ASC 606, Revenue from Contracts with Customers, redefined how businesses recognize revenue. Issued by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), ASC 606 replaces outdated guidelines. It makes revenue recognition more transparent and comparable across industries.

This standard applies to all businesses with contracts involving the transfer of goods or services. ASC 606 became effective in 2018 for public companies and in 2019 for private companies. The standard requires both to follow a structured, five-step process for revenue recognition.

The Core Principle of ASC 606

ASC 606 centers on one clear principle: recognize revenue when control of a good or service transfers to the customer. The amount of revenue recognized should reflect the payment the company expects to receive to fulfill its obligations.

Control is a key concept under ASC 606. It’s not just about physical possession — it’s about the ability to direct the use of the good or service and obtain substantially all of its benefits. This distinction is important, as revenue can only be recognized when the customer gains both the ability to use the asset and benefit from it. This creates a clearer alignment between revenue and the delivery of value to the customer.

Simply put, revenue isn’t recognized when an invoice is issued or payment is received. Instead, you must align revenue recognition with the actual delivery of goods or services to the customer. This creates more consistency and makes sure financial statements accurately reflect the company’s performance.

Detailed Walkthrough of the 5-Step Model

ASC 606 introduces a five-step model for recognizing revenue. This model standardizes how your company accounts for revenue across industries and contracts, providing a consistent approach.

Step 1: Identify the Contract With a Customer

A contract under ASC 606 is an agreement between two or more parties that creates enforceable rights and obligations. To qualify, the contract must meet specific criteria:

- The contract has commercial substance. This means it changes the cash flows of the business.

- All parties must have approved the contract and are committed to fulfilling their obligations.

- The rights to goods or services and the payment terms are clearly defined.

- It must be probable that the company will collect the payment for the goods or services provided.

Contracts don’t have to be written. Oral agreements or contracts implied through customary business practices can also qualify as long as the parties have clear rights and obligations.

Additionally, accrued revenue may apply if the company provides services before receiving payment, requiring them to recognize the revenue earned even if cash has not yet been received.

Contract modifications introduce a little more complexity. Contracts that evolve need careful evaluation under ASC 606. If a contract modification adds new goods or services that are distinct from the original scope, it is treated as a separate contract. Otherwise, the modification may require adjusting the transaction price or reallocating it across existing obligations.

Step 2: Identify the Performance Obligations in the Contract

Performance obligations are the specific promises to deliver goods or services within a contract. ASC 606 defines them as distinct goods or services that the customer can benefit from on their own or together with other resources.

A good or service is distinct if:

- The customer can use or benefit from it on its own or with other readily available resources.

- The company’s promise to transfer the good or service is separate from other promises in the contract.

Identifying performance obligations often requires significant judgment, especially in complex contracts. Misjudging this can impact the timing of revenue recognition, so you must carefully assess each obligation. For instance, a software company might sell a software license, implementation services, and customer support as part of one package. Under ASC 606, the company needs to determine if these represent separate performance obligations or a single combined one.

Step 3: Determine the Transaction Price

The transaction price is the total amount a company expects to receive for transferring goods or services to the customer. This step requires you to estimate the amount you’ll collect, considering various factors like variable consideration, financing terms, and non-cash payments.

Key elements include:

- Variable consideration: Contracts often contain elements like performance bonuses, discounts, rebates, or penalties. You must estimate the impact of these factors and include the most likely outcome in the transaction price. You can use two methods to estimate variable consideration: The expected value method, which is best when there are several possible outcomes,The most likely amount method, which applies to binary outcomes, such as performance-based bonuses.

- Financing components: If the contract involves deferred or early payment, the company may need to adjust the price to account for the time value of money. You must evaluate whether the financing component is significant enough to impact the transaction price. For long-term contracts, especially with deferred payments, you must apply discount rates to adjust for the financing element.

- Non-cash consideration: When a customer pays with something other than cash (e.g., goods, services, or equity), you need to estimate the fair value of that consideration.

For example, a construction company bidding on a long-term contract may include performance bonuses or penalties based on project completion dates. Under ASC 606, it must estimate the likelihood of achieving these outcomes and factor them into the transaction price.

Step 4: Allocate the Transaction Price to the Performance Obligations

Once the transaction price is determined, it must be allocated to the identified performance obligations in the contract. The allocation is based on the standalone selling price of each good or service. This means each performance obligation receives a portion of the transaction price that reflects its standalone value.

To allocate the transaction price, follow these steps:

- Determine the standalone selling price of each obligation. This is the price you would charge for that specific product or service if sold separately.

- Allocate the total transaction price to each performance obligation proportionally, based on the relative standalone selling prices.

If the standalone selling price isn’t directly observable, you must estimate it using methods such as:

- Adjusted market assessment: Evaluating what customers are willing to pay for goods or services in similar markets.

- Expected cost-plus-margin approach: Estimating the costs of fulfilling the obligation and adding a reasonable margin to that cost.

For instance, a software company selling a bundle of licenses, consulting services, and support must allocate the total transaction price across these obligations based on the standalone value of each service.

Step 5: Recognize Revenue When Each Performance Obligation Is Satisfied

Companies must recognize revenue when they satisfy a performance obligation by transferring control of the good or service to the customer. This can happen either at a point in time or over time, depending on the nature of the obligation.

Revenue recognition occurs when:

- The customer gains control of the good or service.

- The company fulfills its promise to transfer the good or service as outlined in the contract.

For performance obligations fulfilled over time, you must recognize revenue as the customer receives and consumes the benefits. This could be through methods like milestone tracking (output measure) or tracking costs incurred versus total expected costs (input measure). For obligations satisfied at a point in time, revenue is recognized when the customer takes control — typically upon delivery or completion of the service.

For example, a manufacturing company producing customized equipment for a client may recognize revenue over time as the project progresses, while a retail business delivering goods to a customer recognizes revenue at the point of sale.

Impact on Different Industries

ASC 606 affects industries differently based on how they structure contracts and recognize revenue. While the core principle stays the same, the application of the five-step model varies across sectors.

Software and SaaS

Software companies often have complex contracts that bundle licenses, implementation services, and support. Under ASC 606, these companies must separate and allocate the transaction price to each performance obligation. For example, many software providers have shifted from selling perpetual licenses to subscription-based models. This shift often means recognizing recurring revenue over the subscription period, requiring ongoing evaluation of when customers consume the service.

Manufacturing

Manufacturers with long-term contracts for custom products must often recognize revenue over time. For instance, a manufacturer building custom machinery for a client might recognize revenue as the project progresses, depending on when the customer takes control of the asset. For manufacturers of highly customized products, this means evaluating each milestone carefully to align revenue with control transfer.

Real Estate

Real estate developers typically use contracts that span long periods and include performance-based milestones. Under ASC 606, they must recognize revenue as they fulfill performance obligations, such as reaching project milestones or delivering completed units. This change often shifts the timing of revenue recognition compared to older standards.

Telecommunications

Telecom companies face challenges in unbundling services like mobile plans, data services, and handsets. Under ASC 606, they need to separate these services, recognize revenue from handsets upfront, and spread out revenue from service plans over time. Telecom companies also face principal versus agent considerations, determining whether they act as a principal in a transaction (and recognize full revenue) or merely as an agent (and recognize only commissions).

Challenges and Considerations in Applying ASC 606

Applying ASC 606 can be challenging, especially for companies with multi-element contracts or variable pricing models.

Estimating the Transaction Price

Companies often face difficulty estimating variable considerations, such as performance bonuses, rebates, or penalties. Accurately predicting these amounts is crucial to avoiding underreporting or overreporting revenue. Misestimation can lead to costly restatements or regulatory scrutiny. Companies can choose between the expected value or most likely amount methods for variable consideration, depending on the contract specifics.

Identifying Performance Obligations

Some contracts contain bundled goods and services that require significant judgment to separate. For example, a software provider might need to decide whether training, implementation, and support are distinct obligations or part of the same overall service. Misidentifying obligations can lead to incorrect revenue timing.

Revenue Recognition Timing

Determining when a company has transferred control of a good or service can also be tricky, especially for long-term contracts. The decision to recognize revenue at a point in time or over time can significantly affect reported revenue and financial health. You must use judgment in cases where control transfers gradually, such as with custom manufacturing or service contracts.

Industry-Specific Complexities

Certain industries face unique challenges in applying ASC 606. For instance, real estate developers must navigate the timing of milestone-based revenue, while telecommunications firms must unbundle complex services into distinct performance obligations. Companies in industries like travel or e-commerce must also consider principal versus agent guidance. This determines whether they recognize the gross transaction price (as the principal) or just their commission (as an agent).

Contract Costs

Under ASC 606, companies can capitalize certain contract costs, like sales commissions or costs to fulfill a contract. These costs are then amortized throughout the contract, aligning expenses with revenue recognition. This adds a layer of complexity to contracts with extended timelines or high fulfillment costs.

The Securities and Exchange Commission (SEC) has commented on the importance of companies providing clear, transparent disclosures under ASC 606. Regulators expect businesses to explain their assumptions, estimates, and judgments clearly so stakeholders can understand how revenue is recognized.

Concluding Thoughts

ASC 606 has transformed the way businesses recognize revenue, bringing more transparency and consistency across industries. But, the shift to ASC 606 can be complex, especially if you’re managing multiple performance obligations or variable transaction prices. Following the five-step model goes a long way to provide a structured approach to revenue recognition.

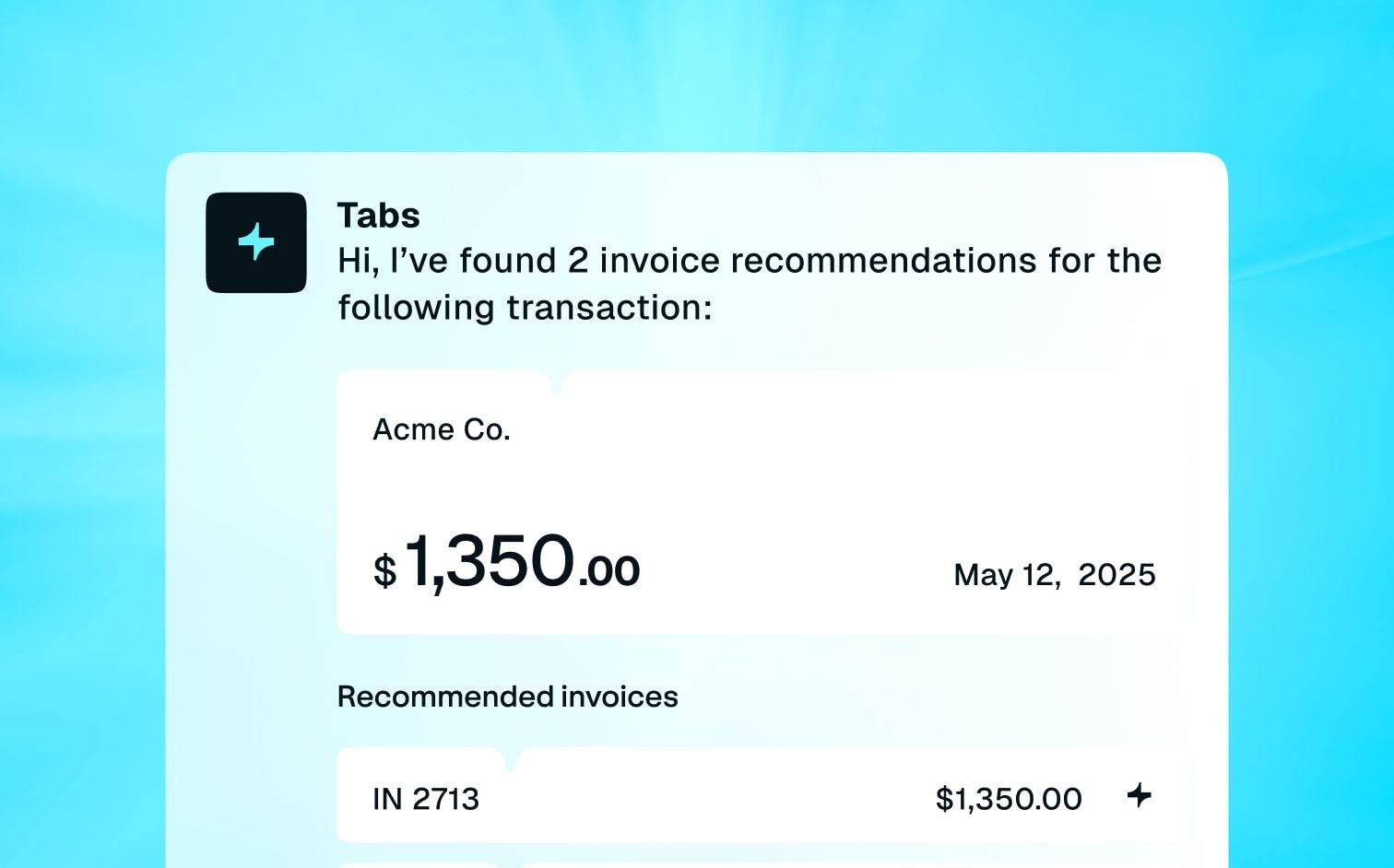

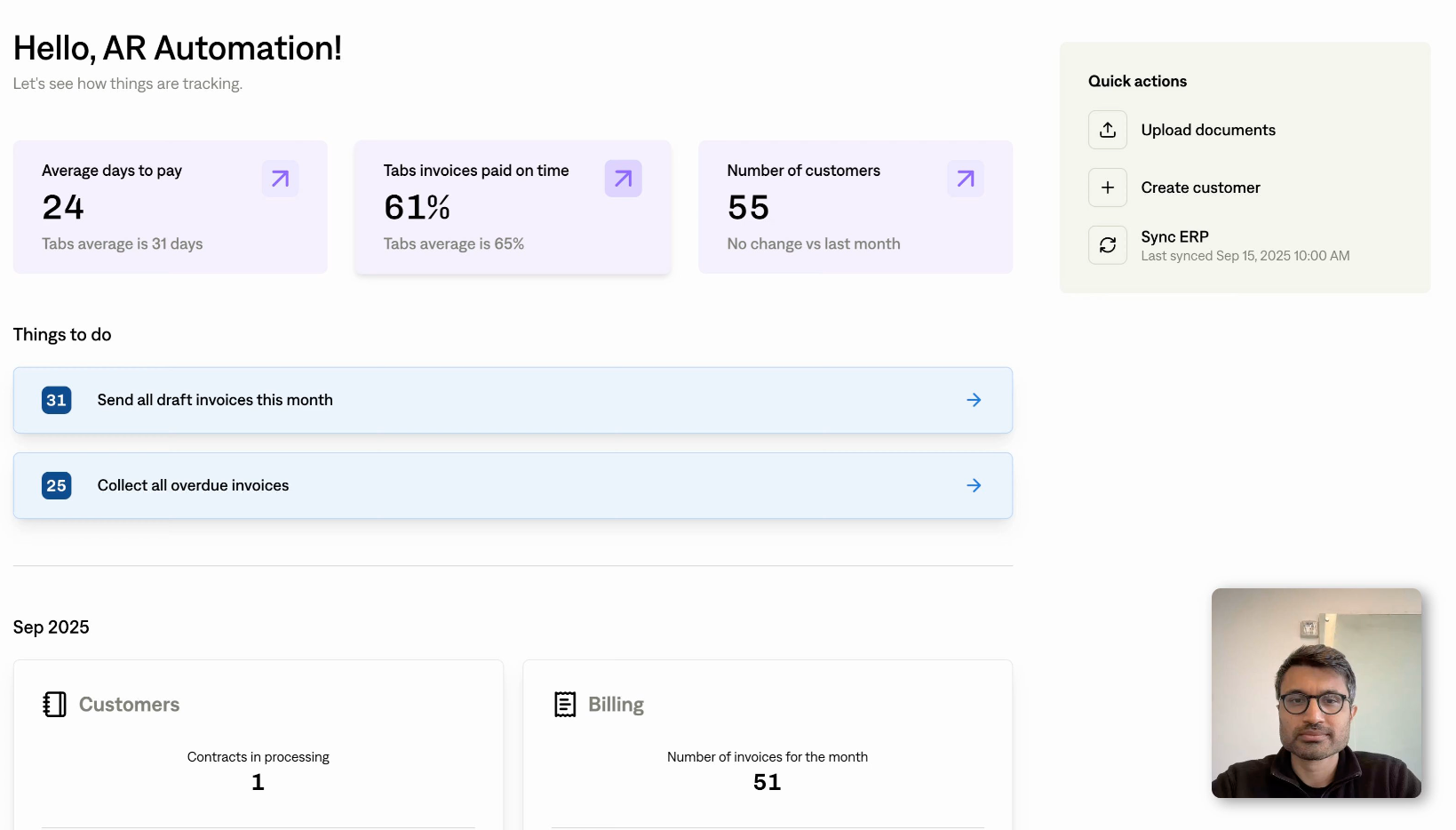

Whether you operate in software, manufacturing, or real estate, ASC 606 is necessary to maintain accurate, reliable financial reporting. Using technology solutions like Tabs can make compliance easier. With AI-powered automation, Tabs helps finance teams simplify revenue recognition, reduce manual errors, and improve cash flow management.

See how Tabs can help you navigate ASC 606 compliance, and effectively position your company for long-term success and financial stability.