Cash Application: Definition and Importance

Author: Tabs Team

Last updated: July 23, 2024

Table of Contents

At the heart of every efficient accounts receivable (AR) process lies a meticulous task: matching payments to invoices, known as cash application. By accurately matching payments to invoices, you can update your records promptly, which is crucial for maintaining an accurate view of the company's financial status. Without efficient cash application, your company may face cash flow issues, leading to operational challenges and economic instability.

Accurate cash application also reduces the risk of discrepancies in financial records. Discrepancies can lead to errors in financial reporting, which can have serious implications, including misstated financial statements and potential regulatory issues.

Automation and AI have significantly transformed the cash application process. Traditional methods of cash application were manual, labor-intensive, and prone to errors. These methods required finance teams to spend a significant amount of time and effort in manually matching payments to invoices, often leading to delays and inaccuracies. However, with automation and AI, you can now automate many aspects of the cash application process, improving both efficiency and accuracy.

Step-by-Step Breakdown

The cash application process involves several steps, starting from receiving payments to matching them with the correct invoices.

Payment and Remittance Aggregation

Receiving Payments: You can accept payments through various methods, including checks, Automated Clearing House transfers, wire transfers, credit cards, and electronic fund transfers. Each payment method may come with remittance advice, which provides details about which invoices are being paid.

For instance, when a customer sends a check, they often include a remittance slip that lists the invoice numbers and the amount allocated to each invoice. This remittance advice is crucial for the cash application process, as it provides the information needed to apply the payment to the correct invoices accurately.

Collecting Remittance Information: Remittances can be sent separately from the payments themselves. They may arrive via email, Electronic Data Interchange, or accounts payable portals. Remittances typically list invoice numbers, dates, and other relevant details that are essential for matching payments to the correct invoices.

For example, a customer might make an electronic payment and send the remittance advice via email. The finance team needs to collect this information and verify that it is accurately captured in the system.

Without accurate remittance details, it becomes challenging to correctly apply payments to the appropriate accounts. This can lead to mismatched payments, discrepancies in financial records, and potential delays in the payment application process. Your business needs efficient systems in place to collect and manage remittance information.

Automated Aggregation: Advanced systems use Optical Character Recognition (OCR) and AI to automatically extract and aggregate remittance information from various sources. OCR technology scans documents and extracts relevant information, such as invoice numbers and payment amounts. AI algorithms then process this information and match it to the corresponding invoices in the system. This automation significantly reduces the need for manual data entry, minimizes errors, and speeds up the cash application process.

For example, when a business receives a large volume of payments and remittances, manually processing each document can be time-consuming and prone to errors. Automated aggregation systems streamline this process by quickly and accurately capturing the necessary information, allowing the finance team to focus on more strategic tasks.

The benefits of automated aggregation are numerous.

- It increases accuracy by reducing the risk of human error. Automated systems can handle large volumes of data quickly and accurately, making sure that payments are matched to the correct invoices. This improves the overall accuracy of financial records and reduces the likelihood of discrepancies.

- Automation speeds up the cash application process. By eliminating the need for manual data entry and matching, businesses can process payments more quickly. This leads to faster updates to financial records, improved cash flow management, and a more accurate view of the company's financial status.

- Automation reduces the workload for finance teams. By handling repetitive and time-consuming tasks, automated systems free up finance professionals to focus on more strategic activities, such as analyzing financial data and making informed business decisions. This can lead to increased productivity and better decision-making.

Invoice Matching and Deduction Coding

Once payments and remittances are aggregated, the next step is matching the payments to their respective invoices. This step can be straightforward if the remittance advice is clear and matches the payment exactly. However, challenges arise when payments cover multiple invoices, involve short payments, or include discounts and deductions.

When there are discrepancies, such as short payments or discounts taken by customers, the cash application team must investigate and code these deductions correctly. This often involves reaching out to customers for clarification or matching the reasons for deductions with internal reason codes used in the ERP system. Proper deduction coding ensures that all discrepancies are accurately recorded and resolved.

Manual matching of payments to invoices is time-consuming and prone to errors. However, automated systems can significantly streamline this process. These systems use pre-built algorithms and AI to match payments to invoices based on various parameters, such as invoice numbers, purchase order numbers, and item numbers. Automation reduces the workload on the finance team and improves accuracy, leading to more efficient cash application.

Cash Posting to ERP Systems

After matching and coding are complete, the next step is to post the cash to the company's ERP system. This step involves closing the open AR entries and updating the financial records to reflect the received payments. Accurate posting maintains up-to-date financial records and ensures the integrity of the company's financial data.

In integrated systems, this process is often seamless, with automated posting reducing the risk of errors. Automated systems make sure that all matched payments are accurately reflected in the ERP system, updating financial records in real time. However, in manual systems, this involves manually updating Excel sheets and ERP systems, which can be inefficient and error prone.

Accurate and timely posting is a must for keeping up-to-date financial records. Delays or errors in this step can impact other AR processes, such as credit and collections. It can also lead to customer dissatisfaction if payments are not correctly recorded, potentially straining customer relationships and affecting future business transactions.

Significance of Cash Application

Financial Health

Cash application has a significant impact on a company's financial health. By confirming that payments are matched to invoices accurately and promptly, you can improve your working capital and liquidity. An efficient cash application ensures that the company has a clear and accurate view of its financial status, which is crucial for effective cash flow management.

Proper cash flow management helps meet short-term financial obligations and invest in growth opportunities. Accurate cash application helps you maintain healthy cash flows, reducing the risk of cash shortages and financial instability. This, in turn, supports your company's overall financial health and stability.

Operational Efficiency

Automating the cash application process can increase operational efficiency. By reducing the need for manual processes, businesses can minimize errors and speed up the cash application process. Automation also frees up the AR team to focus on more strategic tasks, such as analyzing financial data and improving customer relationships.

Higher productivity of the AR team is another key benefit of automating cash application. With automated systems handling repetitive and time-consuming tasks, the AR team can concentrate on higher-value activities. This improves the efficiency of the AR department and contributes to the overall operational efficiency of the business.

Automation can lead to significant cost savings. By reducing the need for manual data entry and investigation of discrepancies, your company can lower its operational costs. These cost savings can be reinvested in other areas of the business, supporting growth and development.

The significance of cash application extends beyond just the AR process. It impacts the financial health of the company, supports effective cash flow management, and enhances operational efficiency. By leveraging automation and AI, businesses can transform their cash application process, leading to improved accuracy, efficiency, and overall financial stability.

Challenges in Cash Application

Manual Processes

Even with automation, manual processes can still present challenges in cash application. Here are some reasons why:

- Incomplete Automation Coverage: Not all aspects of the cash application process may be automated. Certain complex transactions or exceptions might still require manual intervention, which can slow down the process and introduce errors.

- Data Quality Issues: Automated systems rely on the quality of the input data. If remittance information is incomplete, incorrect, or in an unrecognized format, manual review and correction may still be necessary.

- System Integration Problems: Automation works best when integrated seamlessly with existing ERP and accounting systems. If there are integration gaps or compatibility issues, manual processes might still be needed to transfer or reconcile data between systems.

- Human Oversight: Even with automation, human oversight is essential to monitor the process, resolve discrepancies, and handle exceptions. This means that errors in human judgment or oversight can still impact the overall accuracy.

- Initial Setup and Configuration: Setting up and configuring automated systems can be complex. During this phase, manual processes might be heavily relied upon, and any errors or oversights during setup can affect the long-term effectiveness of the automation.

- Change Management: Transitioning from manual processes to automated ones requires significant change management. Staff need to be trained, and new workflows must be established. Resistance to change or inadequate training can lead to continued reliance on manual methods.

- Exception Handling: Some payments might not fit the standard patterns recognized by automated systems, such as partial payments, overpayments, or payments with unusual deductions. These exceptions often need to be handled manually.

- System Downtime and Maintenance: During system downtimes or maintenance periods, manual processes might need to be temporarily reinstated to ensure continuity, which can reintroduce inefficiencies and errors.

To mitigate the challenges of manual processes, even with automation, your business can focus on improving data quality, ensuring seamless system integration, providing comprehensive training for staff, and establishing clear protocols for exception handling. Regular audits and updates of automated systems can also help maintain accuracy and efficiency.

Technological Gaps

Even with automated cash application, technological gaps can include limited integration capabilities with other financial systems, lack of real-time data synchronization, inadequate handling of complex or nonstandard transactions, and insufficient user-friendly interfaces.

Additionally, there may be challenges related to system scalability, cybersecurity vulnerabilities, and the need for continuous updates to keep up with evolving payment methods and regulatory requirements. These gaps can hinder the full potential of automation, leading to inefficiencies and persistent manual interventions.

To tackle these technological gaps, you should invest in powerful integration solutions that offer seamless connectivity with other financial systems. Implementing real-time data synchronization can increase accuracy and timeliness. Choosing flexible and scalable automation platforms can accommodate complex transactions and growth. Enhancing user interfaces through user-centric design improves usability. Regular cybersecurity audits and updates are essential for protecting data. Lastly, staying informed about industry trends and regulatory changes allows for timely updates to automation systems, ensuring continued compliance and efficiency.

Downstream Impacts

Errors in cash application affect collections. Inaccurate records make it hard to track overdue invoices. This delays collection efforts and impacts cash flow.

Customer satisfaction can suffer due to these errors. Incorrectly applied payments can result in disputes and strained customer relationships. Timely and accurate cash application is crucial for maintaining good customer relations.

Strategies for Improving Cash Application

Automation and AI Solutions

Automating remittance capture and invoice matching offers substantial benefits. AI can quickly and accurately match payments to invoices, reducing manual effort. Automation minimizes errors and speeds up the cash application process.

Advanced systems use OCR to extract data from remittances. AI algorithms then match this data to invoices. This reduces the workload on finance teams and increases accuracy.

Process Optimization

Streamlining workflows improves efficiency. Identifying and eliminating bottlenecks in the process helps speed up cash application. Clear, efficient workflows provide smoother operations.

Training and support for AR teams are essential. Well-trained staff can handle exceptions more effectively. Ongoing support means they stay updated with the latest tools and techniques.

Choosing the Right Cash Application System

When it comes to streamlining AR processes and ensuring accurate cash flow management, selecting the right cash application system can make a significant difference for your company.

Key Features to Look For

Strong matching systems: A good system should handle various payment types and match them to the correct invoices accurately. This reduces the need for manual intervention.

Integration capabilities: The system should seamlessly integrate with existing ERP and accounting software. This ensures data consistency and reduces manual data entry.

Real-time reporting and analytics: They provide immediate insights into cash flow and payment statuses. This helps you make informed financial decisions.

Evaluating Providers

Consider scalability and efficiency. The system should grow with your business and handle increased transaction volumes. Efficient systems provide quick processing times and reduce delays.

Customer support and service guarantees are important. Reliable support gets any issues resolved quickly. Providers should offer service guarantees about system reliability.

Concluding Thoughts

Cash application is a vital part of the accounts receivable process. It involves matching payments to invoices accurately and promptly. This process is essential for maintaining financial accuracy and ensuring smooth cash flow.

Manual cash application processes are often slow and error prone. They involve complex tasks like remittance linking and invoice matching. These challenges can lead to inefficiencies and financial discrepancies.

Automation and AI solutions offer significant improvements. They streamline remittance capture and invoice matching. Automated systems reduce manual effort and minimize errors.

Choosing the right cash application system is key. Look for matching capabilities, integration with existing systems, and real-time reporting. Evaluate providers based on scalability, efficiency, and customer support.

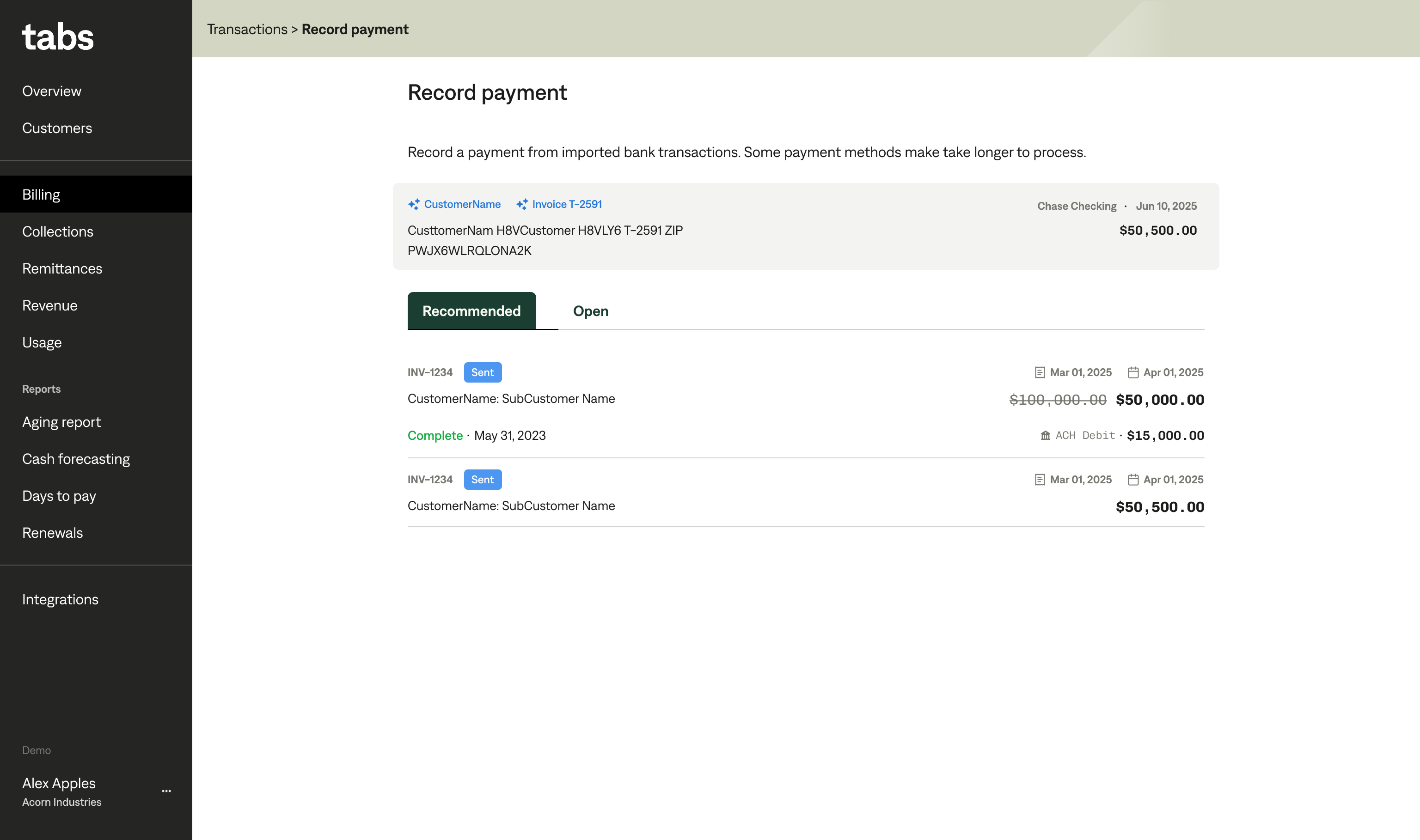

Tabs offers a seamless solution for B2B payments with automated cash application. Our system leverages advanced OCR and AI technologies to ensure accurate and efficient payment matching. With Tabs, you can reduce manual effort, minimize errors, and improve your cash flow management.

Tabs integrates smoothly with your existing ERP and accounting systems. This integration ensures data consistency and reduces the need for manual data entry. Real-time reporting and analytics provide immediate insights into your financial status.

By automating your cash application process with Tabs, you can streamline operations and enhance efficiency. Our system handles various payment types and matches them to the correct invoices quickly and accurately. This reduces the workload on your finance team and speeds up the cash application process.

Tabs also supports your AR team with ongoing training and support. Our team ensures that your staff is equipped to handle any exceptions and stays updated with the latest tools and techniques. This support helps maintain a smooth and efficient cash application process.

Efficient cash application is essential for maintaining financial accuracy and managing cash flow. Manual processes and technological gaps can lead to inefficiencies and errors. Automation and AI solutions, like Tabs, offer significant improvements in accuracy and efficiency.

Related Posts:

The Future of Cash Application: Why Tabs Built an AI-Powered Solution

We talk to a lot of finance professionals and there are a handful of themes that we hear no matter the size, industry, or tenure of the operator. People are concerned about scaling their teams when...

What Exactly is Revenue Recognition?

Accurate financial reporting is at the heart of any business, but many companies struggle with it. According to a 2024 survey by BlackLine, nearly 40% of CFOs globally don’t fully trust their...

Direct Method Cash Flow: A Field Guide

When it comes to cash flow statements, the direct method provides a crystal-clear picture of your business's financial health. Unlike the indirect method, which can be convoluted, the direct method...