Tabs in the press

About Tabs

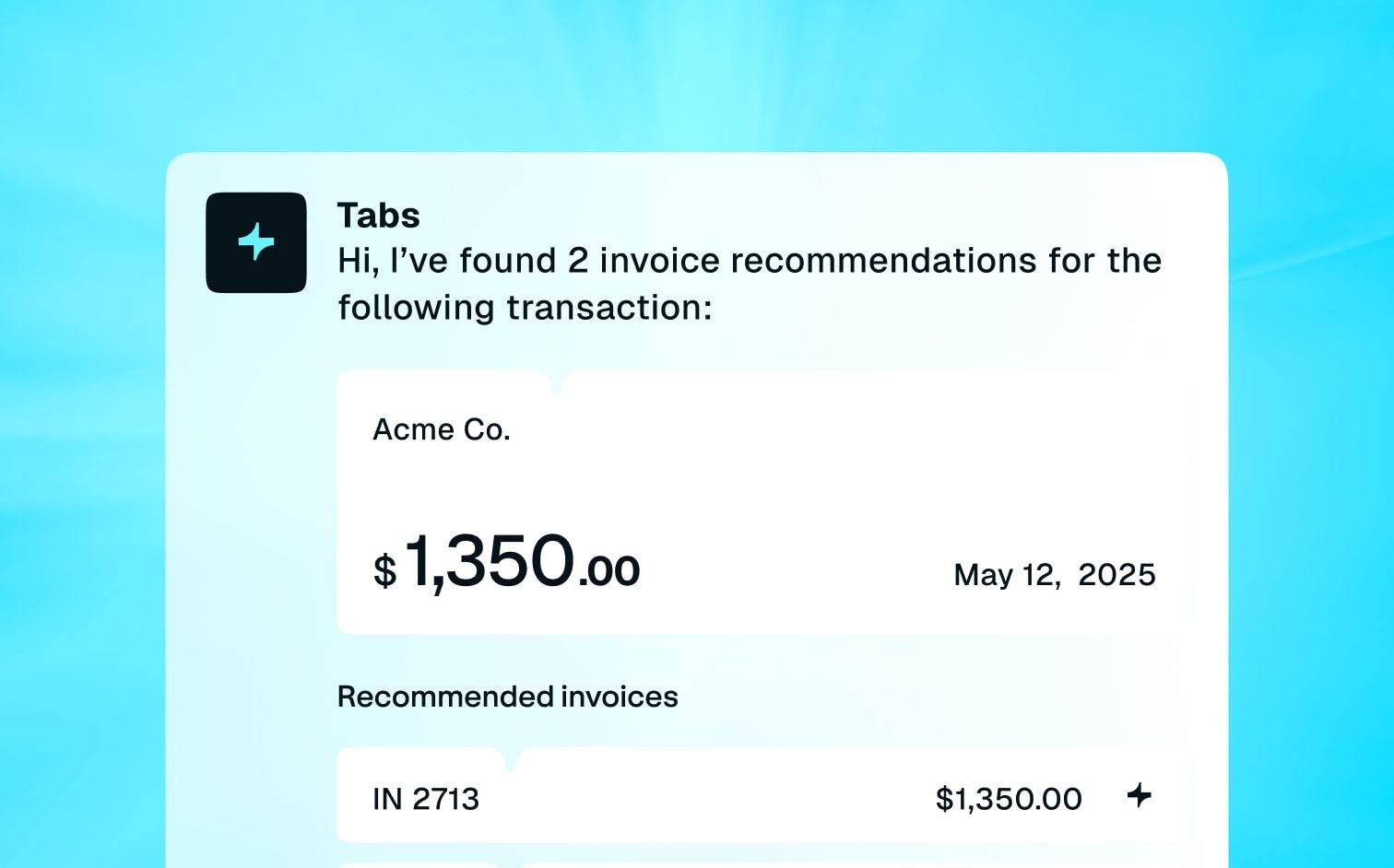

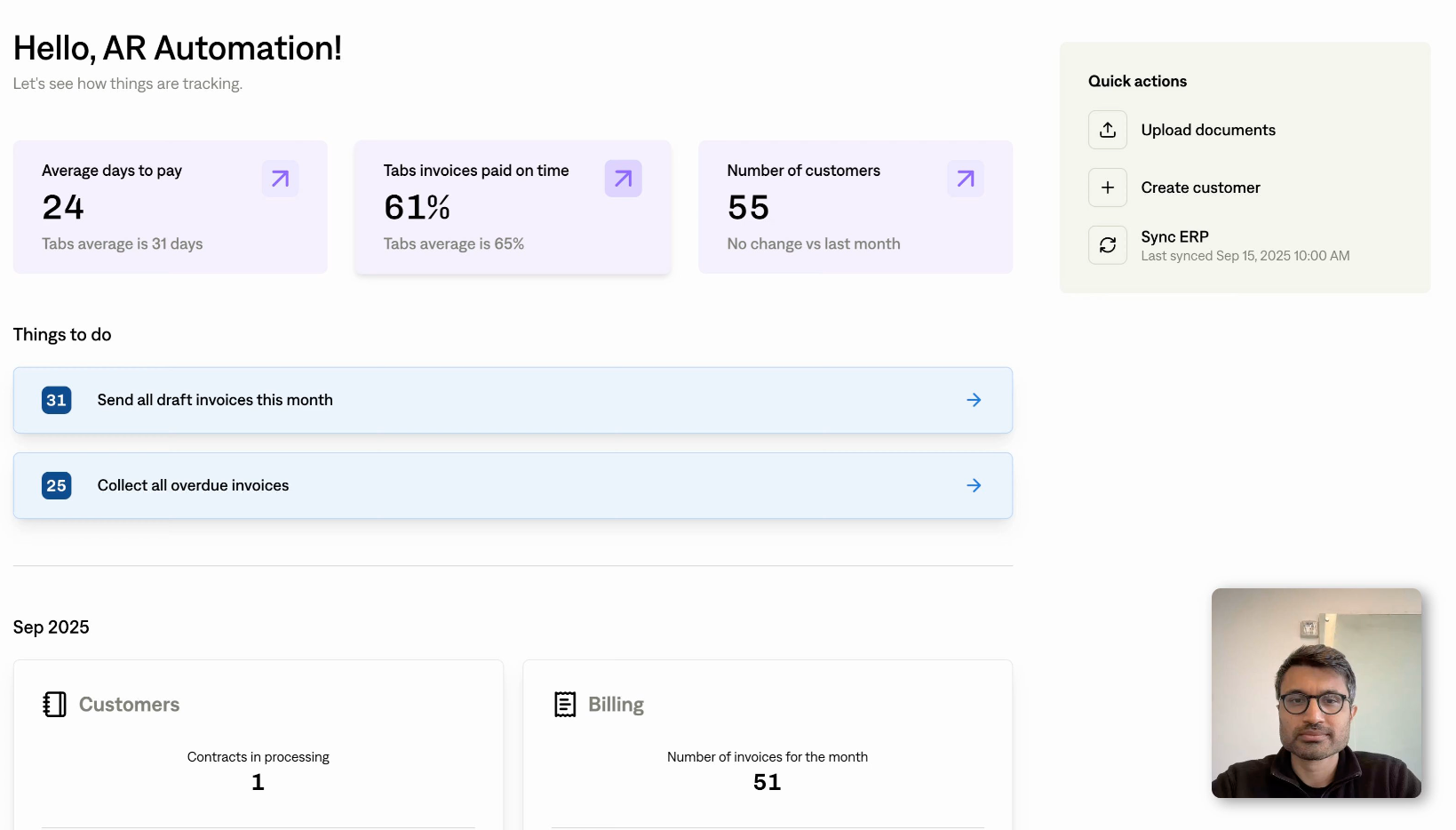

Finance software hasn’t kept pace. For decades, companies have relied on outdated systems that bury teams in manual work. We started Tabs to fix that, building the modern revenue stack: AI-native automation that turns contracts into action, eliminates errors, and powers finance with speed and accuracy.