Money coming in every month keeps your business running smoothly. If you're running a subscription-based company, Monthly Recurring Revenue (MRR) will tell you how much money your business can count on each month.

For growing businesses, this metric is more than just a number. It's a powerful tool that helps you plan for the future, make smart decisions, and show investors your company's strength. Understanding and tracking your MRR can be the difference between thriving and surviving in the competitive world of subscription services.

Understanding Monthly Recurring Revenue

MRR is the total revenue your company expects from its subscription customers each month. It's a key metric for your subscription-based business, especially if you're in the SaaS industry.

This metric is important for several reasons:

- It helps you forecast future revenue and plan your budgets.

- Growth shows if you're acquiring new customers and retaining existing ones.

- Investors often use it to evaluate your company's financial stability and growth potential.

Your MRR differs from other revenue metrics because it only includes predictable, recurring revenue from subscriptions. It excludes one-time fees, setup costs, or any nonrecurring charges.

In the SaaS world, your MRR calculations relates closely to other important metrics:

- Customer Acquisition Cost (CAC): The cost for you to acquire a new customer

- Customer Lifetime Value (LTV): The total revenue you expect from a customer over time

- Churn Rate: The rate at which your customers cancel their subscriptions

When you track all these metrics, you can make informed decisions about customer acquisition strategies, pricing models, and product development.

How to Calculate MRR

Calculating your Monthly Recurring Revenue is straightforward, but be careful to include only your recurring revenue.

Basic Formula

The basic formula is:

MRR = Number of Active Subscribers × Average Revenue Per Subscriber

For example, if you have 100 active subscribers and your average revenue per subscriber is $50, your MRR would be:

100 × $50 = $5,000

Handling Different Subscription Tiers

If you offer multiple subscription tiers, calculate the monthly recurring revenue for each tier separately and then add them together. For instance:

- 50 Basic subscribers at $30 each: 50 × $30 = $1,500

- 30 Pro subscribers at $50 each: 30 × $50 = $1,500

- 20 Enterprise subscribers at $100 each: 20 × $100 = $2,000

Your total MRR would be $1,500 + $1,500 + $2,000 = $5,000

What to Include and Exclude

To calculate properly, distinguish between recurring and nonrecurring revenue.

Include:

- All recurring charges from active subscriptions. This is the core of your MRR. It includes the base subscription fee that customers pay regularly (monthly, annually, etc.). For example, if a customer pays $50 per month for your basic plan, include this $50 in your MRR calculation.

- Recurring add-ons or upgrades. Include any additional features or services that customers pay for on a recurring basis. For instance, if a customer adds a $10/month storage upgrade to their base plan, add this $10 to their contribution to MRR.

Exclude:

- One-time setup fees. These are fees you charge only once when a customer first signs up, often to cover onboarding or initial setup costs. While these fees contribute to revenue, they're not recurring and shouldn't be part of MRR.

- Nonrecurring add-ons or purchases. Exclude any one-time purchases or add-ons that aren't part of the regular subscription. For example, if a customer buys a one-time training session or a single license for additional software, don’t count them in MRR.

- Canceled or churned subscriptions. Once a customer cancels their subscription, remove their contribution to MRR immediately. Even if they're in a "grace period" where they can still use the service, their subscription is no longer recurring, and you should not count it in MRR.

Dealing With Annual Subscriptions

If you offer annual subscriptions, convert them to a monthly value. Simply divide the annual subscription price by 12 to get the monthly equivalent.

For example, if a customer pays $1,200 for an annual subscription, you'd count that as $100 per month in your MRR calculations.

Calculating your MRR means you'll have a clear picture of your recurring revenue, helping you make informed decisions about your business growth and financial health.

Types of Monthly Recurring Revenue

To track your business growth accurately and pinpoint where your business is growing or struggling, you need to know the different types of MRR:

- New: Revenue from new customers signing up for your service.

- Expansion: Additional revenue from existing customers upgrading or purchasing add-ons.

- Reactivation: Revenue from customers who had canceled but have now resubscribed.

- Contraction: Lost revenue from existing customers downgrading their plans.

- Churned: Revenue lost from customers canceling their subscriptions.

Calculate your Net New MRR using this formula:

Net New MRR = New MRR + Expansion MRR + Reactivation MRR - Contraction MRR - Churned MRR

Impact on Business Decisions

Your MRR directly influences key business decisions:

- Resource Allocation: Higher MRR might justify investing in new features or expanding your team. It provides the financial confidence to allocate resources towards growth initiatives, such as hiring additional staff or upgrading infrastructure.

- Pricing Strategy: If your Expansion MRR is low, consider introducing new pricing tiers or features. Analyze which plans contribute most to your MRR to optimize your pricing structure. This could involve creating higher-value tiers or adjusting existing ones to better align with customer needs and willingness to pay.

- Customer Retention: High Churned MRR signals a need to focus on improving customer satisfaction and retention strategies. Investigate the reasons behind churn and implement targeted retention campaigns. This might include enhancing customer support, offering loyalty programs, or improving product onboarding.

- Marketing and Sales: Low New MRR might indicate it's time to boost your customer acquisition efforts. Use MRR data to identify your most valuable customer segments and tailor your marketing strategies accordingly. This could involve refining your messaging, exploring new channels, or adjusting your sales approach.

- Product Development: Expansion MRR trends can guide your product roadmap, showing which features drive upgrades. Prioritize development efforts on features that have historically led to increased MRR through upsells or reduced churn.

- Financial Planning: Stable or growing MRR allows for more accurate revenue forecasting and budget planning. It provides a reliable baseline for projecting future cash flows, which is crucial for strategic planning, investor relations, and securing funding.

Ways to Optimize MRR

To boost your monthly recurring revenue, consider these strategies.

Optimizing Pricing Strategies

To optimize your pricing strategies, start by conducting market research. This helps you understand what your customers are willing to pay and how your pricing compares to competitors.

Consider using tiered pricing models to offer different levels of service or product bundles at various price points, catering to different segments of your market.

Dynamic pricing is another effective strategy. It involves adjusting prices based on market demand, customer usage, and economic conditions. This flexibility can help you maximize revenue in changing market conditions.

Don't forget to regularly A/B test different pricing structures to find the most effective approach for maximizing your revenue over time.

Tabs Tip: Review your pricing strategy quarterly. Analyze customer adoption rates for each tier and adjust your offerings based on this data to maximize value for both your customers and your business.

Upselling and Cross-Selling

To boost your MRR through upselling and cross-selling, start by identifying opportunities. Analyze customer usage and behavior to spot potential upgrades or additional products that could enhance their experience.

Use data analytics to create personalized recommendations. These targeted offers should meet the specific needs or interests of individual customers, increasing the likelihood of successful upsells.

Offer incentives for upgrades, such as time-sensitive discounts or exclusive features. These promotions can encourage customers to move to higher-tier plans, increasing your MRR.

Make sure that the process for adding services or upgrading is seamless for the customer. This minimizes friction and enhances their overall experience with your product.

Tabs Tip: Implement a "next best action" system that suggests the most relevant upgrade or additional service to each customer based on their usage patterns and history.

Improving Customer Retention

Implementing customer success programs is a powerful way to improve retention. These dedicated teams help customers achieve their goals using your product, which can increase satisfaction and reduce churn.

Keep your customers engaged through regular communication. Use email newsletters, user webinars, and special events to keep your brand top of mind and your customers connected with your product.

Create feedback loops to continuously improve your offering. Actively seek and respond to customer feedback to address any issues before they lead to cancellations.

Consider using loyalty programs to reward long-term customers. Perks such as discounts, beta features, or free months of service can encourage continued subscription and boost customer loyalty.

Tabs Tip: Set up an early warning system that flags accounts showing signs of potential churn (e.g., decreased usage, missed payments). This allows your team to proactively address issues and improve retention.

Challenges and Considerations

When working with MRR, be aware of these common pitfalls and considerations:

- One-time fees: Don't include nonrecurring payments in your MRR. This can inflate your figures and give you a false sense of financial stability. Examples include setup costs, installation fees, or special one-off services. Keeping these separate means your MRR reflects only predictable, ongoing revenue.

- Customer misclassification: Keep trial users and paid subscribers separate. Mixing these can lead to unrealistic MRR figures. Create clear definitions for each customer type in your organization. Remember, free trial users don't contribute to MRR until they convert to paid plans.

- Discounts and credits: Always adjust your calculations for these. They can significantly change your revenue per user. This includes promotional discounts, loyalty rewards, and any credits issued due to service issues. Failing to account for these can overstate your true recurring revenue.

- Churn rates: Account for cancellations and downgrades. Ignoring churn can paint an overly optimistic picture of your financial health. Track both customer churn (number of customers lost) and revenue churn (amount of recurring revenue lost) for a comprehensive view.

- Accounting standards: Be aware of GAAP (U.S.) and IFRS (global) rules for revenue recognition. These affect how you report MRR in financial statements. Consult with accounting professionals to make sure your MRR calculations align with relevant standards, especially when dealing with complex scenarios like multi-year contracts or bundled services.

- Consistency in reporting: Use the same calculation methods across all periods. This ensures compliance and allows for accurate financial analysis over time. Document your MRR calculation process thoroughly, including any assumptions or specific methodologies used.

- Disclosure requirements: If publicly traded, be prepared to explain your MRR calculation methods in financial statements. This transparency is critical for investors and regulators. Be ready to explain your methodology clearly and consistently. Consider including a detailed explanation of your MRR calculation in your company's Management Discussion and Analysis (MD&A) section of financial reports.

- Currency fluctuations: For businesses operating internationally, currency exchange rates can impact MRR. Decide whether to report MRR in a single currency (converting all others) or maintain separate MRR figures for each currency. Be consistent in your approach and disclose your method.

- Contract changes mid-period: Customers may upgrade, downgrade, or cancel mid-month. Develop a consistent policy for how to handle these changes in your MRR calculations. Some companies use prorated figures, while others wait until the start of the next period to reflect changes.

- Seasonality: Some businesses experience predictable fluctuations in MRR due to seasonal factors. Be aware of these patterns in your industry and account for them in your forecasting and analysis. This will help you distinguish between normal seasonal variations and true growth or decline trends.

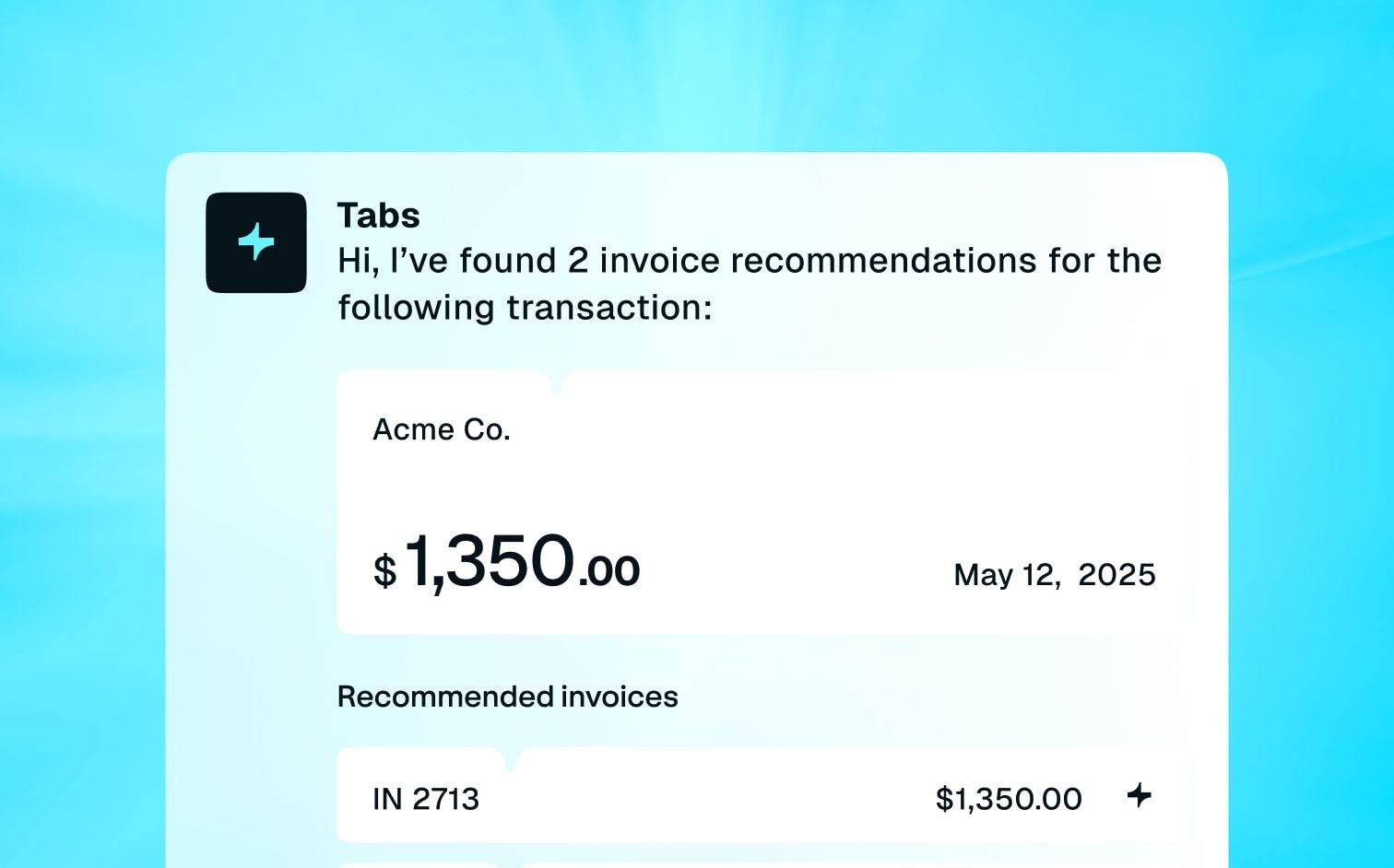

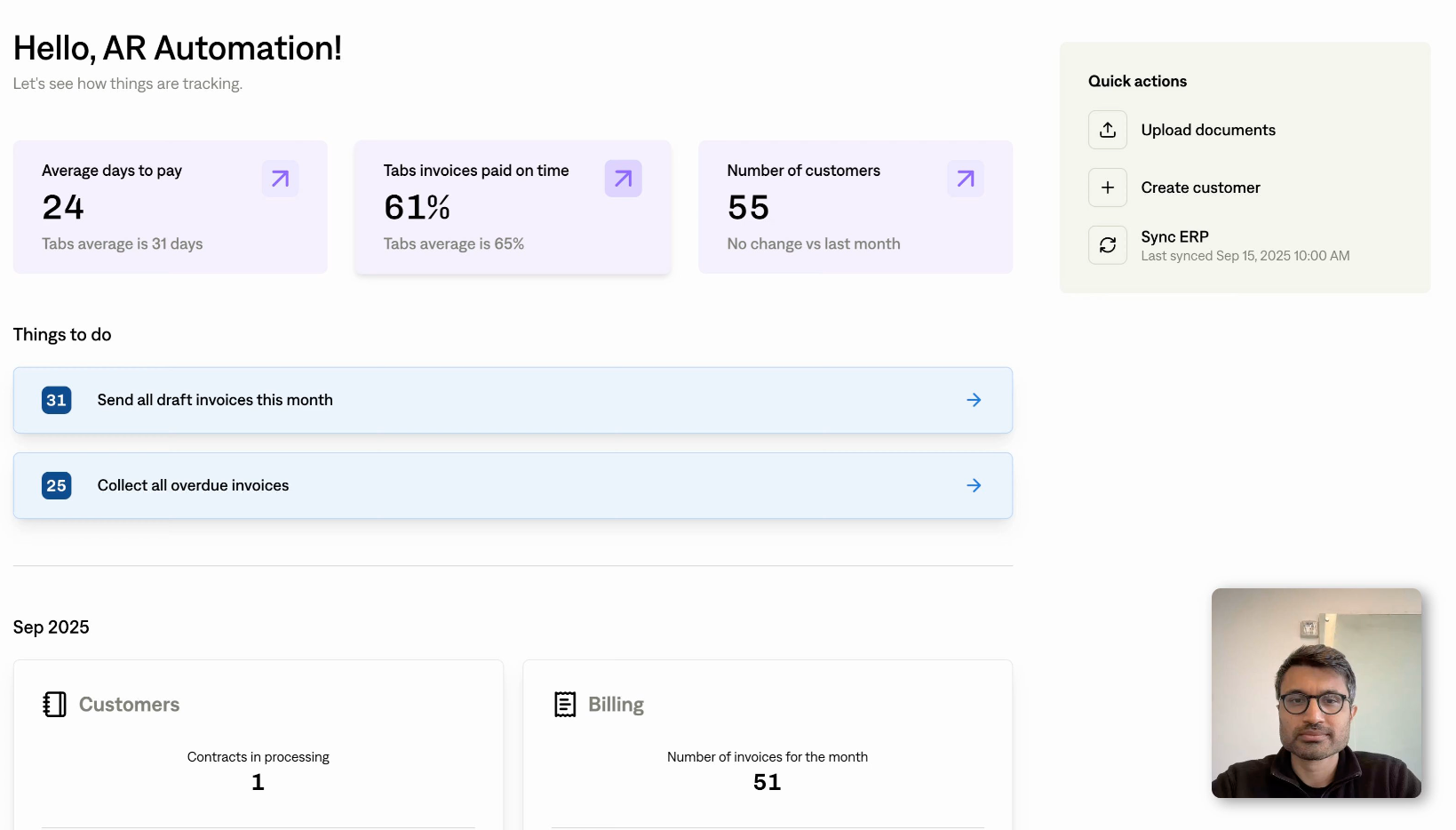

Revenue Automation and Reporting

To tackle these challenges effectively, consider integrating revenue automation tools. These can streamline your MRR calculation process, reducing errors and keeping you compliant with accounting standards.

Automation tools can aggregate revenue data from various payment systems and plans. They apply necessary adjustments for discounts, credits, and churn automatically. This saves time and increases the accuracy of your MRR figures.

With automated reporting, you can generate real-time MRR insights. This allows you to spot trends quickly and make informed decisions. You can also easily break down your MRR by customer segments, products, or other relevant factors.

While automation can greatly improve your MRR tracking, it's still very important to understand the underlying principles. Regularly review your automated processes to make sure they align with your business model and accounting standards.

By addressing these challenges and leveraging automation, your MRR calculations will be accurate, consistent, and compliant. This gives you a solid foundation for financial planning and strategic decision-making in your subscription-based business.

Integrating Into Company Culture

- Education: Help all team members understand MRR and its importance. Hold training sessions to explain how different roles impact MRR. This creates alignment across departments and helps everyone see how their work contributes to the company's financial health.

- Transparency: Share data across the organization. Create a dashboard that's accessible to all employees, showing key monthly metrics. This fosters a sense of ownership and accountability.

- Goal Setting: Incorporate MRR targets into your company and individual goals. For example, the sales team might have goals for New MRR, while the customer success team focuses on reducing Churn MRR.

- Regular Reviews: Hold monthly MRR review meetings with key stakeholders. Discuss trends, challenges, and strategies for improvement.

- Cross-functional Collaboration: Encourage teams to work together to improve MRR. For instance, product and customer success teams can collaborate to identify features that drive expansion MRR.

- Celebrate Wins: Recognize and reward individuals and teams who contribute to MRR growth. This could be through formal recognition programs or simple shout-outs in company meetings.

- Decision-Making Framework: Use MRR in your decision-making processes. When evaluating new initiatives or strategies, always consider the potential impact on MRR.

Start by focusing on one or two of these strategies. As they become ingrained in your company culture, gradually introduce the others. Cultural change takes time and consistent effort.

Concluding Thoughts

MRR is a critical metric for your subscription business. It offers a clear view of your financial health and growth potential. Consistent tracking and analyzing provides valuable insight into customer behavior, pricing effectiveness, and overall business performance.

Use this financial metric as a compass for your business strategies. Let it inform your approach to customer acquisition, retention efforts, and product development. Regular analysis enables you to identify trends early and adapt swiftly to market shifts.

Integrate MRR tracking into the core of your business operations. Dedicate time each month to review your figures, seeking opportunities for optimization and growth. This ongoing focus on monthly recurring revenue will drive long-term success in your subscription model.

You're not just measuring your business — you're laying the groundwork for sustainable growth in the competitive landscape of subscription services.

Ready to elevate your financial metric tracking capabilities? Tabs offers powerful tools to automate your MRR calculations and deliver in-depth insights into your subscription metrics. With Tabs, you can effortlessly monitor all your monthly recurring revenue, from new customer acquisition to churn rates, in one centralized platform. Experience how Tabs can transform your subscription business management — try it today.