Running a subscription business? Then understanding Annual Recurring Revenue (ARR) is mission-critical. It's the north star metric that guides your financial planning, benchmarks your success, and attracts investors. This post breaks down everything you need to know about ARR, from a clear definition and explanation of its importance, to how to calculate it accurately. Let's get started.

We'll also explore the factors that can impact ARR, from customer churn and pricing strategies to market trends and evolving subscription models. Get ready to master ARR and take your subscription business to the next level.

Key Takeaways

- ARR is the heartbeat of your subscription business. This north star metric provides a clear picture of your predictable income, empowering you to make data-driven decisions for sustainable growth. Understanding ARR is fundamental to accurate forecasting, strategic planning, and attracting investment.

- Accurate ARR calculation is essential. Avoid common mistakes by focusing on recurring revenue, normalizing subscription terms, and accounting for discounts and contract changes. Utilize billing software like Tabs to automate calculations and gain deeper financial insights.

- Customer-centric strategies drive ARR growth. Prioritize customer acquisition and retention through exceptional experiences, effective pricing, and ongoing support. Leverage data analytics to understand customer behavior and optimize your strategies for long-term ARR growth.

What is Annual Recurring Revenue (ARR)?

Annual Recurring Revenue (ARR) is the lifeblood of any subscription business. It's a north star metric that tells you how much recurring revenue you can expect from your customers over a year. Think of it as the predictable engine driving your business forward.

Understanding ARR is crucial for forecasting, budgeting, attracting investment, and ultimately, growing your business. This metric helps you see the big picture of your financial health and make informed decisions about the future.

ARR for Subscriptions: Why It Matters

ARR represents the normalized yearly value of your recurring revenue streams. It doesn't include one-time purchases or variable fees. Instead, it focuses on the predictable income you receive from subscriptions. This provides a clear and consistent view of your revenue performance, making it easier to track progress and identify trends.

For subscription businesses, ARR is a key indicator of long-term growth potential and overall financial stability. It's the foundation upon which you can build a sustainable and thriving business.

Want to secure funding? ARR is often the first thing investors look at. Need to make strategic decisions about your product or pricing? ARR provides the essential data you need.

How Does ARR Differ From Other Metrics?

ARR is often confused with other financial metrics, but it's important to understand the distinctions. Total revenue, for example, encompasses all income sources, including one-time sales, professional services, and other non-recurring revenue streams. ARR, on the other hand, zeroes in specifically on the recurring portion generated by subscriptions. This focused view allows you to assess the health and growth of your subscription model independently from other business activities.

Another key difference is between ARR and Monthly Recurring Revenue (MRR). While both focus on recurring subscription revenue, MRR provides a short-term, month-to-month snapshot, while ARR offers a broader, annual perspective. The Corporate Finance Institute offers a helpful breakdown of the difference between ARR and MRR.

Think of MRR as a tactical metric for managing short-term performance, while ARR is a strategic metric for long-term growth and valuation. By focusing on ARR, you gain a clearer understanding of your business's overall trajectory and its ability to generate sustainable revenue growth.

ARR vs. Total Revenue

It’s easy to confuse ARR with total revenue, but they represent distinct aspects of your business’s financials. Total revenue encompasses all income streams, from one-time sales and professional services to recurring subscriptions. In contrast, ARR focuses only on the predictable, recurring portion generated by subscriptions. This targeted view helps you assess the health and growth of your subscription model independently from other business activities, which is critical for SaaS businesses focused on long-term growth.

ARR vs. MRR for Different Subscription Lengths

ARR and Monthly Recurring Revenue (MRR) both measure recurring subscription revenue, but they differ in scope. MRR provides a short-term, monthly snapshot, while ARR offers a broader, annual perspective. Think of MRR as your tactical metric for managing short-term performance, while ARR is your strategic compass for long-term growth and valuation. For a deeper dive into these metrics, the Corporate Finance Institute offers helpful resources.

Regardless of individual subscription lengths—whether monthly, quarterly, or annual—ARR provides a standardized annual view. This allows you to compare performance across different subscription models and make informed decisions about pricing and growth strategies. A $10 monthly subscription translates to $120 in ARR, just like a $120 annual subscription. This standardization makes ARR invaluable for long-term planning and forecasting.

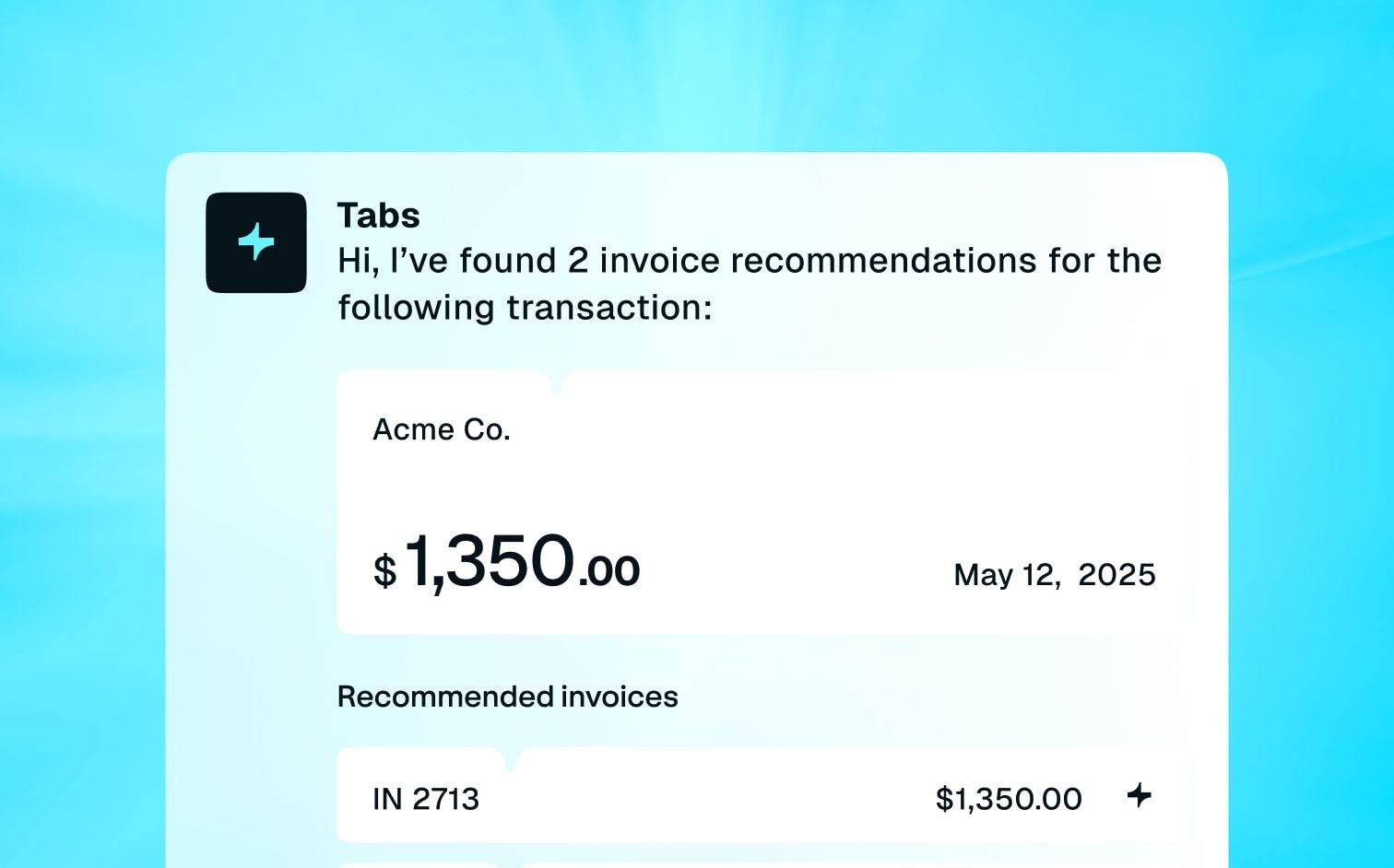

Platforms like Tabs can automate these calculations, providing accurate ARR insights regardless of how complex your subscription terms are. This automation frees up your time so you can focus on what truly matters—growing your SaaS business.

Calculating Annual Recurring Revenue

Understanding your Annual Recurring Revenue is crucial for the financial health of any subscription business. It provides a clear picture of your predictable income stream, allowing you to make informed decisions about growth and future investments. Let's break down how to calculate ARR accurately.

The ARR Formula: Simple and Effective

Calculating ARR is straightforward. You're totaling the value of your annual subscriptions, factoring in any additional recurring revenue from add-ons or upgrades, and then subtracting lost revenue from cancellations and downgrades. Think of it as a snapshot of your recurring revenue, normalized to a single year.

ARR = (sum of subscription revenue for the year + recurring revenue from add-ons and upgrades) - revenue lost from cancellations and downgrades that year

This gives you a clear view of the revenue you can reliably expect year after year.

Calculating Committed Annual Recurring Revenue (CARR)

While ARR provides a valuable overview of your recurring revenue, Committed Annual Recurring Revenue (CARR) offers a more conservative and arguably more realistic perspective. CARR focuses solely on the recurring revenue that's locked in from existing customer contracts, excluding any potential revenue from new sales or upsells. It’s like looking at the bedrock of your revenue stream—the revenue you can count on, no matter what.

This makes CARR particularly useful for financial planning and forecasting, giving you a clear picture of your predictable revenue base. It’s essential for making sound business decisions, especially when it comes to allocating resources and projecting growth.

Calculating CARR is similar to calculating ARR but with a key difference: you only include the recurring revenue from currently active contracts. For example, if a customer signs a two-year contract for your software, you’d only include the value of the remaining contract term in your CARR calculation. So, if one year remains on that contract, you’d include that year's worth of revenue. Any potential renewals or expansions beyond that initial term are excluded. This focus on committed revenue makes CARR a powerful tool.

Understanding both ARR and CARR provides a comprehensive view of your recurring revenue, enabling you to make more informed decisions about the future of your business. For a deeper dive into ARR and other key SaaS metrics, check out this helpful resource from SaaS Academy.

Common ARR Calculation Mistakes to Avoid

While the ARR formula itself is simple, there are some common pitfalls to watch out for. One frequent mistake is confusing ARR with cash flow. Remember, ARR focuses solely on recurring revenue, not all cash coming into your business.

Cash flow encompasses all cash transactions, including one-time purchases, expenses, and investments. Keeping these two metrics distinct is key for accurate financial analysis.

Another common mistake is not accounting for different subscription terms. Make sure to normalize all subscriptions to a 12-month period for accurate ARR calculations. For example, if a customer pays $200 every six months, their annualized contribution to ARR would be $400.

Another important consideration is how you handle discounts and late payments. While discounts impact what customers pay, they shouldn't be deducted from your ARR calculation. Your ARR should reflect the full value of the subscription, regardless of discounts offered. Similarly, late payments don't change the subscription value, so they shouldn't affect your ARR calculation.

By understanding these nuances and breaking down your ARR into its core components – new customers, renewals, upgrades, downgrades, and churn – you gain a much more precise understanding of your business's financial performance. This granular view allows you to pinpoint areas for improvement and make strategic decisions to drive growth. Consider using billing software, like Tabs, to automate these calculations and gain deeper insights into your recurring revenue streams.

Why is Tracking ARR Important?

Annual Recurring Revenue (ARR) is more than just a number; it's the heartbeat of your subscription business. It provides a high-level view of your predictable revenue stream, offering crucial insights for growth and strategic planning. Understanding and effectively managing your ARR is fundamental to long-term success.

ARR for Financial Planning and Forecasting

ARR provides a stable foundation for financial forecasting. Unlike one-time sales, recurring revenue offers a degree of predictability, allowing you to project future income and allocate resources effectively. This long-term perspective is essential for making informed decisions about product development, marketing campaigns, and overall business strategy.

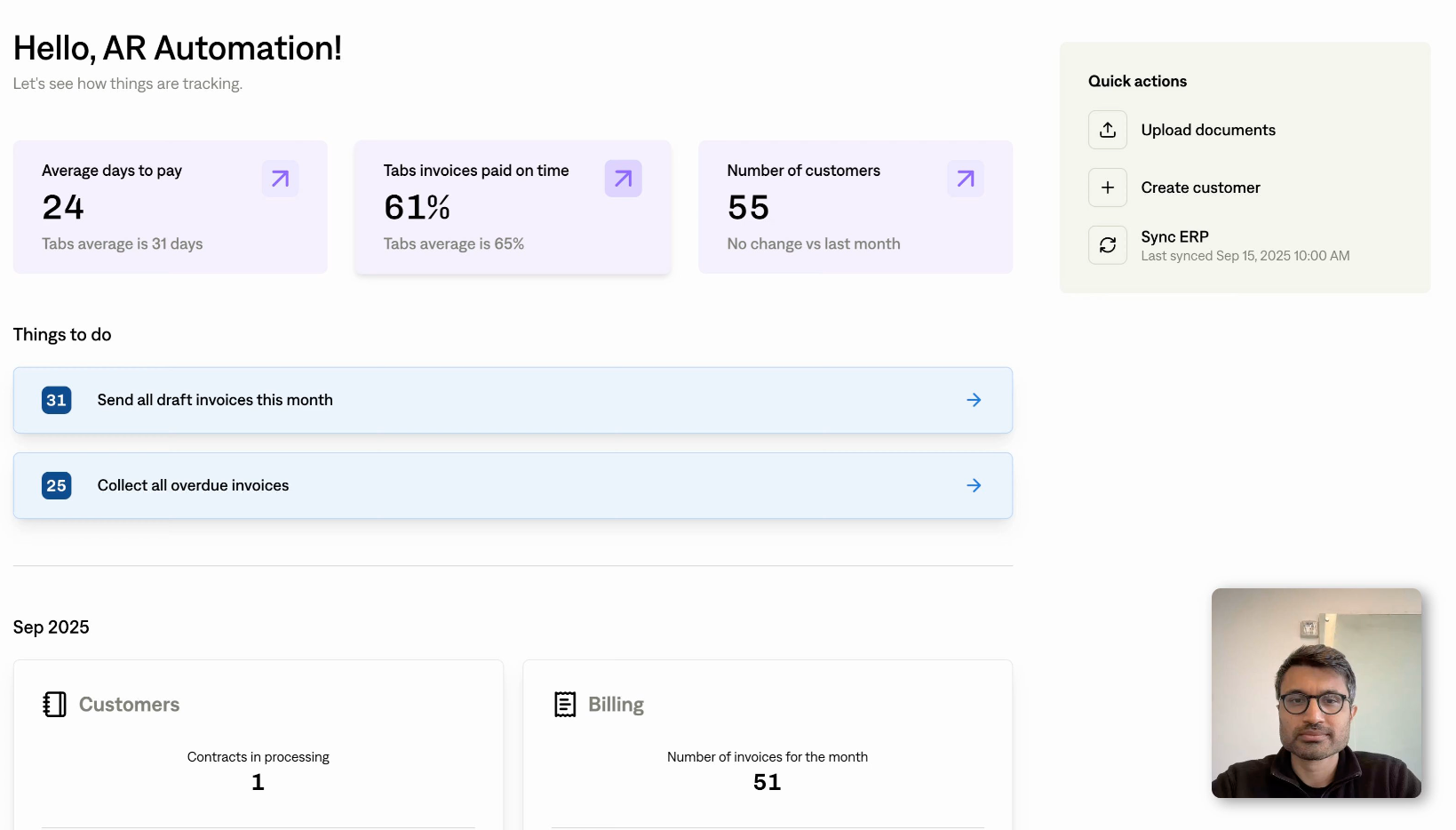

While Monthly Recurring Revenue (MRR) offers a short-term snapshot, ARR gives you the bigger picture, crucial for setting realistic goals and planning for sustainable growth. Accurate ARR forecasting enables you to anticipate potential challenges and opportunities, ensuring your business remains financially healthy. Tools like Tabs reporting can help you visualize and analyze your ARR data, making forecasting more efficient and accurate.

Using ARR to Attract Investors & Value Your Business

In the eyes of investors, ARR is a key indicator of a subscription business's health and potential. It demonstrates the stability and predictability of your revenue streams, making your business more attractive to potential investors. A healthy ARR signifies not only current success but also the promise of future growth and profitability. Investors use ARR as a benchmark for evaluating a company's financial stability and its ability to generate consistent returns.

By effectively managing and growing your ARR, you strengthen your company's valuation and attract investment capital to fuel further expansion. Demonstrating a clear understanding of your ARR and its growth trajectory is essential for securing funding and building investor confidence.

Relationship Between ARR and Company Valuation

For SaaS businesses, especially those seeking venture capital or planning an exit, ARR is critical. It's a cornerstone of how investors evaluate your company's health and potential. A consistently growing ARR shows the stability and predictability of your revenue, making your company more appealing to investors. It signals not only current success, but also the potential for future growth and profitability. Investors use ARR as a key benchmark for assessing a company's financial stability and its ability to generate consistent returns.

What a $1 Million ARR Means

Reaching $1 million ARR is a major milestone for any SaaS business. As Bessemer Venture Partners points out, it marks your transition from a promising idea to a revenue-generating business. Hitting this milestone signals that you've likely found product-market fit, can acquire and retain customers, and are ready to scale. It's a strong indicator of viability and often a requirement for Series A funding. This achievement unlocks new growth opportunities and validates the effort invested in building your business.

Benchmark Performance & Measure Growth with ARR

ARR serves as a vital benchmark for measuring the overall performance and growth of your subscription business. Tracking ARR over time allows you to identify trends, assess the effectiveness of your sales and marketing efforts, and make data-driven decisions to optimize your strategies. A strong ARR growth rate indicates a healthy and expanding business, while stagnant or declining ARR signals the need for adjustments.

Understanding what constitutes a good ARR growth rate for your industry and stage of business is crucial for setting realistic targets and measuring your progress. Regularly monitoring your ARR and comparing it to industry benchmarks provides valuable insights into your competitive position and helps you identify areas for improvement. By leveraging ARR data, you can fine-tune your operations, improve customer acquisition and retention, and drive sustainable growth.

What Constitutes a "Good" ARR?

Defining a "good" ARR isn’t one-size-fits-all. It depends on several factors, including your industry, business model, and stage of growth. Early-stage startups often prioritize rapid ARR growth—sometimes exceeding 100% year over year—as they focus on acquiring market share. As companies mature, a healthy ARR growth rate typically sits between 20% and 40%. Established companies might aim for a more sustainable growth rate of 10% to 20%.

Comparing your ARR growth to industry benchmarks offers helpful context. Resources like the Maxio SaaSpedia offer insights into typical ARR growth rates for different SaaS segments. However, remember that these are just averages. A "good" ARR for your business ultimately depends on your specific goals and circumstances.

Understanding ARR Growth Rate

Your ARR growth rate reveals how quickly your recurring revenue is expanding. It's a critical indicator of your business's overall health and trajectory. Calculate your ARR growth rate by subtracting your previous year's ARR from your current year's ARR. Then, divide the result by the previous year's ARR and multiply by 100 to express it as a percentage.

Tracking ARR over time allows you to identify trends and assess the effectiveness of your sales and marketing strategies. Consistent growth suggests a successful business model, while declining or stagnant ARR signals a need for adjustments. Understanding a good ARR growth rate for your specific situation is crucial for setting realistic targets and measuring progress. Regularly monitoring your ARR and comparing it to industry benchmarks, as highlighted by Paddle and the Corporate Finance Institute, provides valuable insights into your competitive position and helps you identify areas for improvement.

Factors That Influence ARR

Several key factors influence your ARR, and understanding them is crucial for sustainable growth. Let's break down these elements:

Customer Acquisition and Its Impact on ARR

Attracting new customers is the most obvious way to increase ARR. Effective strategies include refining your pricing, broadening your market reach, and continually improving your product features. Think about what your ideal customer truly values and how you can deliver that better than anyone else.

Optimizing these areas is essential for growing ARR for SaaS and subscription-based businesses. Consider leveraging content marketing and targeted advertising to reach a wider audience and showcase the value of your product.

Managing Retention and Churn to Maximize ARR

Holding onto your existing customers is just as important as acquiring new ones. Customer retention directly impacts your recurring revenue, especially in a subscription model. A high churn rate can quickly offset your efforts to acquire new customers. Regularly collecting customer feedback is a smart way to gauge satisfaction and identify potential churn risks.

Forbes offers helpful advice on improving customer satisfaction and retention. Addressing customer concerns proactively and providing exceptional customer support can significantly improve retention rates.

Upselling and Cross-Selling: Grow Your ARR

Upselling and cross-selling are powerful levers for ARR growth. By offering existing customers additional products, upgrades, or related services, you increase their lifetime value and, consequently, your ARR. For example, if a customer is currently on a basic plan, you might upsell them to a premium plan with more features. Or, you could cross-sell a complementary product that enhances their current subscription.

Consider using Tabs's automated invoicing software to streamline these processes and manage the complexities of tiered pricing. Scaltup also advises that optimizing your pricing strategy and implementing effective upselling and cross-selling techniques are crucial for maximizing recurring revenue.

Strategies to Improve Your ARR

Growing your Annual Recurring Revenue involves a multi-pronged approach. It's about acquiring new customers, yes, but also nurturing your existing customer base and encouraging them to spend more. Let's break down some key strategies.

Improve Customer Retention Through Experience

Happy customers are loyal customers. Prioritizing customer satisfaction translates directly to higher retention rates and a healthier ARR. Regularly collecting customer feedback is crucial. Use surveys, feedback forms, and even social media to understand customer needs and identify areas for improvement.

This feedback offers valuable insights, allowing you to address pain points and enhance the overall customer experience. Actively listening to your customers is a powerful tool for business improvement. A positive customer experience fosters loyalty, reduces churn, and directly impacts your bottom line.

Effective Pricing Strategies for ARR Growth

Pricing isn't just about numbers; it's about the perceived value you offer. Are you charging what your product is truly worth? Value-based pricing ensures your prices reflect the value you deliver.

Regularly review your pricing strategy to ensure it aligns with market trends and customer expectations. Optimizing your pricing can significantly impact your ARR. Experiment with different pricing models, such as tiered pricing, to cater to various customer segments and maximize revenue. Tabs offers insights into pricing models to help you make data-driven decisions.

Leverage Data Analytics to Optimize ARR

Analyzing customer behavior, churn rates, and other key metrics reveals valuable insights into what's working and what's not. Analyzing customer feedback helps identify patterns and prioritize areas for improvement. Incorporate ARR into your financial models for accurate planning and valuation. Robust reporting tools, like those offered by Tabs, can provide the data you need to make informed business decisions.

Sales Tracking Tools for Accurate ARR Calculation

Effective sales tracking is essential for accurate ARR calculation. A robust Customer Relationship Management (CRM) system provides a central hub for all customer interactions and sales data. To truly maximize your ARR calculations, consider incorporating these tools:

- Visualization and dashboard tools offer real-time reporting insights into your sales performance, allowing you to quickly identify trends and potential issues. Real-time dashboards, like those offered by Tabs, can be invaluable for monitoring key metrics and making data-driven decisions.

- Real-time analytics tools go beyond basic reporting, offering deeper analysis of your sales data to uncover hidden patterns and opportunities. These tools can help you understand which sales strategies are most effective and identify areas for improvement.

- Automation tools streamline data capture and logging, reducing manual effort and minimizing errors. Automating these processes frees up your team to focus on higher-value activities, like building customer relationships and closing deals. Features like Tabs’s AI-powered contract extraction can automate key parts of this process.

By integrating these tools with your CRM, you create a powerful system for tracking sales and calculating ARR accurately. This precise data empowers you to make informed decisions, optimize your sales strategies, and drive revenue growth.

Onboarding and Customer Success for ARR Growth

First impressions are crucial. A smooth onboarding process sets the stage for a positive, long-term customer relationship. Ensure new customers understand your product's value and how to use it effectively. Effective customer retention strategies significantly increase ARR and foster sustainable growth.

Invest in customer success programs to provide ongoing support and resources. ARR represents the total recurring revenue from active subscriptions, so keeping those subscriptions active is paramount. By focusing on customer success, you're not just improving ARR today—you're building a foundation for sustained growth.

ARR vs. MRR: Understanding the Differences

Annual Recurring Revenue and Monthly Recurring Revenue are two key metrics for subscription businesses. While related, they offer different perspectives on your revenue stream. ARR provides a high-level overview of your predictable revenue over a year. Think of it as the big picture of your financial health and growth potential.

MRR, in contrast, focuses on your recurring revenue each month, providing a more granular view. This makes MRR ideal for tracking short-term performance and making quick operational adjustments.

When to Use ARR vs. MRR

ARR is your go-to metric for long-term strategic planning. It helps you forecast revenue trends, secure investments, and understand your company's overall valuation. This long-term perspective is essential for attracting investors and retaining top talent.

MRR, on the other hand, is essential for day-to-day operations. Use it to monitor immediate performance, identify emerging trends, and make tactical decisions that impact your short-term revenue goals. Understanding both metrics empowers you to make informed decisions at both the strategic and operational levels.

Converting Between ARR and MRR

Converting between ARR and MRR is straightforward. To calculate ARR from your MRR, simply multiply your MRR by 12. To determine your MRR from your ARR, divide your ARR by 12.

For example, an MRR of $5,000 translates to an ARR of $60,000. Conversely, an ARR of $120,000 equals an MRR of $10,000. This simple conversion allows you to seamlessly switch between these two valuable metrics and gain a comprehensive understanding of your revenue.

Tracking and Analyzing Your ARR

Knowing how to calculate your ARR is just the first step. Regularly tracking and analyzing this metric is crucial for understanding your business's financial health and making informed decisions. This means having systems in place to monitor ARR, identify trends, and understand the factors that contribute to revenue changes.

Tools and Software for ARR Management

Thankfully, several tools can help manage and calculate your ARR, freeing up your time to focus on other aspects of your business. Choose software that automatically tracks both ARR calculations and related metrics. Tabs not only does not, but also offers robust reporting features designed for recurring revenue businesses, providing clear insights into your key financial metrics. You can extract key contract terms with AI, automate complex invoicing, support any payment type, and simplify revenue recognition.

Streamlining Recurring Billing and Revenue Recognition with Tabs

Managing recurring billing and revenue recognition can be a headache for subscription businesses. Thankfully, tools like Tabs streamline these processes, freeing you to focus on growth. Accurate ARR calculation is essential. Avoiding common mistakes—like neglecting to normalize subscription terms or miscalculating discounts—is key.

Tabs automates these often complex calculations, ensuring accuracy and efficiency. Choosing software that automatically tracks ARR and related metrics is crucial for scaling subscription businesses. This automation not only saves you time but also provides deeper insights into your recurring revenue streams. Using billing software for ARR management empowers you to make data-driven decisions.

With Tabs, you can easily track key metrics, identify trends, and understand the factors influencing your revenue. Our robust reporting features are designed specifically for recurring revenue businesses. We help you break down your ARR into its core components—new customers, renewals, upgrades, downgrades, and churn—providing a precise understanding of your financial performance, allowing you to pinpoint areas for improvement and make strategic decisions to drive growth, much like the Corporate Finance Institute suggests in its ARR overview.

Integrating ARR Tracking with Other Key Metrics

Don't look at ARR in isolation. For a comprehensive understanding of your business's performance, integrate ARR tracking with other key metrics. Annual Recurring Revenue helps with forecasting, attracting investors, and retaining talent. Combining ARR with your MRR provides a more granular view of your revenue streams, useful for both long-term planning and short-term adjustments.

Think of ARR as a vital sign for your subscription business, offering insights into your financial health and growth potential. By connecting these different data points, you can build a more complete picture of your business's trajectory and make more strategic decisions.

Other Important Metrics Related to ARR

While ARR provides a crucial high-level view of your recurring revenue, understanding its relationship to other metrics offers a more nuanced understanding of your business's financial health. Let's explore some related metrics that provide valuable context and insights.

One common point of confusion is the difference between ARR and total revenue. Total revenue encompasses all income sources, including one-time sales, professional services, and other non-recurring revenue streams. ARR, however, focuses solely on the predictable, recurring portion generated by subscriptions. This distinction is crucial for accurately assessing the health and growth of your subscription model, separate from other business activities.

Another key relationship to understand is that between ARR and Monthly Recurring Revenue (MRR). MRR provides a month-to-month snapshot of your recurring revenue, making it a tactical metric for monitoring short-term performance and making quick adjustments. ARR, on the other hand, offers a broader, annual perspective, making it a strategic metric for long-term growth and valuation.

Combining ARR with MRR gives you a comprehensive understanding of your revenue performance. This granular view is useful for both long-term planning and short-term adjustments, enabling you to make data-driven decisions at both the strategic and operational levels. For more on using ARR alongside other metrics, check out our reporting resources at Tabs.

Overcoming Common ARR Challenges

Calculating your Annual Recurring Revenue (ARR) is more nuanced than simply totaling yearly subscriptions. Several factors can impact ARR calculations and skew your business’s financial health. Let’s break down common ARR challenges and how to address them.

Managing Fluctuations in Your Subscriptions

Subscriptions naturally fluctuate. Customers join and leave, upgrade or downgrade their plans—it’s the SaaS lifecycle. However, significant swings in subscriber numbers complicate forecasting and planning. Understanding ARR is essential for forecasting revenue, setting realistic goals, and making informed decisions about product development, pricing, and customer acquisition.

To manage fluctuations, prioritize strategies that promote predictable, recurring revenue. Closely monitor your customer churn. If you see a spike, investigate. Are customers leaving due to pricing, features, or customer service?

Addressing these issues can stabilize your subscriber base and your ARR. Consider offering longer-term contracts with incentives, like a discounted rate, to retain customers and reduce churn.

Accounting for Discounts and Promotions in ARR

Discounts and promotions attract new customers and drive sales, but they can complicate ARR calculations. Calculating ARR involves summing the yearly recurring charges of all paying customers. It’s important to distinguish ARR from cash flow and account for discounts and late payments. Your ARR should reflect the actual recurring revenue you can expect, not the sticker price.

Track discounts meticulously. Differentiate between one-time discounts and recurring discounts. One-time discounts, like a sign-up bonus, don’t impact long-term ARR. Recurring discounts, such as an introductory rate, should be factored into your ARR calculations for the discount period.

Thankfully, Tabs automates these calculations.

Handling Contract Changes and Upgrades

Contract changes, like upgrades, downgrades, and add-ons, impact ARR. Upgrades and add-ons increase ARR, while downgrades decrease it. Accurately reflecting these changes is crucial for a clear financial picture. Any expansion revenue from add-ons or upgrades affects the annual subscription price.

Implement a system for tracking contract modifications. When a customer upgrades or downgrades, immediately update their subscription value in your ARR calculations. For add-ons, factor in their recurring revenue.

Automated billing software like Tabs handles complex contract modifications, ensuring accurate ARR calculations. This frees you to focus on strategic decisions, not manual data entry.

Using Customer Feedback to Grow ARR

Customer feedback is invaluable for any business, especially those focused on recurring revenue. It provides direct insight into what your customers value, their pain points, and how you can better tailor your offerings. This, in turn, can significantly impact your ARR. By actively seeking and implementing customer feedback, you create a cycle of improvement that fosters loyalty, reduces churn, and fuels revenue growth.

Implementing Effective Feedback Loops

Consistent feedback loops are crucial for gathering insights and iterating on your product or service. Think of it as an ongoing conversation with your customers. Customer feedback drives business improvement. Analyzing this feedback helps you identify patterns and prioritize areas for improvement, enabling data-driven decisions.

Integrate feedback mechanisms into every stage of the customer journey. This could include short in-app surveys, personalized email requests for feedback, or even dedicated customer forums. The key is to make sharing easy for customers and demonstrate that their input is valued. Tabs' robust reporting tools can help you analyze key metrics and identify areas where customer feedback can drive positive change.

Drive Retention with Customer Surveys

Surveys are powerful tools for collecting structured feedback. Whether online or offline, surveys let customers express their opinions on specific aspects of your business. Send targeted email surveys after key milestones, such as onboarding or a product update. Keep surveys concise and focused, with clear questions that elicit actionable insights.

For example, ask about satisfaction with specific features, their support experience, or their likelihood to recommend your service. Collecting this feedback is key to measuring and improving customer satisfaction and retention. By understanding what influences customer loyalty, you can proactively address potential issues and develop strategies to keep customers engaged and subscribed, directly impacting ARR.

Retaining existing customers is often more cost-effective than acquiring new ones. Tabs's end-to-end services can streamline your financial processes, freeing up resources for customer retention.

Future-Proofing Your ARR Strategy

A strong ARR provides a solid foundation for your business, but the subscription landscape is constantly changing. To keep your ARR trending upwards, you need to adapt to evolving subscription models and prepare for market shifts. This proactive approach will help you maintain a healthy ARR and achieve sustainable growth.

Adapting to Evolving Subscription Models

The subscription world is dynamic. New models are always emerging, from tiered pricing to usage-based subscriptions and everything in between. Understanding these models and how they might impact your business is crucial for long-term success.

For example, value-based pricing—charging based on the perceived value your product offers—is gaining traction. This model requires a deep understanding of your customer and what they consider valuable.

Experimenting with different models can help you find the right fit for your business and maximize your ARR. Tabs offers resources and insights on pricing models to help you make informed decisions.

Staying informed about industry trends is also essential. Keep an eye on what your competitors are doing and how customer preferences are changing. Annual recurring revenue (ARR) is a north star metric for subscription businesses, providing a forecast of revenue and a gauge of the business's health.

Understanding how different subscription models influence ARR is key to informed decision-making and strategic growth. As subscription models evolve, so too should your strategies for acquiring and retaining customers.

Preparing for Market and Economic Shifts

Market conditions and the economy can significantly impact your ARR. A downturn can lead to increased churn as customers look to cut costs. Having a long-term view of your company's progress is essential, while monthly recurring revenue (MRR) offers a better lens for short-term analysis. By closely monitoring your ARR, you can identify potential problems early on and take steps to mitigate them.

This might involve adjusting your pricing, offering discounts, or doubling down on customer retention efforts. Effective customer retention strategies can significantly increase ARR and foster sustainable business growth.

Diversifying your customer base can also help protect your ARR from market volatility. If you're heavily reliant on a single industry or customer segment, a downturn in that area could have a disproportionate impact on your revenue. By expanding into new markets or targeting different customer profiles, you can create a more resilient business that's better equipped to weather economic storms.

Monitoring ARR helps businesses identify areas for improvement, such as increasing sales, renewals, and upgrades, while minimizing downgrades and churn. Tools like Tabs' reporting features can provide valuable insights into your key metrics, empowering you to make data-driven decisions and optimize your ARR strategy for long-term success.

Related Articles

Frequently Asked Questions

What exactly is Annual Recurring Revenue (ARR), and why is it so important for my business?

ARR is essentially the predictable yearly revenue you can expect from your subscriptions. It gives you a clear picture of your financial health, helps you forecast future growth, and is a key metric investors look at. Think of it as the bedrock of your subscription business's financial stability. It's different from your total revenue, which includes one-time sales, and from monthly recurring revenue (MRR), which offers a shorter-term view.

How do I calculate ARR, and what are some common mistakes to avoid?

Calculating ARR involves adding up the value of your annual subscriptions, including recurring add-ons or upgrades, and subtracting any lost revenue from cancellations or downgrades. Be careful not to confuse ARR with cash flow, which includes all cash transactions. Also, remember to normalize all subscriptions to a 12-month period, even if customers pay on a different schedule. Using billing software can automate these calculations and help you avoid errors.

How can I actually use ARR to improve my business?

ARR is a powerful tool for planning and decision-making. Use it to forecast your finances, set realistic growth targets, and attract investors. By tracking ARR over time, you can identify trends, measure your performance against competitors, and make data-driven adjustments to your strategy. A healthy ARR can also boost your company's valuation and make it more attractive to potential investors.

What's the difference between ARR and MRR, and when should I use each one?

ARR provides a broad, annual overview of your recurring revenue, while MRR offers a closer look at your monthly performance. Use ARR for long-term strategic planning and forecasting, and MRR for monitoring short-term trends and making operational adjustments. They're both valuable metrics, but they serve different purposes. You can easily convert between the two: multiply your MRR by 12 to get your ARR, or divide your ARR by 12 to get your MRR.

What are some of the biggest challenges in managing ARR, and how can I overcome them?

Fluctuating subscriber numbers, discounts and promotions, and contract changes can all make managing ARR tricky. To address these challenges, focus on strategies that promote stable, recurring revenue. Closely monitor your churn rate, track discounts meticulously, and implement a system for managing contract modifications. Using billing software can automate these processes and provide valuable insights into your ARR.