Juggling customer relationships and financial operations is a constant balancing act. But amidst the chaos, don't neglect your accounts receivable (AR). Manual AR processes can drain your resources. AR automation software streamlines everything from invoicing to payment collection, freeing up your team. In this post, we'll explore the benefits of AR automation software, key features, and how to choose the right solution. We'll also cover successful implementation and maximizing ROI. Ready to transform your AR from a pain point to a powerhouse? Let's get started.

Key Takeaways

- Automate AR to free up your finance team: Software handles repetitive tasks, so your team can focus on higher-value work like financial planning and analysis.

- Get paid faster and improve customer relationships: Streamlined billing and payment processes mean quicker payments and happier customers.

- Gain valuable insights into your finances: Robust reporting features provide real-time data, empowering you to make informed decisions and optimize your financial strategies.

What is AR Automation Software?

Accounts receivable (AR) automation software streamlines the entire invoicing and payment process, from generating invoices to collecting payments. Think of it as a digital assistant for your finance team, handling repetitive tasks so they can focus on higher-value work like financial planning and analysis. This type of software integrates with your existing accounting systems to create a seamless flow of information, reducing manual data entry and minimizing the risk of errors. Ultimately, AR automation helps businesses get paid faster and more efficiently. For companies looking to improve their recurring billing processes, AR automation is key. It provides the tools to manage subscriptions, automate renewals, and gain a clearer picture of your monthly recurring revenue (MRR). Automating these functions can significantly reduce churn and improve overall revenue growth. You can also gain more control over complex invoicing needs with automated solutions that extract key contract terms using AI.

How AR Automation Software Works

AR automation software handles many crucial tasks, freeing up your team to focus on higher-value work. Here's a breakdown of the core functions:

Capturing and Entering Data

This is the foundation of AR automation. The software streamlines the often tedious process of generating and sending invoices. Think about how much time your team currently spends manually creating invoices, emailing them, and then tracking their status. AR automation software takes over these repetitive tasks, reducing manual data entry and the associated errors. This also speeds up the entire invoicing cycle, getting you paid faster. Features like automated invoice generation, email delivery, and online payment portals all contribute to a more efficient system. For more information on streamlining your billing, check out this resource on automating complex invoicing.

Reconciling and Updating Records

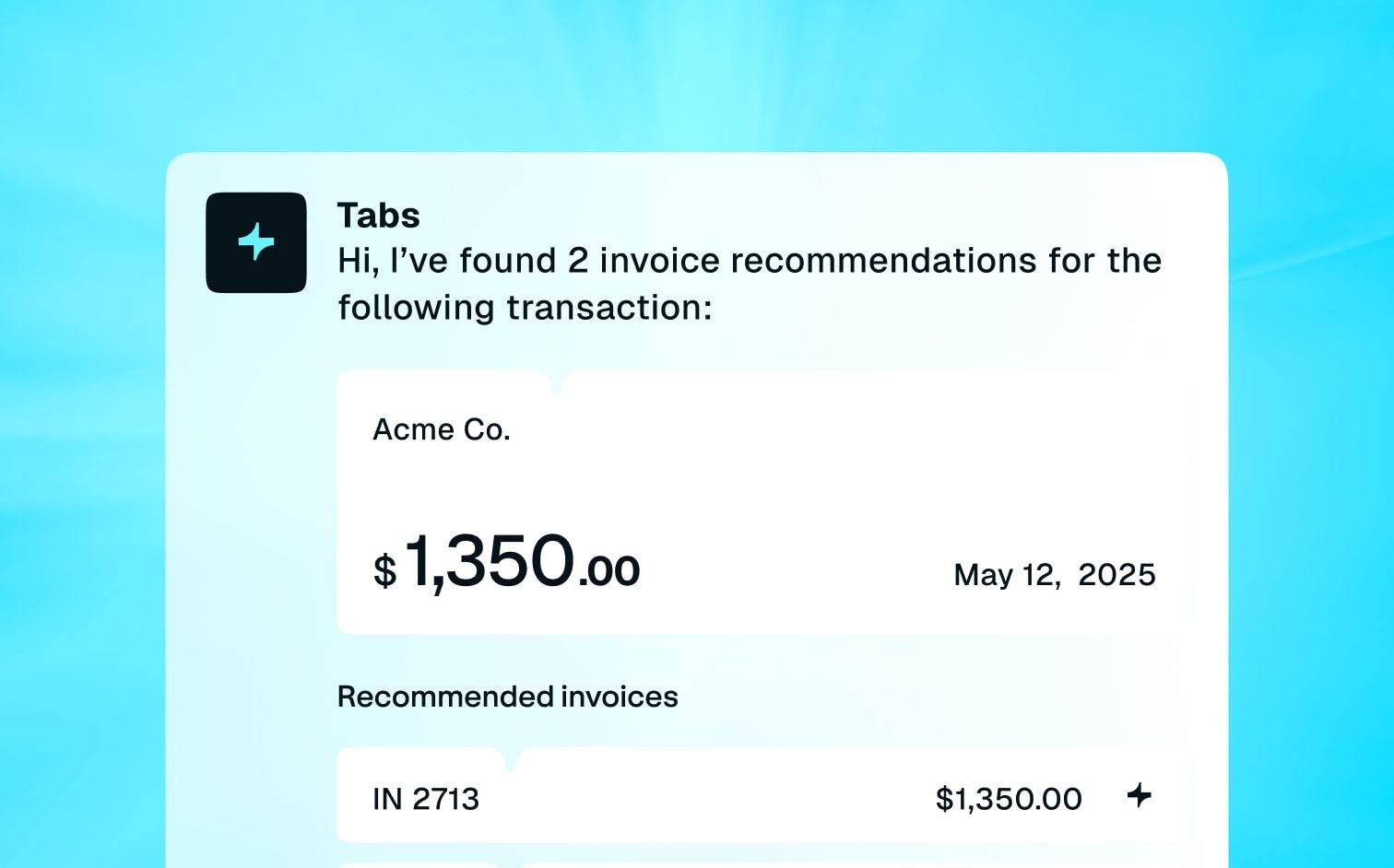

Beyond simply sending invoices, AR automation software helps reconcile payments with open invoices and updates your financial records. This ensures your books accurately reflect all transactions, essential for managing cash flow effectively. Instead of manually matching payments to invoices, the software automates this process, reducing discrepancies and saving your team valuable time. This real-time reconciliation also provides a clearer picture of your outstanding receivables. Learn how Tabs streamlines revenue recognition with automation.

Managing Overdue Accounts and Collections

Let’s be honest, dealing with overdue accounts is one of the most frustrating parts of managing accounts receivable. AR automation software can significantly improve your ability to handle these situations. Automating payment reminders and collection processes frees up your team’s time and reduces the effort spent chasing overdue invoices. Automated reminders for upcoming and late payments keep customers informed about their obligations, leading to quicker payments and improved cash flow.

More sophisticated AR automation solutions use artificial intelligence to predict late payments and personalize outreach efforts, whether through emails or calls. This proactive approach helps recover overdue payments and builds better customer relationships by providing a more tailored communication experience. Plus, having access to complete account histories helps your finance team make smart decisions about which accounts to prioritize for collections, ultimately reducing bad debt and improving your overall financial health. For SaaS businesses, this can be particularly helpful in managing recurring subscriptions and minimizing involuntary churn.

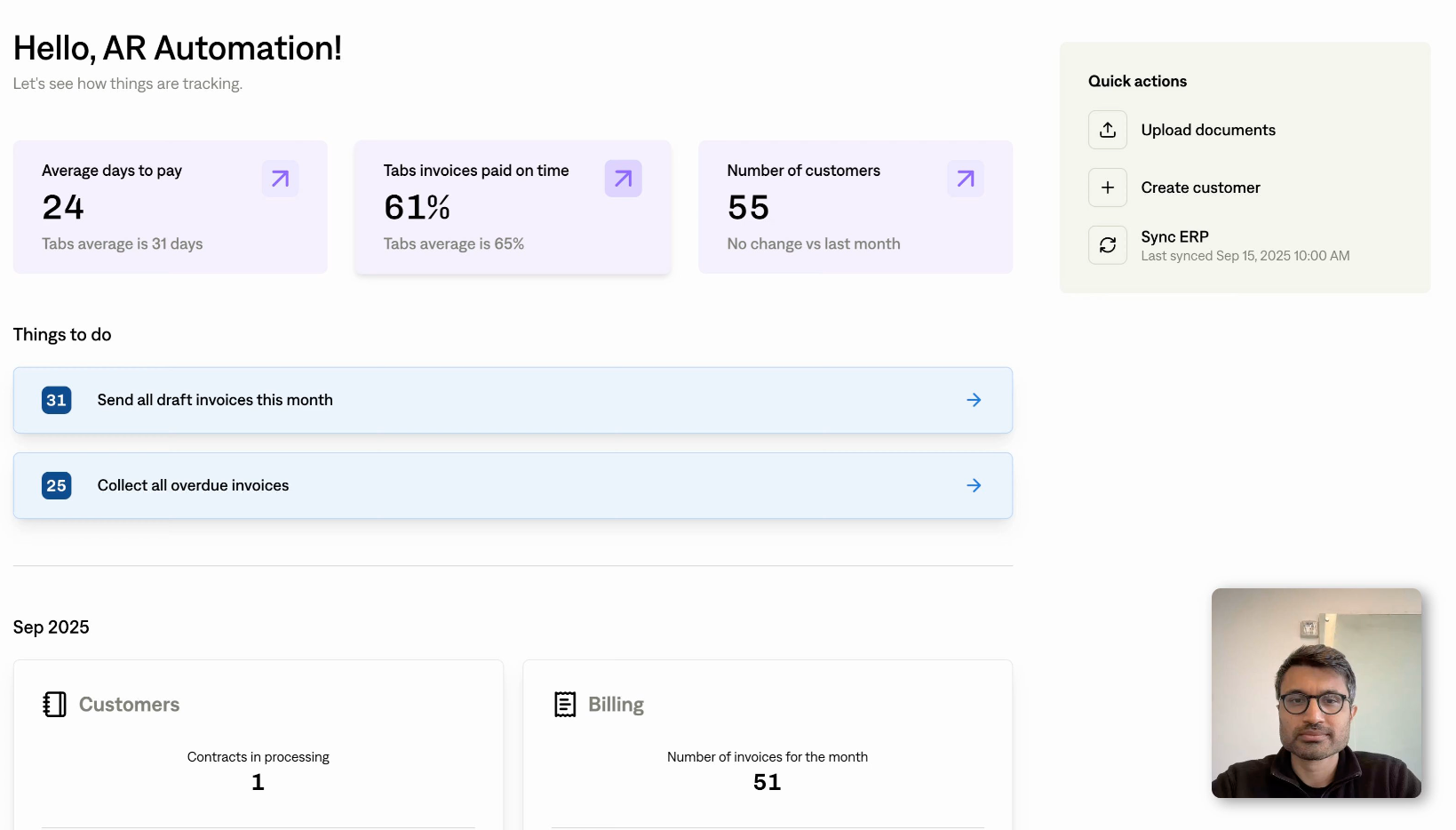

Generating Reports and Financial Statements

Robust reporting is a key feature of AR automation software. You can easily track key metrics like outstanding invoices, average payment times, and days sales outstanding (DSO). The software can also generate financial statements, giving you a real-time view of your financial health. This data-driven insight empowers you to make informed business decisions, from adjusting credit policies to forecasting future revenue. Explore how Tabs provides robust reports for finance teams.

Benefits of AR Automation Software

Automating your accounts receivable (AR) process offers significant advantages, impacting everything from your daily operations to your long-term financial health. Here's a closer look at some key benefits:

Improve Your Cash Flow

AR automation tools streamline accounts receivable processes, leading to more predictable and efficient cash flow management. Features like automated invoicing and payment reminders ensure timely payments. Automated invoice processing minimizes delays caused by manual tasks, getting payments into your account faster. This consistent cash flow allows you to reinvest in your business, cover expenses, and maintain a healthy financial position. For a deeper dive into optimizing your billing strategies, explore resources focused on improving Monthly Recurring Revenue (MRR).

Reduce Errors and Improve Accuracy

Manual data entry is prone to errors, which can lead to billing disputes, delayed payments, and strained customer relationships. Automation minimizes these risks. AR automation software ensures accurate invoice generation and distribution, reducing the chance of human error. This accuracy accelerates payment cycles and improves your overall cash flow. Plus, accurate financial reporting gives you a clearer picture of your financial performance.

Free Up Your Team's Time

AR automation frees your finance team from tedious manual tasks like data entry and follow-ups. Automated reports and alerts help track past-due invoices efficiently, allowing your team to focus on more strategic initiatives. This shift from reactive to proactive work empowers your team to contribute to higher-level financial planning and analysis, driving business growth. Consider exploring how AI-powered contract analysis can further streamline operations.

Reduced Costs and Increased Efficiency

Manual AR processes involve a lot of paper, postage, and person-hours. Automating these tasks saves time, labor, and other associated costs. AR automation software significantly reduces these operational expenses by streamlining processes and minimizing manual intervention. You'll see a noticeable decrease in costs associated with printing, mailing, and processing invoices. This also frees up your staff to focus on more strategic tasks, further enhancing efficiency and contributing to cost savings. Automated solutions, like those offered by Tabs for complex invoicing, can drastically reduce the time spent on manual data entry and processing. Plus, streamlined processes contribute to more predictable and efficient cash flow management.

Build Stronger Customer Relationships

Clear and timely communication is crucial for maintaining positive customer relationships. AR automation provides real-time visibility into AR operations, enabling you to offer better service. You can promptly address customer inquiries and resolve payment issues efficiently. This transparency builds trust and fosters stronger customer relationships, leading to increased customer loyalty and retention. Learn more about how flexible payment options can further enhance customer satisfaction.

Streamlined Payment Experiences

Beyond efficiency gains for your team, AR automation software directly benefits your customers. Clunky, manual processes often lead to confusing invoices, delayed payment confirmations, and a generally frustrating payment experience. AR automation smooths out these wrinkles, creating a more user-friendly experience that encourages timely payments and builds trust. Learn more about how Tabs supports various payment types.

Automated invoicing ensures customers receive accurate invoices promptly, eliminating confusion and reducing the likelihood of disputes. Automated payment reminders gently nudge customers about upcoming due dates, minimizing late payments without aggressive collection tactics. Offering flexible payment options, like online portals and various payment methods, further simplifies the process, making it easier for customers to pay how they want. This streamlined approach fosters positive customer relationships, leading to increased loyalty and retention. For SaaS businesses managing subscriptions, this also contributes to a smoother recurring billing process.

Real-time visibility into payment status is another advantage. With AR automation, customers can easily access their payment history and current balance, eliminating the need for time-consuming inquiries to your customer service team. This transparency builds confidence and reinforces a sense of control over their financial interactions with your business. Plus, quicker payments through automated processing mean faster access to products or services, further enhancing customer satisfaction. For a deeper dive into the benefits of automation, explore this resource on automating complex invoicing.

Must-Have AR Automation Features

Finding the right AR automation software can feel overwhelming. Focus your search by prioritizing these must-have features:

System Integration

Your AR automation software should seamlessly integrate with your existing accounting software and other business tools. This interoperability ensures data flows smoothly between systems, eliminating manual data entry and reducing the risk of errors. Look for software that offers integrations with your current CRM, ERP, and payment gateways. A unified system provides a holistic view of your financial operations. For example, if your billing platform already handles recurring billing, ensure your new AR automation software can connect and enhance its capabilities. This integration is key for efficient data management and streamlined invoicing.

ERP and Accounting Software Integration

Integrating your AR automation software with existing ERP and accounting systems is crucial for maximizing efficiency and accuracy in your financial operations. Your AR automation software should seamlessly integrate with your existing accounting software and other business tools. This interoperability ensures data flows smoothly between systems, eliminating manual data entry and reducing the risk of errors. Look for software that offers integrations with your current CRM, ERP, and payment gateways. A unified system provides a holistic view of your financial operations, which is especially helpful for managing complex recurring billing scenarios.

This integration not only streamlines the invoicing process, but also enhances data management. For SaaS businesses in particular, ensuring your AR automation software integrates with your existing subscription management platform is key. This streamlines recurring billing and revenue recognition, ultimately freeing up your finance team to focus on strategic initiatives. When selecting AR automation software, prioritize solutions that offer these robust integration capabilities to save time, reduce errors, and improve your overall financial health. For more on how Tabs handles complex billing needs for SaaS companies, check out our AI-powered contract analysis tools.

Customization Options

No two businesses are exactly alike. Your AR automation software should be flexible enough to adapt to your specific workflows and requirements. This might include customizable invoice templates, automated reminder schedules, and specific reporting formats. The ability to tailor the software ensures it supports your unique business processes.

Scaling for Growth

As your business expands, your AR operations will become more complex. Choose software that can handle increasing transaction volumes and evolving needs. Scalability ensures your AR automation solution remains effective as your business grows, avoiding the need for costly software replacements later.

User-Friendly Design

A user-friendly interface is crucial for quickly adopting and using the software. Your team should be able to easily learn the system without extensive training. Look for intuitive navigation, clear dashboards, and readily available support resources. A user-friendly system encourages consistent use and maximizes the benefits of automation.

Payment Processing and Tracking

Efficient payment processing is at the heart of AR automation. The software should support various payment methods, automate payment reconciliation, and provide real-time tracking of incoming payments. This streamlined approach accelerates cash flow and simplifies reconciliation. Learn more about supporting various payment types.

Automated Cash Application

Automated cash application is a game-changer for businesses looking to enhance their accounts receivable (AR) processes. This feature uses AI and machine learning to automatically match incoming payments to their corresponding invoices, significantly reducing manual reconciliation. This automation achieves high rates of straight-through processing, meaning payments are posted and reconciled without manual intervention. This also frees up your team for higher-level tasks. For a deeper dive into how AI is transforming finance, check out resources on AI-powered contract analysis.

Automated cash application minimizes delays caused by manual tasks, getting payments into your account faster and improving cash flow. This efficiency accelerates the payment cycle and enhances the accuracy of financial records, as the software ensures accurate matching and recording of all transactions. With fewer manual processes, your team can dedicate more time to strategic financial planning and analysis. Learn how Tabs streamlines revenue recognition with automation.

The real-time reconciliation capabilities of automated cash application provide a clearer picture of outstanding receivables. This transparency is crucial for effective cash flow management and strategic financial planning. Real-time AR insights empower more informed decisions about credit policies, collections strategies, and financial forecasting. Explore how Tabs provides robust reports for finance teams to support these efforts.

Real-Time Visibility and Analytics

Real-time visibility into your AR data is essential for informed decision-making. Your software should offer robust reporting and analytics, providing insights into key metrics like days sales outstanding (DSO), average payment time, and collection effectiveness. These data-driven insights empower you to identify trends, optimize processes, and improve overall financial performance. Explore options for robust reporting.

Key Metrics: DSO and Cash Flow

Understanding key metrics like Days Sales Outstanding (DSO) and cash flow is crucial for managing your accounts receivable effectively. DSO measures the average number of days it takes to collect payment after a sale. A lower DSO generally indicates quicker payments, which is essential for healthy cash flow.

AR automation software plays a significant role in optimizing these metrics. Streamlining AR processes leads to more predictable and efficient cash flow management. Features like automated invoicing and payment reminders ensure timely payments, directly impacting your DSO. Automated systems can also flag potential payment delays early on, allowing your team to proactively address issues.

Robust reporting within AR automation software lets you easily track key metrics. Real-time visibility into your AR data is essential for informed decisions, from adjusting credit policies to forecasting revenue. This data-driven insight empowers you to fine-tune collections strategies.

By focusing on these key metrics and using AR automation, businesses can improve cash flow and enhance overall financial health, enabling reinvestment in growth and maintaining a competitive edge. Regularly monitoring DSO and cash flow provides a clear picture of your financial performance and identifies areas for AR process improvement.

Choosing the Right AR Automation Software

Selecting the right AR automation software can feel overwhelming, but breaking it down into key steps makes the process manageable. By focusing on your specific needs and priorities, you can find the perfect solution to streamline your financial operations.

AR Automation Software Examples

Exploring specific examples of AR automation software can give you a better sense of the available features and approaches. Here are a couple of options to consider (note: we’re not affiliated with these companies—just sharing some well-known examples):

Versapay

Versapay offers a comprehensive accounts receivable automation platform designed to enhance cash flow clarity and streamline collections. The software automates routine AR tasks, enabling businesses to manage their working capital more effectively. Key features include faster payment processing—reportedly 25% quicker—through a secure online portal that allows customers to easily access invoices and make payments. This self-service approach improves cash flow and enhances the customer experience. Versapay also offers integrated collections management tools for further streamlining.

Sage Intacct

Sage Intacct provides robust AR automation capabilities within its accounting software suite. It simplifies invoicing and payment processes, integrating seamlessly with existing systems, which is especially helpful for businesses already using other Sage products. The software offers advanced reporting features that allow businesses to track key metrics such as Days Sales Outstanding (DSO) and cash flow, empowering data-driven financial decisions. This integration and reporting capability make Sage Intacct a solid option for businesses looking to optimize AR processes within a comprehensive financial management system. For more details, check out their accounts receivable page.

Assess Your Needs

Before you start browsing software options, take the time to thoroughly assess your current AR processes and pinpoint your pain points. Are you struggling with manual data entry, tracking down late payments, or reconciling transactions? Understanding your specific challenges will guide you toward the features you need most. Consider your business size and industry, too, as some software caters to specific niches. For example, a subscription-based business will have different needs than an e-commerce retailer. Defining your requirements upfront will save you time and effort. Think about what a streamlined process would look like for your team and what key metrics you want to improve, such as days sales outstanding (DSO).

Evaluate Tech Compatibility

Once you have a clear picture of your needs, consider how well the software integrates with your existing systems. Seamless data flow between your CRM, accounting software, and AR automation platform is crucial for efficient operations. Check if the software offers integrations with the tools you already use or if it requires complex workarounds. A smooth integration will minimize disruptions to your workflow and maximize the benefits of automation. Look for APIs and other integration options that ensure a cohesive tech stack. This interoperability will prevent data silos and ensure accurate reporting. For example, Tabs Platform allows you to automate complex invoicing and supports any payment type, making integration smoother.

Consider Costs and Pricing

Pricing structures for AR automation software vary widely, from subscription-based models to usage-based fees. Carefully analyze the pricing details and ensure they align with your budget and expected ROI. Look beyond the upfront costs and consider the long-term value the software offers. Will it significantly reduce manual labor costs, minimize errors, and improve cash flow? Factor these potential savings into your cost analysis. A transparent pricing model that outlines all fees and potential add-on costs will help you make an informed decision. Consider solutions that offer value for specific needs, such as Tabs Platform, which simplifies revenue recognition, a crucial aspect of financial management for subscription businesses.

Review Customer Support Options

Reliable customer support is essential for a smooth implementation and ongoing success with your AR automation software. Look for vendors that offer comprehensive support resources, including documentation, tutorials, and responsive customer service. Check if they provide onboarding assistance and ongoing training to help your team effectively use the software. A knowledgeable and accessible support team can make a significant difference in addressing any technical issues or questions that may arise. Consider the availability of different support channels, such as phone, email, or live chat, to ensure you can get assistance when you need it. Look for vendors who prioritize customer success and offer proactive support, like helping you extract key contract terms with AI to streamline your processes further.

Factors to Consider

Beyond the must-have features, several other factors play a crucial role in selecting the right AR automation software. Thinking about these upfront will help you choose a solution that truly fits your business needs.

Integration Capabilities

Your AR automation software should seamlessly integrate with your existing accounting software and other business tools. This interoperability ensures data flows smoothly between systems, eliminating manual data entry and reducing the risk of errors. Look for software that offers integrations with your current CRM, ERP, and payment gateways. A unified system provides a holistic view of your financial operations. For example, integrating with your CRM can automate customer data updates, ensuring accurate invoicing and personalized communication. A smooth integration with your ERP system helps streamline order-to-cash processes and provides real-time visibility into your financial data. This reduces the need for manual data transfers and minimizes the risk of discrepancies between systems. For SaaS businesses, seamless integration with recurring billing platforms is essential for managing subscriptions and automating renewals.

Scalability

As your business expands, your AR operations will become more complex. Choose software that can handle increasing transaction volumes and evolving needs. Scalability ensures your AR automation solution remains effective as your business grows, preventing the need for costly software replacements or upgrades later. Consider whether the software can accommodate a growing customer base, higher transaction volumes, and new product or service offerings. A scalable solution adapts to your changing needs, providing long-term value and minimizing disruptions to your operations. This is particularly important for SaaS companies experiencing rapid growth, where the volume of transactions can increase significantly.

Ease of Use

A user-friendly interface is crucial for quickly adopting and using the software. Your team should be able to easily learn the system without extensive training. Look for intuitive navigation, clear dashboards, and readily available support resources. A user-friendly system encourages consistent use and maximizes the benefits of automation. Consider the learning curve for new users and the availability of training materials like tutorials and documentation. A system that’s easy to understand and use will encourage adoption and minimize frustration among your team members. This also reduces the time and resources required for training and onboarding.

Customer Support

Reliable customer support is essential for a smooth implementation and ongoing success with your AR automation software. Look for vendors that offer comprehensive support resources, including documentation, tutorials, and responsive customer service. A knowledgeable and accessible support team can make a significant difference in addressing any technical issues or questions that may arise. Evaluate the vendor’s reputation for customer support and the availability of different support channels, such as email, phone, or live chat. Proactive support and readily available resources can contribute significantly to a positive user experience. Prompt and efficient support can minimize downtime and ensure you get the most out of your investment.

Pricing

Pricing structures for AR automation software vary widely, from subscription-based models to usage-based fees. Carefully analyze the pricing details and ensure they align with your budget and expected ROI. Look beyond the upfront costs and consider the long-term value the software offers, such as reduced manual labor, minimized errors, and improved cash flow. Factor these potential savings into your cost analysis. A transparent pricing model that clearly outlines all fees and potential add-on costs will help you make an informed decision. For SaaS businesses, consider how the pricing structure aligns with your growth plans and pricing models. For example, some providers offer tiered pricing based on transaction volume or features, allowing you to scale your costs as your business grows.

Implementing AR Automation

Successfully integrating new software takes careful planning and execution. Here’s how to smoothly implement AR automation and set your team up for success.

Planning Your Transition

Moving to automated AR involves more than just flipping a switch. Before choosing software, assess your current AR processes, pinpoint pain points, and identify bottlenecks. Understanding your existing workflows helps you choose the right software and create a practical implementation plan. This upfront work minimizes disruptions and eases the transition for your team. Consider a dedicated project team to manage implementation and keep everyone informed. Clear communication and a well-defined timeline are key to managing change.

Effective Staff Training

Your team needs to know how to use the new software to realize its full potential. Comprehensive training is crucial. Go beyond the basics and show your team how to use features like automated invoicing, payment reminders, and reporting. Hands-on training and readily available documentation will empower your staff to confidently use the system. Consider assigning "super users" within your team to provide ongoing support and answer questions.

Data Migration

Data migration is a critical step. Ensure all relevant historical data—customer information, invoices, payment history—is accurately transferred to the new system. Work closely with your software provider to develop a robust migration plan. This might involve data cleansing and validation to ensure accuracy and consistency. A clean data migration sets the foundation for accurate reporting and analysis.

Ensure Data Accuracy

While automation minimizes manual errors, maintaining data accuracy is ongoing. Establish regular audits and data verification procedures. This could include reconciling data with other systems and reviewing reports for inconsistencies. Accurate data is essential for effective reporting, forecasting, and informed decision-making. Consider implementing data quality checks within the software to catch errors in real-time.

Maximizing Your AR Automation ROI

Getting the most out of your AR automation software involves a strategic approach. Here's how to maximize your return on investment:

Tracking KPIs

Implementing AR automation tools with robust reporting and alert features is crucial. This allows you to easily track past-due invoices and effectively monitor your collections process. Closely monitoring key performance indicators (KPIs) like Days Sales Outstanding (DSO) and collections effectiveness index (CEI) helps identify trends and pinpoint areas for improvement. For example, setting up alerts for overdue invoices empowers your team to take swift action and improve overall cash flow. Explore reporting options with Tabs Platform.

Optimizing Your Processes

Comprehensive AR automation tools streamline your entire accounts receivable process. From automating invoice generation and payment reminders to reconciliation and reporting, these tools free up valuable time for your team. Optimizing processes through automation not only improves efficiency but also enhances cash flow management, contributing to better financial performance. By automating routine tasks, your team can focus on more strategic activities, such as building stronger customer relationships and pursuing new growth opportunities. Learn how Tabs Platform streamlines complex invoicing.

Leveraging Advanced Features

Beyond core features like automated invoicing and online payment processing, explore the advanced functionalities offered by some AR automation software. Features like automated payment reconciliation, AI-powered contract extraction, and dispute resolution tools can significantly enhance your AR efficiency. Choosing software with these capabilities allows you to address complex billing scenarios, reduce manual intervention, and improve overall accuracy. Consider which advanced features best align with your specific business needs to maximize your ROI. See how Tabs Platform simplifies revenue recognition and supports various payment options.

Common AR Pain Points and How Automation Helps

Let’s face it, managing accounts receivable can be a headache. Chasing down late payments, resolving invoice disputes, and dealing with data entry errors takes up valuable time and resources. Many of these common AR pain points can be significantly reduced, or even eliminated, with automation.

Late Payments

Late payments disrupt cash flow and create uncertainty in your financial planning. Manually sending payment reminders and tracking overdue invoices is a tedious process. AR automation software automates these tasks, sending timely payment reminders and escalating follow-ups as needed. This proactive approach helps ensure you get paid on time and improves your overall cash flow management. Automated invoice processing minimizes delays, getting payments into your account faster and leading to more predictable and efficient cash flow.

Invoice Disputes

Invoice disputes are frustrating for both you and your customers. They often arise from errors in manual data entry, leading to discrepancies between what was billed and what the customer believes they owe. This can damage customer relationships and delay payments. AR automation software minimizes these risks by ensuring accurate invoice generation and distribution, reducing the chance of human error and subsequent disputes. Accurate reporting also provides a clear audit trail, making it easier to resolve any discrepancies that may arise.

Manual Data Entry Errors

Manual data entry is a major source of errors in AR processes. Typos, transposed numbers, and incorrect information can lead to a cascade of problems, from invoice disputes to delayed payments. AR automation software tackles this issue head-on. The software streamlines the often tedious process of generating and sending invoices, reducing manual data entry and the associated errors. This not only saves time but also improves the accuracy of your financial records. This automation ensures accurate data capture and reduces the need for manual intervention. For more complex invoicing, explore automated solutions that extract key contract terms using AI.

The Future of AR Automation

The future of AR automation is bright, driven by advancements that promise to transform financial operations. Let's explore some key trends shaping this exciting field.

AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to revolutionize AR processes. Imagine software that predicts late payments based on historical data or automatically adjusts collection strategies for different customer segments. This automation streamlines operations and allows for more accurate forecasting and proactive risk management. AI-powered tools can analyze vast datasets to identify patterns and trends, providing valuable insights that would be impossible to uncover manually. Think of it as having a virtual AR assistant constantly working to optimize your processes and improve your bottom line. Tabs Platform is at the forefront of leveraging AI to extract key contract terms, simplifying and accelerating contract review.

Straight-Through Processing (STP)

Straight-through processing (STP) is a game-changer in AR automation. It automates the entire invoicing and payment process, from invoice generation to payment posting and reconciliation. Think of it as a completely hands-off approach, minimizing manual intervention and maximizing efficiency. This seamless flow of information eliminates bottlenecks and significantly reduces the time and effort required to manage accounts receivable. For businesses dealing with high volumes of invoices, STP is essential for maintaining healthy financial operations. It allows your finance team to focus on strategic initiatives, like analyzing financial data and optimizing pricing models, rather than getting bogged down in repetitive manual tasks.

Automated cash application, a key component of STP, uses AI and machine learning to automatically match payments to invoices, even when payments come from various sources like vendor portals, emails, or PDFs. This automation achieves a high rate of straight-through processing, often exceeding 90%. This high level of automation not only accelerates cash flow but also minimizes errors associated with manual data entry. The result? A more accurate and up-to-date financial picture for your business. Plus, with efficient payment processing at the core of AR automation, your software should support various payment methods and provide real-time tracking of incoming payments, further streamlining your operations.

Enhanced Data Analytics

Data is king, and in the future of AR automation, its reign will be even more powerful. Expect more sophisticated data analytics tools integrated into AR software. These tools will provide real-time visibility into key metrics, allowing businesses to make data-driven decisions about their collections strategies. Imagine dashboards that show you exactly where your cash is tied up, which customers are most likely to pay late, and what actions you can take to improve your overall financial health. This insight empowers businesses to optimize their working capital and make informed decisions that drive growth. For robust reporting on key metrics, explore the reporting capabilities of Tabs Platform.

Mobile-First AR Management

In today's fast-paced business world, accessibility is key. Mobile-first AR management is becoming increasingly important, allowing finance teams to access and manage AR processes from anywhere, at any time. This means you can approve invoices, track payments, and communicate with customers on the go, all from your mobile device. This flexibility improves efficiency and allows for faster response times, which can be crucial for maintaining positive customer relationships. This focus on mobility ensures that AR processes are no longer tied to the office, empowering finance teams to work smarter and more effectively.

Is AR Automation Right for Your Business?

Deciding whether to automate your accounts receivable processes is a big decision. It requires an honest assessment of your current challenges, resources, and future goals. While AR automation offers significant advantages, it's not a one-size-fits-all solution. Here's a guide to help you determine if it's the right move for your business:

Signs you're ready for AR automation:

- High invoice volume: If your team spends significant time manually processing many invoices, automation can drastically reduce this workload. Think about how much time your team dedicates to tasks like data entry, sending invoices, and tracking payments. If it's a substantial portion of their day, automation could free them up for more strategic activities. Learn more about automating complex invoicing.

- Errors in manual processes: Manual data entry is prone to human error. If you frequently experience discrepancies in invoices, payments, or reporting, automation can improve accuracy and minimize costly mistakes. Accurate revenue recognition is crucial for any business.

- Difficulty tracking payments: Struggling to keep track of outstanding invoices and payment due dates? Automated systems provide real-time visibility into your AR, making managing cash flow and following up on late payments easier. Robust reporting on key metrics can provide valuable insights for your finance team.

- Strained customer relationships: Late or incorrect invoices can damage customer relationships. AR automation ensures timely and accurate billing, leading to a smoother customer experience. Features like online payment portals can make paying easier for customers, further improving satisfaction. Explore how to support any payment type.

- Limited visibility into AR data: A lack of clear insights into your AR data can hinder decision-making. Automated systems provide comprehensive reports and dashboards, giving you a real-time view of your financial health.

- Scaling your business: As your business grows, manual AR processes become increasingly difficult to manage. Automation provides the scalability you need to handle increasing transaction volumes without adding significant overhead. Consider how AI can extract key contract terms as your business expands.

If any of these scenarios resonate with your current situation, AR automation could be a valuable investment. It's not just about saving time; it's about improving accuracy, strengthening customer relationships, and gaining better control over your financial operations.

Related Articles

- Best Accounts Receivable Automation Software

- Accounts Receivable Automation: A Comprehensive Guide

- Tabs - AR Automation for B2B Businesses

Frequently Asked Questions

What's the difference between AR automation and using standard accounting software?

While most accounting software handles basic invoicing, AR automation goes further. It streamlines the entire AR process, from generating invoices and sending automated reminders to processing payments and reconciling transactions. This level of automation frees your team from tedious manual tasks, allowing them to focus on more strategic financial work. Think of it as upgrading from a bicycle to a car – both get you there, but one is significantly faster and more efficient.

Is AR automation software difficult to implement?

The implementation process varies depending on the software and your existing systems. Look for software providers that offer comprehensive onboarding and support. A good provider will guide you through the process, helping you migrate data, configure settings, and train your team. While there's always an adjustment period with new software, a well-planned implementation can minimize disruptions and ensure a smooth transition.

How much does AR automation software typically cost?

Pricing varies widely based on features, the number of users, and transaction volume. Some providers offer tiered pricing plans, while others use a customized quote approach. It's essential to evaluate your specific needs and budget to find the best fit. Consider the potential return on investment (ROI) – factors like reduced labor costs, fewer errors, and faster payments can significantly offset the software cost.

Can AR automation software integrate with my existing CRM and ERP systems?

Most AR automation software is designed to integrate with popular CRM and ERP systems. This integration is crucial for seamless data flow and avoids manual data entry. When evaluating software, confirm compatibility with your existing systems and inquire about the integration process. A smooth integration is key to maximizing the benefits of automation.

What if I have complex billing requirements? Can AR automation software handle that?

Many AR automation platforms offer flexible customization options to accommodate complex billing scenarios. Look for features like customizable invoice templates, support for various pricing models, and the ability to handle different currencies and payment methods. Some advanced platforms even offer AI-powered features to extract data from contracts and automate complex billing rules.