TABS CASE STUDY

How Kea Accelerated Customer Payments with Tabs

With Tabs, Kea's Head of Finance, Jessica Maksavan, has been able to eliminate the manual invoice calculations that previously took hours each month. Now, customer data flows straight into Tabs, where invoices are calculated using the key terms from each customer contract.

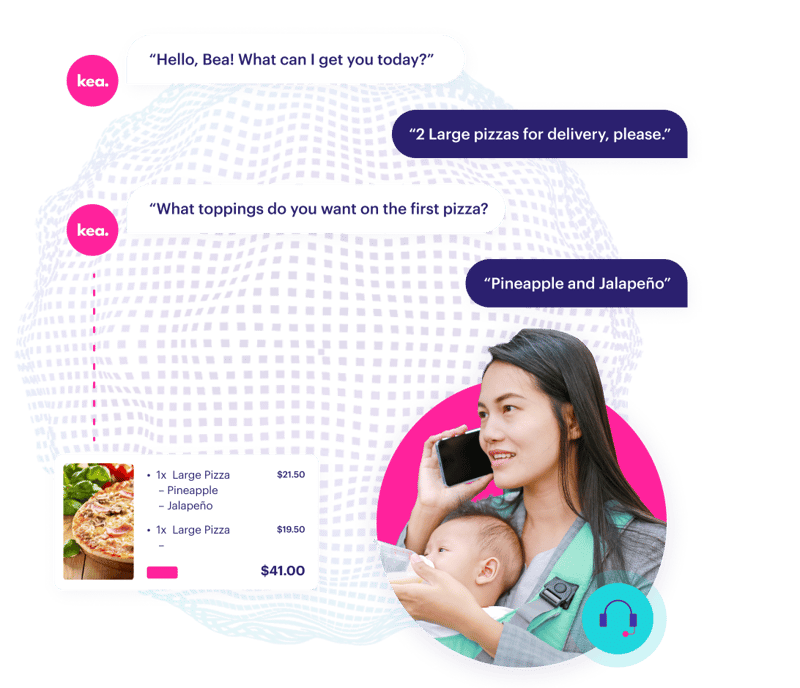

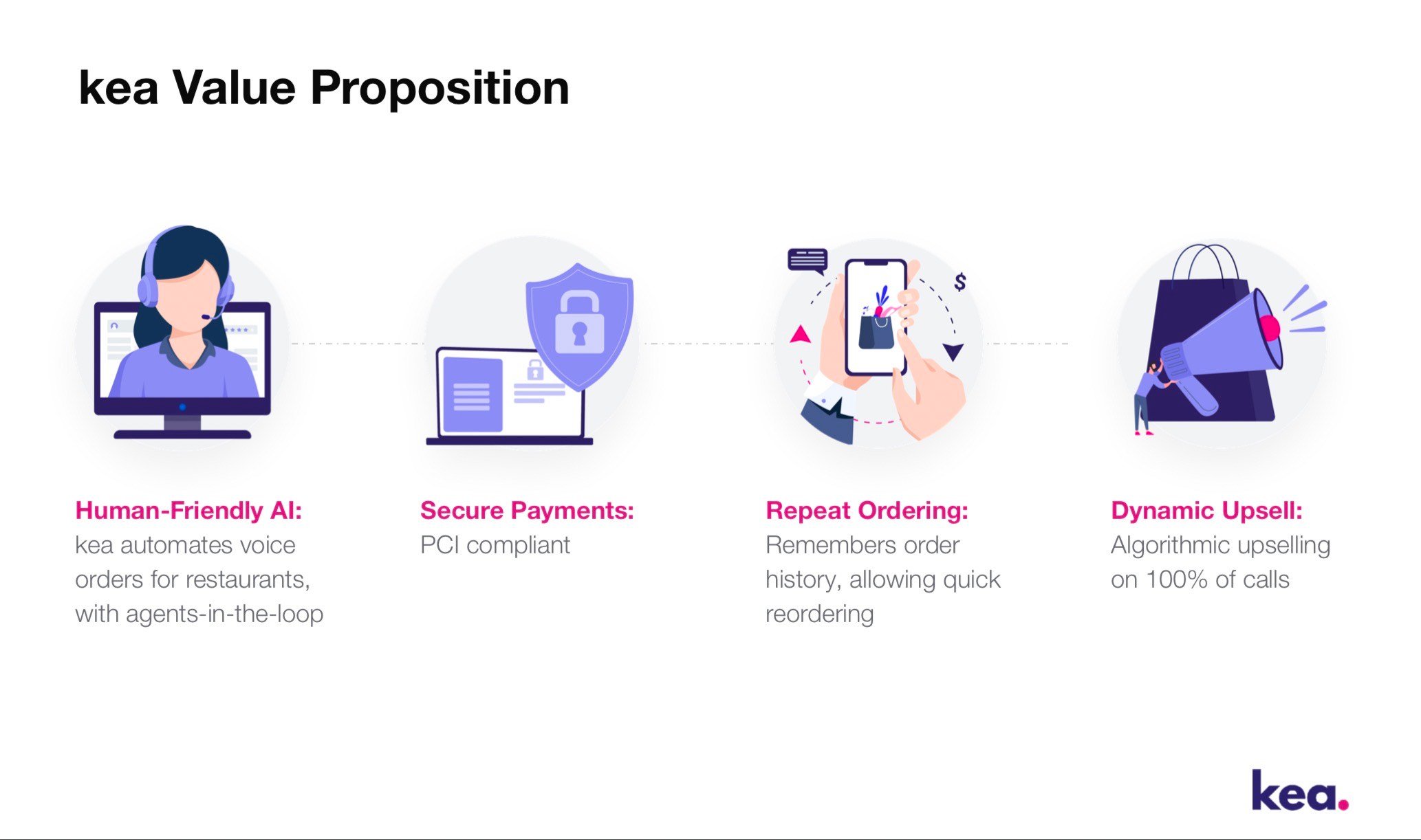

Kea is a conversational AI company that helps restaurants operate more intelligently and own their relationship with customers. Kea’s software takes orders over the phone and integrates with restaurants’ existing payment systems so that restaurants can focus on making food. Since launching in 2018, the company has served over 1,000,000 guests and raised more than $29.6 million.

The Challenge

Kea’s pricing model required complex calculations and manual effort to accurately build and send out each customer invoice.

At this stage of the company’s growth, contracts are bespoke with wide variance in the pricing and billing terms across contracts. Kea takes a commission on each order placed through their system, meaning invoice amounts for each customer change monthly depending on the volume of orders. Finally, Kea works with national restaurants who have both a corporate model and a franchisee model. It’s crucial that Kea bills the company for the corporate-owned stores and each individual franchisee for franchise stores.

These layers of complexity meant that Jessica Maksavan, Head of Finance & Ops at Kea, was having to do hours of manual work each month to get invoices out on time. Jessica had to go into each contract to see the terms of percentage and any flat fees. She then had to pull volume amounts from Kea’s internal database, before sharing all of the relevant information with an outsourced bookkeeper to compile the invoices.

“Tabs was able to onboard us in less than a week. We began implementation at the end of October and invoices went out in the first week of November. It was absolutely amazing.”

The Solution

With Tabs, Jessica has been able to completely eliminate the manual invoice calculations that previously took hours each month. Now, customer volume data flows straight into Tabs, where invoices are calculated using the key terms from each customer contract. Jessica receives an email when invoices are ready and scheduled, and her bookkeeper does a quick review before approving. This reduction in outsourced bookkeeping hours resulted in direct cost savings for Kea’s Finance team.

“In Finance we have an allotted budget to spend on tools to help us scale. Tabs was a software I prioritized, due to its ability to address my invoicing and A/R pain points and to have an impact on our team (time spent in manual process) and CCC (decreased DSO and streamlined how customers are paying) most quickly.”

The Tabs integration with Stripe has also been a game-changer for Kea. Tabs makes it easy for Kea to automatically charge customers paying by card, leading to an increase in credit card usage and a decrease in sales days outstanding.

Not only are customers now paying faster, they’re happier about the experience. The Kea team received positive feedback from customers, who appreciate that they can now easily see a breakdown of billing details by store location on their invoices.

For Jessica, however, the biggest benefit of using Tabs is peace of mind. At a fast-growing start-up with lean staffing, there are numerous operational and strategic tasks to focus on every month. Now, she thinks less about the billing and receivables process, knowing that it’s fully automated and accurate invoices will go out on time each month. This enables Jessica to spend more time with customers and on strategic tasks that will help the company scale.

Impact

- 13 day decrease in Days Sales Outstanding (DSO)

- Reduction in time to process invoices and outsourcing costs

- Improved customer satisfaction with the billing experience