Want to truly understand your recurring revenue? You need to get familiar with Annual Contract Value (ACV). This essential SaaS metric reveals the average annual worth of your customer contracts. Understanding ACV is key to making smart decisions about sales, marketing, and customer success. Let's break down how to calculate it, use it effectively, and even automate it for smoother revenue management.

Annual Contract Value differs from Annual Recurring Revenue (ARR), which is the total amount of money your business earns from all your subscription customers in a year.

Both ACV and ARR are significant for your subscription-based business because they help you predict how much money you’ll make in the future. They also give you a clear picture of your business’s health and growth potential.

Think of it this way: If your ACV is high, it means each customer is paying you a good amount of money every year. And if your ARR is growing steadily, it shows that you’re adding more customers and expanding your revenue streams.

Understanding ACV and ARR can help you make financially sound decisions about pricing, marketing, and customer retention strategies to keep your business thriving.

What is Annual Contract Value (ACV)?

The thing to remember is that it focuses on individual customer contracts, not your entire customer base. It looks at the value of each agreement separately, typically over a fixed period of one year (hence the “annual” in ACV).

So, why is this such an important metric for your subscription-based business? It helps you measure the health and potential of your customer relationships. By understanding the average value of your contracts, you can make informed decisions about how to acquire, retain, and grow your customer base.

For example, if you know your annual contract value is $1,000, you can use that information to make decisions. With this, you can set revenue targets, plan your sales strategies, and allocate your marketing budget effectively. Track changes in the annual value of your individual contracts over time to see if customers are upgrading to higher-value plans. If not, you may need to adjust your pricing or packaging.

ACV also helps you predict your revenue more accurately. Since it calculates the value of your contracts over a fixed period, you can use it to forecast how much money you’ll make from your existing customers in the coming months or quarters.

Overall, ACV is a foundational metric for subscription-based businesses because it provides a clear, consistent way to measure the value of your customer relationships.

Key Takeaways

- ACV reveals the health of customer relationships: Knowing your average annual contract value helps you understand the value of individual customers and predict future revenue from contracts, informing pricing strategies and resource allocation. It provides a clear way to compare contracts, regardless of their length or complexity.

- Combine ACV with ARR for a complete financial picture: ACV focuses on individual contract value, while ARR shows your total recurring revenue. Using both metrics together gives you a comprehensive view of your business's financial health and potential for growth.

- Automation streamlines ACV management: Automated billing software simplifies ACV calculations, reduces errors, and provides real-time financial insights. This frees up your team to focus on strategic decisions and revenue optimization.

Calculating Annual Contract Value

To calculate your annual contract value, you need to know two things:

- The total contract value (TCV) of a customer’s subscription

- The length of the contract term

Once you have those two pieces of information, you can use this simple formula:

ACV = TCV / Contract Length (in years)

ACV Calculation Example 1

Imagine you have a customer who signs up for your software at a rate of $150 per month on a three-year contract.

- Step 1: Calculate the TCV. TCV = Monthly Subscription Rate × Number of Months in the Contract. TCV = $150 × 36 months (3 years × 12 months per year). TCV = $5,400

- Step 2: Divide the TCV by the Contract Length. ACV = TCV / Contract Length (in years). ACV = $5,400 / 3 years ACV = $1,800

In this example, the customer’s ACV is $1,800. This means that, on average, you can expect to earn $1,800 per year from this customer throughout their three-year contract.

ACV Calculation Example 2

Suppose another customer signs up for an annual plan at $2,000 per year.

In this case, the TCV is already expressed in annual terms, so the ACV is simply equal to the TCV:

ACV = TCV (when the contract is already in annual terms)

ACV = $2,000

Note that you can calculate ACV differently depending on your business model and pricing structure. For example, if you offer monthly subscriptions without long-term contracts, you might calculate ACV by multiplying the monthly rate by 12 to get the annual value.

The takeaway is that ACV helps you normalize the value of your customer contracts over a consistent period (usually a year) so you can make apples-to-apples comparisons and informed business decisions.

Multi-Year Contracts and ACV

When including or excluding one-time fees in the first year of multi-year contracts, there are a few important considerations.

To clarify the term, one-time fees are typically one-off charges that a customer pays at the beginning of their contract, such as setup fees, onboarding costs, or implementation charges. They’re separate from the recurring subscription fees that the customer pays throughout the term of the contract.

When calculating ACV, you have two options for handling these one-time fees:

- Include the one-time fees in the TCV and calculate ACV as usual. If you choose this approach, you’ll add the one-time fees to the TCV before dividing it by the contract length to get the ACV. This method gives you a slightly higher ACV in the first year, but it also provides a more accurate picture of the total value of the contract.Suppose a customer signs a 3-year contract at $1,000 per year, with a one-time setup fee of $500. The TCV would be $3,500 ($1,000 × 3 years + $500), and the ACV would be $1,167 ($3,500 / 3 years).

- Exclude the one-time fees and calculate ACV based only on recurring revenue. Alternatively, you can choose to exclude the one-time fees from your ACV calculation and focus solely on the recurring subscription revenue. This approach gives you a more consistent ACV throughout the life of the contract, but it may understate the total value of the deal.Using the same example, if you exclude the $500 setup fee, the TCV would be $3,000 ($1,000 × 3 years), and the ACV would be $1,000 ($3,000 / 3 years).

Deciding on which approach depends on your business goals and how you want to communicate the value of your contracts. If you want to emphasize the total value of each deal, including one-time fees in your ACV calculation may make sense. But, if you want to focus on the predictable, recurring revenue from your customers, excluding one-time fees may be the better option.

In short, be consistent in your approach and clearly communicate your methodology to stakeholders. This way, everyone is on the same page when discussing and analyzing your ACV metrics.

Handling Short-Term Contracts and ACV

Short-term contracts, typically lasting less than a year, present unique challenges for calculating Annual Contract Value (ACV). Since ACV represents the average annual value, applying the standard formula (TCV / Contract Length) to a short-term contract might inflate the perceived annual revenue. For example, a six-month contract worth $5,000 would yield an ACV of $10,000, which doesn't accurately reflect the annualized revenue potential.

One approach for shorter agreements is to annualize the contract value. In our example, the $5,000 six-month contract translates to an annualized value of $10,000. This provides a realistic comparison against annual contracts. However, it’s crucial to distinguish between actual ACV and annualized ACV to avoid overestimating projected revenue. Clearly label these figures to maintain accuracy in your financial reporting. Another option, particularly for a mix of short-term and long-term contracts, is to calculate ACV based on the total contract value over a specific period, such as a quarter or month. This allows for more granular analysis of revenue trends.

Impact of One-Time Fees on ACV Calculation

One-time fees, such as setup or implementation charges, can complicate ACV calculations. These non-recurring payments contribute to the Total Contract Value (TCV) but don't reflect the ongoing value of the customer relationship. Including them in your ACV calculation can skew your understanding of recurring revenue. Salesforce defines one-time fees as distinct from recurring subscription fees, highlighting the importance of considering their impact on ACV. This is especially important for SaaS businesses that rely on predictable recurring revenue streams.

One-Time Fees in Multi-Year Contracts

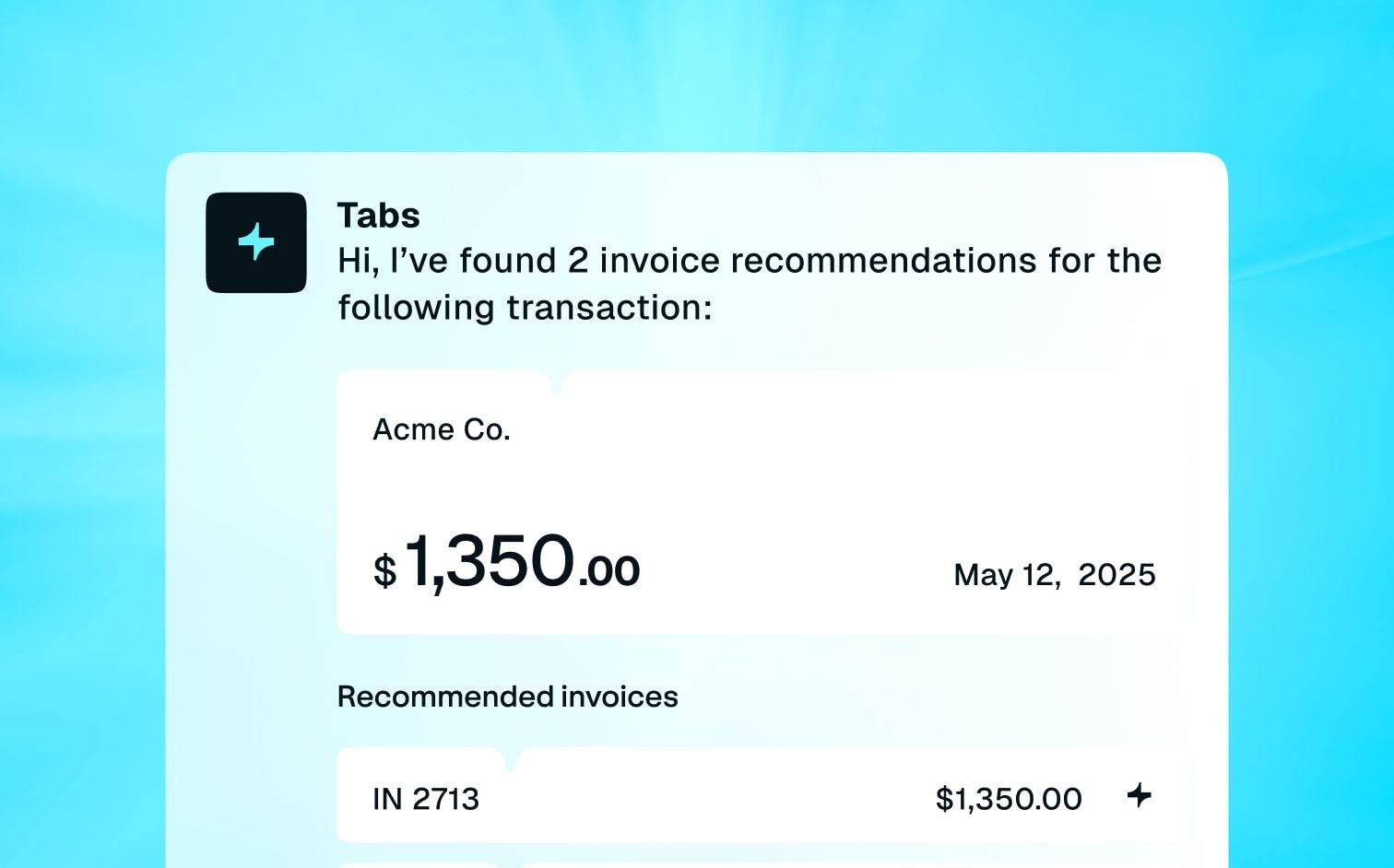

For multi-year contracts, you have two primary options: include or exclude one-time fees. Including them increases the first year's ACV, reflecting the total initial contract value. Excluding them provides a more consistent ACV across the contract’s lifespan, focusing solely on recurring revenue. Paddle discusses these two approaches, emphasizing the importance of choosing a method aligned with your business objectives. Consistency is key—choose one method and maintain it for accurate trend analysis. Using a platform like Tabs can simplify this process by automating the management of complex invoicing that includes both recurring and one-time fees.

One-Time Fees in Single-Year Contracts

With single-year contracts, the impact of one-time fees is more pronounced. Sage notes that some companies include one-time fees in the ACV calculation for single-year contracts. This helps understand the total value derived from the customer in that year. However, consider the potential for overstating recurring revenue when making comparisons to multi-year contracts or projecting future revenue based on this inflated ACV. This is where accurate revenue recognition becomes crucial, and a platform like Tabs can provide the necessary tools to manage this effectively.

Variations in ACV Calculation Methods

There’s no single approach to calculating ACV. The best method depends on your business model and contract structures. Klipfolio highlights the flexibility of ACV calculations, suggesting that businesses with monthly subscriptions might calculate ACV by multiplying the monthly rate by 12. This approach works well for businesses without fixed-term contracts, providing a standardized annualized value for comparison. Choose a method that accurately reflects your revenue streams and provides actionable insights. Documenting your chosen method ensures consistency and transparency in your financial reporting. For SaaS businesses with varying contract lengths and payment structures, Tabs offers a streamlined solution to manage subscriptions and gain clear insights into ACV.

ACV vs. ARR: What's the Difference?

Understanding ACV

ACV is a customer-level metric that measures the average annual value of a single customer contract. It takes the TCV of a customer’s subscription and divides it by the length of the contract in years. ACV helps you understand how much revenue you can expect from each customer on an annual basis based on their specific contract terms.

For example, if a customer signs a two-year contract for $2,400, their ACV would be $1,200 ($2,400 / 2 years). ACV is useful for analyzing the value of individual customer relationships and predicting revenue from specific contracts.

Understanding ARR

ARR is a company-level metric that measures the total recurring revenue your business generates from all your customers over a year. It’s the sum of all your customers’ annual subscription fees, excluding any one-time charges or variable fees.

To calculate ARR, you take the monthly recurring revenue (MRR) from all your customers and multiply it by 12. For instance, if your business has 100 customers paying an average of $100 per month, your MRR would be $10,000, and your ARR would be $120,000 ($10,000 × 12 months).

ARR gives you a high-level view of your business’s overall recurring revenue stream instead of focusing on individual customer contracts like ACV does.

Key Differences Between ACV and ARR

- ACV is a customer-level metric, while ARR is a company-level metric.

- ACV measures the average annual value of a single customer contract, while ARR measures the total recurring revenue from all customers over a year.

- ACV helps you analyze individual customer relationships, while ARR gives you a big-picture view of your business’s recurring revenue.

ACV vs. TCV: Understanding the Distinction

While both relate to contract value, ACV and TCV offer different perspectives. Think of TCV (Total Contract Value) as the big-picture number—the overall value of a customer’s contract over its entire duration. It’s the total amount you expect to receive from a customer based on their agreement with you. ACV (Annual Contract Value), on the other hand, normalizes that total value into an annual amount, making it easier to compare contracts with different lengths.

Let’s say a customer signs a three-year contract for $36,000. The TCV is the full $36,000. The ACV, however, is $12,000 ($36,000 / 3 years). ACV helps you understand the yearly impact of that contract on your revenue stream, providing a standardized way to compare the value of different contracts, regardless of their duration. This is particularly useful for SaaS businesses that often deal with varying contract lengths and pricing models.

ACV vs. LTV: Long-Term Value vs. Annualized Revenue

ACV and LTV (Lifetime Value) are distinct metrics that provide different insights into customer relationships. ACV focuses on the average annual revenue from a single contract. LTV broadens the perspective to encompass the total revenue you expect from a customer throughout their entire relationship with your business. It goes beyond the current contract and projects into the future, considering the potential for long-term growth.

Think of it this way: ACV is a snapshot of the present, while LTV is a forecast of the future. ACV tells you how much a customer is worth to your business *right now*, based on their current contract. LTV predicts how much they will be worth over the long term, considering factors like potential upsells, cross-sells, and renewals. For example, a customer might have an ACV of $1,000, but their LTV could be $5,000 if they remain a customer for five years and upgrade their subscription along the way. Understanding both ACV and LTV is crucial for making strategic decisions about customer acquisition, customer retention, and overall business growth. For more on pricing models and how they impact LTV, check out our resources.

How ACV and ARR Impact Business Strategy

When it comes to shaping your business strategy, ACV and ARR work best together.

Strategic Decision-Making with ACV and ARR

ACV helps you understand the value of your customer contracts, which can inform things like pricing and packaging decisions. If your ACV is too low, you may need to adjust your pricing tiers or add more value to your offerings to increase the average contract size. But, if your ACV is high, you might consider expanding your customer base with more affordable plans to attract a wider range of users.

Also, ACV and ARR can help you set sales targets and allocate marketing resources effectively. When you know your typical contract value and total recurring revenue, you can create realistic goals for your sales team and invest in marketing channels that are most likely to attract high-value customers.

Finally, ACV and ARR highlight the importance of retaining your existing customers. Since these metrics focus on recurring revenue, any customer churn will directly impact your bottom line. Monitoring ACV and ARR helps you prioritize customer success initiatives and proactively address any issues that may lead to cancellations or downgrades.

Financial Forecasting with ACV and ARR

ACV and ARR are crucial inputs for creating accurate revenue forecasts. By multiplying your average ACV by the number of new customers you expect to acquire, you can project your future revenue growth. Similarly, ARR helps you establish a baseline for your recurring revenue and understand how changes in your customer base will impact your overall financial performance.

These metrics also help with valuation and fundraising. Investors often look at ACV and ARR when evaluating the potential of a subscription-based business. A high ACV suggests that you’re able to generate significant value from each customer, while a growing ARR indicates that your business has a stable and predictable revenue stream.

Tracking your ACV and ARR can help you make informed decisions about how to allocate your resources. For example, if your ACV is high but your sales cycle is long, you may need to invest more in sales and customer support to maintain those valuable relationships. Similarly, if your ARR is growing rapidly, you might prioritize investments in infrastructure and product development to keep up with demand.

Using ACV in the Real World

ACV and Sales Performance

By tracking the average contract value for each sales rep or team, you can identify top performers and areas for improvement. For example, if one sales rep consistently closes deals with a higher ACV, you can analyze their techniques and share best practices with the rest of the team. Conversely, if a rep’s ACV is consistently lower than average, you may need to provide additional training or resources to help them sell more effectively.

Setting Fair Compensation and Incentives with ACV

Tie sales team compensation to ACV to incentivize them to focus on higher-value contracts. This encourages sales representatives to prioritize securing contracts that contribute more significantly to the company’s revenue. Design sales incentive programs that reward securing longer-term contracts and higher ACV deals. This strategy not only motivates sales teams but also aligns their efforts with the company’s long-term financial objectives.

For example, offer higher commissions or bonuses for deals that exceed a certain ACV threshold. This motivates sales reps to pursue larger deals and prioritize upselling or cross-selling opportunities. Implement tiered commission structures where the commission percentage increases as the ACV of the deal goes up. This rewards reps for closing bigger deals and encourages them to strive for higher contract values. Tracking the average contract value for each sales rep or team allows you to identify top performers and areas for improvement.

Beyond compensation, using ACV to set fair incentives also involves recognizing and rewarding non-monetary contributions. Acknowledge sales reps who consistently bring in high-ACV customers with awards, promotions, or opportunities for professional development. This creates a positive feedback loop where sales reps are motivated not just by financial rewards, but also by recognition and growth opportunities. If your ACV is too low, you may need to adjust your pricing tiers or add more value to your offerings to increase the average contract size. This insight can guide compensation structures to ensure that sales teams are rewarded for driving higher-value contracts.

By carefully structuring compensation and incentives around ACV, you can create a sales culture that prioritizes long-term value creation and sustainable growth for your business. Monitoring ACV and ARR helps you prioritize customer success initiatives and proactively address any issues that may lead to cancellations or downgrades. This focus on retention can also be reflected in compensation plans, rewarding sales teams for maintaining high-value customer relationships.

Customer Retention and ACV

By segmenting your customers based on their ACV, you can identify your most valuable accounts and make sure they receive the highest level of support and attention. This might include dedicated account managers, personalized onboarding, or priority access to new features and upgrades.

Additionally, you can make data-backed calls on where to invest in product development, marketing, and other areas of your business. For instance, if a significant portion of your revenue comes from enterprise customers with high ACVs, you may want to focus on building features and integrations that cater to their specific needs.

Using ACV for Customer Segmentation

Customer segmentation is a powerful way to group your customers based on shared characteristics. Using ACV as a segmentation factor lets you tailor your approach to different customer groups, maximizing their lifetime value and improving your bottom line. Think of it as creating a VIP list—your high ACV customers get the star treatment, while you nurture other segments strategically.

Segmenting by ACV helps you identify your most valuable accounts, ensuring they receive top-tier support and attention (Salesforce). This could involve dedicated account managers, personalized onboarding, or early access to new features. For instance, a SaaS business might offer premium support to its high-ACV clients, including proactive troubleshooting and dedicated training. This personalized approach strengthens relationships and reduces churn.

Beyond personalized service, ACV segmentation informs product development and marketing strategies. If your revenue primarily comes from enterprise-level customers with high ACVs, focusing on features and integrations that meet their specific needs is a smart move (Salesforce). Imagine a project management software company noticing a concentration of high-ACV customers in the design industry. They might prioritize developing integrations with popular design tools to better serve this valuable segment. This data-driven approach ensures resources are allocated effectively, maximizing ROI.

Finally, monitoring ACV within segments helps you prioritize customer success initiatives and proactively address potential churn (Salesforce). By understanding the ACV trends within each segment, you can anticipate potential issues and develop targeted retention strategies. For example, if a specific customer segment shows a declining ACV, you can investigate the cause and implement measures like exclusive discounts or loyalty programs to encourage upgrades and prevent downgrades. This proactive approach helps maintain a healthy recurring revenue stream and strengthens your overall financial performance. For a deeper dive into optimizing recurring revenue, explore resources like those available on Tabs.

Financial Planning with ACV

When you multiply your average ACV by the number of new customers you expect to acquire in a given period, you can project your revenue growth and make informed decisions about budgeting, staffing, and other investments.

Moreover, tracking changes in ACV over time can provide valuable insights into the health and trajectory of your business. If your ACV is consistently increasing, it may indicate that you’re successfully moving upmarket and attracting more valuable customers. But, if your ACV is declining, it could signal a need to reassess your pricing strategy or improve your product’s value proposition.

ACV and Investor Appeal

When you're seeking funding, a strong ACV is key for attracting investors. A healthy ACV shows that your SaaS business can generate significant value from each customer. This signals a sustainable and profitable business model, which is a major draw for potential investors. As Salesforce notes, a high ACV paired with a growing ARR indicates a stable and predictable revenue stream, making your business more appealing to investors. This is especially important in the SaaS world, where recurring revenue is paramount.

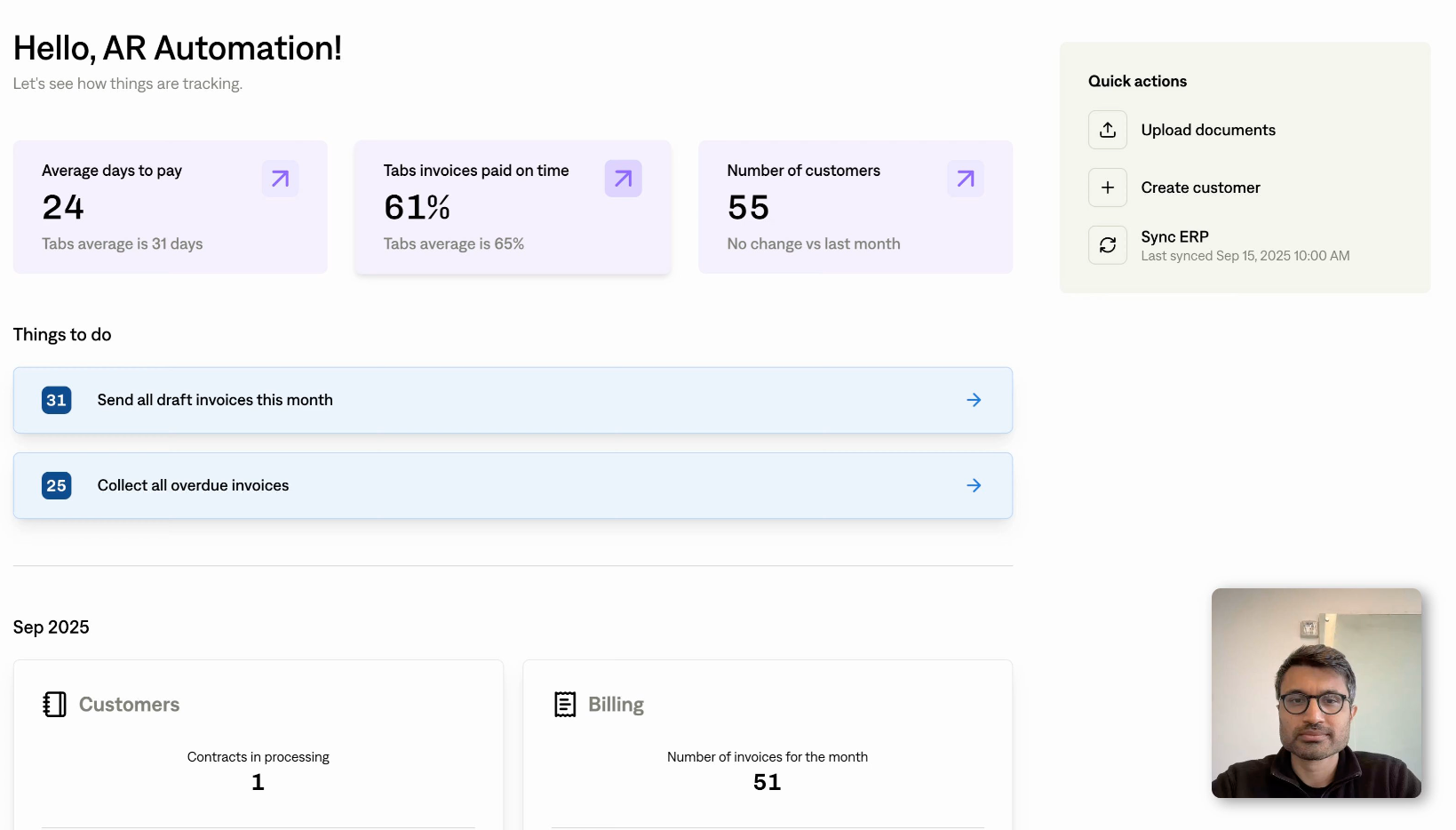

Beyond just having a high ACV, it's important to show how you'll maintain and grow that value. This is where a robust billing platform like Tabs can help. Tabs lets you automate complex invoicing processes, manage different payment types, and get detailed reporting insights into key metrics. This control and visibility streamlines your financial operations and gives investors confidence in your ability to manage and scale revenue.

Pricing and Packaging Insights from ACV

Your ACV provides valuable data to inform your pricing and packaging strategies. A lower-than-desired ACV might mean it's time to rethink your pricing tiers or improve your offerings. Perhaps you could introduce a premium tier with extra features or offer bundled packages to encourage higher-value contracts. On the other hand, a high ACV could be a chance to expand your customer base with more affordable entry-level plans, reaching a wider market. Salesforce explains how understanding your ACV can directly shape these pricing decisions.

ACV insights can also help you pinpoint your ideal customer profile. Mosaic notes that businesses can be categorized as high-ACV (fewer, larger contracts) or low-ACV (many, smaller contracts). Knowing which category you fit into—or want to fit into—lets you tailor your marketing and sales efforts more effectively. For example, if you're aiming for high ACV, you might focus on reaching enterprise clients directly and developing custom solutions for their needs. A platform like Tabs, with its AI-powered contract analysis and revenue recognition features, can be incredibly helpful in managing these high-value contracts. This automation lets you focus on building strong customer relationships and maximizing the value of each contract.

Challenges with ACV

While ACV is an incredible tool for your business, it’s not always smooth sailing. Calculating and using ACV effectively comes with its own set of challenges.

Handling Variable Contract Terms

When calculating ACV, you may see some wild variability in contract terms. It’s like trying to compare apples to oranges. Contracts can differ a lot in terms of duration, payment structures, and one-time fees. This contract chaos leads to inconsistencies in your ACV calculations, making it difficult to compare ACVs across various contracts or customer segments.

Picture this: You have one contract that’s three years long with a hefty upfront payment and lower annual fees and another with evenly spread-out annual payments. Trying to compare the ACVs of these two can throw off your perception of customer value if you’re not careful, and that can lead to some seriously wonky strategic decisions.

Consistent ACV Calculations

Keeping your ACV on the straight and narrow means establishing some standardized methods for calculating it. Without clear guidelines, you might have different teams calculating ACV in their own particular way, and that can cause confusion and unreliable data. You don’t want to be making big decisions based on numbers that don’t add up.

Tips for Maintaining Consistency

Here are some tips to help you maintain consistency and keep your metrics on point:

- Create an ACV Calculation Playbook: Develop and document a standard formula and guidelines for calculating ACV. Decide upfront whether to include one-time fees, how to handle multi-year contracts, and any other considerations that are specific to your business.

- Train Your Team: Make sure everyone who’s involved in calculating and using ACV is on the same page. Regular training sessions and documentation can help keep everyone in sync and consistent across the board.

- Keep It Fresh: Your ACV calculation methods might need an update from time to time. Periodically review and revise your procedures to reflect any changes in your business model or market conditions.

- Automate It: Consider using software tools that automate ACV calculations according to your standardized policies. Not only does this reduce the risk of human error, but it also guarantees that your calculations are consistent every single time.

High vs. Low ACV Business Models

Understanding the difference between high and low ACV business models is crucial for SaaS companies. It directly impacts your sales strategy, marketing efforts, and overall financial planning. Think of it like choosing the right fishing rod for the type of fish you're trying to catch—you need the right tools and techniques for each.

High ACV businesses typically focus on a smaller number of larger contracts. These often involve complex sales processes, longer sales cycles, and a greater emphasis on personalized customer relationships. Imagine enterprise software solutions that require extensive onboarding and dedicated support—those usually fall into the high ACV category. Because each contract is so valuable, these businesses prioritize building strong relationships with key accounts and providing a high-touch experience. Robust reporting on key metrics is essential for finance teams in this model. For example, Tabs offers robust reporting features designed for this purpose.

Low ACV businesses, on the other hand, operate on a high-volume, low-price model. They aim to acquire a large number of customers, often through self-service channels and automated marketing. Think of apps with monthly subscriptions or online tools with tiered pricing. These businesses focus on streamlined onboarding, efficient customer support, and scalable processes. While the individual contract value is lower, the sheer volume of customers generates significant revenue. Automating processes, like complex invoicing with Tabs, is key for these businesses. This allows them to efficiently manage a large volume of transactions.

The strategic implications of these models are significant. If your ACV is too low, you may need to adjust your pricing tiers or add more value to your offerings to increase the average contract size. This could involve bundling features, offering premium support options, or focusing on a niche market. Conversely, if your ACV is high, you might consider expanding your customer base with more affordable plans to attract a wider range of users. This could involve introducing a freemium model, offering tiered pricing, or developing a self-service product version. Flexible payment options, like those offered by Tabs, can be crucial for adapting to different pricing strategies.

Leveraging Automated Systems for ACV Management

For SaaS businesses dealing with complex recurring billing and a high volume of contracts, automated billing software like Tabs can significantly streamline ACV calculations and financial reporting. Automated systems ensure accurate data, reduce manual effort, and provide real-time insights into your ACV, enabling more effective financial management. Consider using software tools that automate ACV calculations according to your standardized policies. This is especially important for companies with high ACVs, where automated systems for billing and tracking revenue become essential for managing complex billing processes.

Automated systems offer several key advantages:

- Improved Accuracy: Eliminating manual calculations reduces the risk of human error, leading to more precise ACV figures. This is crucial for accurate revenue forecasting and financial planning.

- Increased Efficiency: Automation frees up your finance team from tedious manual tasks, allowing them to focus on more strategic activities like analyzing ACV trends and identifying opportunities for growth. Extracting key contract terms with AI can further enhance efficiency.

- Real-Time Visibility: Automated systems provide up-to-the-minute data on your ACV, giving you a clear and current view of your business's financial health. Robust reports on key metrics can offer valuable insights for finance teams.

- Better Decision-Making: With accurate, real-time ACV data at your fingertips, you can make more informed decisions about pricing, sales strategies, and customer retention efforts. By tracking the average contract value for each sales rep or team, you can identify top performers and areas for improvement.

By automating your ACV management, you can gain a competitive edge in the SaaS market. Features like automated complex invoicing, support for any payment type, and simplified revenue recognition offered by platforms like Tabs can significantly contribute to optimizing your financial operations and driving business growth.

Using ACV in Benchmarking and Upselling

ACV isn't just a number; it's a powerful tool for understanding your customers and growing your business. Let's explore how you can use ACV for benchmarking sales performance and identifying upselling opportunities.

ACV and Sales Performance

Tracking the average contract value for each sales rep or team provides valuable insights into individual performance and overall sales effectiveness. If one sales rep consistently closes deals with a higher ACV, analyze their techniques and share those best practices with the team. This knowledge sharing can improve everyone's performance and drive overall sales growth. Conversely, if a rep's ACV is consistently lower, identify areas for improvement and provide additional training or resources. ACV can be a key performance indicator (KPI) for evaluating sales success and identifying areas for targeted coaching.

Identifying Upselling Opportunities with ACV

ACV can be instrumental in identifying upselling opportunities. By analyzing customer ACVs, you can pinpoint customers with lower-than-average contract values who might be receptive to upgrades. Identifying these customers allows you to tailor your sales and marketing efforts, offering them additional features, services, or higher-tier plans that better meet their needs. This targeted approach can increase customer lifetime value and boost overall revenue. For example, if a customer is using a basic plan and their ACV is significantly lower than the average, they might be a good candidate for an upgrade to a premium plan with more features and benefits. This data-driven approach ensures you're focusing your efforts on the customers most likely to convert to higher-value plans.

Beyond upselling, ACV data can inform strategic decision-making across your business. Understanding your average contract value helps you make informed choices about pricing and packaging. If your ACV is too low, you might consider adjusting your pricing tiers or adding more value to your offerings to increase the average contract size. A higher ACV can also give you the flexibility to offer more competitive pricing on lower-tier plans to attract a wider range of customers. Regularly reviewing your ACV can help you fine-tune your pricing strategy and optimize your revenue streams.

Finally, segmenting your customers based on ACV allows you to identify your most valuable accounts and ensure they receive the highest level of support and attention. This personalized approach can foster stronger customer relationships and increase retention rates. By understanding the value each customer brings to your business, you can allocate resources effectively and prioritize customer success initiatives. Robust reporting on ACV can provide a clear picture of your customer base and inform your customer success strategies.

Final Thoughts on Annual Contract Value

By now, you’ve seen how this powerful metric sheds light on the annual value of your contracts, giving you the insights you need to make smart decisions about where to focus your time, energy, and resources.

But ACV works best when paired with other financial metrics like ARR. Together, they create a comprehensive picture of your company’s financial landscape, helping you navigate the ups and downs of running a successful business.

Putting this metric to work starts with making it a central part of your business strategy. You can forecast your revenue with greater accuracy, evaluate your sales team’s performance, and retain your high-value customers. It’s all about prioritizing the contracts that matter most and aligning your efforts to maximize your revenue potential.

Managing B2B contracts and streamlining your accounts receivable process can be a challenge, but that’s where Tabs can help. Our AI-powered platform simplifies contract management and automates the AR process, giving you the tools you need to boost your cash flow and drive sustainable growth. By integrating Tabs into your financial strategy, you can take your ACV analysis to the next level and unlock new opportunities for success.

Related Articles

Frequently Asked Questions

What's the simplest way to explain Annual Contract Value (ACV)? It's the average annual revenue you expect from a single customer contract. Think of it as the yearly worth of one customer relationship, based on their agreement with you.

How does ACV differ from Total Contract Value (TCV)? TCV is the total value of the entire contract over its full duration, while ACV breaks that down to an annual average. So, a three-year contract for $30,000 has a TCV of $30,000 but an ACV of $10,000.

Why is understanding both ACV and Annual Recurring Revenue (ARR) important for my business? ACV helps you analyze individual customer relationships and set pricing strategies, while ARR gives you a broader view of your total recurring revenue and helps with financial forecasting. They work together to provide a complete picture of your business's financial health.

What are some common pitfalls to avoid when calculating ACV? Inconsistencies in handling variable contract terms (like different durations or one-time fees) can lead to inaccurate ACV calculations. Establish a standardized method and ensure your team follows it consistently. Using automated billing software can help maintain accuracy and consistency.

How can I use ACV to improve my business strategy? ACV can inform pricing decisions, help identify upselling opportunities, and guide resource allocation for customer retention. By understanding the value of different customer segments, you can tailor your approach and maximize your overall revenue potential.