for customers to share thoughts or report issues anytime. Make sure it's easy to find and simple to use.

By offering a variety of feedback channels, you cater to different communication preferences and increase the likelihood of receiving valuable insights. Remember to promote these channels and make it clear to customers how their feedback will be used. For example, consider adding a feedback button directly within your software interface, or highlighting the link to your feedback form in your email signature. This proactive approach demonstrates your commitment to customer satisfaction.

Analyze and Act on Customer Insights

Collecting feedback is only the first step. The real value lies in analyzing the data and taking action. Use tools available to you to organize and interpret the feedback you receive. Look for patterns and trends. What are the recurring pain points? Where are customers consistently delighted? Robust reporting tools can help you identify these trends and visualize the data effectively.

Prioritize the most critical issues and develop a plan to address them. This might involve improving your product, refining your onboarding process, or adjusting your customer support strategies. Closing the feedback loop by communicating the changes you've made based on customer input demonstrates that you value their opinions and are committed to their success. This builds trust and strengthens customer relationships, ultimately contributing to lower churn rates. By consistently analyzing and acting on customer insights, you create a continuous improvement cycle that benefits both your customers and your business. This iterative process allows you to adapt to evolving customer needs and stay ahead of potential churn triggers.

Measure and Improve Churn Reduction

After implementing churn reduction strategies, how do you know they're working? The answer lies in consistent measurement and improvement. This iterative process relies heavily on tracking the right metrics and adapting your approach based on the data.

Track Key Performance Indicators (KPIs)

Identifying and tracking key performance indicators (KPIs) provides quantifiable insights into your churn reduction efforts. Here are some essential KPIs to monitor:

- Customer Churn Rate: This fundamental metric measures the percentage of customers who cancel their subscriptions or stop using your services over a specific period. A lower churn rate indicates better customer retention. Regularly calculating your churn rate helps you understand the overall health of your customer base. Resources like Churned offer more information on calculating and understanding churn rate.

- Monthly Recurring Revenue (MRR) Churn: This KPI focuses specifically on the recurring revenue lost due to churn. Tracking MRR churn helps you understand the financial impact of customer loss and identify areas for revenue improvement. Tabs offers robust reporting features to help you keep a close eye on your MRR.

- Customer Lifetime Value (CLTV): CLTV represents the total revenue you expect from a customer throughout their relationship with your business. A higher CLTV indicates greater customer profitability. By understanding CLTV, you can make informed decisions about acquisition costs and retention strategies.

- Customer Acquisition Cost (CAC): CAC measures the cost of acquiring a new customer. Keeping CAC low while maximizing CLTV is crucial for sustainable growth.

Continuously Improve Your Strategy

Tracking KPIs is only the first step. The real value comes from analyzing the data and using it to continuously refine your churn reduction strategies. Here's how:

- Analyze Churn Reasons: Don't just measure the churn rate; dig deeper to understand why customers are leaving. Conduct exit interviews, analyze customer feedback, and identify patterns in churn behavior. This qualitative data provides valuable context for your quantitative metrics.

- Refine Onboarding Processes: A strong onboarding experience sets the stage for long-term customer success. Regularly review and improve your onboarding process to ensure it's efficient, engaging, and addresses customer needs effectively. Consider using resources like Customer Success Collective for guidance on building a strong onboarding program.

- Segment Your Customers: Not all customers are created equal. Segment your customer base based on behavior, demographics, or other relevant factors. This allows you to tailor your retention strategies to specific customer groups and address their unique needs.

- Experiment and Iterate: Churn reduction is an ongoing process. Continuously experiment with different strategies, A/B test different approaches, and track the results. Use data-driven insights to iterate on your strategies and find what works best for your business. For example, experiment with different pricing models to see how they impact churn. Remember, even small improvements can have a significant impact on your bottom line. Tools like Tabs can help you automate complex invoicing and manage various payment types, freeing up time to focus on these strategic initiatives.

Build a Customer-Centric Culture

A customer-centric culture is key to reducing churn. It's more than just offering great customer service—it's about weaving customer focus into the fabric of your entire organization. This approach ensures everyone, from product development to finance, prioritizes customer needs and satisfaction. When your whole team is invested in keeping customers happy, it creates a powerful force against churn. This section explores two crucial elements of building this culture: aligning your teams and training your employees.

Align Teams Around Retention

Siloed teams often work with different metrics and goals. Sales might focus on closing new deals, while customer success manages existing accounts. This disconnect can lead to a fragmented customer experience, increasing the risk of churn. To combat this, align all teams around the shared goal of customer retention. Start by establishing company-wide KPIs related to churn, like customer lifetime value (CLTV) and retention rate. When every team understands how their work contributes to these shared metrics, it fosters a sense of collective responsibility for customer success. For example, product teams can prioritize features that improve customer satisfaction, and marketing can focus on campaigns that nurture existing customers. This unified approach creates a more cohesive and effective retention strategy. Robust reporting and shared dashboards can help visualize these KPIs and keep everyone aligned.

Train Employees for Better Customer Experiences

Your employees are the face of your company. They interact directly with customers, shaping their perception of your brand and influencing their decision to stay or leave. Investing in comprehensive employee training is crucial for delivering exceptional customer experiences. Equip your team with the skills to handle customer inquiries effectively, resolve issues efficiently, and build strong relationships. Training should cover product knowledge, communication skills, and a deep understanding of your customer base. Empower your employees to anticipate customer needs and offer proactive solutions. When customers feel heard, understood, and valued, they're far less likely to churn. Consider incorporating role-playing scenarios and ongoing feedback sessions into your training program to reinforce best practices and ensure continuous improvement in customer interactions. This investment in your team translates directly into improved customer satisfaction and reduced churn.

Which Industries Does Churn Hit Hardest?

Some industries naturally experience higher churn rates than others. Understanding these differences helps you benchmark your performance and set realistic expectations. Knowing which sectors are most susceptible also allows you to tailor retention strategies if you serve multiple markets.

Identify High-Risk Sectors

Industries with notoriously high churn often involve non-contractual, subscription-based services. Think streaming services, where customers can easily cancel and switch between providers. Similarly, online fitness programs or meal kit deliveries see fluctuations as customer needs and preferences change.

Highly competitive markets also tend to experience higher churn. If numerous companies offer similar products or services, customers might switch for a slightly better deal or a new feature. This is common in the SaaS world, where new software solutions constantly emerge. Tabs billing software helps SaaS companies better manage their recurring revenue and reduce involuntary churn through accurate invoicing and streamlined payment processing. For example, features like automated billing and clear revenue recognition contribute to a smoother customer experience.

Tailor Retention Strategies to Specific Industries

Recognizing these industry-specific challenges lets you create targeted retention strategies. For example, if you operate in a high-churn industry like online gaming, focus on building a strong community and offering exclusive content to keep players engaged. This approach fosters loyalty and reduces the likelihood of players seeking alternative platforms.

For industries with longer sales cycles and higher customer lifetime value (CLTV), like B2B software, personalized onboarding and ongoing customer support are crucial. Proactively addressing potential pain points and demonstrating the ongoing value of your product can significantly reduce churn. Using tools that simplify complex billing processes, like Tabs’ automated invoicing, can also contribute to increased customer satisfaction. This, in turn, fosters stronger client relationships and reduces the likelihood of churn.

Related Articles

- Annual Recurring Revenue (ARR): Your Complete Guide

- Recurring Revenue: A Practical Guide for SaaS Growth

- ARR Guide: Understanding Annual Recurring Revenue

- What is ACV and How Does It Compare to ARR?

Frequently Asked Questions

What's the difference between voluntary and involuntary churn?

Voluntary churn happens when a customer actively chooses to end their relationship with your business. They might cancel their subscription or simply stop using your service. Involuntary churn, on the other hand, occurs due to circumstances outside the customer's control, such as failed payments or expired credit cards. While both types impact your bottom line, addressing involuntary churn is often easier through automated billing systems and clear communication.

How can I calculate my customer churn rate?

Calculating your churn rate involves a simple formula: divide the number of customers lost during a specific period by the number of customers at the beginning of that period, then multiply by 100%. For example, if you started the quarter with 500 customers and lost 50, your churn rate is 10%. Tracking this metric regularly helps you identify trends and assess the effectiveness of your retention strategies.

What are some early warning signs that a customer might churn?

Several red flags can indicate a customer is at risk of churning. Decreased product usage, reduced engagement with your content or support team, and negative feedback in surveys or reviews are all potential indicators. Monitoring these signs allows you to proactively address customer concerns and prevent churn before it happens.

What's the most effective way to reduce customer churn?

There's no single magic bullet for reducing churn, but a multi-faceted approach focusing on customer experience is key. Prioritize excellent customer service, offer a seamless and intuitive user experience, and demonstrate the ongoing value of your product or service. Building a customer-centric culture within your organization, where every team prioritizes customer success, is also crucial.

Beyond financial incentives, how can I improve customer loyalty and reduce churn?

While discounts and loyalty programs can play a role, genuine connection fosters long-term loyalty. Focus on building strong relationships with your customers. Offer personalized support, solicit and act on their feedback, and create a sense of community around your brand. When customers feel valued and understood, they're more likely to stay.