Juggling business finances? You're not alone. Finding ways to streamline operations and boost your bottom line is key. One area ripe for improvement? Payment processing. If manual methods or high credit card fees are eating into your profits, it's time to consider ACH processing. This electronic funds transfer system offers a secure, cost-effective way to manage payments. Let's explore how ACH processing can simplify your billing and improve your cash flow.

Key Takeaways

- ACH offers a cost-effective and efficient payment method for recurring transactions. Understanding the difference between debits and credits helps businesses and individuals optimize their finances.

- ACH transactions typically process within one to three business days. Being mindful of processing times, including cut-off times and holidays, allows for better financial planning. Same-day ACH is available for urgent payments.

- Prioritizing security and compliance is essential for ACH processing. Following best practices, including adhering to NACHA rules and open communication, protects your business and your customers.

What is ACH Processing?

ACH processing is a way to electronically move money between bank accounts. Think of it as a digital highway specifically designed for bank-to-bank transfers. It’s commonly used for recurring transactions like bill payments, peer-to-peer (P2P) money transfers through apps like PayPal and Venmo, and direct deposit payroll. Instead of using paper checks or cards, ACH securely and efficiently moves funds directly between accounts. This makes it a popular choice for businesses and individuals alike. If you've ever set up automatic bill pay or received your salary directly in your checking account, you've interacted with the ACH network.

Understanding ACH Transactions

ACH payments rely on two key mechanisms: ACH debit and ACH credit. An ACH debit pulls money from one account and deposits it into another. This is typically how automatic bill payments work. You authorize a company to debit your account for a specific amount on a recurring basis. Conversely, an ACH credit pushes money into an account. This is the method used for direct deposits, where your employer initiates the transfer of your paycheck into your bank account. These transactions flow through a network of financial institutions, with the originating bank (ODFI) sending instructions to the receiving bank (RDFI) to either debit or credit the appropriate accounts. The ODFI submits these files to an ACH operator, ensuring the secure and efficient processing of the transactions.

Who Uses ACH Processing?

The ACH network is vast, connecting virtually every bank and credit union account in the US. This interconnected system allows for seamless transactions between businesses, individuals, and government entities. Oversight of the ACH network is managed by the National Automated Clearing House Association (Nacha) which establishes the rules and regulations governing these transactions. This ensures the security and reliability of the system. Within each transaction, there are several key players: the originator (the person or entity initiating the payment), the receiver (the recipient of the funds), the ODFI, and the RDFI. Understanding these roles and the overall structure of the ACH network is crucial for effectively leveraging this payment method.

ACH for SaaS Businesses

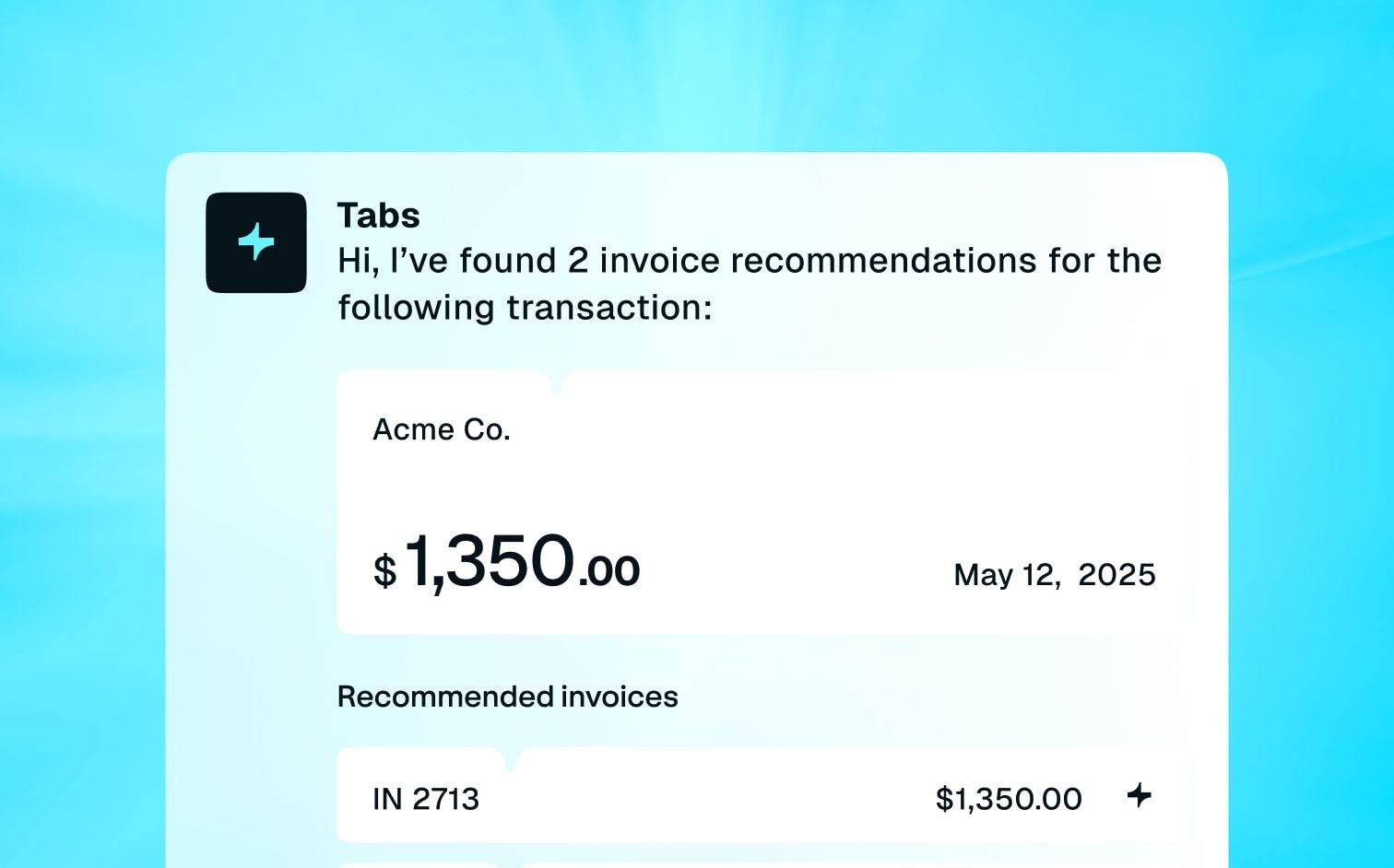

For Software as a Service (SaaS) businesses, using ACH processing can significantly improve financial operations. ACH offers a cost-effective and efficient payment method for recurring transactions, which is especially helpful for subscription-based models. By using ACH, SaaS companies can reduce transaction fees associated with credit card payments, leading to better profit margins and improved cash flow management. A platform like Tabs streamlines these financial processes with automated billing and robust reporting on key metrics. As noted by Stripe, “Understanding the difference between debits and credits helps businesses and individuals optimize their finances” (Stripe).

ACH transactions typically process within one to three business days, which allows SaaS businesses to plan their cash flow more effectively. Being mindful of processing times, including cut-off times and holidays, helps manage customer expectations and ensure timely service delivery. Features like AI-powered contract term extraction further enhance efficiency. As highlighted by Nacha, “The ACH network is vast, connecting virtually every bank and credit union account in the US,” which facilitates seamless transactions between businesses and their customers (Nacha).

Security and compliance are also crucial for SaaS businesses when implementing ACH processing. Following best practices and adhering to NACHA rules protects the business and builds trust with customers. Using a platform like Tabs ensures adherence to these crucial security and compliance measures, simplifying revenue recognition and automating complex invoicing while supporting any payment type. As stated in the ACH Guide for Developers, “Prioritizing security and compliance is essential for ACH processing” (ACH Guide for Developers).

How ACH Processing Works

ACH processing, or Automated Clearing House processing, electronically moves money between bank accounts. Think of it as a digital highway system for financial transactions. Instead of paper checks or wire transfers, ACH payments travel through this network, making the process faster, cheaper, and more efficient. This system is crucial for businesses relying on recurring billing, like subscription services or utility companies. It's also common for payroll direct deposit and online bill pay.

The ACH Process: A Step-by-Step Guide

Here's a breakdown of how an ACH payment works:

- Transaction Initiation: A customer authorizes a payment, or a business initiates a transfer. This starts the ACH process. The transaction goes through a payment processor using either an ACH credit (pushing money to someone) or an ACH debit (pulling money from someone). The originating financial institution (ODFI) and the receiving financial institution (RDFI) are key players—they act like on-ramps and off-ramps on our digital highway.

- Submission to ACH Operator: The ODFI bundles transactions and submits them to an ACH operator, like the Federal Reserve or The Clearing House. This operator acts like a central traffic controller, sorting and routing transactions to the correct RDFIs.

- Transaction Completion: The RDFI receives the transaction and deposits the funds into the recipient's account. Depending on the ACH transfer type, this can happen within hours on the same business day or be scheduled for a future date. This completes the payment.

ACH Network and Nacha Rules

The ACH network is complex but governed by rules and regulations to ensure smooth and secure operation. Nacha sets the rules and standards for all ACH transactions, covering everything from transaction types and processing times to dispute resolution. These rules protect consumers and businesses, ensuring the ACH system's security and reliability. These regulations are essential for maintaining the entire ACH process's integrity.

Understanding Nacha Operating Hours and Holidays

The ACH network operates almost 24/7, settling payments multiple times throughout each business day. More specifically, it's active for 23.25 hours each business day, according to Nacha, the governing body for the ACH network. However, the ACH network isn't a 24/7/365 operation. It's closed on weekends and federal holidays. This means transactions submitted before a weekend or holiday will typically be processed on the next business day. For time-sensitive payments, this delay can be significant, so it's crucial to plan and submit transactions accordingly. Being aware of these operating hours and holidays is essential for managing your cash flow and avoiding surprises.

Transaction Types and Rules (CCD, CTX, PPD, WEB, TEL)

ACH transactions aren't one-size-fits-all. Different transaction types cater to various payment needs, each with its own set of rules. These types are categorized for business and consumer transactions. Common business transaction types include CCD (Corporate Credit or Debit Entry) for payroll and vendor payments, and CTX (Corporate Trade Exchange) for business-to-business payments requiring addenda records. Nacha provides detailed information on these transaction types. For consumers, common types include PPD (Prearranged Payment and Deposit Entry) for recurring bill payments, WEB (Web-initiated Entry) for online payments, and TEL (Telephone-Initiated Entry) for payments authorized over the phone. Understanding the nuances of each type is crucial for ensuring compliance and optimizing your payment processes.

The Role of Prenotification

One of the challenges with ACH payments is the potential for errors, such as incorrect account numbers or insufficient funds. These errors can lead to returned payments, fees, and delays. Prenotification is a valuable tool to mitigate these risks. It’s essentially a "test" transaction, typically for a small amount (like $0.01), sent to verify an account’s validity before processing a larger payment. This small transaction confirms that the account is active and that the routing and account numbers are accurate. While not mandatory, using prenotification can save you time and money by preventing costly errors and ensuring smooth payment processing.

Same Day ACH: Processing and Limits

While traditional ACH payments typically take one to three business days to process, Same Day ACH offers a faster alternative. This expedited service allows for same-day processing, which is particularly useful for time-sensitive transactions. There are limits to Same Day ACH. Currently, the per-payment limit is $1 million, as highlighted by resources on ACH payments. The increasing adoption of Same Day ACH reflects the growing demand for faster payment processing. Understanding the capabilities and limitations of Same Day ACH can help you optimize your payment strategies and improve your cash flow management.

Types of ACH Payments

ACH transactions fall into two main categories: credits and debits. Understanding the difference between these two types is crucial for managing your business finances effectively.

ACH Credits: Sending Money

ACH credits push funds from one bank account to another. Think of it like sending a digital check. This method is commonly used for direct deposits, such as payroll, where the employer sends money to their employees' bank accounts. Businesses also use ACH credits for vendor payments, tax refunds, and other disbursements.

It's a reliable and efficient way to send money electronically, offering a smooth, streamlined experience for both the sender and the recipient. For businesses managing recurring billing, understanding ACH credits is essential for ensuring timely and accurate payments. If you're looking for an additional layer of streamlining, click here to learn how Tabs' platform can simplify complex invoicing activities.

ACH Debits: Receiving Money

ACH debits pull funds from a bank account. This is the go-to method for recurring payments like utility bills, loan repayments, and subscription services. In this scenario, the service provider withdraws the agreed-upon amount from the customer's account. ACH debits simplify recurring billing by automating the collection process, saving businesses time and reducing the risk of late payments. This automated system ensures consistent cash flow and simplifies financial reconciliation. Tabs supports various payment types to make this process seamless.

Choosing the Right ACH Payment Type

Choosing the right ACH transaction type depends on the direction of the money flow. Use ACH credits when your business is sending money, like for payroll or vendor payments. Opt for ACH debits when your business is receiving money, such as collecting recurring subscription fees or one-time payments for services rendered. By understanding this fundamental difference, you can optimize your financial operations and ensure smooth transactions.

Want even more? Click here to learn how to simplify revenue recognition with Tabs. Using the right transaction type contributes to accurate financial reporting and provides valuable insights into your key metrics. Also, explore Tabs' robust reporting tools.

ACH Processing Times

Understanding ACH processing times is crucial for managing your business's cash flow. While ACH offers a cost-effective and reliable payment method, processing times can vary. Let's break down the typical durations and factors that can influence them.

How Long Does ACH Processing Take?

Most ACH transactions are processed within a few business days. Generally, ACH debits, like collecting payments from customers, take one to three days. ACH credits, such as paying vendors or issuing refunds, typically process within one business day. This difference exists because credits often involve pushing money out, while debits involve pulling money in, which requires additional verification steps. Knowing these standard timeframes helps you forecast your finances and ensure you have sufficient funds available when needed. For more detailed information on how ACH transfers work, you can explore resources like this overview from Nacha.

Same-Day ACH Payments

Need faster payments? "Same-Day ACH" is an option. Introduced in 2016, Same-Day ACH allows for same-business-day processing, often for an added fee. This expedited service is beneficial for time-sensitive payments, such as payroll or urgent vendor payments. Nacha provides further details on Same-Day ACH and its growing popularity. While it's not as instantaneous as some other payment methods, it offers a significantly faster alternative to standard ACH processing.

What Affects ACH Processing Speed?

Several factors can influence ACH processing speed. Your financial institution's cut-off times play a significant role. Missing a cut-off time can delay processing by a full business day. It's essential to understand these deadlines and submit your ACH requests well in advance. Additionally, weekends and holidays can impact processing times, as financial institutions don't operate on these days. Streamlining your internal processes, ensuring accurate payment information, and working closely with your billing software provider can help optimize transaction timing and avoid unnecessary delays. By understanding these factors, you can better manage your expectations and ensure timely payments.

Weekends and Holidays

Weekends and holidays can significantly impact ACH processing times. Financial institutions generally don't process ACH transactions on weekends or bank holidays. This means that if a payment is scheduled to be processed on a weekend or holiday, it will typically be processed on the next business day. For example, if a direct deposit payroll is scheduled for a Saturday, it will likely be deposited into employee accounts on the preceding Friday. Similarly, bill payments due on a Sunday will usually be collected on the following Monday. It's crucial to factor in these delays when scheduling payments, especially for time-sensitive transactions. For a deeper dive into how weekends and holidays affect ACH, check out Nacha's "The ABCs of ACH”.

Direct Deposit Processing Time Variations

While most ACH transactions process within one to three business days, the exact timing can vary. One factor influencing processing time is the transaction type. Debits (pulling funds from an account) often process more quickly than credits (pushing funds into an account). This difference exists because debits, such as collecting recurring subscription payments, often involve pre-authorization and established payment schedules. Credits, like payroll direct deposits, may require additional verification, potentially adding to the processing time. Understanding these nuances can help businesses manage cash flow and anticipate when funds will be available. Stripe's resource on ACH processing times offers further insights.

Batch Processing and Its Impact on Timing

ACH transactions are processed in batches, not individually like credit card transactions. This batch processing contributes to ACH's efficiency and cost-effectiveness. The Originating Depository Financial Institution (ODFI) bundles multiple transactions and submits them to an ACH operator (like the Federal Reserve or The Clearing House). These operators act as central clearing hubs, sorting and routing transactions to the correct Receiving Depository Financial Institutions (RDFIs). This model means individual transactions within a batch depend on the overall processing schedule. Nacha's guide on how ACH works details this process and its implications for timing. Understanding batch processing helps businesses anticipate potential delays and manage payment expectations.

ACH Processing Fees

Understanding ACH processing fees is crucial for any business looking to optimize its payment processes. This section breaks down how these fees work and compares them to traditional methods.

Understanding ACH Fees

ACH payment processing offers a cost-effective and convenient way to electronically transfer money between bank accounts. It handles both recurring and one-time payments, effectively replacing paper checks, wire transfers, and even credit and debit cards for certain transactions. Typically, providers charge a small fee per transaction, which can vary based on factors like your processing volume, your provider, and any additional services included in your contract. Some providers might also charge a monthly fee for platform access. Carefully review the different pricing structures to find the best fit for your business.

ACH vs. Other Payment Methods: Cost Comparison

One of the most compelling reasons to use ACH is its cost-effectiveness compared to other payment methods. ACH payment fees are typically around 1% or a bit more, while credit card processing fees can be as high as 3.5%, plus an additional $0.10 to $0.30 per transaction. Forbes Advisor highlights this disparity, noting that "Most ACH payment fees hover around 1% or slightly higher. Credit card processing fees can be up to 3.5% plus 10 cents to 30 cents per transaction." This difference can significantly impact your profitability, especially for businesses with a high volume of payments. ACH offers a more budget-friendly option for many businesses, making it an attractive choice for managing recurring expenses and improving cash flow. Choosing the right payment processing method is a strategic decision, and understanding the associated fee structures is key to making the right choice.

ACH vs. Wire Transfers

Both ACH and wire transfers move money between bank accounts, but they differ in speed, cost, and reach. Wire transfers are generally faster, often completing on the same day, and can be used internationally. However, this speed and global reach come at a cost. Wire transfers are significantly more expensive than ACH, often costing upwards of $35 per transfer. ACH transactions, while typically taking one to three business days domestically, offer a much more budget-friendly option, with fees usually around 1% or a bit more. So, for time-sensitive international payments, wire transfers might be necessary. But for recurring domestic payments, ACH offers a more cost-effective solution. You can learn more about ACH payments here.

ACH vs. Credit Card Payments

For recurring billing, ACH often presents a more attractive option than credit cards, primarily due to cost. Credit card processing fees can significantly impact your margins, typically ranging from 1.5% to 3.5% per transaction, plus an additional $0.10 to $0.30 per transaction. ACH transactions, on the other hand, have significantly lower fees, usually around 1% or slightly more. This cost difference becomes even more substantial with high transaction volumes. Beyond cost, ACH offers more predictable recurring revenue. Unlike credit cards, which can be declined due to expiration or insufficient funds, ACH debits pull funds directly from the customer's bank account, resulting in fewer failed payments and more consistent cash flow. For a deeper look at ACH processing fees and how they compare to other payment methods, explore this resource from Tabs. This comprehensive guide also provides a helpful overview of ACH payments and their increasing popularity in the digital payments landscape.

Benefits of Using ACH Processing

ACH processing offers a wide range of advantages for both businesses and individuals, making it a compelling alternative to traditional payment methods. From cost savings and improved cash flow to increased automation and efficiency, ACH can significantly impact your bottom line.

ACH Benefits for Businesses

For businesses, ACH processing offers a compelling combination of cost-effectiveness and operational efficiency. ACH payments typically carry lower fees than credit card transactions, as highlighted by Forbes in their review of ACH payment processing options. This can translate into significant savings, especially for businesses processing a high volume of transactions. Beyond cost savings, ACH also simplifies accounting. With automated payments, you can reduce manual data entry and reconciliation, freeing up your team to focus on more strategic tasks. This streamlined approach improves accuracy and reduces the risk of errors.

ACH Benefits for Individuals

Individuals also benefit from the convenience and affordability of ACH. Direct deposit, a common form of ACH, is a widely preferred method for receiving paychecks, particularly among younger workers, according to Nacha. The automated nature of direct deposit eliminates trips to the bank and ensures timely access to funds. Similarly, using ACH for recurring payments like utility bills or subscriptions offers significant cost savings compared to other methods. This allows individuals to better manage their personal finances and avoid late fees.

Better Cash Flow Management with ACH

ACH processing can significantly improve cash flow management for businesses. By understanding ACH cut-off times, businesses can ensure timely processing and avoid delays, contributing to a more predictable and stable cash flow. The reliability of the ACH network further enhances this predictability. With fewer payment delays and a clearer picture of incoming funds, businesses can make more informed financial decisions and optimize their working capital. This allows for better forecasting and more strategic allocation of resources.

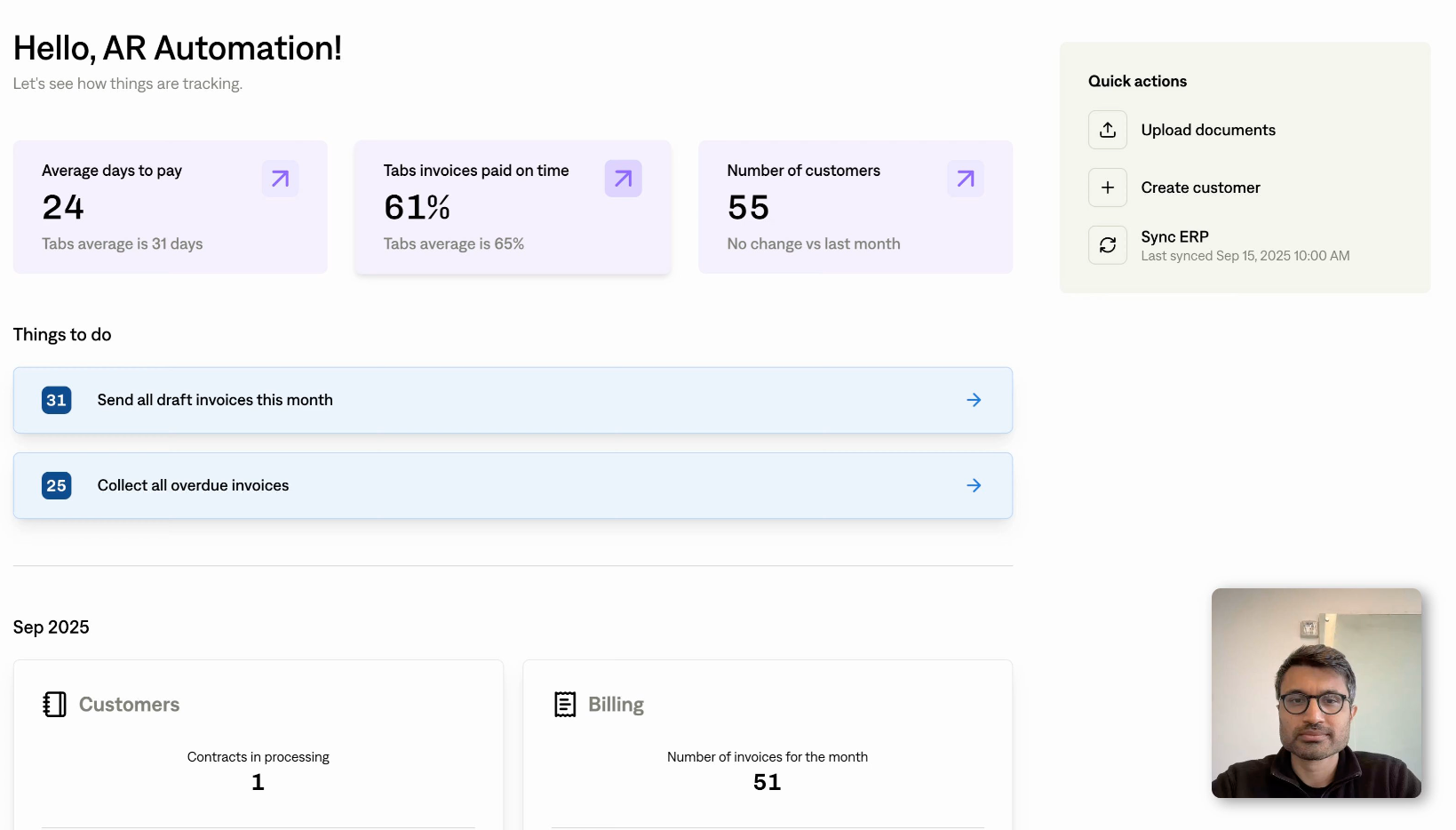

How Tabs Streamlines ACH for Improved Cash Flow

For SaaS businesses, managing recurring revenue is paramount. That's where Tabs comes in. We streamline ACH processing to optimize your cash flow and simplify your financial operations. Our platform integrates seamlessly with your existing systems to automate ACH payments, reducing manual effort and the risk of errors. This automation not only saves you time but also ensures timely payments, leading to more predictable and stable cash flow.

With Tabs, you gain clear visibility into your incoming and outgoing ACH transactions. Our reporting tools provide real-time data and insights into your key financial metrics, empowering you to make informed decisions about your working capital. We understand the importance of accurate revenue recognition in the SaaS world, and our platform simplifies this complex process. Learn how Tabs simplifies revenue recognition and helps you maintain a healthy financial outlook. By leveraging the efficiency and cost-effectiveness of ACH through Tabs, you can free up valuable resources and focus on growing your SaaS business.

Automating and Streamlining with ACH

One of the most significant benefits of ACH is its ability to automate and streamline payment processes. ACH payments eliminate the need for manual processing, reducing administrative overhead and freeing up valuable time and resources. The rise of Same-Day ACH further enhances efficiency, reducing processing times and making ACH a more competitive option compared to real-time payments. This faster processing allows businesses to access funds more quickly and improve their overall financial agility. This also reduces the need for follow-up and collections, further streamlining operations.

ACH Processing: Security and Compliance

Security and compliance are paramount when it comes to ACH processing. Protecting your business and your customers’ financial information should be a top priority. By understanding the safeguards in place and adhering to regulations, you can ensure secure and reliable transactions.

Preventing ACH Fraud

ACH payments are generally secure and reliable, making them a suitable alternative to credit cards for online transactions. The use of encryption and secure networks helps protect sensitive information during the transaction process. Multi-factor authentication adds an extra layer of security, requiring users to verify their identity through multiple channels. Regularly reviewing your bank statements for any unauthorized transactions is also a smart practice. If you notice anything suspicious, report it to your financial institution immediately. Working with a reputable ACH provider that prioritizes security measures like fraud detection and prevention tools can further minimize your risk.

ACH Compliance Requirements

Adhering to Nacha's compliance & security regulations is crucial for maintaining the integrity of the payment system and protecting both businesses and consumers. Staying informed about the latest Nacha rules and updates is essential for maintaining compliance. Your ACH provider should offer resources and support to help you navigate these requirements. Robust reporting features within your billing software can also help you track transactions and ensure everything aligns with regulatory standards.

ACH Limits and Reversals

Understanding transaction limits and reversal processes is key to managing your finances effectively. The Same Day ACH transaction limit increased to $1 million in March 2022, allowing businesses to process larger transactions more efficiently. However, it's important to be aware of your specific bank's limits, as they may vary. While ACH transactions are generally reliable, reversals can occur due to insufficient funds, incorrect account information, or disputes. ACH debits, such as bill pay or withdrawals, generally take 1–3 business days to process, while ACH credits, such as direct deposits or vendor payments, typically take just one business day. Knowing these timelines and potential points of friction is essential for managing cash flow and maintaining positive customer relationships.

Setting Up ACH Processing

Getting started with ACH payments might seem daunting, but it's surprisingly straightforward. This section breaks down the implementation process into digestible steps, helping you transition smoothly to ACH and reap its benefits.

Getting Started with ACH

ACH payment processing offers a cost-effective and convenient way to handle electronic payments directly between bank accounts. It's a versatile solution for both recurring billing and one-time payments, effectively replacing paper checks, wire transfers, and even credit card transactions. For businesses dealing with recurring revenue, ACH can significantly streamline operations. Think of subscription services, utility bills, or loan repayments—all common use cases for ACH. By understanding the basics of how ACH works, you can start exploring how it fits into your financial processes. Learn more about the ins and outs of ACH payments and whether they're right for your business.

Choosing an ACH Provider

Selecting the right ACH provider is crucial for a seamless experience. Look for a provider that aligns with your specific business needs. Consider factors like transaction fees, the volume of transactions you anticipate, and the level of customer support offered. Researching different providers and comparing their services will help you make an informed decision. A reputable provider will offer secure transactions, reliable processing, and valuable features like detailed reporting and reconciliation tools. Reviews of ACH payment processing solutions can be invaluable when evaluating your options. Remember, Tabs offers robust, streamlined, and efficient ACH processing designed to optimize your recurring billing and financial operations. Learn more about how Tabs can transform your billing processes.

ACH Integration Tips

Integrating ACH processing into your existing systems doesn't have to be complicated. Many providers offer APIs and other integration tools to simplify the process. Understanding ACH cut-off times is essential for ensuring timely processing and avoiding delays. Efficiently managing these timelines will keep your cash flow consistent and your customers happy. Additionally, explore tools and strategies that can help reduce hold times for low-risk transactions, which can significantly improve the customer experience. By focusing on a smooth integration process, you can minimize disruptions and maximize the benefits of ACH processing. With Tabs, integration is seamless, allowing you to quickly start leveraging the power of ACH. Explore Tabs' platform integration options and see how easy it is to get started.

Best Practices for ACH Processing

Successfully implementing ACH payments involves more than just understanding the basics. Here are a few best practices to ensure your ACH processing is as smooth and efficient as possible.

Optimizing ACH Payment Timing

Timing is everything with ACH transfers. Unlike credit card transactions that settle almost instantly, ACH payments have processing windows and cut-off times. Knowing these deadlines is crucial for avoiding delays and ensuring your payments arrive on time. Work with your financial institution or payment processor to understand their specific cut-off times. Submitting transactions well in advance of deadlines can significantly improve your cash flow management and keep your customers happy. This predictability helps you forecast accurately and maintain healthy financial operations. For more tips on managing your finances and automating complex invoicing, check out our invoicing features.

Effective Communication for ACH Payments

Transparency is key when it comes to ACH payments. Clearly communicate any potential delays or hold times to your customers upfront. Setting clear expectations helps avoid frustration and builds trust. Let your customers know when they can expect funds to be debited or credited to their accounts. Proactive communication demonstrates professionalism and strengthens customer relationships. For tools to help you automate and streamline customer communication around payments, explore options to support any payment type.

Using Technology to Improve ACH Operations

Leverage technology to streamline your ACH processing. Modern billing software can automate many aspects of ACH, from transaction initiation to reconciliation. Automating these processes not only saves you time and reduces manual errors but also enhances security and efficiency. Look for features like automated reporting, fraud prevention tools, and seamless integration with your existing accounting systems. Tabs offers robust reporting on key metrics to help your finance team stay on top of ACH transactions and overall financial health. For more information on simplifying revenue recognition and automating key processes, explore our resources on revenue recognition and see how our platform features can optimize your billing and revenue operations.

Leveraging Tabs for Optimized ACH Operations

Managing recurring revenue is paramount for SaaS businesses. Optimizing your ACH operations is key to healthy financials, and using the right tools can make all the difference. Tabs offers a comprehensive platform designed to streamline and automate your ACH processes, saving you time and money while enhancing accuracy and security.

One of the biggest pain points for SaaS companies is managing complex invoicing for subscription services. Tabs tackles this head-on with automated invoicing features specifically designed for recurring billing. This automation reduces manual data entry, minimizing errors and freeing up your team to focus on strategic growth initiatives. Plus, with support for various payment types, including ACH, you can offer customers flexible payment options while streamlining back-office operations.

Beyond invoicing, Tabs simplifies revenue recognition, a critical aspect of financial management for SaaS businesses. Our automated revenue recognition tools ensure accurate and compliant financial reporting, giving you a clear view of your financial performance. This clarity is further enhanced by robust reporting tools that provide key insights into your MRR and other essential metrics. With Tabs, you can ditch the spreadsheets and gain a real-time understanding of your financial health.

Finally, Tabs helps you leverage the cost-effectiveness of ACH. By automating ACH processing, you can significantly reduce transaction fees compared to credit card processing. This cost savings contributes directly to your bottom line, improving profitability and allowing you to reinvest in your business. With Tabs, you're not just processing payments; you're optimizing your entire financial operation for sustainable growth.

Related Articles

- Cash Application: Definition and Importance

- Order-to-Cash (O2C) Explained in 5 Minutes

- The Ultimate Guide to B2B Payment Solutions

Frequently Asked Questions

What's the main difference between ACH debit and ACH credit? An ACH debit pulls money from an account, while an ACH credit pushes money into an account. Think of debit as receiving funds and credit as sending funds. For example, if you're a business collecting recurring subscription fees, you'd use ACH debit. If you're paying your vendors, you'd use ACH credit.

How long does an ACH transfer typically take? Most ACH transactions take one to three business days to process. Same-Day ACH is available for faster processing, often for an additional fee, but even that isn't instant. Keep in mind that weekends and holidays can affect processing times.

Are ACH payments secure? Yes, ACH payments are generally secure. The ACH network uses encryption and secure networks to protect sensitive information. Additionally, many providers offer fraud prevention tools and multi-factor authentication to enhance security. However, like any financial transaction, there's always some risk, so it's important to work with a reputable provider and monitor your accounts regularly.

How much does ACH processing cost? ACH processing is typically less expensive than credit card processing. Providers usually charge a small fee per transaction, which can vary based on your transaction volume and the specific provider. Some providers may also charge a monthly fee. It's always a good idea to compare pricing structures and choose the option that best suits your business needs.

How can I integrate ACH processing into my business? Many ACH providers offer APIs and other integration tools to simplify the process of connecting with your existing systems. When choosing a provider, look for one that offers seamless integration and clear documentation. Understanding ACH cut-off times is also crucial for a smooth integration, as it helps ensure timely processing and avoids delays.